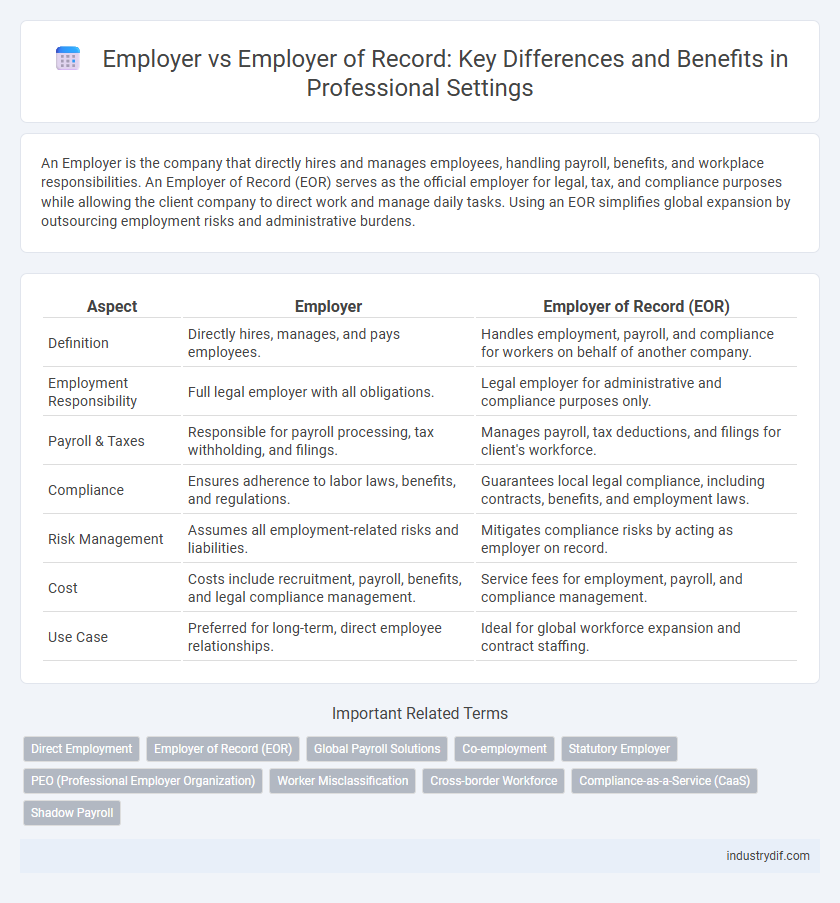

An Employer is the company that directly hires and manages employees, handling payroll, benefits, and workplace responsibilities. An Employer of Record (EOR) serves as the official employer for legal, tax, and compliance purposes while allowing the client company to direct work and manage daily tasks. Using an EOR simplifies global expansion by outsourcing employment risks and administrative burdens.

Table of Comparison

| Aspect | Employer | Employer of Record (EOR) |

|---|---|---|

| Definition | Directly hires, manages, and pays employees. | Handles employment, payroll, and compliance for workers on behalf of another company. |

| Employment Responsibility | Full legal employer with all obligations. | Legal employer for administrative and compliance purposes only. |

| Payroll & Taxes | Responsible for payroll processing, tax withholding, and filings. | Manages payroll, tax deductions, and filings for client's workforce. |

| Compliance | Ensures adherence to labor laws, benefits, and regulations. | Guarantees local legal compliance, including contracts, benefits, and employment laws. |

| Risk Management | Assumes all employment-related risks and liabilities. | Mitigates compliance risks by acting as employer on record. |

| Cost | Costs include recruitment, payroll, benefits, and legal compliance management. | Service fees for employment, payroll, and compliance management. |

| Use Case | Preferred for long-term, direct employee relationships. | Ideal for global workforce expansion and contract staffing. |

Defining Employer and Employer of Record

An employer is a company or individual that hires employees, assumes legal responsibilities, and manages payroll, taxes, and benefits in-house. An Employer of Record (EOR) is a third-party organization that legally employs workers on behalf of another company, handling compliance, payroll, and human resources functions to ensure regulatory adherence. Understanding the distinction clarifies liability and operational control when outsourcing employment management.

Core Responsibilities: Employer vs Employer of Record

Employers hold direct control over hiring, payroll, compliance, and employee management, ensuring alignment with organizational policies and culture. Employers of Record (EOR) assume legal responsibility for tax withholding, benefits administration, and regulatory compliance while enabling businesses to onboard talent without establishing a local entity. Understanding the distinction in core responsibilities helps companies optimize workforce management and mitigate legal risks in global employment scenarios.

Legal Implications and Compliance

An Employer of Record (EOR) assumes full legal responsibility for employment compliance, including payroll, taxes, benefits, and labor law adherence, mitigating risks for the client company. In contrast, a traditional employer holds direct liability for these obligations, requiring robust internal HR and legal infrastructure to manage regulatory complexities. Utilizing an EOR ensures compliance with local and international employment laws, reducing potential legal disputes and penalties for businesses operating across multiple jurisdictions.

Payroll and Benefits Administration

An Employer of Record (EOR) handles payroll processing, tax withholdings, and benefits administration on behalf of the client company, ensuring compliance with local labor laws and regulations. In contrast, the traditional employer directly manages these responsibilities, including employee onboarding, payroll, tax filings, and benefits management. Utilizing an EOR streamlines payroll and benefits administration, reduces legal risks, and accelerates global workforce expansion.

Hiring and Onboarding Processes

An Employer manages direct hiring, payroll, and compliance while maintaining full control over employee onboarding and ongoing HR responsibilities. An Employer of Record (EOR) streamlines hiring by legally employing workers on behalf of a company, handling payroll, taxes, benefits, and regulatory compliance in various jurisdictions. Utilizing an EOR accelerates global expansion and reduces the risks associated with complex international labor laws during onboarding and employment.

