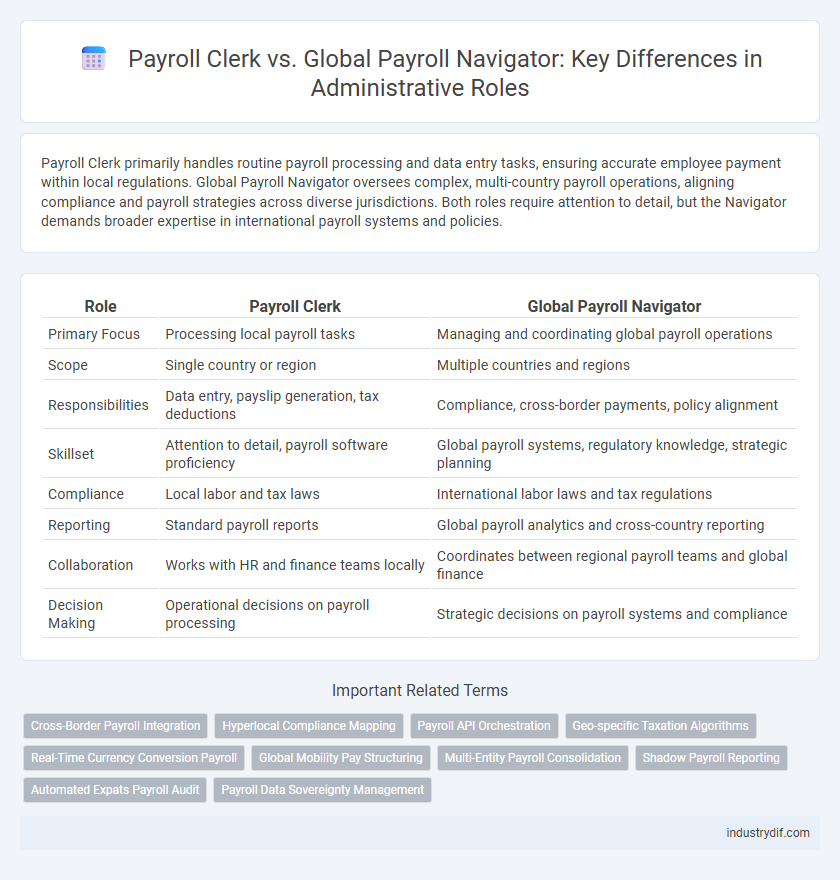

Payroll Clerk primarily handles routine payroll processing and data entry tasks, ensuring accurate employee payment within local regulations. Global Payroll Navigator oversees complex, multi-country payroll operations, aligning compliance and payroll strategies across diverse jurisdictions. Both roles require attention to detail, but the Navigator demands broader expertise in international payroll systems and policies.

Table of Comparison

| Role | Payroll Clerk | Global Payroll Navigator |

|---|---|---|

| Primary Focus | Processing local payroll tasks | Managing and coordinating global payroll operations |

| Scope | Single country or region | Multiple countries and regions |

| Responsibilities | Data entry, payslip generation, tax deductions | Compliance, cross-border payments, policy alignment |

| Skillset | Attention to detail, payroll software proficiency | Global payroll systems, regulatory knowledge, strategic planning |

| Compliance | Local labor and tax laws | International labor laws and tax regulations |

| Reporting | Standard payroll reports | Global payroll analytics and cross-country reporting |

| Collaboration | Works with HR and finance teams locally | Coordinates between regional payroll teams and global finance |

| Decision Making | Operational decisions on payroll processing | Strategic decisions on payroll systems and compliance |

Defining the Roles: Payroll Clerk vs Global Payroll Navigator

A Payroll Clerk is responsible for processing employee paychecks, maintaining payroll records, and ensuring compliance with local tax regulations. In contrast, a Global Payroll Navigator manages payroll operations across multiple countries, aligning payroll processes with international labor laws and corporate policies. The Global Payroll Navigator also coordinates cross-border payroll strategies and resolves complex global payroll issues.

