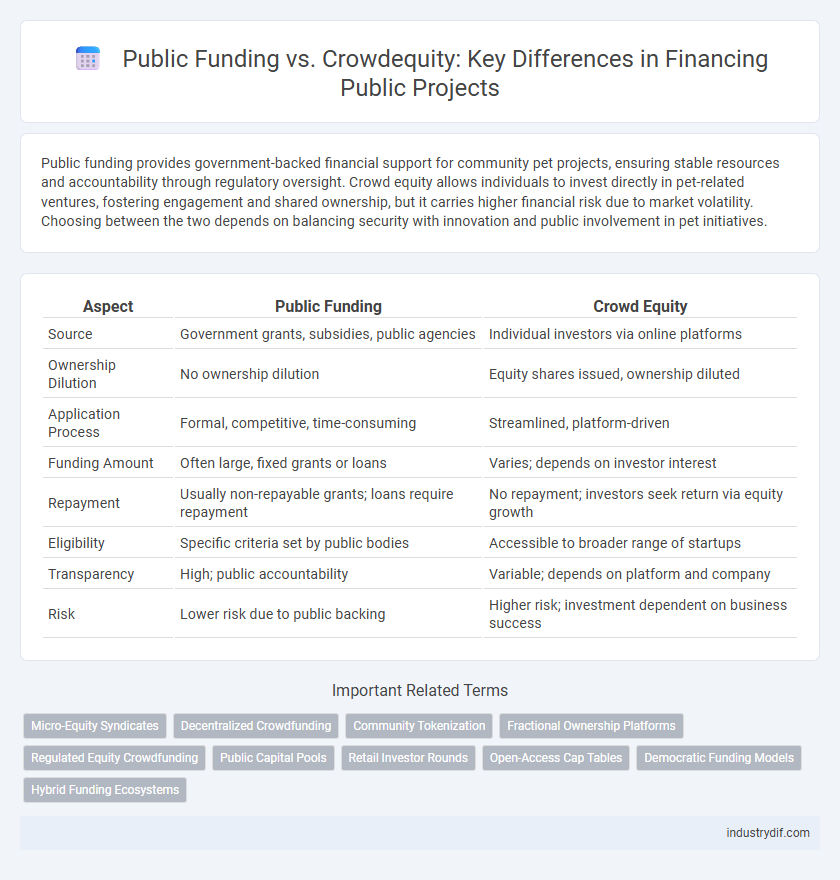

Public funding provides government-backed financial support for community pet projects, ensuring stable resources and accountability through regulatory oversight. Crowd equity allows individuals to invest directly in pet-related ventures, fostering engagement and shared ownership, but it carries higher financial risk due to market volatility. Choosing between the two depends on balancing security with innovation and public involvement in pet initiatives.

Table of Comparison

| Aspect | Public Funding | Crowd Equity |

|---|---|---|

| Source | Government grants, subsidies, public agencies | Individual investors via online platforms |

| Ownership Dilution | No ownership dilution | Equity shares issued, ownership diluted |

| Application Process | Formal, competitive, time-consuming | Streamlined, platform-driven |

| Funding Amount | Often large, fixed grants or loans | Varies; depends on investor interest |

| Repayment | Usually non-repayable grants; loans require repayment | No repayment; investors seek return via equity growth |

| Eligibility | Specific criteria set by public bodies | Accessible to broader range of startups |

| Transparency | High; public accountability | Variable; depends on platform and company |

| Risk | Lower risk due to public backing | Higher risk; investment dependent on business success |

Understanding Public Funding: Definition and Mechanisms

Public funding refers to financial support provided by government bodies or public institutions to promote projects with societal benefits, often allocated through grants, subsidies, or low-interest loans. This mechanism involves stringent application processes, eligibility criteria, and accountability measures to ensure the effective use of taxpayer resources. Unlike crowd equity, which raises capital from individual investors in exchange for shares, public funding emphasizes public interest and policy objectives over profit.

What Is Crowd Equity? Key Features Explained

Crowd equity is a form of investment where individuals fund startups or businesses in exchange for ownership shares, differentiating it from public funding which often involves grants or loans without equity exchange. Key features include direct participation from a large pool of small investors, democratized access to investment opportunities, and potential for high returns linked to company growth. This method leverages online platforms to connect businesses with investors, ensuring transparency and regulatory compliance while enabling businesses to raise capital without traditional financing constraints.

Traditional Public Funding vs. Crowd Equity: Core Differences

Traditional public funding often involves government grants and subsidies allocated through formal application processes targeting specific sectors or projects, providing non-dilutive capital but with stringent compliance requirements. Crowd equity platforms enable startups and small businesses to raise capital by selling shares directly to a large number of individual investors, offering democratized access to equity financing while creating a diverse shareholder base. Key differences include the source of funds, investor engagement levels, regulatory oversight, and the impact on company ownership structure.

Eligibility Criteria: Who Can Avail Public Funding and Crowd Equity?

Public funding eligibility typically requires businesses to meet specific criteria such as operating within designated sectors, demonstrating financial need, and complying with government regulations, often favoring startups, nonprofits, and small enterprises. Crowd equity platforms allow a broader range of participants, including early-stage companies and innovative startups, as long as they comply with securities laws and platform-specific rules. Verification processes for crowd equity focus on investor accreditation and disclosure requirements to ensure transparency and legal compliance.

Application Processes: Step-by-Step Comparison

Public funding application processes typically involve structured steps including eligibility checks, detailed proposal submission, compliance reviews, and formal approval by government agencies. Crowd equity platforms require entrepreneurs to create compelling campaign pages, submit financial disclosures, and engage with potential investors during a due diligence phase before fundraising begins. Both methods demand transparency and documentation, but public funding emphasizes regulatory compliance while crowd equity focuses on investor relations and marketing efforts.