Risk Management and Liability

An Employer of Record (EOR) assumes critical risk management responsibilities by handling employment compliance, payroll, and tax obligations, thereby reducing the liability burden for the client company. Unlike a traditional employer who retains full legal responsibility, the EOR acts as the registered employer, mitigating exposure to regulatory penalties, wrongful termination claims, and workplace disputes. Utilizing an EOR enhances risk mitigation strategies by ensuring adherence to local labor laws and streamlining liability management across jurisdictions.

Cost Structure Comparison

Employers typically incur direct costs such as salaries, benefits, payroll taxes, and compliance management, leading to variable expenses based on workforce size and regional regulations. Employers of Record (EORs) consolidate these expenses into a fixed fee structure, often including payroll processing, tax compliance, and benefits administration, resulting in predictable monthly costs. This comparison highlights that while traditional employers face fluctuating and sometimes hidden costs, EORs provide a streamlined, transparent cost model ideal for international expansion and risk mitigation.

Global Employment Scenarios

Employers of Record (EOR) simplify global employment by legally hiring employees on behalf of client companies, ensuring compliance with local labor laws, tax regulations, and benefits management across multiple countries. Traditional employers directly manage payroll, employment contracts, and compliance but may face challenges navigating diverse international legal frameworks, making EORs essential for companies expanding globally. Utilizing an EOR reduces risks related to misclassification and non-compliance while accelerating market entry and global workforce scalability.

Scalability and Flexibility

An Employer of Record (EOR) enables businesses to scale operations rapidly across multiple regions by handling recruitment, payroll, and compliance, reducing administrative burdens. Traditional employers face challenges in flexibility due to localized regulations and infrastructure requirements that limit instant expansion. Utilizing an EOR offers seamless workforce flexibility, allowing companies to adapt hiring needs efficiently without establishing legal entities in each location.

Choosing Between Employer and Employer of Record

Choosing between an employer and an employer of record depends on the company's need for legal compliance, payroll management, and administrative support in international or remote workforce scenarios. Employers of record assume responsibility for tax filings, benefits administration, and labor law adherence, reducing risk and operational burden. Businesses aiming for rapid global expansion or temporary hires often prefer employers of record to streamline hiring without establishing legal entities.

Related Important Terms

Direct Employment

Direct employment establishes a formal employer-employee relationship where the company assumes full legal responsibility for payroll, benefits, taxes, and compliance with labor laws. Unlike an Employer of Record (EOR) arrangement, direct employment provides companies with greater control over workforce management and employee engagement.

Employer of Record (EOR)

An Employer of Record (EOR) handles all legal, payroll, and compliance responsibilities for employees, enabling companies to quickly onboard talent across multiple jurisdictions without establishing a local entity. Utilizing an EOR minimizes risks related to employment laws and reduces administrative burdens, making it an efficient solution for global workforce management.

Global Payroll Solutions

An Employer of Record (EOR) simplifies global payroll solutions by managing compliance, tax filings, and employee benefits across multiple jurisdictions, reducing the administrative burden for companies expanding internationally. Unlike traditional employers, EORs assume legal responsibility for hiring and payroll, ensuring seamless workforce management and regulatory adherence worldwide.

Co-employment

Employer of Record (EOR) assumes legal responsibility for payroll, taxes, and compliance, enabling businesses to manage talent globally without establishing local entities. Co-employment occurs when the client company directs daily work while the EOR handles administrative obligations, creating a dual employer relationship essential for mitigating risks and ensuring regulatory adherence.

Statutory Employer

A statutory employer is a legal entity designated to assume responsibility for payroll taxes, workers' compensation, and compliance with labor laws on behalf of the primary employer, mitigating liability and administrative burdens. Unlike a traditional employer, the statutory employer handles employment responsibilities without controlling day-to-day work, ensuring adherence to statutory requirements in complex staffing arrangements.

PEO (Professional Employer Organization)

A Professional Employer Organization (PEO) acts as a co-employer, handling HR functions, payroll, benefits, and compliance, while the client company retains control over business operations and employee management. Unlike an Employer of Record (EOR) that assumes full legal employment responsibility, a PEO shares employer responsibilities to streamline administrative tasks and mitigate risks for the client.

Worker Misclassification

Worker misclassification often occurs when companies hire through an Employer of Record (EOR) without fully understanding the distinct legal responsibilities compared to a direct employer, leading to risks in compliance with labor laws and tax obligations. Employers of Record assume formal employer duties such as payroll, benefits, and tax withholding, reducing misclassification risks but requiring clear contractual agreements to protect both parties.

Cross-border Workforce

An Employer of Record (EOR) enables companies to hire and manage a cross-border workforce without establishing a legal entity in foreign jurisdictions, ensuring compliance with local labor laws and tax regulations. In contrast, a traditional employer must directly navigate complex employment contracts, payroll, and benefits administration across multiple countries, which can increase operational risk and costs.

Compliance-as-a-Service (CaaS)

Employer of Record (EOR) streamlines global workforce management by assuming legal responsibility for payroll, tax compliance, and labor law adherence, significantly reducing employer risks. Compliance-as-a-Service (CaaS) integrates seamlessly with EOR solutions, providing real-time regulatory updates and automated reporting to ensure continuous adherence to evolving employment laws.

Shadow Payroll

An Employer of Record (EOR) manages compliance and payroll administration for international employees, while shadow payroll involves recording foreign employees' earnings on the home country's payroll without actual payment, ensuring tax and social security obligations are met. Utilizing shadow payroll minimizes risks of double taxation and regulatory breaches during cross-border assignments or secondments under an EOR arrangement.

Employer vs Employer of Record Infographic

industrydif.com

industrydif.com