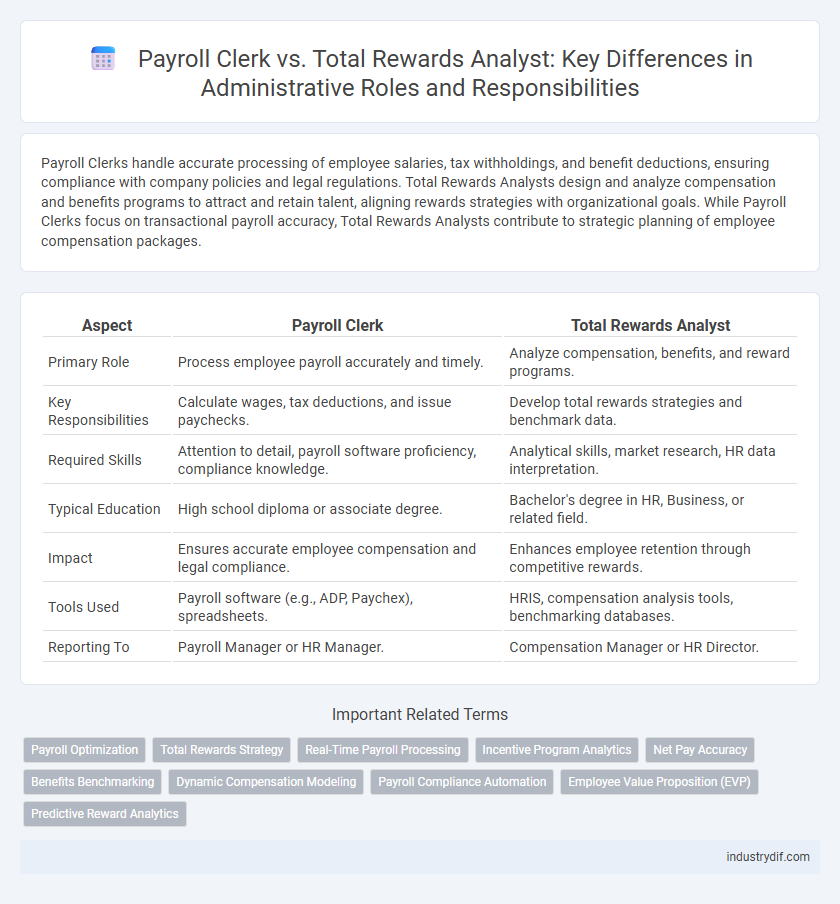

Payroll Clerks handle accurate processing of employee salaries, tax withholdings, and benefit deductions, ensuring compliance with company policies and legal regulations. Total Rewards Analysts design and analyze compensation and benefits programs to attract and retain talent, aligning rewards strategies with organizational goals. While Payroll Clerks focus on transactional payroll accuracy, Total Rewards Analysts contribute to strategic planning of employee compensation packages.

Table of Comparison

| Aspect | Payroll Clerk | Total Rewards Analyst |

|---|---|---|

| Primary Role | Process employee payroll accurately and timely. | Analyze compensation, benefits, and reward programs. |

| Key Responsibilities | Calculate wages, tax deductions, and issue paychecks. | Develop total rewards strategies and benchmark data. |

| Required Skills | Attention to detail, payroll software proficiency, compliance knowledge. | Analytical skills, market research, HR data interpretation. |

| Typical Education | High school diploma or associate degree. | Bachelor's degree in HR, Business, or related field. |

| Impact | Ensures accurate employee compensation and legal compliance. | Enhances employee retention through competitive rewards. |

| Tools Used | Payroll software (e.g., ADP, Paychex), spreadsheets. | HRIS, compensation analysis tools, benchmarking databases. |

| Reporting To | Payroll Manager or HR Manager. | Compensation Manager or HR Director. |

Role Overview: Payroll Clerk vs Total Rewards Analyst

A Payroll Clerk manages employee wage processing, ensuring accurate salary calculations, tax withholdings, and compliance with payroll regulations. In contrast, a Total Rewards Analyst focuses on designing and analyzing compensation, benefits, and incentive programs to enhance employee satisfaction and retention. Both roles require attention to detail, but the Payroll Clerk handles transactional payroll tasks while the Total Rewards Analyst strategically aligns rewards with organizational goals.

