Box office revenue remains a significant indicator of a film's commercial success, attracting audiences through theatrical experiences and premium viewing. Streaming revenue has surged as digital platforms offer convenience and wide accessibility, reshaping the entertainment landscape and consumer habits. The competition between box office and streaming revenue drives innovation in distribution models and content creation strategies.

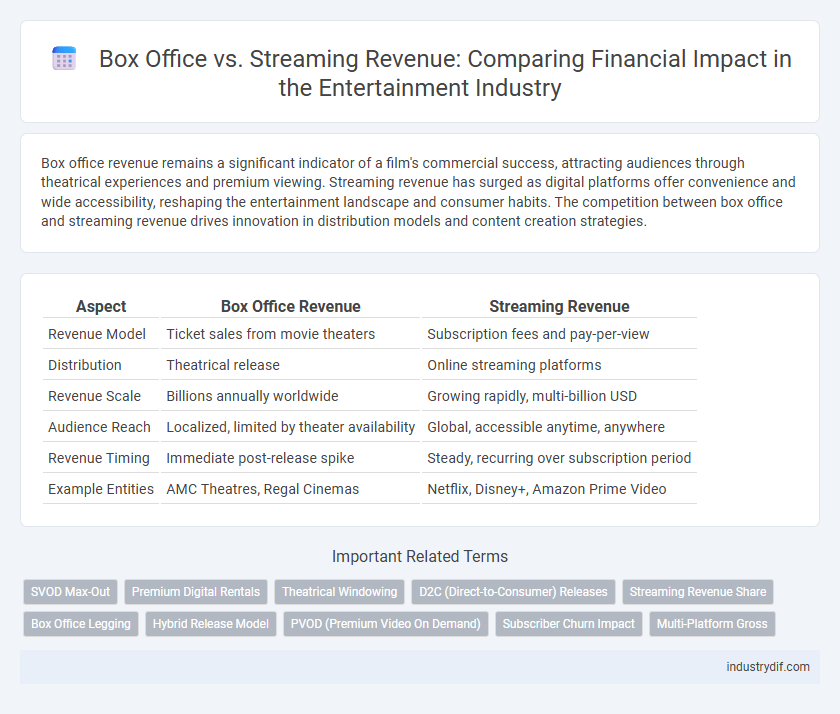

Table of Comparison

| Aspect | Box Office Revenue | Streaming Revenue |

|---|---|---|

| Revenue Model | Ticket sales from movie theaters | Subscription fees and pay-per-view |

| Distribution | Theatrical release | Online streaming platforms |

| Revenue Scale | Billions annually worldwide | Growing rapidly, multi-billion USD |

| Audience Reach | Localized, limited by theater availability | Global, accessible anytime, anywhere |

| Revenue Timing | Immediate post-release spike | Steady, recurring over subscription period |

| Example Entities | AMC Theatres, Regal Cinemas | Netflix, Disney+, Amazon Prime Video |

Overview of Box Office Revenue

Box office revenue remains a crucial indicator of a film's financial success, driven primarily by ticket sales in cinemas worldwide. Despite the rise of streaming platforms, global box office revenue reached approximately $42 billion in 2023, reflecting steady audience demand for theatrical experiences. Major blockbusters and franchise films continue to dominate box office earnings, emphasizing the theatrical window's importance in maximizing franchise profitability.

Understanding Streaming Revenue Models

Streaming revenue models primarily rely on subscription fees, pay-per-view purchases, and advertising, offering diverse income streams compared to traditional box office ticket sales. Subscription Video on Demand (SVOD) platforms like Netflix generate steady monthly revenue, while Advertising Video on Demand (AVOD) services such as Hulu blend ad income with viewer access. Understanding these models highlights how streaming diversifies and potentially stabilizes entertainment revenue beyond the fluctuating box office market.

Historical Trends: Box Office vs Streaming

Box office revenue dominated the entertainment industry for decades, peaking in the late 20th century with blockbuster hits generating billions worldwide. The rise of streaming platforms in the 2010s initiated a significant shift, with global streaming revenue surpassing box office earnings by 2020 due to increased consumer preference for on-demand content. Historical data shows a steady decline in theater attendance juxtaposed with exponential growth in subscriptions to services like Netflix, Disney+, and Amazon Prime Video, reshaping revenue models in the entertainment sector.

Revenue Growth Patterns in Entertainment

Box office revenue experienced steady growth pre-pandemic, driven by blockbuster releases and global market expansion, while streaming revenue surged exponentially with increased home entertainment consumption and subscription model adoption. Recent trends indicate streaming platforms are capturing a larger share of total entertainment revenue due to convenience, exclusive content, and original productions. This shift reflects a broader transformation in consumer behavior, prioritizing on-demand accessibility and diversified digital offerings over traditional theatrical experiences.

Key Differences in Monetization Strategies

Box office revenue relies heavily on one-time ticket sales driven by theatrical releases, creating a surge of income during opening weekends. Streaming revenue generates ongoing income through subscription fees or pay-per-view models, emphasizing long-term user engagement and content accessibility. Marketing strategies for box office prioritize event-based hype, while streaming focuses on retention through personalized content algorithms and exclusive releases.

Impact on Film Distribution

Box office revenue remains a critical metric for major film releases, driving theatrical distribution strategies and influencing marketing budgets. Streaming revenue has reshaped film distribution by enabling direct-to-consumer access, leading studios to balance exclusive theater windows with simultaneous or early digital releases. This shift impacts release patterns, with hybrid distribution models optimizing audience reach and revenue streams across multiple platforms.

