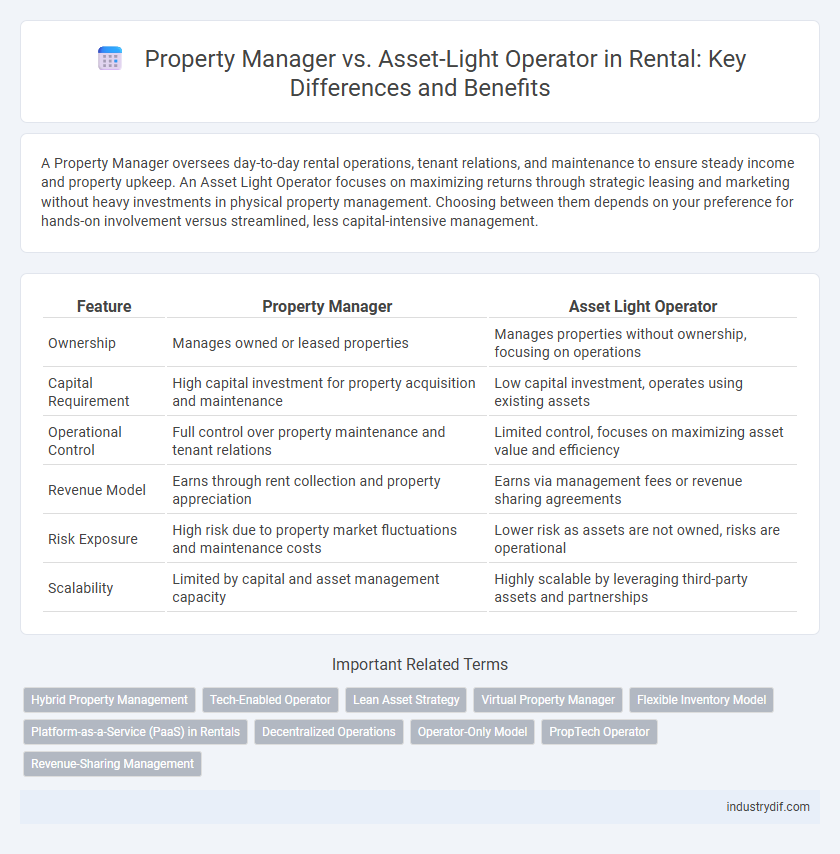

A Property Manager oversees day-to-day rental operations, tenant relations, and maintenance to ensure steady income and property upkeep. An Asset Light Operator focuses on maximizing returns through strategic leasing and marketing without heavy investments in physical property management. Choosing between them depends on your preference for hands-on involvement versus streamlined, less capital-intensive management.

Table of Comparison

| Feature | Property Manager | Asset Light Operator |

|---|---|---|

| Ownership | Manages owned or leased properties | Manages properties without ownership, focusing on operations |

| Capital Requirement | High capital investment for property acquisition and maintenance | Low capital investment, operates using existing assets |

| Operational Control | Full control over property maintenance and tenant relations | Limited control, focuses on maximizing asset value and efficiency |

| Revenue Model | Earns through rent collection and property appreciation | Earns via management fees or revenue sharing agreements |

| Risk Exposure | High risk due to property market fluctuations and maintenance costs | Lower risk as assets are not owned, risks are operational |

| Scalability | Limited by capital and asset management capacity | Highly scalable by leveraging third-party assets and partnerships |

Defining Property Managers in the Rental Industry

Property managers in the rental industry oversee daily operations, tenant relations, and maintenance to ensure smooth property functionality. They handle lease agreements, rent collection, and coordinate repairs, optimizing occupancy rates and tenant satisfaction. Unlike asset light operators, property managers maintain direct responsibility for physical property management and tenant interactions within rental portfolios.

What is an Asset Light Operator?

An Asset Light Operator manages rental properties without owning the real estate, focusing on maximizing revenue through efficient operations and customer service. They leverage technology and partnerships to optimize occupancy and reduce maintenance costs, differentiating from traditional property managers who typically own or directly control assets. This model allows faster scalability and flexibility in adapting to market demand while minimizing capital expenditure.

Key Differences: Property Manager vs Asset Light Operator

A Property Manager oversees the day-to-day operations, maintenance, and tenant relations of rental properties, ensuring compliance and maximizing occupancy rates. An Asset Light Operator, in contrast, focuses on managing rental portfolios with minimal direct ownership or physical asset control, leveraging technology and partnerships to streamline operations. The key difference lies in the degree of asset ownership and operational control, where Property Managers handle tangible property responsibilities, while Asset Light Operators emphasize efficiency and scalability without significant capital investment.

Roles and Responsibilities in Rental Operations

Property managers handle day-to-day rental operations including tenant screening, lease management, maintenance coordination, and rent collection to ensure property performance and tenant satisfaction. Asset light operators focus on maximizing revenue and operational efficiency, often outsourcing physical asset management while managing marketing, pricing strategies, and customer acquisition. The clear division of responsibilities allows property managers to maintain asset condition, whereas asset light operators optimize financial returns through strategic oversight.

Revenue Models: Traditional vs Asset Light Approaches

Property managers generate revenue through fixed fees or a percentage of rental income, focusing on full control and maintenance of physical assets to maximize occupancy and returns. In contrast, asset light operators rely on commission-based models or performance incentives without owning properties, leveraging technology and partnerships to scale quickly while minimizing capital expenditure. The traditional model prioritizes steady, predictable income streams, whereas asset light approaches emphasize flexibility, operational efficiency, and rapid market expansion.

