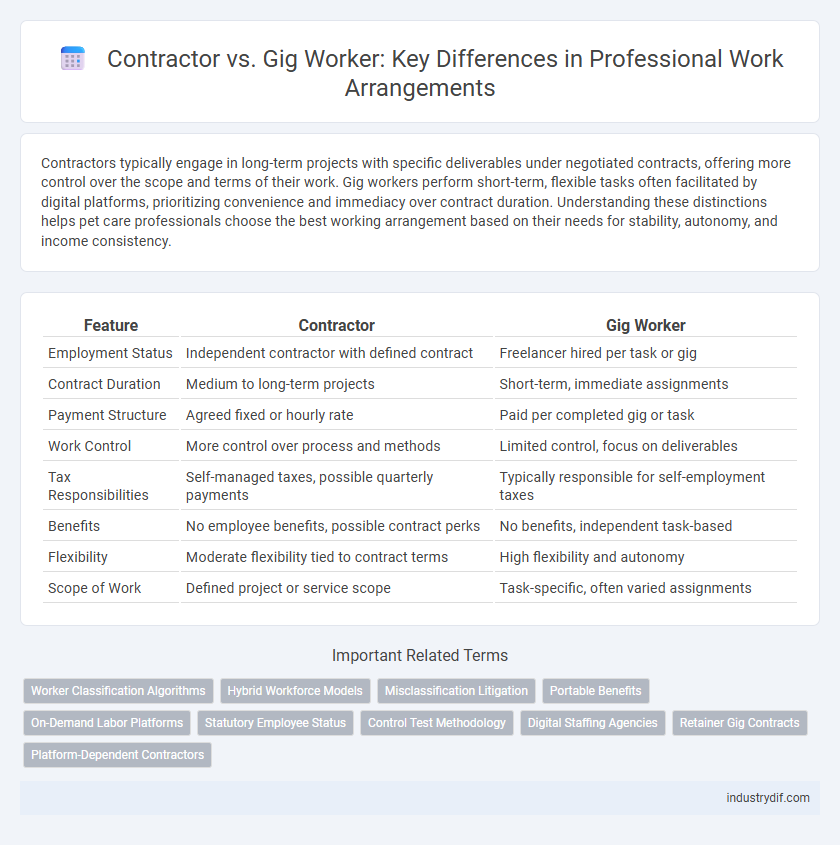

Contractors typically engage in long-term projects with specific deliverables under negotiated contracts, offering more control over the scope and terms of their work. Gig workers perform short-term, flexible tasks often facilitated by digital platforms, prioritizing convenience and immediacy over contract duration. Understanding these distinctions helps pet care professionals choose the best working arrangement based on their needs for stability, autonomy, and income consistency.

Table of Comparison

| Feature | Contractor | Gig Worker |

|---|---|---|

| Employment Status | Independent contractor with defined contract | Freelancer hired per task or gig |

| Contract Duration | Medium to long-term projects | Short-term, immediate assignments |

| Payment Structure | Agreed fixed or hourly rate | Paid per completed gig or task |

| Work Control | More control over process and methods | Limited control, focus on deliverables |

| Tax Responsibilities | Self-managed taxes, possible quarterly payments | Typically responsible for self-employment taxes |

| Benefits | No employee benefits, possible contract perks | No benefits, independent task-based |

| Flexibility | Moderate flexibility tied to contract terms | High flexibility and autonomy |

| Scope of Work | Defined project or service scope | Task-specific, often varied assignments |

Definition of Contractor vs. Gig Worker

Contractors are self-employed individuals or businesses hired on a project basis, typically with formal agreements outlining specific duties and deliverables. Gig workers perform short-term, task-based jobs often facilitated through digital platforms, with flexible schedules and minimal contractual obligations. Understanding these distinctions informs legal classifications, tax treatments, and workforce management strategies.

Key Differences Between Contractors and Gig Workers

Contractors typically engage in longer-term projects with defined scopes and often have established contracts detailing responsibilities and payment terms, whereas gig workers undertake short-term, task-based assignments with more flexible arrangements. Contractors usually operate through an LLC or business entity, managing their own taxes and expenses, while gig workers often rely on platform-based apps that handle payments and offer limited control over job selection. The level of autonomy, legal classification, tax obligations, and benefits eligibility serve as critical factors distinguishing contractors from gig workers in professional settings.

Legal Classifications and Implications

Contractors are legally classified as independent entities responsible for their own taxes, insurance, and compliance with contract terms, while gig workers often fall under ambiguous classifications that can blur the lines between employees and freelancers. Misclassification risks include penalties for companies and denial of benefits or protections for workers, emphasizing the importance of clear contractual definitions and adherence to labor laws such as the Fair Labor Standards Act (FLSA) and IRS guidelines. Understanding the legal distinctions directly impacts contractual obligations, tax liabilities, and eligibility for benefits like unemployment insurance and workers' compensation.

Payment Structures and Compensation

Contractors typically receive payment based on negotiated contracts or project milestones, offering a fixed or hourly rate that reflects the scope and duration of work. Gig workers often earn through platform-based, task-oriented compensation where payments are made per completed gig without guaranteed income or benefits. Understanding these distinct payment structures is crucial for managing expectations around earnings, tax obligations, and financial planning in professional engagements.

Tax Responsibilities and Deductions

Contractors are responsible for paying self-employment taxes, including Social Security and Medicare, and can deduct business expenses such as equipment, office supplies, and travel costs to reduce taxable income. Gig workers, classified as independent contractors, must report all income and expenses on Schedule C, and they are eligible for similar deductions but often face greater challenges in tracking expenses for irregular earnings. Both must make estimated quarterly tax payments to avoid penalties, emphasizing the importance of meticulous record-keeping for accurate tax reporting and maximizing deductions.