Key Responsibilities and Daily Tasks

Payroll Clerks manage employee compensation by processing wages, calculating deductions, and ensuring timely salary disbursements. Total Rewards Analysts design and analyze compensation programs, including benefits, bonuses, and incentives, to enhance employee satisfaction and retention. While Payroll Clerks focus on accurate payroll execution, Total Rewards Analysts emphasize strategic compensation planning and market competitiveness.

Required Skills and Qualifications

Payroll Clerks require proficiency in data entry, payroll software such as ADP or Paychex, and strong attention to detail for accurate wage calculations and compliance with tax regulations. Total Rewards Analysts need advanced analytical skills, experience with compensation benchmarking, benefits administration, and knowledge of HRIS systems like Workday or SAP SuccessFactors. Both roles demand strong organizational abilities and familiarity with federal and state labor laws to ensure regulatory adherence.

Educational Background and Certifications

Payroll Clerks typically possess a high school diploma or an associate degree in accounting, finance, or business administration, often supplemented by certifications such as the Certified Payroll Professional (CPP) to enhance payroll processing expertise. Total Rewards Analysts generally require a bachelor's degree in human resources, business, or a related field, with certifications like the Certified Compensation Professional (CCP) providing specialized knowledge in compensation, benefits, and employee rewards strategy. Both roles benefit from proficiency in payroll systems and data analysis, but Total Rewards Analysts focus more on strategic compensation design supported by advanced educational credentials.

Core Competencies in Payroll and Total Rewards

Payroll Clerks demonstrate expertise in wage calculation, tax compliance, and record maintenance, ensuring accurate and timely payroll processing. Total Rewards Analysts excel in designing compensation frameworks, analyzing benefits trends, and supporting employee incentive programs to enhance organizational retention. Both roles require strong data analysis skills and familiarity with HR information systems to optimize payroll and rewards administration.

Tools and Technology Used

Payroll Clerks primarily use payroll software such as ADP, Paychex, and QuickBooks to manage employee compensation, tax withholdings, and benefits deductions. Total Rewards Analysts utilize advanced analytics tools like Excel, Tableau, and HRIS platforms including Workday and Oracle HCM to analyze compensation data, benchmark salaries, and design incentive programs. Both roles require proficiency in payroll systems and data analysis software, but Total Rewards Analysts emphasize strategic tools for compensation planning and reporting.

Compliance and Regulatory Knowledge

Payroll Clerks ensure compliance with federal and state payroll regulations, managing accurate tax withholdings, wage laws, and reporting requirements. Total Rewards Analysts possess in-depth regulatory knowledge to design compensation and benefits programs adhering to labor laws and industry standards. Both roles require continuous updates on compliance changes to mitigate risks and maintain organizational alignment with regulatory frameworks.

Career Path and Advancement Opportunities

Payroll Clerks typically begin their careers processing employee compensation and managing payroll records, advancing into supervisory roles or specializing in payroll systems management. Total Rewards Analysts focus on designing and analyzing compensation and benefits programs, with career progression leading to senior analyst positions or human resources management roles. Both paths offer advancement opportunities within human resources, with Total Rewards Analysts often moving toward strategic roles involving compensation planning and policy development.

Salary Comparison and Compensation Packages

Payroll Clerks earn an average annual salary of $40,000 to $55,000, focusing primarily on processing employee paychecks and ensuring compliance with tax regulations. Total Rewards Analysts command higher salaries, typically ranging from $65,000 to $90,000, reflecting their broader role in designing and managing comprehensive compensation and benefits programs. Compensation packages for Total Rewards Analysts often include performance bonuses and extended benefits, whereas Payroll Clerks generally receive standard wage and benefit offerings.

