Box office revenues traditionally dominate big-budget movie releases, offering audiences the cinematic experience of large screens and immersive sound quality that premium video on demand (PVOD) cannot replicate. PVOD services provide convenience and immediate access, allowing viewers to watch new releases from home, often at a higher rental price than standard streaming. Both platforms compete for audience attention, with box office appealing to communal viewing and event-driven releases, while PVOD taps into the growing demand for flexible, at-home entertainment options.

Table of Comparison

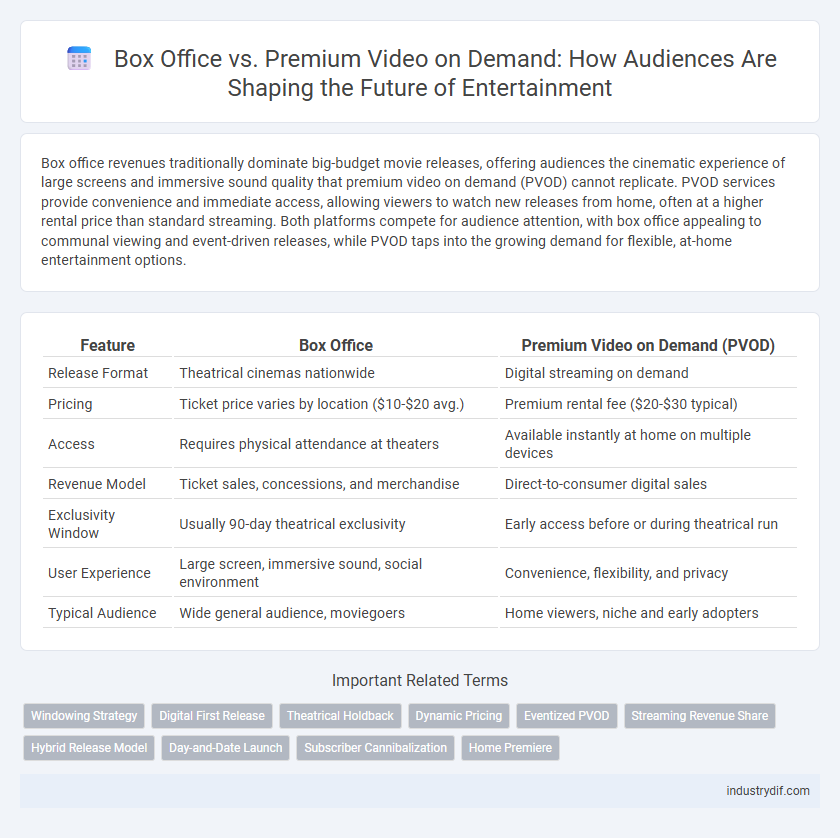

| Feature | Box Office | Premium Video on Demand (PVOD) |

|---|---|---|

| Release Format | Theatrical cinemas nationwide | Digital streaming on demand |

| Pricing | Ticket price varies by location ($10-$20 avg.) | Premium rental fee ($20-$30 typical) |

| Access | Requires physical attendance at theaters | Available instantly at home on multiple devices |

| Revenue Model | Ticket sales, concessions, and merchandise | Direct-to-consumer digital sales |

| Exclusivity Window | Usually 90-day theatrical exclusivity | Early access before or during theatrical run |

| User Experience | Large screen, immersive sound, social environment | Convenience, flexibility, and privacy |

| Typical Audience | Wide general audience, moviegoers | Home viewers, niche and early adopters |

Overview of Box Office and Premium Video on Demand

Box office revenue represents the traditional method of film distribution, generating billions annually through theatrical ticket sales worldwide. Premium Video on Demand (PVOD) allows consumers to rent or purchase new-release movies online at a premium price, providing studios an alternative revenue stream that bypasses theaters. The rise of PVOD has shifted consumer behavior by offering immediate access and convenience, challenging the dominance of box office earnings in the entertainment industry.

