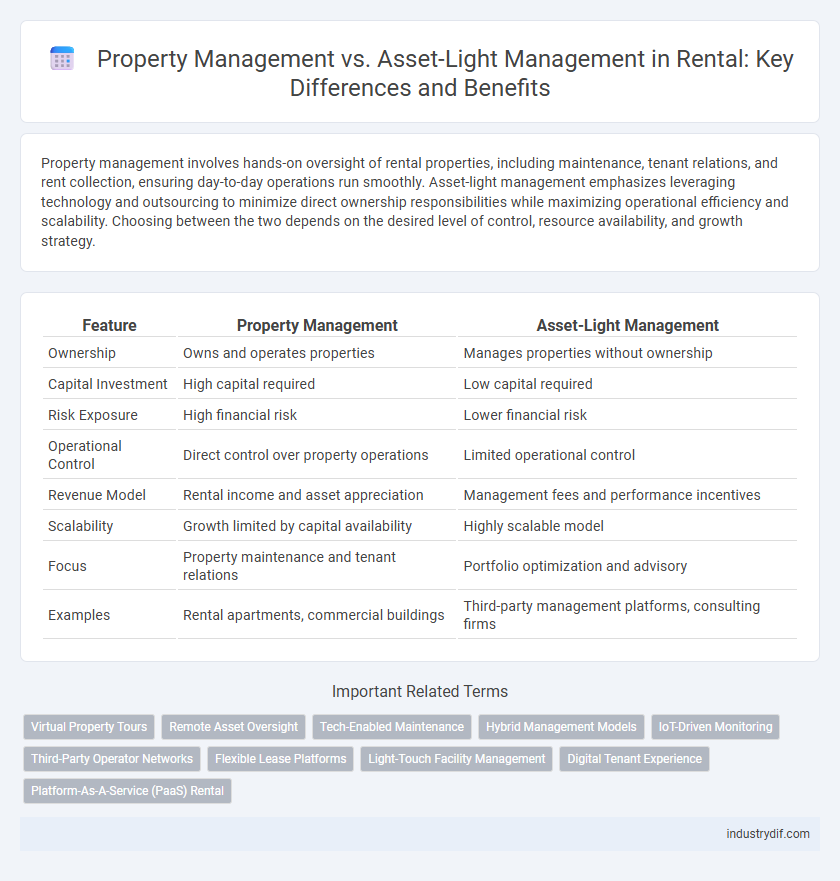

Property management involves hands-on oversight of rental properties, including maintenance, tenant relations, and rent collection, ensuring day-to-day operations run smoothly. Asset-light management emphasizes leveraging technology and outsourcing to minimize direct ownership responsibilities while maximizing operational efficiency and scalability. Choosing between the two depends on the desired level of control, resource availability, and growth strategy.

Table of Comparison

| Feature | Property Management | Asset-Light Management |

|---|---|---|

| Ownership | Owns and operates properties | Manages properties without ownership |

| Capital Investment | High capital required | Low capital required |

| Risk Exposure | High financial risk | Lower financial risk |

| Operational Control | Direct control over property operations | Limited operational control |

| Revenue Model | Rental income and asset appreciation | Management fees and performance incentives |

| Scalability | Growth limited by capital availability | Highly scalable model |

| Focus | Property maintenance and tenant relations | Portfolio optimization and advisory |

| Examples | Rental apartments, commercial buildings | Third-party management platforms, consulting firms |

Definition of Property Management

Property management involves overseeing and maintaining rental properties, including tenant relations, rent collection, repairs, and compliance with regulations. It requires hands-on responsibility for the physical asset and daily operations, ensuring optimal property performance and tenant satisfaction. This contrasts with asset-light management, which focuses more on operational oversight without direct ownership or extensive physical involvement in the property.

Understanding Asset-Light Management

Asset-light management in property rental emphasizes maximizing returns by minimizing direct ownership and operational responsibilities, focusing instead on strategic oversight and partnership with local operators. This approach reduces capital expenditure and risk while improving scalability across multiple rental properties. Property managers retain control over tenant relations and maintenance through outsourcing, enabling efficient portfolio growth without heavy asset investments.

Key Differences Between Property Management and Asset-Light Management

Property management involves direct oversight of rental properties, including tenant relations, maintenance, and rent collection, whereas asset-light management focuses on controlling property operations without ownership, often leveraging third-party partnerships. Key differences include capital investment levels, with property management requiring substantial assets, while asset-light models minimize financial exposure by managing properties on behalf of owners. The operational responsibilities differ as property managers handle day-to-day tasks, whereas asset-light managers prioritize strategic decisions and service coordination.

Cost Structures in Property vs Asset-Light Models

Property management involves direct control over physical assets, leading to higher fixed costs such as maintenance, staffing, and infrastructure expenses. Asset-light management reduces capital expenditure by leveraging third-party partnerships or technology platforms, resulting in more variable costs tied to service fees and performance incentives. The cost structure in asset-light models is typically more scalable and flexible, allowing firms to adjust expenses quickly based on market demand and occupancy rates.

Operational Responsibilities: Who Handles What?

Property management involves handling day-to-day operational responsibilities such as tenant relations, rent collection, property maintenance, and compliance with local regulations. Asset-light management focuses on strategic oversight, often outsourcing operational tasks to third-party service providers, allowing owners to minimize direct involvement in everyday property operations. This division of roles optimizes efficiency by assigning hands-on management to specialized teams while asset-light managers concentrate on portfolio performance and value enhancement.

