Private label products leverage retailer branding to offer cost-effective alternatives, enhancing margin control and shelf space dominance. Direct-to-consumer (DTC) brands prioritize customer engagement and data-driven personalization, bypassing traditional retail channels to build stronger brand loyalty. Retailers face strategic decisions balancing private label's price competitiveness with DTC's innovative, consumer-centric approach.

Table of Comparison

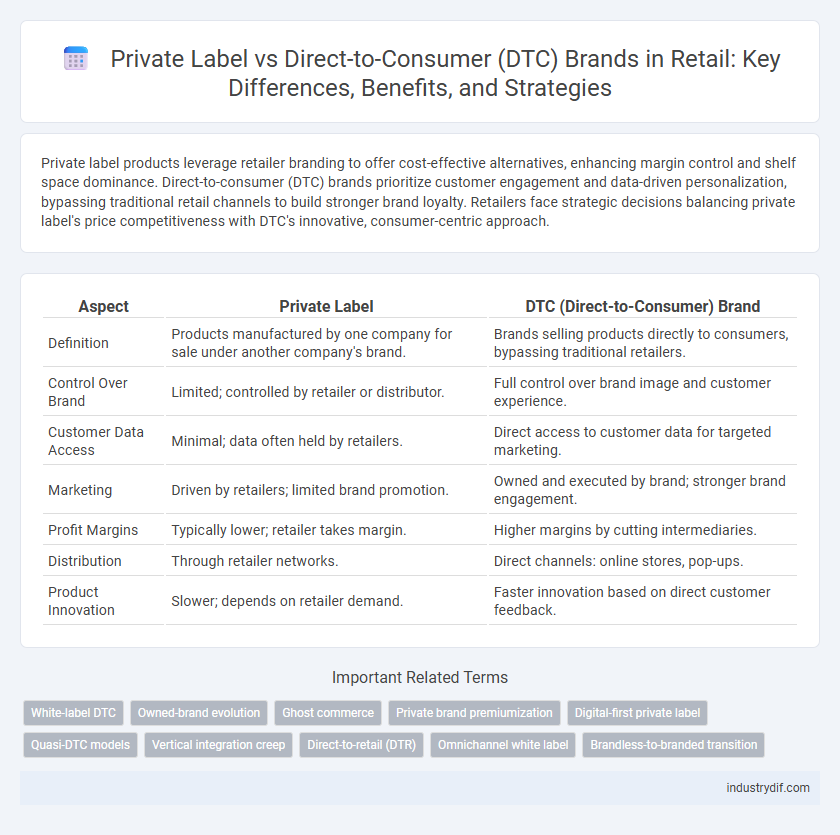

| Aspect | Private Label | DTC (Direct-to-Consumer) Brand |

|---|---|---|

| Definition | Products manufactured by one company for sale under another company's brand. | Brands selling products directly to consumers, bypassing traditional retailers. |

| Control Over Brand | Limited; controlled by retailer or distributor. | Full control over brand image and customer experience. |

| Customer Data Access | Minimal; data often held by retailers. | Direct access to customer data for targeted marketing. |

| Marketing | Driven by retailers; limited brand promotion. | Owned and executed by brand; stronger brand engagement. |

| Profit Margins | Typically lower; retailer takes margin. | Higher margins by cutting intermediaries. |

| Distribution | Through retailer networks. | Direct channels: online stores, pop-ups. |

| Product Innovation | Slower; depends on retailer demand. | Faster innovation based on direct customer feedback. |

Understanding Private Label and DTC: Key Definitions

Private label brands are products manufactured by one company but sold under a retailer's brand name, allowing retailers to offer exclusive items and control pricing. Direct-to-consumer (DTC) brands bypass traditional retail channels by selling products directly to customers through online platforms, fostering stronger brand-consumer relationships. Understanding the distinctions between private label and DTC is crucial for retail strategies focused on brand differentiation and customer engagement.

Business Models: Private Label vs DTC

Private label business models rely on retailers sourcing products from third-party manufacturers and selling under their own brand, enabling cost control and rapid product diversification. Direct-to-consumer (DTC) brands own the entire customer experience, from product design to marketing and sales, allowing for greater brand authority and higher profit margins. While private labels leverage existing retail infrastructure, DTC models emphasize customer data analytics and personalized marketing to build long-term loyalty.

Supply Chain Differences in Private Label and DTC

Private label brands rely heavily on retailer-controlled supply chains, leveraging established distribution networks to manage inventory, production, and logistics efficiently at scale. In contrast, DTC brands maintain direct control over their supply chains, allowing for greater agility in inventory management, faster response to consumer demand, and personalized customer experiences. The supply chain for DTC often integrates advanced technologies like direct fulfillment and data-driven forecasting, optimizing operational efficiency and reducing intermediary costs.

Branding and Customer Ownership

Private label brands rely on retailers' established trust and distribution channels, often lacking distinct brand identity and direct customer relationships. Direct-to-consumer (DTC) brands prioritize strong branding and personalized customer engagement, securing complete ownership of customer data and loyalty. This ownership enables DTC brands to tailor marketing strategies, optimize customer experiences, and drive long-term growth independent of third-party retailers.

Product Development and Customization

Private label brands excel in product development by leveraging established manufacturer expertise to create cost-effective, scalable items tailored for retailer specifications. DTC brands prioritize customization through direct consumer feedback loops, enabling rapid iteration and personalized product offerings that enhance customer loyalty. Both approaches optimize product innovation, with private labels focusing on efficiency and DTC brands emphasizing tailored consumer experiences.