Industry Demand and Job Outlook

Payroll Clerks are in steady demand across industries such as healthcare, manufacturing, and retail, driven by the need for accurate employee compensation management and compliance with tax regulations. Total Rewards Analysts, positioned within human resources, see growing opportunities in sectors prioritizing employee retention and competitive benefits, including technology and finance. Employment projections indicate faster growth for Total Rewards Analysts due to expanding benefits complexity and strategic workforce planning trends.

Related Important Terms

Payroll Optimization

Payroll Clerks specialize in processing employee wages, tax deductions, and compliance with labor laws, ensuring accurate and timely payroll execution. Total Rewards Analysts optimize payroll by analyzing compensation structures, benefits programs, and market trends to enhance employee retention and cost-efficiency.

Total Rewards Strategy

Total Rewards Analysts specialize in developing and implementing comprehensive total rewards strategies that integrate compensation, benefits, and employee recognition to enhance workforce engagement and retention. Payroll Clerks primarily focus on accurate payroll processing and compliance, lacking the strategic scope involved in designing and managing total rewards programs.

Real-Time Payroll Processing

Payroll Clerks ensure accurate real-time payroll processing by managing employee time data, verifying hours, and addressing discrepancies promptly to guarantee timely salary disbursements. Total Rewards Analysts analyze compensation structures and benefits packages but rely on Payroll Clerks for the operational execution of real-time payroll data handling.

Incentive Program Analytics

A Payroll Clerk primarily manages employee payment processing and basic payroll record-keeping, while a Total Rewards Analyst specializes in analyzing incentive program effectiveness using data-driven insights to optimize compensation strategies and enhance employee engagement. Total Rewards Analysts leverage analytics tools to assess incentive plan performance metrics, balancing cost efficiency with motivational outcomes in alignment with organizational goals.

Net Pay Accuracy

Payroll Clerks ensure net pay accuracy by processing employee wages, deductions, and tax withholdings with meticulous attention to detail, reducing errors in paycheck distribution. Total Rewards Analysts monitor compensation structures and benefits plans, analyzing data to optimize pay accuracy and compliance with regulatory standards.

Benefits Benchmarking

Payroll Clerks manage employee compensation records and ensure accurate processing of wages, while Total Rewards Analysts focus on benefits benchmarking by analyzing market data to design competitive compensation packages that attract and retain talent. Benefits benchmarking involves comparing health insurance plans, retirement options, and other perks against industry standards to optimize total rewards strategies.

Dynamic Compensation Modeling

Payroll Clerks primarily manage accurate salary disbursement and tax withholdings, ensuring compliance with local regulations, while Total Rewards Analysts specialize in dynamic compensation modeling by analyzing market trends and designing competitive pay structures to optimize employee retention and engagement. The advanced data analytics utilized by Total Rewards Analysts enable the development of flexible compensation packages aligned with strategic organizational goals, contrasting with the more transactional focus of Payroll Clerks.

Payroll Compliance Automation

Payroll Clerks ensure accurate employee compensation by processing payroll data and adhering to tax regulations, while Total Rewards Analysts focus on designing competitive benefits packages and salary structures. Payroll Compliance Automation streamlines tax filings, reduces errors, and enhances regulatory adherence, benefiting both roles by improving efficiency and accuracy in payroll management.

Employee Value Proposition (EVP)

Payroll Clerks ensure accurate salary processing and compliance with financial regulations, directly supporting the Employee Value Proposition by maintaining trust and timely compensation. Total Rewards Analysts enhance the EVP by designing competitive compensation packages and benefits strategies that attract and retain top talent while aligning with organizational goals.

Predictive Reward Analytics

Payroll Clerks manage accurate employee compensation and ensure compliance with payroll regulations, emphasizing transactional accuracy and data entry. Total Rewards Analysts leverage predictive reward analytics to forecast compensation trends, optimize benefits strategies, and enhance employee retention through data-driven insights.

Payroll Clerk vs Total Rewards Analyst Infographic

industrydif.com

industrydif.com