Scalability and Business Growth Potential

Property managers focus on day-to-day rental operations, ensuring tenant satisfaction and property maintenance, which limits scalability to the number of properties they can directly oversee. Asset light operators leverage technology and third-party services to manage portfolios without owning assets, enabling rapid expansion and higher business growth potential. This model allows for scalable growth by minimizing capital expenditure while maximizing operational efficiency in the rental market.

Technology Adoption in Property Management

Property managers leverage advanced property management software and Internet of Things (IoT) devices to streamline tenant communications, automate maintenance requests, and optimize rental income. Asset-light operators prioritize cloud-based platforms and data analytics to reduce overhead costs while maximizing portfolio efficiency through outsourced services. Technology adoption drives enhanced operational agility and scalable growth in both property management models.

Operational Control and Risk Exposure

Property managers maintain direct operational control over rental properties, overseeing tenant relations, maintenance, and compliance, which increases their risk exposure to property damages and legal liabilities. In contrast, asset light operators focus on managing rental portfolios without owning physical assets, reducing capital investment and minimizing operational risks by outsourcing property management tasks. This model shifts operational control away from asset-heavy responsibilities, allowing for scalable management with lower financial exposure.

Impact on Tenant Experience and Satisfaction

Property managers provide hands-on services such as maintenance coordination and tenant communication, leading to quicker issue resolution and enhanced tenant satisfaction. Asset light operators, leveraging technology and third-party vendors, optimize operational efficiency but may deliver less personalized tenant interactions. The balance between direct management and streamlined operations significantly influences tenant experience and retention rates in rental properties.

Choosing the Right Model for Your Rental Business

Choosing the right model for your rental business depends on your operational goals and resource availability. Property managers handle day-to-day tenant relations and maintenance, ensuring consistent service quality through hands-on management, while asset light operators focus on maximizing returns by outsourcing property ownership and leveraging digital platforms. Evaluating factors such as control preferences, scalability, and cost efficiency will help determine whether a property manager or an asset light operator aligns better with your rental business strategy.

Related Important Terms

Hybrid Property Management

Hybrid property management integrates the hands-on oversight of a Property Manager with the streamlined scalability of an Asset Light Operator, optimizing rental operations and tenant satisfaction. This model leverages advanced technology platforms for efficient maintenance and leasing processes while maintaining personalized, local market expertise to maximize property value and operational efficiency.

Tech-Enabled Operator

Tech-enabled operators leverage advanced property management software and automation tools to streamline rental processes, enhance tenant communication, and optimize maintenance schedules. Unlike traditional property managers, asset light operators minimize physical asset holdings, focusing on scalable tech solutions that improve operational efficiency and boost return on investment.

Lean Asset Strategy

A Property Manager typically handles day-to-day operations such as maintenance, tenant relations, and lease management, optimizing property performance with a hands-on approach. In contrast, an Asset Light Operator emphasizes a lean asset strategy by leveraging technology and outsourcing to minimize capital investment and operational overhead while maximizing asset utilization and return on investment.

Virtual Property Manager

A Virtual Property Manager leverages cloud-based technology to oversee rental properties efficiently without owning physical assets, contrasting with an Asset Light Operator who typically manages multiple properties through partnerships while minimizing capital investment. This digital-first approach enhances real-time communication, automates maintenance requests, and optimizes tenant screening, driving operational scalability and cost-effectiveness in rental management.

Flexible Inventory Model

Property Managers maintain direct control over rental assets, ensuring consistent upkeep and tenant relations, while Asset Light Operators leverage a flexible inventory model by partnering with multiple property owners to dynamically scale and optimize available rental units. This flexible inventory approach enables Asset Light Operators to rapidly adjust supply based on market demand without the overhead of ownership, enhancing operational agility and responsiveness.

Platform-as-a-Service (PaaS) in Rentals

Property Managers handle day-to-day rental operations, tenant relations, and maintenance, while Asset Light Operators leverage Platform-as-a-Service (PaaS) solutions to streamline property management through automated workflows and real-time data analytics. PaaS in rentals enhances scalability and operational efficiency by integrating booking, payment processing, and performance tracking on a centralized platform.

Decentralized Operations

Property managers handle day-to-day rental activities and tenant relations, ensuring operational efficiency through localized decision-making within decentralized operations. Asset light operators leverage decentralized strategies by outsourcing property ownership and maintenance, focusing on scalable management services to optimize rental portfolio performance.

Operator-Only Model

The Operator-Only Model in rental property management emphasizes lean operations by focusing solely on asset utilization and tenant services without direct property ownership, contrasting with traditional Property Managers who handle both physical assets and tenant relations. This model enhances scalability and profitability by minimizing capital expenditure and leveraging third-party asset owners.

PropTech Operator

Property managers handle day-to-day rental operations, tenant communication, and maintenance coordination, ensuring consistent cash flow and tenant satisfaction. PropTech operators, as asset light operators, leverage technology platforms to optimize rental processes, reduce overhead, and scale property management services efficiently across multiple locations.

Revenue-Sharing Management

Property managers handle day-to-day rental operations and maintenance, ensuring consistent tenant satisfaction and occupancy rates, while asset light operators focus on maximizing revenue through strategic partnerships with minimal capital investment. In revenue-sharing management, asset light operators leverage flexible agreements to optimize profitability by aligning interests with property owners, contrasting with property managers' fixed fee structures that prioritize operational control.

Property Manager vs Asset Light Operator Infographic

industrydif.com

industrydif.com