Pricing Strategies: Margin Control and Value Proposition

Private label brands often leverage lower production and distribution costs to offer competitive pricing, enhancing margin control while maintaining a strong value proposition for budget-conscious consumers. DTC brands focus on premium pricing strategies supported by direct customer relationships and unique brand experiences that justify higher margins through perceived value and customer loyalty. Strategic pricing in both models balances cost efficiencies with targeted market positioning to optimize profitability and consumer trust.

Marketing Approaches in Private Label vs DTC

Private label brands typically leverage retailer-driven marketing strategies, emphasizing in-store promotions, price competitiveness, and shelf placement to attract value-conscious consumers. DTC brands prioritize digital marketing channels such as social media advertising, influencer partnerships, and personalized email campaigns to build brand loyalty and gather first-party customer data. The contrast in approaches reflects private labels' reliance on retailer infrastructure versus DTC brands' focus on direct customer engagement and brand storytelling.

Customer Experience and Relationship Building

Private label brands often enhance customer experience by offering affordable, exclusive products that foster brand loyalty within retail ecosystems. DTC brands prioritize personalized interactions through direct communication channels, enabling tailored recommendations and faster response times that deepen customer relationships. Both models leverage data analytics to optimize customer insights, driving improved satisfaction and retention.

Challenges and Risks for Retailers

Private label brands face challenges in brand differentiation and quality perception, risking lower consumer trust compared to established DTC brands known for unique value propositions. Retailers managing DTC brands must invest heavily in digital marketing and customer experience to maintain engagement, while facing risks from supply chain complexities and fluctuating consumer preferences. Both models necessitate significant operational agility to mitigate inventory risks and ensure profitability in highly competitive retail markets.

The Future of Private Label and DTC in Retail

Private label and direct-to-consumer (DTC) brands are reshaping retail by leveraging consumer data and personalized experiences for competitive advantage. Advanced analytics and AI-driven insights enable retailers to optimize private label product development, pricing, and marketing strategies, while DTC brands capitalize on direct customer relationships to build loyalty and streamline supply chains. The future of retail hinges on the integration of these models, combining the cost-efficiency of private labels with the agility and innovation inherent in DTC approaches to meet evolving consumer demands.

Related Important Terms

White-label DTC

White-label DTC brands leverage pre-manufactured products rebranded and sold directly to consumers, enabling retailers to capitalize on established supply chains while maintaining control over branding and customer experience. This approach reduces product development costs and accelerates market entry compared to traditional private label models, which often involve bespoke manufacturing agreements and longer lead times.

Owned-brand evolution

Owned-brand evolution in retail highlights the strategic shift from traditional private labels to direct-to-consumer (DTC) brands, leveraging data-driven customer insights to enhance brand loyalty and margin control. This transition enables retailers to differentiate through exclusive products, optimized pricing strategies, and personalized marketing, driving growth in competitive markets.

Ghost commerce

Private label products, often manufactured by third parties and sold under a retailer's brand, contrast with DTC brands that control the entire supply chain and customer experience. Ghost commerce leverages this by enabling retailers to launch private labels rapidly without inventory risk, using DTC strategies for personalized marketing and data-driven sales optimization.

Private brand premiumization

Private label premiumization in retail leverages high-quality materials, exclusive formulations, and sophisticated packaging to elevate store brands, directly competing with DTC brands by offering consumers enhanced value and luxury at lower price points. This strategic enhancement drives retailer profit margins and fosters customer loyalty by meeting growing demand for premium, cost-effective alternatives to national brands.

Digital-first private label

Digital-first private label brands leverage direct-to-consumer (DTC) strategies by using data-driven marketing and seamless e-commerce platforms to enhance customer personalization and reduce distribution costs. These brands optimize supply chains and digital touchpoints, outperforming traditional private labels through agile product development and targeted online engagement.

Quasi-DTC models

Quasi-DTC models blend private label products with direct-to-consumer channels, enabling retailers to maintain brand control while leveraging physical stores and online platforms for consumer engagement. This hybrid approach enhances data collection and customer insights, optimizing inventory management and personalized marketing strategies to drive higher profitability.

Vertical integration creep

Private label products often leverage vertical integration by controlling manufacturing, distribution, and retail channels to reduce costs and increase margins, while DTC brands use vertical integration to maintain direct customer relationships and agile supply chains. Vertical integration creep occurs as both models expand control over multiple stages in the value chain, intensifying competition in retail by blurring traditional boundaries between producers and sellers.

Direct-to-retail (DTR)

Direct-to-retail (DTR) models enable brands to bypass traditional wholesale channels by supplying products directly to retail stores, optimizing supply chain efficiency and increasing shelf visibility. This approach blends the control advantages of direct-to-consumer (DTC) with the market reach of private label distribution, driving higher margins and faster product turnover.

Omnichannel white label

Private label products integrated within an omnichannel retail strategy enable seamless consumer experiences by combining in-store availability with direct-to-consumer digital platforms, enhancing brand control and margin optimization. Leveraging data-driven insights across online and offline touchpoints, retailers can tailor white label offerings to specific customer segments, driving loyalty and boosting overall sales performance.

Brandless-to-branded transition

Private label products are evolving as retailers invest in building branded identities to increase customer loyalty and margins, reflecting a strategic shift from anonymous offerings to distinct brand experiences. This brandless-to-branded transition leverages direct-to-consumer (DTC) strategies, utilizing personalized marketing and data-driven insights to foster stronger consumer relationships and differentiate in competitive retail markets.

Private label vs DTC (direct-to-consumer) brand Infographic

industrydif.com

industrydif.com