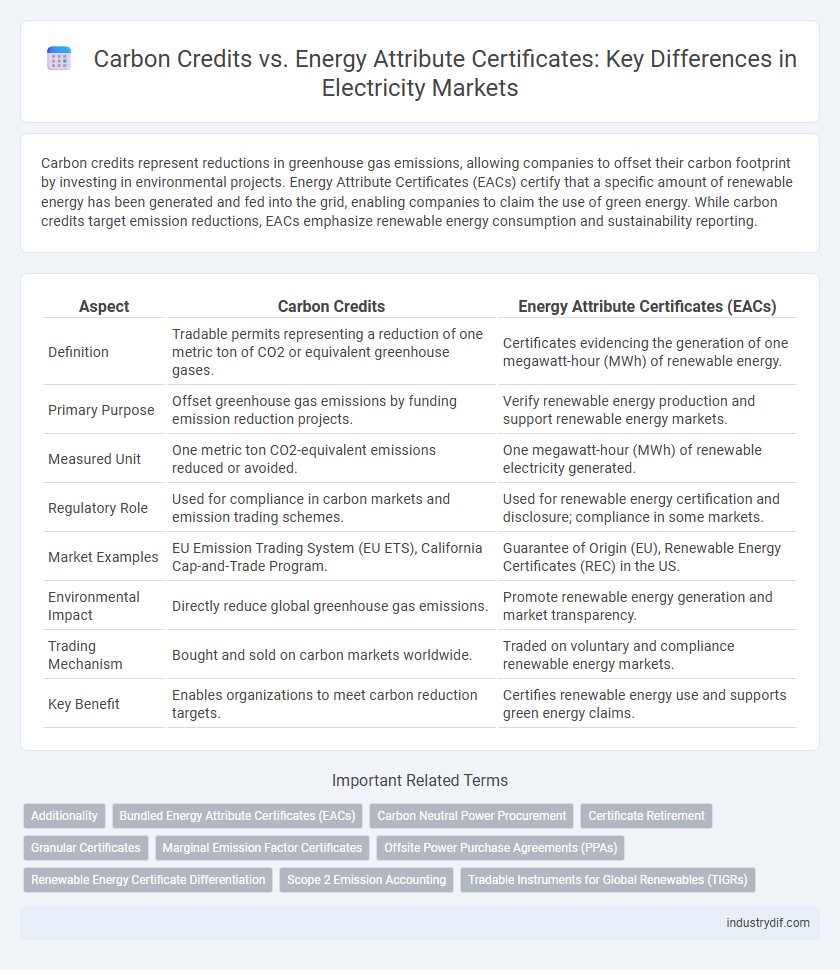

Carbon credits represent reductions in greenhouse gas emissions, allowing companies to offset their carbon footprint by investing in environmental projects. Energy Attribute Certificates (EACs) certify that a specific amount of renewable energy has been generated and fed into the grid, enabling companies to claim the use of green energy. While carbon credits target emission reductions, EACs emphasize renewable energy consumption and sustainability reporting.

Table of Comparison

| Aspect | Carbon Credits | Energy Attribute Certificates (EACs) |

|---|---|---|

| Definition | Tradable permits representing a reduction of one metric ton of CO2 or equivalent greenhouse gases. | Certificates evidencing the generation of one megawatt-hour (MWh) of renewable energy. |

| Primary Purpose | Offset greenhouse gas emissions by funding emission reduction projects. | Verify renewable energy production and support renewable energy markets. |

| Measured Unit | One metric ton CO2-equivalent emissions reduced or avoided. | One megawatt-hour (MWh) of renewable electricity generated. |

| Regulatory Role | Used for compliance in carbon markets and emission trading schemes. | Used for renewable energy certification and disclosure; compliance in some markets. |

| Market Examples | EU Emission Trading System (EU ETS), California Cap-and-Trade Program. | Guarantee of Origin (EU), Renewable Energy Certificates (REC) in the US. |

| Environmental Impact | Directly reduce global greenhouse gas emissions. | Promote renewable energy generation and market transparency. |

| Trading Mechanism | Bought and sold on carbon markets worldwide. | Traded on voluntary and compliance renewable energy markets. |

| Key Benefit | Enables organizations to meet carbon reduction targets. | Certifies renewable energy use and supports green energy claims. |

Understanding Carbon Credits: Definition and Purpose

Carbon credits represent a tradable certificate that quantifies the reduction of one metric ton of carbon dioxide or equivalent greenhouse gas emissions, serving as a mechanism to incentivize organizations to reduce their carbon footprint. They are primarily utilized in carbon markets to offset emissions by funding projects such as renewable energy, reforestation, and methane capture, supporting global climate goals. Understanding carbon credits is essential for businesses aiming to comply with regulations, achieve sustainability targets, and participate in environmental trading schemes.