Audience Demographics and Consumption Habits

Box office revenue remains dominant among older audiences aged 35 and above who prefer the immersive experience of theaters, while streaming platforms attract younger viewers aged 18-34 due to convenience and personalized content. Research indicates that families and millennials increasingly favor streaming for on-demand accessibility, contributing to a shift in revenue distribution. Consumption habits show that evening and weekend theater attendance peaks for blockbuster releases, whereas streaming usage is more evenly distributed throughout the day, reflecting changing lifestyle patterns.

Profit Margins: Theatrical Release vs Streaming

Theatrical releases typically yield higher profit margins due to premium ticket pricing and ancillary revenue streams such as concessions and merchandise sales, despite higher distribution and marketing costs. Streaming platforms generate steady revenue through subscription models and lower distribution expenses but often face thinner profit margins due to content licensing fees and increased competition for subscribers. Analyzing box office earnings compared to streaming revenue highlights a shifting entertainment landscape where studios balance immediate theatrical gains with long-term streaming subscriber growth.

Influence on Production Budgets and Content Creation

Box office revenue continues to drive higher production budgets, as theatrical releases demand visually spectacular and large-scale content to attract audiences and maximize ticket sales. Streaming services influence content creation by prioritizing diverse, serialized storytelling and niche genres, optimizing for subscriber retention rather than one-time mass appeal. This shift results in a balanced industry where blockbuster films coexist with innovative digital series, each shaping production strategies around their distinct revenue models.

Future Outlook for Box Office and Streaming Revenue

The future outlook for box office revenue highlights a gradual recovery driven by expanding global markets and the rise of blockbuster franchises, despite challenges posed by fluctuating theater attendance. Streaming revenue continues exponential growth fueled by increased subscription services, original content investment, and evolving consumer preferences favoring on-demand viewing. Industry forecasts predict a balanced entertainment ecosystem where hybrid release models optimize both box office and streaming income streams.

Related Important Terms

SVOD Max-Out

SVOD max-out occurs when subscription video on demand services reach their subscriber capacity, limiting further revenue growth and shifting the focus to diversified revenue streams such as exclusive theatrical releases and premium video-on-demand. Box office revenue remains critical for blockbuster titles, while streaming platforms increasingly rely on original content and tiered pricing models to sustain profitability amid saturated subscription markets.

Premium Digital Rentals

Premium digital rentals generate significant revenue by offering early access to blockbuster films, bridging the gap between traditional box office earnings and home viewing preferences; this model capitalizes on consumer demand for convenience without sacrificing profitability. Studios increasingly leverage premium rentals as a strategic revenue stream that complements theatrical releases and offsets declining physical media sales.

Theatrical Windowing

Theatrical windowing, the exclusive period during which films are shown in cinemas before streaming release, significantly impacts box office revenue by driving early audience engagement and maximizing ticket sales. Shortening the theatrical window often shifts revenue toward streaming platforms, altering the traditional revenue distribution between box office and digital viewership.

D2C (Direct-to-Consumer) Releases

D2C releases have reshaped the entertainment industry by shifting significant revenue streams from traditional box office sales to streaming platforms, capitalizing on direct consumer subscriptions and viewership data. This transition leverages exclusive digital content and personalized marketing strategies, driving higher profit margins and audience engagement compared to conventional theatrical releases.

Streaming Revenue Share

Streaming revenue accounts for an increasingly significant share of the entertainment market, surpassing traditional box office earnings in several key demographics. Subscription services like Netflix, Disney+, and Amazon Prime Video have driven this shift by offering vast content libraries and exclusive releases that boost global streaming revenue share.

Box Office Legging

Box office lagging behind streaming revenue reflects a significant shift in entertainment consumer behavior, with global theatrical revenues dropping by over 20% since 2019 while streaming subscriptions surged to exceed 1 billion worldwide. Major studios are reallocating budgets to prioritize digital releases, as box office earnings in key markets like the U.S. and China struggle to regain pre-pandemic levels.

Hybrid Release Model

The hybrid release model, combining simultaneous theatrical and streaming launches, drives significant revenue diversification by capturing both box office ticket sales and digital subscription income. Studios leverage this strategy to maximize audience reach while optimizing profit streams from varied consumer preferences in the entertainment market.

PVOD (Premium Video On Demand)

Premium Video On Demand (PVOD) has emerged as a significant revenue stream, generating higher per-title income compared to traditional box office sales by charging premium rental fees directly to consumers. This shift in entertainment consumption allows studios to capitalize on early digital releases, often capturing revenue that would otherwise be delayed or diminished by theatrical release windows.

Subscriber Churn Impact

Box office revenue experiences less immediate impact from subscriber churn compared to streaming platforms, where fluctuating subscriber numbers directly influence monthly earnings and content investment strategies. High churn rates in streaming services lead to volatile revenue streams, prompting companies to enhance exclusive content and user engagement to stabilize subscriber retention.

Multi-Platform Gross

Multi-platform gross revenue, combining box office and streaming earnings, has become a crucial metric for measuring a film's overall financial success in the entertainment industry. This integrated approach reflects the growing importance of digital distribution alongside traditional theatrical releases, maximizing audience reach and revenue potential.

Box Office vs Streaming Revenue Infographic

industrydif.com

industrydif.com