Risk management focuses on identifying, assessing, and mitigating potential threats to minimize losses and ensure stability within an organization. Antifragility goes beyond traditional risk management by embracing volatility and uncertainty, enabling systems or businesses to grow stronger when exposed to stressors and disruptions. Implementing antifragile principles transforms risk management from a defensive approach into a proactive strategy that harnesses challenges for continuous improvement and innovation.

Table of Comparison

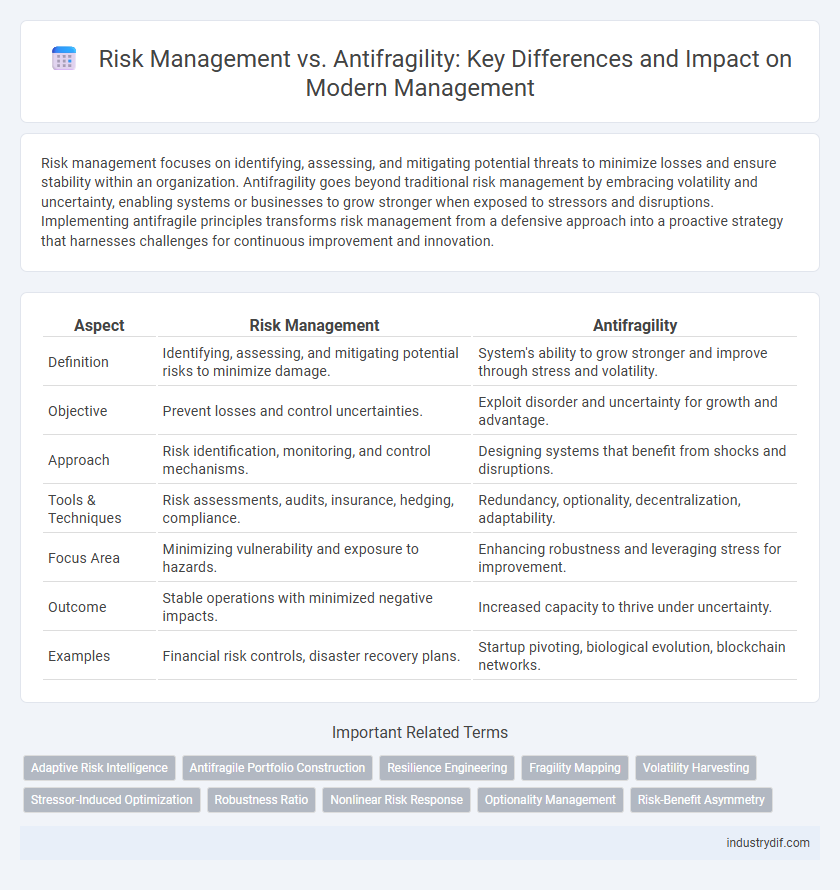

| Aspect | Risk Management | Antifragility |

|---|---|---|

| Definition | Identifying, assessing, and mitigating potential risks to minimize damage. | System's ability to grow stronger and improve through stress and volatility. |

| Objective | Prevent losses and control uncertainties. | Exploit disorder and uncertainty for growth and advantage. |

| Approach | Risk identification, monitoring, and control mechanisms. | Designing systems that benefit from shocks and disruptions. |

| Tools & Techniques | Risk assessments, audits, insurance, hedging, compliance. | Redundancy, optionality, decentralization, adaptability. |

| Focus Area | Minimizing vulnerability and exposure to hazards. | Enhancing robustness and leveraging stress for improvement. |

| Outcome | Stable operations with minimized negative impacts. | Increased capacity to thrive under uncertainty. |

| Examples | Financial risk controls, disaster recovery plans. | Startup pivoting, biological evolution, blockchain networks. |

Defining Risk Management in Modern Industries

Risk management in modern industries involves identifying, assessing, and prioritizing potential threats to minimize negative impacts on business operations and objectives. It incorporates systematic processes such as risk assessment, mitigation strategies, and continuous monitoring to ensure operational resilience and compliance with regulatory frameworks. Emphasizing predictive analytics and scenario planning enhances decision-making and safeguards organizational assets against emerging uncertainties.

Understanding Antifragility: Beyond Resilience

Antifragility surpasses traditional risk management and resilience by not only withstanding shocks but thriving and growing stronger from volatility and uncertainty. Unlike resilience, which aims to recover from disruptions, antifragility leverages disorder to enhance system performance and innovation. Embracing antifragility in management fosters adaptive strategies that capitalize on risk exposure rather than merely mitigating it.

Core Principles: Risk Management vs Antifragility

Risk Management centers on identifying, assessing, and mitigating potential threats to minimize loss and maintain stability within an organization. Antifragility, a concept introduced by Nassim Nicholas Taleb, emphasizes systems that thrive and grow stronger when exposed to volatility, uncertainty, and stressors. Core principles of Risk Management involve control and prevention, while Antifragility focuses on adaptation, learning, and leveraging disorder as a source of strength.

Key Industry Applications of Risk Management

Risk management plays a crucial role in industries such as finance, healthcare, and manufacturing by identifying, assessing, and mitigating potential risks to ensure operational continuity and regulatory compliance. In finance, risk management techniques like value-at-risk (VaR) and stress testing help protect against market volatility and credit defaults. Healthcare relies on risk management frameworks to minimize patient safety incidents and maintain quality standards, while manufacturing utilizes risk assessments to prevent supply chain disruptions and equipment failures.

Implementing Antifragility Strategies in Organizations

Implementing antifragility strategies in organizations requires shifting from traditional risk management, which aims to minimize harm, to designing systems that benefit from volatility and uncertainty. This involves fostering decentralized decision-making, promoting redundancy, and encouraging continuous experimentation to enhance organizational adaptability. Companies embracing antifragility integrate feedback loops and stress-testing practices that transform disruptions into growth opportunities, ensuring resilience beyond mere risk mitigation.