What Are Energy Attribute Certificates (EACs)?

Energy Attribute Certificates (EACs) represent proof that 1 megawatt-hour (MWh) of electricity was generated from renewable energy sources, facilitating the tracking and trading of green energy. Unlike carbon credits, which quantify greenhouse gas emission reductions, EACs certify the environmental origin of electricity, supporting corporate sustainability goals and regulatory compliance. Major EAC systems include Guarantees of Origin (GO) in Europe, Renewable Energy Certificates (RECs) in the United States, and International Renewable Energy Certificates (I-RECs) for emerging markets.

Key Differences Between Carbon Credits and EACs

Carbon credits represent quantified reductions or removals of carbon dioxide emissions that can be traded or sold to offset emissions elsewhere, directly supporting climate change mitigation projects. Energy Attribute Certificates (EACs), including Guarantees of Origin (GOs) or Renewable Energy Certificates (RECs), verify that a specific amount of electricity was generated from renewable sources, ensuring renewable energy consumption tracking and compliance. The key difference lies in carbon credits targeting emission reductions, while EACs certify renewable electricity generation without conveying carbon offset claims.

How Carbon Credits Work in the Electricity Sector

Carbon credits in the electricity sector represent quantified reductions in greenhouse gas emissions generated by clean energy projects, such as wind, solar, or hydroelectric plants. Each carbon credit corresponds to one metric ton of CO2 equivalent emissions avoided, allowing utilities and companies to offset their carbon footprint by purchasing these credits. This mechanism incentivizes the development of renewable energy sources and supports compliance with emissions reduction targets under international carbon trading schemes.

The Role of EACs in Renewable Energy Tracking

Energy Attribute Certificates (EACs) play a crucial role in renewable energy tracking by providing a transparent and verifiable method to certify the generation of renewable electricity. Unlike carbon credits, which focus on emissions reductions, EACs specifically track the origin of renewable energy and enable consumers and businesses to claim renewable energy consumption. This system supports market mechanisms that drive investment in clean energy projects and ensure compliance with renewable portfolio standards globally.

Market Mechanisms: Trading Carbon Credits vs EACs

Carbon credits represent verified reductions in greenhouse gas emissions and are traded in compliance markets to offset carbon footprints. Energy Attribute Certificates (EACs), such as Guarantees of Origin or Renewable Energy Certificates, verify the generation of renewable electricity and are traded primarily in voluntary markets to support renewable energy procurement. While carbon credits directly contribute to emission reductions, EACs facilitate renewable energy consumption disclosure, making their market mechanisms complementary but distinct in driving decarbonization.

Regulatory Frameworks for Carbon Credits and EACs

Regulatory frameworks for Carbon Credits are governed by international protocols such as the Kyoto Protocol and Paris Agreement, which ensure verifiable greenhouse gas emission reductions. In contrast, Energy Attribute Certificates (EACs) like Guarantees of Origin (GO) and Renewable Energy Certificates (RECs) are regulated primarily at the regional and national levels, with the European Union's Renewable Energy Directive providing a key legislative structure for EAC issuance and trading. Both systems rely on stringent verification processes but serve distinct purposes: Carbon Credits target emission offsetting, while EACs confirm the renewable origin of electricity consumption.

Environmental Impact: Offsetting vs Attribute Tracking

Carbon credits represent quantified reductions in greenhouse gas emissions that can be purchased to offset carbon footprints, directly supporting projects like reforestation and renewable energy installations. Energy Attribute Certificates (EACs) track the origin of electricity from renewable sources without necessarily reducing emissions, enabling consumers to claim use of green energy. While carbon credits emphasize environmental impact through offsetting, EACs focus on attribute tracking to promote transparency and support market demand for renewable electricity.

Corporate Strategies: Choosing Carbon Credits or EACs

Corporate strategies for sustainability increasingly weigh the benefits of Carbon Credits versus Energy Attribute Certificates (EACs) to meet environmental goals and regulatory requirements. Carbon Credits provide verifiable emission reductions, enabling companies to offset their carbon footprint directly, whereas EACs demonstrate the procurement of renewable energy, supporting claims of green electricity consumption. Selecting between these tools depends on a company's specific carbon accounting needs, stakeholder expectations, and the alignment with broader climate commitments.