Flexibility and Autonomy in Work

Contractors typically enjoy greater flexibility in project selection and schedule management, allowing them to tailor their work according to expertise and availability. Gig workers, while also benefiting from flexible hours, often face less control over job variety and work conditions due to platform-driven task assignments. This distinction highlights contractors' enhanced autonomy in navigating their professional engagements compared to gig workers.

Benefits and Protections Offered

Contractors typically receive higher pay rates and maintain control over project execution but lack guaranteed benefits such as health insurance, retirement plans, and unemployment protection. Gig workers enjoy flexible work arrangements but often face minimal access to traditional employee benefits, relying instead on platform-specific protections like limited liability and dispute resolution mechanisms. Understanding the differences in benefits and protections is crucial for both parties to navigate compliance and secure appropriate coverage.

Common Industries for Each Worker Type

Contractors are commonly engaged in industries such as construction, information technology, and engineering, where specialized skills and project-based work are prevalent. Gig workers frequently operate in sectors like ride-sharing, food delivery, and freelance creative services, benefiting from flexible, on-demand job opportunities. Understanding the industry focus helps businesses tailor workforce solutions and optimize operational efficiency.

Challenges and Risks in Each Role

Contractors face challenges such as managing fluctuating workloads, securing consistent contracts, and handling complex tax obligations like estimated quarterly payments. Gig workers encounter risks including income instability, lack of employee benefits, and vulnerability to platform changes that can abruptly affect earnings. Both roles require proactive financial planning, strong self-management skills, and awareness of legal classifications to mitigate potential risks.

Choosing the Right Path: Contractor or Gig Worker

Choosing between a contractor and a gig worker depends on factors such as job stability, tax obligations, and control over work schedules. Contractors often engage in longer-term projects with consistent income and tax responsibilities like self-employment tax, while gig workers enjoy flexibility but face income variability and less job security. Evaluating project scope, desired income consistency, and benefits eligibility helps professionals determine the ideal path.

Related Important Terms

Worker Classification Algorithms

Worker classification algorithms utilize machine learning models to analyze job characteristics, contract terms, and work patterns to accurately distinguish contractors from gig workers. These algorithms optimize compliance with labor laws by assessing factors such as degree of control, payment structure, and duration of engagement.

Hybrid Workforce Models

Hybrid workforce models integrate both contractors and gig workers to maximize flexibility and cost efficiency, leveraging contractors for specialized, long-term projects while engaging gig workers for short-term, on-demand tasks. This approach enhances organizational agility by balancing expertise and scalability in dynamic business environments.

Misclassification Litigation

Misclassification litigation between contractors and gig workers has surged due to disputes over employment status, impacting tax liability and benefits eligibility under laws such as the Fair Labor Standards Act and ABC test criteria. Companies face significant legal risks and financial penalties when courts determine workers are misclassified, underscoring the importance of clear contractual definitions and compliance with state-specific labor regulations.

Portable Benefits

Contractors typically lack access to employer-provided portable benefits, whereas gig workers increasingly rely on platforms offering portable benefits tailored to their flexible work patterns. Portable benefits, such as health insurance and retirement plans, are crucial for both groups to secure financial stability despite variable income streams.

On-Demand Labor Platforms

On-demand labor platforms differentiate contractors from gig workers by offering flexible, project-based roles where contractors often have more defined responsibilities and longer-term engagements, while gig workers take on short-term, task-oriented jobs with less commitment. These platforms optimize workforce scalability and operational efficiency by matching clients with the appropriate labor type based on project scope and time commitment.

Statutory Employee Status

Statutory employee status applies to workers who, while technically independent contractors, meet specific IRS criteria that classify them as employees for tax purposes, obligating employers to withhold Social Security and Medicare taxes. Contractors lack this status, maintaining full control over taxes and benefits, whereas gig workers often fall into a gray area where their classification can impact eligibility for statutory employee protections and employer tax responsibilities.

Control Test Methodology

The Control Test Methodology evaluates the degree of control a company exerts over a worker's tasks, schedules, and methods, distinguishing contractors, who maintain autonomy, from gig workers, who often face direct supervision or algorithm-driven management. This approach assesses behavioral control, financial control, and the nature of the working relationship to determine classification under labor laws and contractual obligations.

Digital Staffing Agencies

Digital staffing agencies streamline talent acquisition by categorizing workers as contractors or gig workers, optimizing project-based hiring with flexible engagement models tailored to specific business needs. Contractors typically engage in longer-term, skill-specific assignments with clear deliverables, while gig workers offer short-term, task-oriented support, enabling businesses to scale resources efficiently.

Retainer Gig Contracts

Retainer gig contracts offer a hybrid model where contractors provide ongoing services under a flexible agreement, ensuring steady income while maintaining project-based autonomy. This arrangement bridges the gap between traditional contractor roles and gig work, optimizing resource allocation and client engagement in professional settings.

Platform-Dependent Contractors

Platform-dependent contractors rely heavily on digital platforms for contract acquisition, earning a significant portion of their income through consistent project assignments from a single platform. Unlike gig workers who engage in short-term, task-based jobs across multiple platforms, these contractors often maintain ongoing relationships with platform clients, resulting in semi-stable income but limited autonomy.

Contractor vs Gig Worker Infographic

industrydif.com

industrydif.com