Core Responsibilities Comparison

Payroll Clerks primarily handle data entry, processing employee timesheets, and ensuring accurate paycheck distribution within local or regional contexts. Global Payroll Navigators oversee complex payroll operations across multiple countries, ensuring compliance with international labor laws, tax regulations, and currency conversions. Both roles require attention to detail, but the Global Payroll Navigator demands advanced knowledge of global payroll systems and cross-border financial regulations.

Required Skills and Qualifications

Payroll Clerks require proficiency in payroll software, strong attention to detail, and knowledge of tax regulations and labor laws to ensure accurate and timely employee compensation. Global Payroll Navigators must possess advanced understanding of multinational payroll systems, cross-border compliance, and currency conversion, alongside excellent analytical and communication skills to manage global payroll operations effectively. Both roles benefit from experience in payroll processing, data management, and confidentiality, with the Global Payroll Navigator demanding a higher level of expertise in international payroll complexities.

Role in Payroll Processing Workflow

Payroll Clerk primarily manages data entry and verification tasks to ensure accurate employee compensation within the payroll processing workflow. Global Payroll Navigator coordinates multi-jurisdictional payroll operations, integrating compliance regulations across different countries to optimize the payroll lifecycle on a global scale. Their distinct roles contribute to efficiency by balancing detailed transactional accuracy with comprehensive regulatory oversight in payroll processing.

Technology and Software Utilization

Payroll Clerks primarily manage employee compensation through traditional payroll software such as ADP and Paychex, ensuring accurate wage calculations and tax withholdings. In contrast, Global Payroll Navigators leverage advanced cloud-based platforms like SAP SuccessFactors and Workday, integrating multi-country compliance and real-time data analytics for seamless international payroll processing. The use of AI-driven automation and blockchain technology in Global Payroll Navigator roles significantly enhances accuracy, security, and scalability across global operations.

Compliance and Regulatory Knowledge

Payroll Clerks are responsible for processing employee payments accurately, requiring foundational compliance knowledge specific to local labor laws and tax regulations. In contrast, a Global Payroll Navigator possesses advanced expertise in multinational payroll systems, ensuring regulatory adherence across diverse jurisdictions and mitigating legal risks in international operations. This role demands a comprehensive understanding of global tax treaties, social security agreements, and cross-border compliance standards.

Scope of Payroll Management: Local vs Global

Payroll Clerks primarily manage local payroll processes, ensuring compliance with regional tax laws, wage regulations, and employee benefits within a specific country or jurisdiction. Global Payroll Navigators coordinate payroll activities across multiple countries, handling diverse legal requirements, currency exchanges, and multinational reporting standards to streamline global workforce compensation. Expertise in cross-border payroll integration and global compliance is critical for effective global payroll management.

Career Advancement Opportunities

Payroll Clerks typically handle routine payroll processing tasks, offering a foundational understanding of payroll systems and compliance regulations. Transitioning to a Global Payroll Navigator role expands career opportunities by involving complex, multinational payroll coordination, strategic problem-solving, and advanced regulatory knowledge. This progression enhances professional growth, leadership potential, and eligibility for senior positions within global human resources and finance departments.

Collaboration with Other Departments

Payroll Clerks manage payroll data with accuracy while collaborating closely with HR, finance, and compliance teams to ensure timely salary disbursements and legal adherence. Global Payroll Navigators coordinate complex multinational payroll processes by integrating efforts across regional offices, tax authorities, and benefit providers to maintain global payroll consistency and regulatory compliance. Effective interdepartmental collaboration enhances payroll accuracy, reduces errors, and supports strategic financial planning.

Impact on Organizational Efficiency

Payroll Clerks primarily handle routine payroll tasks such as data entry, salary calculations, and record maintenance, ensuring accuracy and compliance in payroll processing. Global Payroll Navigators integrate payroll functions across multiple countries, managing complex international tax regulations, currency conversions, and legal compliance to streamline global payroll operations. Their combined impact significantly enhances organizational efficiency by reducing errors, accelerating payroll cycles, and enabling seamless cross-border payroll management.

