Major networks provide curated, high-quality entertainment content with established viewer trust and consistent schedules, ideal for audiences seeking familiar programming. FAST channels offer free, ad-supported streaming with a broad selection of niche and diverse content, attracting viewers interested in flexibility and variety without subscription fees. Choosing between these options depends on the desire for traditional, reliable broadcasting versus on-demand, cost-free access to specialized entertainment.

Table of Comparison

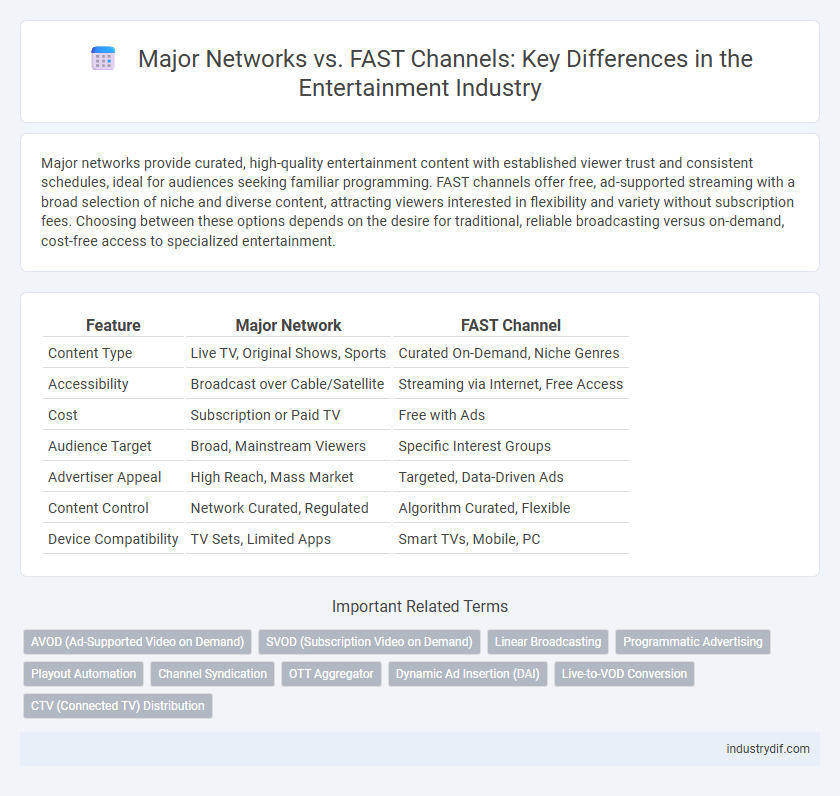

| Feature | Major Network | FAST Channel |

|---|---|---|

| Content Type | Live TV, Original Shows, Sports | Curated On-Demand, Niche Genres |

| Accessibility | Broadcast over Cable/Satellite | Streaming via Internet, Free Access |

| Cost | Subscription or Paid TV | Free with Ads |

| Audience Target | Broad, Mainstream Viewers | Specific Interest Groups |

| Advertiser Appeal | High Reach, Mass Market | Targeted, Data-Driven Ads |

| Content Control | Network Curated, Regulated | Algorithm Curated, Flexible |

| Device Compatibility | TV Sets, Limited Apps | Smart TVs, Mobile, PC |

Definition of Major Networks and FAST Channels

Major networks are traditional broadcast television companies such as ABC, NBC, and CBS that deliver a wide range of live and scheduled programming through cable, satellite, and over-the-air signals. FAST channels, or Free Ad-supported Streaming TV channels, provide on-demand and linear streaming content over the internet without subscription fees, monetized primarily through advertising. Unlike major networks, FAST channels focus on digital distribution, leveraging internet connectivity to reach cord-cutters with curated, niche programming.

Historical Evolution of Television Broadcasting

Major networks pioneered television broadcasting in the mid-20th century, establishing centralized programming and nationwide distribution. The rise of FAST (Free Ad-Supported Streaming TV) channels in the 21st century disrupted traditional models by leveraging internet streaming technology for targeted, on-demand content delivery. This historical evolution reflects a shift from linear broadcasting to digital, interactive platforms that cater to changing viewer habits and advertising strategies.

Key Differences Between Major Networks and FAST Channels

Major networks offer scheduled programming with a broad range of live shows, sports, and news, providing a traditional TV viewing experience supported by advertising revenue and subscriber fees. FAST (Free Ad-Supported Streaming TV) channels deliver continuous, on-demand streaming content that targets niche audiences with curated playlists, relying solely on ad revenue without subscription costs. The key differences lie in content delivery methods, monetization models, and viewer engagement, where major networks emphasize established programming blocks and FAST channels prioritize flexible, internet-based accessibility.

Content Acquisition and Programming Strategies

Major networks leverage extensive budgets to secure exclusive content rights and invest in high-profile original programming, driving viewer loyalty and advertising revenue. FAST channels operate with lower acquisition costs by streaming licensed or ad-supported content catalogs, maximizing reach with targeted, data-driven programming strategies. Emphasizing flexible content scheduling and niche audience targeting, FAST channels adapt rapidly to viewer preferences compared to the more rigid programming blocks of major networks.

Advertising Models and Revenue Streams

Major networks rely heavily on traditional advertising models with premium-priced national commercials and sponsorships, generating substantial revenue through targeted ad slots during prime-time programming. FAST channels operate on an advertising-supported streaming model, leveraging programmatic ads that offer flexible, data-driven monetization across a broad, on-demand audience. Revenue streams for FAST channels include dynamically inserted ads and subscription hybrid fees, enabling diverse income avenues beyond linear broadcast constraints.