Historical Evolution of Movie Distribution

The historical evolution of movie distribution reveals a significant shift from traditional box office dominance to the rise of Premium Video on Demand (PVOD) platforms. Initially, theatrical releases were the primary revenue stream for films, but advancements in digital technology and changing consumer preferences accelerated the adoption of PVOD, offering home viewers early access to new releases. This transformation has reshaped the industry landscape, with studios leveraging simultaneous or shortened theatrical windows to maximize profitability and audience reach.

Revenue Models: Box Office vs Premium VOD

Box office revenue relies on ticket sales from theatrical releases, generating immediate income based on audience turnout and theater capacity, typically sharing profits between studios and exhibitors. Premium Video on Demand (PVOD) leverages direct-to-consumer digital sales or rentals at higher price points, providing studios with a larger share of revenue by bypassing traditional distribution channels. The contrasting models reflect shifting consumer preferences, with box office capitalizing on event-driven experiences and PVOD offering convenience and early access, impacting overall profitability strategies in the entertainment industry.

Consumer Trends and Viewing Preferences

Consumer trends reveal a growing preference for Premium Video on Demand (PVOD) as audiences seek convenience and immediate access to new releases, significantly impacting box office revenues. Data indicates that younger demographics favor streaming platforms, driving an increase in at-home viewing experiences over traditional theater visits. Despite this shift, blockbuster franchises continue to draw substantial box office crowds, highlighting a complementary dynamic between theatrical releases and PVOD services.

Impact on Film Studios and Distributors

Box Office revenue directly influences film studios' financing and marketing strategies, often driving large-scale theatrical releases with global distribution deals. Premium Video on Demand (PVOD) offers studios and distributors a significant revenue stream by accelerating release windows and reducing dependency on physical theaters, thus increasing profit margins on digital sales and rentals. The shift toward PVOD impacts traditional distribution models, compelling studios to balance theatrical earnings against digital platform accessibility to optimize overall profitability.

Marketing Strategies for Theatrical and PVOD Releases

Marketing strategies for theatrical releases emphasize wide-reaching advertising campaigns, exclusive premieres, and partnerships with cinema chains to maximize box office turnout. For Premium Video on Demand (PVOD), campaigns focus on digital promotions, targeted social media ads, and leveraging influencers to drive immediate online rentals and purchases. Data analytics play a crucial role in both approaches, enabling studios to optimize audience targeting and tailor promotional content to increase engagement and revenue.

Challenges and Opportunities in Both Platforms

Box Office revenue faces challenges from shifting consumer preferences toward Premium Video on Demand (PVOD), which offers convenience and immediate access but struggles with pricing transparency and piracy concerns. PVOD presents opportunities to capture home viewers unwilling to attend theaters, enabling studios to monetize content faster while negotiating windowing strategies with exhibitors. Both platforms must adapt through flexible distribution models, leveraging data analytics to optimize release timing and audience targeting in a competitive entertainment market.

Influence of Technology on Distribution Channels

Advancements in streaming technology and high-speed internet have significantly shifted the entertainment distribution landscape, enabling Premium Video on Demand (PVOD) to rival traditional box office revenue. Enhanced digital platforms allow studios to release films directly to consumers, reducing dependency on theatrical venues while expanding global accessibility. This technological evolution challenges conventional box office dominance, fostering a hybrid distribution model that maximizes revenue through simultaneous or staggered releases across multiple channels.

Future Predictions for the Movie Industry

Future predictions for the movie industry indicate a dynamic shift as box office revenues continue to face competition from Premium Video on Demand (PVOD) platforms, which offer immediate home access to new releases. Industry analysts project that PVOD will significantly expand its market share, driven by consumer preference for convenience and the growing adoption of high-speed internet worldwide. Despite this trend, blockbuster theatrical releases are expected to remain integral for maximizing global revenue, creating a hybrid distribution model that leverages both traditional cinema experiences and digital streaming growth.

