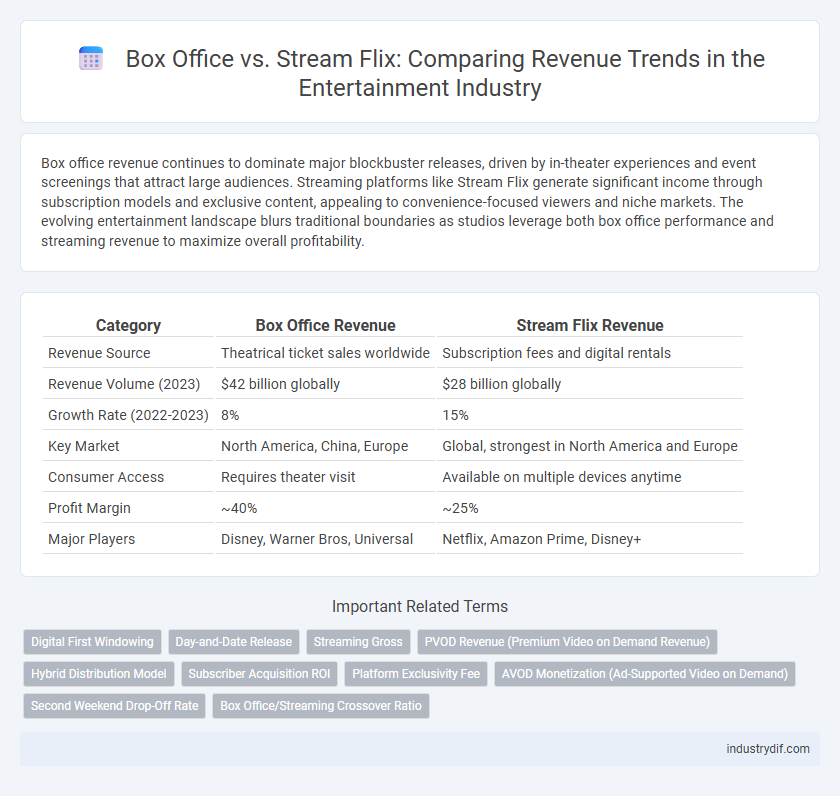

Box office revenue continues to dominate major blockbuster releases, driven by in-theater experiences and event screenings that attract large audiences. Streaming platforms like Stream Flix generate significant income through subscription models and exclusive content, appealing to convenience-focused viewers and niche markets. The evolving entertainment landscape blurs traditional boundaries as studios leverage both box office performance and streaming revenue to maximize overall profitability.

Table of Comparison

| Category | Box Office Revenue | Stream Flix Revenue |

|---|---|---|

| Revenue Source | Theatrical ticket sales worldwide | Subscription fees and digital rentals |

| Revenue Volume (2023) | $42 billion globally | $28 billion globally |

| Growth Rate (2022-2023) | 8% | 15% |

| Key Market | North America, China, Europe | Global, strongest in North America and Europe |

| Consumer Access | Requires theater visit | Available on multiple devices anytime |

| Profit Margin | ~40% | ~25% |

| Major Players | Disney, Warner Bros, Universal | Netflix, Amazon Prime, Disney+ |

Understanding Box Office and Stream Flix Revenue Models

Box office revenue is generated through ticket sales at theaters, offering a traditional, event-based income stream dependent on opening weekend performance and peak audience turnout. Stream Flix revenue models primarily rely on subscription fees, pay-per-view, or ad-supported content, focusing on sustained viewer engagement and data-driven personalization to maximize long-term profitability. Understanding these models highlights the shifting dynamics in entertainment consumption from fixed, location-bound sales to flexible, digitally-accessible platforms.

Key Revenue Drivers in Theatrical Releases

Theatrical releases primarily generate revenue through box office ticket sales, driven by factors such as star power, marketing campaigns, and franchise popularity. Premium formats like IMAX and 3D significantly boost revenue per ticket, while strategic release dates during holidays and weekends maximize audience turnout. Concessions and merchandise sales within theaters also contribute to overall theatrical revenue performance.

Stream Flix Revenue: Subscription and Pay-Per-View Explained

Stream Flix revenue primarily derives from two models: subscription-based streaming and pay-per-view services. Subscription streaming generates steady income through monthly or yearly fees, offering unlimited access to a vast library of content, while pay-per-view requires viewers to pay for individual titles, providing an additional revenue stream for exclusive releases or new content. This dual approach allows Stream Flix to maximize revenue by catering to both regular viewers and occasional users seeking specific titles.

Consumer Behavior: Moviegoers vs. Streamers

Moviegoers tend to seek immersive, social experiences driven by the cinematic atmosphere, leading to higher per-visit spending at box offices. Streamers prioritize convenience and affordability, resulting in steady subscription revenue and on-demand content consumption patterns. Consumer behavior shifts show a growing preference for streaming platforms among younger demographics, while traditional movie theaters retain loyal patrons valuing event-style entertainment.

Global Reach: Box Office vs. Digital Distribution

Box office revenue remains a dominant force in regions with established cinema infrastructure, generating over $42 billion globally in 2023, driven by blockbuster releases and region-specific preferences. Digital distribution through streaming platforms like Netflix, Disney+, and Amazon Prime has expanded global reach to over 230 countries, enabling access to diverse content libraries and localized programming that boost subscriber growth to more than 1.2 billion worldwide. The shift towards streaming reflects changing consumer behavior, with digital revenue surpassing traditional box office earnings in markets with high internet penetration and mobile device usage.