Measuring Success: Metrics for Risk Management and Antifragility

Risk management success is primarily measured by metrics such as risk exposure reduction, incident frequency, and compliance rates, focusing on minimizing potential losses. Antifragility metrics emphasize the system's ability to improve and grow stronger under stress, utilizing indicators like adaptive capacity, stress response efficiency, and long-term performance gains. Comparing these metrics highlights that while risk management aims for stability, antifragility seeks continuous improvement through volatility and challenges.

Case Studies: Industry Examples of Both Approaches

Case studies in risk management often highlight industries such as finance and healthcare, where predictive analytics and contingency planning mitigate potential losses and ensure regulatory compliance. In contrast, antifragility is exemplified by technology firms and supply chain innovators that thrive on market volatility, using stressors to drive adaptation and improved performance. The automotive industry's transition to electric vehicles demonstrates a hybrid approach, employing risk controls while embracing antifragile strategies to capitalize on emerging trends and disruptions.

Challenges and Limitations in Risk Management and Antifragility

Risk management often struggles with unpredictability and the inability to anticipate rare, high-impact events, limiting its effectiveness in dynamic environments. Antifragility addresses these limitations by benefiting from volatility and stressors, yet it faces challenges in practical implementation and requires a cultural shift towards embracing uncertainty. Both approaches demand continuous adaptation, but risk management's reliance on predefined models contrasts with antifragility's emphasis on systemic resilience and growth through disorder.

Integrating Risk Management with Antifragility Frameworks

Integrating risk management with antifragility frameworks enhances organizational resilience by enabling systems to adapt and grow stronger from uncertainties and stressors. This approach shifts the focus from merely mitigating risks to leveraging volatility as a catalyst for innovation and improvement. By embedding antifragile principles into risk assessment and response strategies, businesses can transform potential disruptions into strategic advantages that drive sustainable growth.

The Future of Organizational Robustness: Choosing the Right Path

Risk management involves identifying, assessing, and mitigating potential threats to minimize negative impacts on organizational goals. Antifragility goes beyond robustness by enabling organizations to grow stronger when exposed to volatility, stress, or uncertainty. Embracing antifragility prepares businesses for future complexities by turning disruptions into opportunities for sustainable growth and competitive advantage.

Related Important Terms

Adaptive Risk Intelligence

Adaptive Risk Intelligence enhances organizational resilience by integrating antifragility principles that enable systems to learn and improve from stressors and uncertainties. Unlike traditional risk management, which aims to minimize harm, adaptive frameworks leverage volatility to strengthen decision-making and strategic agility.

Antifragile Portfolio Construction

Antifragile portfolio construction emphasizes building investment strategies that improve in response to market volatility, contrasting with traditional risk management methods that primarily seek to minimize losses. By incorporating diverse, convex assets and adaptive allocation models, antifragile portfolios capitalize on uncertainty and disorder to enhance long-term growth and resilience.

Resilience Engineering

Risk management focuses on identifying, assessing, and mitigating potential threats to minimize adverse impacts, while antifragility emphasizes systems that improve and adapt through stress and volatility. Resilience engineering integrates these approaches by designing processes and infrastructures that not only withstand disruptions but evolve to enhance performance under uncertainty.

Fragility Mapping

Fragility mapping identifies vulnerabilities within organizational systems by highlighting points susceptible to stress or failure, enabling targeted risk management strategies. Antifragility goes beyond by designing processes that improve and adapt through exposure to volatility, transforming potential disruptions into opportunities for growth.

Volatility Harvesting

Risk management aims to minimize losses through identification, assessment, and mitigation of uncertainties, while antifragility leverages volatility harvesting to benefit from disorder and fluctuations, enhancing system adaptability and growth. Volatility harvesting exploits market or operational volatility by maintaining dynamic strategies that capitalize on variability rather than merely avoiding risk.

Stressor-Induced Optimization

Risk management involves identifying, assessing, and mitigating potential threats to minimize harm, whereas antifragility emphasizes systems that improve and evolve when exposed to stressors. Stressor-induced optimization in antifragile systems leverages challenges to enhance adaptability and performance, surpassing traditional risk management's focus on risk reduction.

Robustness Ratio

The Robustness Ratio measures a system's capacity to maintain performance despite disruptions, serving as a critical metric in risk management strategies. Unlike traditional risk management that seeks to minimize loss, antifragility emphasizes systems that improve through stress, where the Robustness Ratio highlights resilience but not the adaptive advantage inherent in antifragile designs.

Nonlinear Risk Response

Risk management traditionally emphasizes identifying and mitigating potential threats to minimize losses, operating on linear assumptions about risk behavior. Antifragility, by contrast, thrives on nonlinear risk responses, gaining strength and adaptability from volatility and uncertainty instead of merely resisting or absorbing shocks.

Optionality Management

Risk management primarily focuses on identifying, assessing, and mitigating potential threats to minimize losses, whereas antifragility emphasizes leveraging uncertainty and shocks to improve and grow stronger. Optionality management, a key concept in antifragility, involves creating flexible strategies with multiple choices and pathways that enable organizations to capitalize on unforeseen opportunities while limiting downside exposure.

Risk-Benefit Asymmetry

Risk management primarily focuses on identifying, assessing, and mitigating potential threats to minimize losses, whereas antifragility thrives on volatility and stressors, gaining strength from disorder through risk-benefit asymmetry. This asymmetric approach leverages uncertainty to create opportunities where potential gains significantly outweigh potential losses, transforming traditional risk paradigms into adaptive growth mechanisms.

Risk Management vs Antifragility Infographic

industrydif.com

industrydif.com