Audience Reach and Demographics

Major networks traditionally command vast audience reach with broad demographic appeal, attracting diverse viewers across age groups and regions. FAST (Free Ad-supported Streaming TV) channels target more specific demographics, often appealing to niche markets with curated content tailored to distinct interests and viewing habits. While major networks leverage established brand recognition for mass market penetration, FAST channels excel in capturing younger, digital-savvy audiences through personalized, on-demand streaming experiences.

Distribution Platforms and Accessibility

Major networks dominate traditional distribution platforms such as cable and satellite, offering wide accessibility through established infrastructure and subscription models. FAST (Free Ad-supported Streaming TV) channels distribute content primarily via digital streaming platforms like smart TVs, apps, and connected devices, ensuring free, on-demand access without subscription fees. FAST channels leverage internet connectivity to reach broader audiences with flexible viewing options, contrasting with the fixed schedule and regional restrictions typical of major networks.

Impact on Content Creators and Studios

Major networks offer content creators higher budgets, broader distribution, and established audience reach, boosting revenue potential and brand recognition. FAST (Free Ad-supported Streaming TV) channels provide studios with flexible content monetization through targeted advertising and niche audience engagement, often with lower entry barriers and quicker feedback loops. The evolving landscape compels creators to balance traditional network prestige against FAST's innovative ad-supported models for maximizing content value.

Challenges Facing Major Networks and FAST Channels

Major networks face declining viewership due to shifting consumer preferences toward on-demand streaming and FAST channels offering free, ad-supported content. FAST channels struggle with limited brand recognition and lower ad revenue compared to established networks despite rapid audience growth. Both encounter challenges in content licensing, technological adaptation, and monetization amid competitive digital entertainment landscapes.

The Future of Television: Convergence and Competition

Major networks continue to dominate traditional television with high-budget original content and broad audience reach, while FAST (Free Ad-supported Streaming TV) channels capitalize on growing streaming demand with cost-effective, ad-supported models. The future of television hinges on convergence, where major networks integrate FAST offerings into their ecosystems, blending linear and on-demand experiences to meet evolving viewer preferences. Competitive dynamics intensify as consumer demand drives innovation in content delivery, monetization strategies, and personalized viewing across multiple platforms.

Related Important Terms

AVOD (Ad-Supported Video on Demand)

Major networks leverage extensive subscriber bases and premium content libraries to maximize AVOD revenue, while FAST channels prioritize curated, genre-specific streams designed to attract niche audiences with lower operational costs. Both models capitalize on targeted advertising data, but FAST channels offer increased ad inventory and faster audience growth due to their free, linear-style experience tailored for AVOD consumption.

SVOD (Subscription Video on Demand)

Major networks continue to dominate SVOD markets by leveraging exclusive content libraries and established brand recognition, driving higher subscriber loyalty and engagement. FAST channels offer a growing, cost-effective alternative with ad-supported free streaming but typically attract lower viewer retention and less premium content compared to major network SVOD platforms.

Linear Broadcasting

Major networks continue to dominate linear broadcasting with high-budget, prime-time programming and live events that attract broad audiences, while FAST channels offer ad-supported, niche content streams decentralized on digital platforms without the constraints of traditional schedules. Linear broadcasting on major networks benefits from established brand recognition and nationwide reach, whereas FAST channels leverage targeted advertising and flexible viewer engagement to complement traditional TV viewership.

Programmatic Advertising

Major networks dominate programmatic advertising through extensive audience data and premium inventory, enabling precise targeting and higher CPMs. FAST channels leverage automated ad placement and real-time bidding to efficiently monetize ad slots, appealing to advertisers seeking cost-effective, scalable reach in streaming environments.

Playout Automation

Major networks leverage advanced playout automation systems to ensure seamless, 24/7 broadcasting with minimal human intervention, enhancing content delivery efficiency and reliability. FAST channels utilize cloud-based playout automation to rapidly scale programming and dynamically insert targeted ads, optimizing viewer engagement and monetization opportunities.

Channel Syndication

Major networks leverage extensive resources to produce and syndicate high-demand content across multiple platforms, maximizing audience reach and advertising revenue. FAST channels syndicate diverse, niche programming by aggregating licensed or original content, providing cost-effective, ad-supported streaming options that cater to specific viewer segments.

OTT Aggregator

OTT aggregators streamline content distribution by integrating Major Network programming with various FAST channels, enhancing viewer choice and maximizing ad revenue. Combining exclusive Major Network titles with FAST channel accessibility boosts audience engagement through seamless, on-demand entertainment options.

Dynamic Ad Insertion (DAI)

Dynamic Ad Insertion (DAI) enables FAST channels to deliver personalized, targeted advertisements during live or on-demand streaming, maximizing ad relevance and viewer engagement compared to traditional major networks. Major networks rely on fixed ad slots with limited targeting capabilities, whereas FAST channels leverage DAI technology to optimize monetization and improve audience analytics in real-time.

Live-to-VOD Conversion

Major networks leverage extensive resources and established viewer bases to efficiently convert live broadcasts into on-demand content, enhancing long-term viewer engagement and monetization. FAST channels prioritize rapid Live-to-VOD conversion to maximize accessibility and ad revenue through automated content repurposing and targeted streaming technology.

CTV (Connected TV) Distribution

Major networks dominate CTV distribution by leveraging established brand loyalty and extensive content libraries, ensuring widespread viewer reach and premium advertising opportunities. FAST channels capitalize on ad-supported free streaming models, rapidly growing audience share through niche content and lower barriers to entry on connected TV platforms.

Major Network vs FAST Channel Infographic

industrydif.com

industrydif.com