Revenue Reporting and Transparency Challenges

Box office revenue reporting relies on centralized data collection from theaters, offering relatively transparent and standardized financial figures compared to the fragmented reporting mechanisms in streaming platforms like Stream Flix. Streaming revenue is often aggregated within broader subscription or advertising income, complicating precise transparency and direct comparison with theatrical ticket sales. This disparity in revenue reporting standards creates challenges for industry analysts trying to accurately assess and compare the financial performance of films across box office and streaming mediums.

Impact of Release Windows on Revenue Streams

The timing of release windows significantly influences revenue distribution between box office and streaming platforms, with shorter theatrical windows boosting initial cinema earnings while accelerating digital revenue growth. Premium Video on Demand (PVOD) and simultaneous releases have disrupted traditional models, shifting audience spending from cinemas to streaming services. Data indicates that optimized release strategies can maximize total revenue by balancing theatrical exclusivity and streaming accessibility.

Major Industry Players Shaping Revenue Trends

Major industry players like Disney, Netflix, and Warner Bros. anchor revenue trends by leveraging blockbuster theatrical releases alongside expansive streaming libraries. Disney's box office dominance through franchises like Marvel and Star Wars continues to outpace streaming-only revenues, while Netflix strengthens its market share via original content and subscriber growth. Warner Bros.' hybrid release model exemplifies evolving strategies that blend theatrical and streaming revenues, reshaping entertainment industry financial dynamics.

Profit Margins: Theatrical vs. Streaming Platforms

Theatrical releases typically yield higher profit margins per ticket due to premium pricing and concession sales, driving substantial box office revenue despite higher distribution costs. Streaming platforms generate consistent income through subscription models and lower variable costs but often face slimmer margins per viewer because of content acquisition and platform maintenance expenses. Profitability in entertainment increasingly depends on balancing high-margin box office hits with scalable streaming content to maximize total revenue streams.

Future Outlook: Evolving Revenue Strategies in Entertainment

The future of entertainment revenue hinges on the dynamic balance between box office receipts and Stream Flix subscription growth, with studios increasingly adopting hybrid release models to maximize profits. Advanced data analytics and personalized content recommendations drive subscriber retention on streaming platforms, while event-driven theatrical releases maintain box office relevance. Strategic investments in original content and international market expansion will reshape revenue streams, highlighting a diversified approach to sustaining entertainment profitability.

Related Important Terms

Digital First Windowing

Digital first windowing has shifted revenue dynamics by prioritizing streaming platforms like Netflix and Disney+ over traditional box office releases, driving exponential growth in digital subscription revenue. This strategy leverages early exclusive digital premieres to capture global audiences, reducing theatrical revenue but significantly expanding overall entertainment earnings through direct-to-consumer streaming models.

Day-and-Date Release

Day-and-date releases generate simultaneous revenue streams by debuting films in theaters and on streaming platforms, capturing diverse audience segments and maximizing initial earnings. This strategy reshapes traditional box office models by blending theatrical ticket sales with subscription and rental revenue from services like Netflix and Amazon Prime.

Streaming Gross

Streaming gross revenue surpassed $50 billion globally in 2023, outpacing traditional box office earnings that totaled around $42 billion during the same period. Major platforms like Netflix, Disney+, and Amazon Prime contribute significantly to this surge, leveraging exclusive content and personalized viewer experiences to drive subscriber growth and maximize streaming profits.

PVOD Revenue (Premium Video on Demand Revenue)

Premium Video on Demand (PVOD) revenue has surged as a significant alternative to traditional box office income, generating billions by enabling early digital releases of new films at a premium price. This shift in consumer preferences toward at-home viewing experiences on platforms like Stream Flix has redefined revenue models, with PVOD offering studios higher immediate returns compared to the longer theatrical run revenue cycle.

Hybrid Distribution Model

The hybrid distribution model combines box office revenue and streaming platform earnings like Netflix, optimizing total gross by reaching both theatrical audiences and at-home viewers simultaneously. This approach maximizes revenue streams by leveraging the global accessibility of digital platforms while maintaining traditional box office profits through exclusive theatrical windows.

Subscriber Acquisition ROI

Box office revenue traditionally drives high upfront returns, but streaming platforms like Stream Flix demonstrate superior long-term subscriber acquisition ROI by leveraging personalized content and lower distribution costs. Stream Flix's data-driven algorithms optimize viewer engagement and retention, translating into sustained revenue growth compared to the one-time purchase model of theatrical releases.

Platform Exclusivity Fee

Platform exclusivity fees significantly impact the revenue dynamics between box office releases and streaming services like Stream Flix, as studios charge premium fees to secure exclusive content distribution rights. These fees often lead to higher upfront payments for streaming platforms, altering traditional box office revenue shares while boosting streaming subscriber growth and long-term retention.

AVOD Monetization (Ad-Supported Video on Demand)

AVOD platforms are reshaping entertainment revenue models by generating substantial income through targeted advertising, overtaking traditional box office earnings in key demographics. This shift highlights the growing preference for ad-supported streaming, leveraging user data to optimize ad placements and maximize monetization beyond conventional ticket sales.

Second Weekend Drop-Off Rate

The second weekend drop-off rate for box office releases averages around 50-60%, significantly impacting total theatrical revenue compared to streaming platforms where viewer retention rates often exceed 70% due to immediate accessibility and subscription models. Stream Flix's ability to maintain stronger engagement beyond initial premieres results in steadier revenue flows, contrasting with the sharp theatrical decline after opening weekends.

Box Office/Streaming Crossover Ratio

The Box Office/Streaming crossover ratio highlights the shifting revenue dynamics, with global box office receipts declining by 20% while streaming platforms saw a 35% increase in subscription revenue in 2023. This ratio underscores how studios optimize content releases to maximize earnings from simultaneous theatrical and digital premieres.

Box Office vs Stream Flix Revenue Infographic

industrydif.com

industrydif.com