Case Studies: Success Stories and Flops

Case studies reveal that films like "Roma" and "Wonder Woman 1984" demonstrate how Premium Video on Demand (PVOD) can drive substantial revenue while reaching wider audiences during theater closures. Conversely, major box office flops such as "Cats" highlight risks when theatrical releases underperform, despite high budgets and marketing. Successful hybrid release strategies blend PVOD and box office elements, optimizing profit channels shaped by shifting consumer viewing habits.

Related Important Terms

Windowing Strategy

The windowing strategy in entertainment leverages the box office release followed by a timed premium video on demand (PVOD) availability to maximize revenue streams by capturing different consumer segments. Optimizing the interval between theatrical release and PVOD access influences overall profitability and affects audience viewing preferences in competitive markets.

Digital First Release

Digital First Release strategies prioritize premium video on demand platforms by leveraging immediate global accessibility and higher profit margins compared to traditional box office revenue. Shifting from theatrical exclusivity, this approach maximizes audience reach, reduces distribution costs, and adapts to evolving consumer viewing habits in the entertainment industry.

Theatrical Holdback

Theatrical holdback secures exclusive cinema revenue by restricting film availability on Premium Video on Demand (PVOD) platforms during initial release windows, typically lasting 30 to 90 days. This strategic delay maximizes box office earnings, ensuring studios capitalize on theatrical attendance before transitioning to digital rental or purchase options.

Dynamic Pricing

Dynamic pricing in box office ticket sales adjusts prices based on real-time demand, maximizing revenue during peak times and high-profile releases, while Premium Video on Demand (PVOD) employs flat-rate pricing or tiered fees to attract early viewers and capture revenue before theatrical windows close. The integration of demand-sensitive pricing models in PVOD is emerging to rival box office earnings by leveraging consumer data and viewing habits for personalized price optimization.

Eventized PVOD

Eventized Premium Video on Demand (PVOD) offers consumers scheduled digital premieres that mimic theatrical windows, driving exclusive engagement and maximizing revenue for studios beyond traditional box office sales. This model leverages limited-time availability and high-profile releases to capture audience attention while adapting to shifting viewing habits favoring home consumption.

Streaming Revenue Share

Streaming revenue share from Premium Video on Demand (PVOD) has surged, capturing an increasing portion of total entertainment income as consumer preferences shift toward home viewing. This trend has challenged traditional box office dominance, with PVOD platforms generating substantial revenue by offering early digital releases and exclusive content.

Hybrid Release Model

The hybrid release model combines box office theatrical releases with Premium Video on Demand (PVOD) platforms, maximizing revenue by catering to both cinema-goers and at-home viewers simultaneously. This strategy leverages the wide reach of PVOD while maintaining traditional box office profits, adapting to evolving consumer preferences and increasing accessibility.

Day-and-Date Launch

Day-and-date launches simultaneously release films in both theaters and premium video on demand (PVOD) platforms, optimizing revenue streams by catering to diverse viewer preferences and expanding initial audience reach. This strategy leverages the box office's traditional appeal while capitalizing on the convenience and immediacy of PVOD, often boosting total earnings during critical opening weekends.

Subscriber Cannibalization

Box office revenues face challenges from Premium Video on Demand (PVOD), as increased subscriber cannibalization reduces theatrical attendance and shifts consumer spending toward at-home releases. The trend highlights a significant impact on traditional cinema profits, with studios balancing release windows to optimize both PVOD income and box office performance.

Home Premiere

Home Premiere services offer a lucrative alternative to traditional box office releases by providing early access to new films directly to viewers at home, generating significant revenue through premium rental fees. This shift boosts the entertainment industry's profitability by capitalizing on consumer demand for convenient, on-demand movie experiences while reducing dependence on physical theater attendance.

Box Office vs Premium Video on Demand Infographic

industrydif.com

industrydif.com