Future Trends in Carbon Credits and EAC Markets

Future trends in carbon credits indicate increasing integration with blockchain technology to enhance transparency and traceability, while regulatory frameworks are expected to tighten globally, driving higher demand and prices. Energy Attribute Certificates (EACs) are evolving with digitization efforts to facilitate cross-border trading and renewable energy verification, supporting corporate sustainability goals more effectively. Market convergence between carbon credits and EACs suggests a growing emphasis on holistic environmental impact assessments, promoting synergy in decarbonization and renewable energy procurement strategies.

Related Important Terms

Additionality

Carbon credits represent verified emissions reductions that ensure additionality by funding projects that would not occur otherwise, directly decreasing greenhouse gases. Energy Attribute Certificates (EACs) certify renewable energy generation but often lack the additionality requirement, as purchasing EACs does not guarantee increased renewable energy capacity or reduced emissions beyond existing projects.

Bundled Energy Attribute Certificates (EACs)

Bundled Energy Attribute Certificates (EACs) combine renewable energy generation with carbon offset verification, providing a dual benefit of guaranteeing renewable energy consumption and supporting carbon credit markets. These certificates enhance corporate sustainability claims by linking specific electricity usage to verified environmental attributes, ensuring transparency and accountability in carbon accounting.

Carbon Neutral Power Procurement

Carbon Credits represent verified emission reductions from projects that remove or avoid greenhouse gases, enabling companies to offset their carbon footprint, while Energy Attribute Certificates (EACs) certify renewable energy generation but do not directly equate to carbon offsetting. In carbon neutral power procurement, combining Carbon Credits with EACs ensures both the support for renewable energy markets and the compensation for unavoidable emissions, enhancing corporate sustainability claims.

Certificate Retirement

Certificate retirement in Carbon Credits represents the permanent removal of emission allowances to offset carbon footprints, ensuring no double counting in carbon markets. Energy Attribute Certificates (EACs) retirement verifies renewable energy consumption by retiring certificates tied to specific electricity generation, guaranteeing that claimed green energy is exclusively accounted for one user.

Granular Certificates

Granular energy attribute certificates enable precise tracking of renewable energy generation down to specific timeframes, improving the accuracy of carbon credit claims and supporting verifiable reductions in greenhouse gas emissions. Unlike broad carbon credits, granular certificates provide detailed data for each megawatt-hour produced, ensuring transparent and accountable reporting in energy markets.

Marginal Emission Factor Certificates

Marginal Emission Factor Certificates quantify the incremental emissions avoided by substituting marginal electricity generation sources with renewable energy, offering a more precise environmental impact metric than traditional Carbon Credits or Energy Attribute Certificates. These certificates enhance transparency in carbon accounting by reflecting real-time grid dynamics and supporting targeted reductions in fossil fuel-based power generation.

Offsite Power Purchase Agreements (PPAs)

Offsite Power Purchase Agreements (PPAs) enable corporations to procure renewable energy directly from developers, generating Energy Attribute Certificates (EACs) that verify clean electricity production without granting carbon credits, which quantify emissions reductions in carbon markets. While carbon credits offset greenhouse gas emissions, EACs serve as evidence of renewable energy consumption, making them crucial for companies aiming to meet renewable energy targets through offsite PPAs.

Renewable Energy Certificate Differentiation

Renewable Energy Certificates (RECs) represent proof that one megawatt-hour (MWh) of electricity was generated from renewable sources, directly supporting green energy markets, whereas Carbon Credits quantify the reduction of one metric ton of CO2 emissions and facilitate compliance with carbon offset programs. Unlike Carbon Credits, which are primarily focused on emissions reduction, RECs specifically certify renewable energy generation and enable businesses to claim renewable electricity consumption.

Scope 2 Emission Accounting

Carbon credits represent verified emission reductions from projects outside direct electricity consumption, while Energy Attribute Certificates (EACs) specifically track renewable energy generation to account for Scope 2 emissions in corporate reporting. Accurate Scope 2 emission accounting relies on EACs to substantiate electricity sourcing and demonstrate compliance with renewable energy procurement goals, whereas carbon credits primarily offset other scopes without directly influencing Scope 2 metrics.

Tradable Instruments for Global Renewables (TIGRs)

Tradable Instruments for Global Renewables (TIGRs) provide a blockchain-based framework for certifying renewable energy generation, allowing companies to claim and trade the environmental benefits of green electricity, unlike traditional Carbon Credits which primarily offset emissions. TIGRs enhance transparency and traceability in renewable energy markets by representing Energy Attribute Certificates (EACs) digitally, facilitating global compliance and investment in clean energy projects.

Carbon Credits vs Energy Attribute Certificates Infographic

industrydif.com

industrydif.com