Related Important Terms

Cross-Border Payroll Integration

Payroll Clerks primarily handle routine payroll processing tasks within local jurisdictions, ensuring compliance with domestic tax laws and benefit regulations. In contrast, Global Payroll Navigators specialize in cross-border payroll integration by coordinating multi-country payroll systems, managing international tax compliance, and streamlining global employee compensation frameworks.

Hyperlocal Compliance Mapping

A Payroll Clerk manages routine payroll processes within specific locales, ensuring timely and accurate employee compensation, while a Global Payroll Navigator specializes in hyperlocal compliance mapping across multiple jurisdictions to navigate complex international payroll regulations. Expertise in hyperlocal compliance mapping enables the Global Payroll Navigator to minimize legal risks by aligning payroll practices with local tax laws, labor regulations, and statutory requirements in diverse regions.

Payroll API Orchestration

Payroll Clerks handle routine payroll processing tasks, while Global Payroll Navigators leverage Payroll API Orchestration to integrate multiple payroll systems across different regions, ensuring seamless data flow, compliance, and real-time updates. Payroll API Orchestration optimizes payroll accuracy and reduces manual intervention by automating cross-platform synchronization and error resolution.

Geo-specific Taxation Algorithms

Payroll Clerks manage local payroll processing by manually applying geo-specific taxation algorithms, ensuring compliance with regional tax laws and regulations. In contrast, Global Payroll Navigators leverage advanced automation and AI-driven geo-specific taxation algorithms to efficiently handle multi-country payroll complexities while minimizing errors and regulatory risks.

Real-Time Currency Conversion Payroll

Payroll Clerks typically handle standard payroll processing within a local or regional framework, while Global Payroll Navigators specialize in managing complex, real-time currency conversion payroll across multiple international jurisdictions. Real-time currency conversion payroll enables seamless and accurate employee compensation in various currencies, minimizing exchange rate discrepancies and ensuring compliance with global financial regulations.

Global Mobility Pay Structuring

Global Payroll Navigators specialize in managing complex payroll processes across multiple countries, ensuring compliance with international tax laws and currency regulations, which is essential for effective Global Mobility Pay Structuring. Payroll Clerks typically handle routine payroll calculations and data entry within a single country, lacking the advanced expertise required for coordinating global compensation packages and aligning them with multinational mobility strategies.

Multi-Entity Payroll Consolidation

Payroll Clerks typically handle the processing and entry of payroll data for individual entities within an organization, whereas Global Payroll Navigators specialize in multi-entity payroll consolidation, ensuring accurate compliance and streamlined reporting across various jurisdictions. Their expertise in integrating payroll data from multiple subsidiaries facilitates unified financial management and supports global regulatory requirements.

Shadow Payroll Reporting

Payroll Clerks primarily handle routine payroll processing and local tax calculations, while Global Payroll Navigators specialize in complex international payroll compliance, including meticulous Shadow Payroll Reporting for expatriates to ensure accurate tax withholding and cross-border regulatory adherence. Effective Shadow Payroll Reporting mitigates risks of double taxation and ensures alignment with global mobility policies, enhancing overall payroll accuracy and legal compliance in multinational organizations.

Automated Expats Payroll Audit

Automated Expats Payroll Audit significantly enhances accuracy and compliance, reducing manual errors and processing time compared to traditional Payroll Clerk methods. Global Payroll Navigator leverages advanced algorithms and real-time data integration to streamline expat payroll management across multiple jurisdictions, ensuring seamless audits and regulatory adherence.

Payroll Data Sovereignty Management

Payroll Clerks typically handle payroll processing within a single country, focusing on local compliance and data management, whereas Global Payroll Navigators manage payroll data sovereignty across multiple jurisdictions, ensuring adherence to international data protection laws like GDPR and CCPA. Effective Payroll Data Sovereignty Management involves maintaining strict control over where payroll data is stored and processed, minimizing legal risks and enhancing compliance in global payroll operations.

Payroll Clerk vs Global Payroll Navigator Infographic

industrydif.com

industrydif.com