Risk and Liability Distribution

Property management involves direct control over rental operations and maintenance, placing significant risk and liability on the manager for tenant issues, property damage, and regulatory compliance. Asset-light management minimizes ownership stakes by outsourcing operational responsibilities, which reduces direct liability but requires rigorous contract enforcement and oversight to manage risks effectively. Choosing between these approaches depends on the desired balance between operational control and risk exposure.

Scalability and Growth Potential

Property management offers scalable growth through direct control of rental operations, tenant relations, and property maintenance, enabling asset optimization and enhanced revenue streams. Asset-light management prioritizes leveraging third-party services and technology platforms to expand portfolio size rapidly without heavy capital investment, facilitating faster market entry and reduced operational risks. Scalability in property management requires substantial resource allocation, whereas asset-light approaches enable agile growth and broader market diversification with minimized overhead.

Revenue Streams and Profit Margins

Property management generates consistent revenue streams through rental income and tenant fees, maintaining stable profit margins by controlling operational expenses and maintenance costs. Asset-light management leverages third-party ownership, earning primarily from management fees and performance incentives, which often results in higher profit margins due to lower capital expenditure and reduced risk exposure. Comparing the two, property management offers predictable cash flow, while asset-light models emphasize scalability and margin optimization through streamlined asset control.

Technology and Automation in Both Models

Property management leverages technology and automation to streamline tenant communications, maintenance requests, and rent collection, enhancing operational efficiency and tenant satisfaction. Asset-light management utilizes advanced software platforms and data analytics to optimize property portfolios without direct ownership, enabling scalable, cost-effective control over multiple assets. Both models increasingly integrate AI-driven tools and IoT devices to improve predictive maintenance, energy management, and real-time reporting, driving innovation in the rental industry.

Choosing the Right Management Approach for Your Rental Business

Choosing the right management approach for your rental business depends on your investment goals and operational capacity. Property management involves hands-on oversight and maintenance responsibilities, ideal for investors seeking direct control and consistent tenant engagement. Asset-light management emphasizes outsourcing operations to third-party firms, enabling scalability and reduced operational burden while maximizing portfolio growth potential.

Related Important Terms

Virtual Property Tours

Virtual property tours enhance asset-light management by reducing the need for physical site visits and streamlining tenant acquisitions through immersive digital experiences. Property management benefits from these tours by improving operational efficiency, enabling remote inspections, and accelerating lease agreements in the rental market.

Remote Asset Oversight

Remote asset oversight in property management enables real-time monitoring and maintenance coordination, minimizing physical presence and operational costs. Asset-light management leverages technology-driven platforms to streamline tenant communication and financial reporting, enhancing scalability and efficiency without heavy capital investment.

Tech-Enabled Maintenance

Tech-enabled maintenance in property management enhances operational efficiency by integrating IoT devices, predictive analytics, and automated scheduling to reduce downtime and maintenance costs. Asset-light management leverages these technologies to streamline service providers' deployment without owning physical assets, optimizing resource allocation and scalability in rental property portfolios.

Hybrid Management Models

Hybrid management models combine traditional property management with asset-light strategies, optimizing operational efficiency while minimizing capital expenditures. This approach leverages technology-driven platforms and third-party services to enhance tenant experience and maximize rental income without the heavy burdens of full asset ownership.

IoT-Driven Monitoring

IoT-driven monitoring in property management enables real-time data collection on rental unit conditions, enhancing maintenance efficiency and tenant satisfaction by proactively addressing issues. Asset-light management leverages IoT technology to remotely oversee multiple properties without direct ownership, optimizing operational costs while ensuring property performance and risk mitigation.

Third-Party Operator Networks

Third-party operator networks enhance property management by leveraging established local expertise, enabling efficient leasing, maintenance, and tenant relations without substantial capital investment. Asset-light management strategies prioritize partnering with these networks to reduce operational risks and increase scalability across multiple rental properties.

Flexible Lease Platforms

Flexible lease platforms in property management streamline tenant experiences by offering scalable lease terms and automated rent collection, enhancing operational efficiency across diverse rental portfolios. Asset-light management leverages these platforms to minimize capital investment while maximizing flexibility and responsiveness to market demand fluctuations, optimizing rental income.

Light-Touch Facility Management

Light-touch facility management emphasizes minimal intervention and cost efficiency by handling essential maintenance and tenant services without full operational oversight, contrasting with traditional property management which involves comprehensive asset control and hands-on management. This asset-light approach reduces overhead expenses and increases scalability for rental portfolios, making it ideal for property owners seeking to optimize returns while maintaining tenant satisfaction.

Digital Tenant Experience

Property management emphasizes hands-on operational control and maintenance of rental units, while asset-light management focuses on maximizing returns through digital tenant experience platforms that streamline communication, payments, and maintenance requests. Leveraging digital tools in asset-light models enhances tenant satisfaction and retention by providing seamless, real-time interactions and automated service delivery.

Platform-As-A-Service (PaaS) Rental

Platform-As-A-Service (PaaS) rental models leverage asset-light management by offering scalable property management solutions without direct ownership of physical assets, enhancing operational efficiency and flexibility. This approach allows property managers to integrate technological platforms for seamless tenant engagement, maintenance coordination, and real-time data analytics, optimizing rental income and occupancy rates.

Property management vs Asset-light management Infographic

industrydif.com

industrydif.com