Regulatory Landscape: Compliance in Public Funding and Crowd Equity

Public funding operates under stringent government regulations ensuring transparency, accountability, and strict reporting standards to safeguard taxpayer money. Crowd equity funding is governed by securities laws, primarily regulated by the SEC under Regulation Crowdfunding, requiring issuers to comply with investor limits, disclosure requirements, and periodic financial reporting. Both funding types emphasize compliance but differ in regulatory bodies, with public funding subject to public sector audit standards and crowd equity under private investment security frameworks.

Investor Engagement: Institutional vs. Retail Participation

Public funding often relies on institutional investors who bring significant capital and financial expertise, fostering deeper investor engagement through regulatory oversight and structured reporting. Crowd equity leverages retail participation, enabling a broader base of smaller investors to contribute capital while increasing community involvement and brand advocacy. Institutional investors typically demand rigorous due diligence and governance, whereas retail investors prioritize transparency and accessibility, shaping the dynamics of fundraising approaches.

Impact on Ownership and Control: Public Funding vs. Crowd Equity

Public funding typically allows businesses to retain full ownership and control since the capital comes from government grants or subsidies without equity dilution. Crowd equity involves selling shares to a large group of investors, leading to shared ownership and often resulting in diluted decision-making power for the original founders. The choice between public funding and crowd equity directly impacts how control is maintained and how strategic decisions are managed within a company.

Success Stories: Notable Public Funding and Crowd Equity Examples

Notable public funding success stories include the European Union's Horizon 2020 program, which has enabled breakthrough innovations in renewable energy and healthcare by allocating over EUR80 billion in grants. Crowd equity platforms like SeedInvest and Crowdcube have empowered startups such as Elvie, a femtech company that raised millions through equity crowdfunding, democratizing investment opportunities. These examples highlight how both public funding and crowd equity can accelerate growth and innovation in diverse sectors.

Choosing the Right Path: Factors to Consider for Businesses

Evaluating public funding versus crowd equity requires analyzing factors such as control retention, funding amount, and investor expectations. Public funding often offers substantial capital with regulatory oversight, while crowd equity provides access to diverse investors but may dilute ownership. Businesses must assess their growth stage, financial needs, and long-term strategy to select the optimal funding route.

Related Important Terms

Micro-Equity Syndicates

Micro-Equity Syndicates combine the advantages of public funding and crowd equity by pooling small investments from diverse backers to support startups, enabling greater access to capital while minimizing individual risk. These syndicates enhance funding efficiency through collective decision-making and facilitate broader participation in early-stage equity opportunities often limited to traditional venture capital.

Decentralized Crowdfunding

Decentralized crowdfunding leverages blockchain technology to enable transparent and secure capital raising, contrasting with traditional public funding methods that rely on governmental allocation and bureaucratic processes. Crowdfunding through decentralized platforms allows a diverse pool of investors to gain equity stakes directly, enhancing accessibility and reducing reliance on central authorities in public project financing.

Community Tokenization

Community tokenization leverages blockchain technology to transform public funding into accessible digital assets, allowing broader participation and enhancing transparency in resource allocation. Unlike traditional public funding, crowd equity enables individuals to invest directly in community projects through token ownership, fostering local economic growth and decentralized decision-making.

Fractional Ownership Platforms

Fractional ownership platforms leverage crowd equity models to democratize real estate and asset investments by allowing multiple investors to purchase shares in high-value properties typically funded through public funding mechanisms. These platforms enhance liquidity, diversify investor risk, and provide transparent ownership structures, contrasting with traditional public funding that often involves larger capital requirements and less individual control.

Regulated Equity Crowdfunding

Regulated equity crowdfunding offers startups access to public funding while ensuring investor protection through regulatory oversight, contrasting with traditional public funding that often involves government grants or subsidies without equity exchange. This method allows businesses to raise capital by selling shares to a broad base of investors under strict compliance with securities laws, enhancing transparency and market access.

Public Capital Pools

Public Capital Pools serve as centralized financial resources that channel public funding into diverse projects, ensuring accountability and broad societal benefits. Unlike crowd equity, which relies on individual investor contributions and offers potential ownership stakes, Public Capital Pools aggregate government or institutional funds to support large-scale initiatives without diluting control or requiring direct investor returns.

Retail Investor Rounds

Retail investor rounds in public funding offer regulated access to capital for startups, enabling widespread participation while maintaining investor protections through government oversight. Crowd equity platforms attract retail investors by allowing smaller investments in exchange for equity, promoting democratized ownership but often with less stringent regulatory frameworks compared to traditional public funding sources.

Open-Access Cap Tables

Open-access cap tables enhance transparency in equity distribution, making crowd equity funding more attractive by allowing broader public participation in ownership compared to traditional public funding. This openness facilitates investor confidence and accelerates capital raising while maintaining regulatory compliance.

Democratic Funding Models

Democratic funding models emphasize equal participation in allocating public resources, ensuring transparency and accountability in decision-making processes. Unlike crowd equity, which relies on individual investments for ownership stakes, public funding leverages collective taxpayer contributions to support projects benefiting society at large.

Hybrid Funding Ecosystems

Hybrid funding ecosystems combine public funding and crowd equity to maximize capital access for startups and social enterprises, leveraging government grants alongside community investment platforms. This approach enhances resource diversity, reduces financial risks, and accelerates innovation by blending institutional support with grassroots participation.

public funding vs crowd equity Infographic

industrydif.com

industrydif.com