Public-private partnerships (PPPs) leverage collaboration between government and private entities to deliver public services efficiently, sharing risks and resources for mutual benefit. Social impact bonds (SIBs) represent a financing mechanism where private investors fund social programs upfront, and returns are linked to achieving specific outcomes verified by the government. While PPPs focus on joint infrastructure or service delivery, SIBs prioritize outcome-based investments, aligning financial incentives with social impact.

Table of Comparison

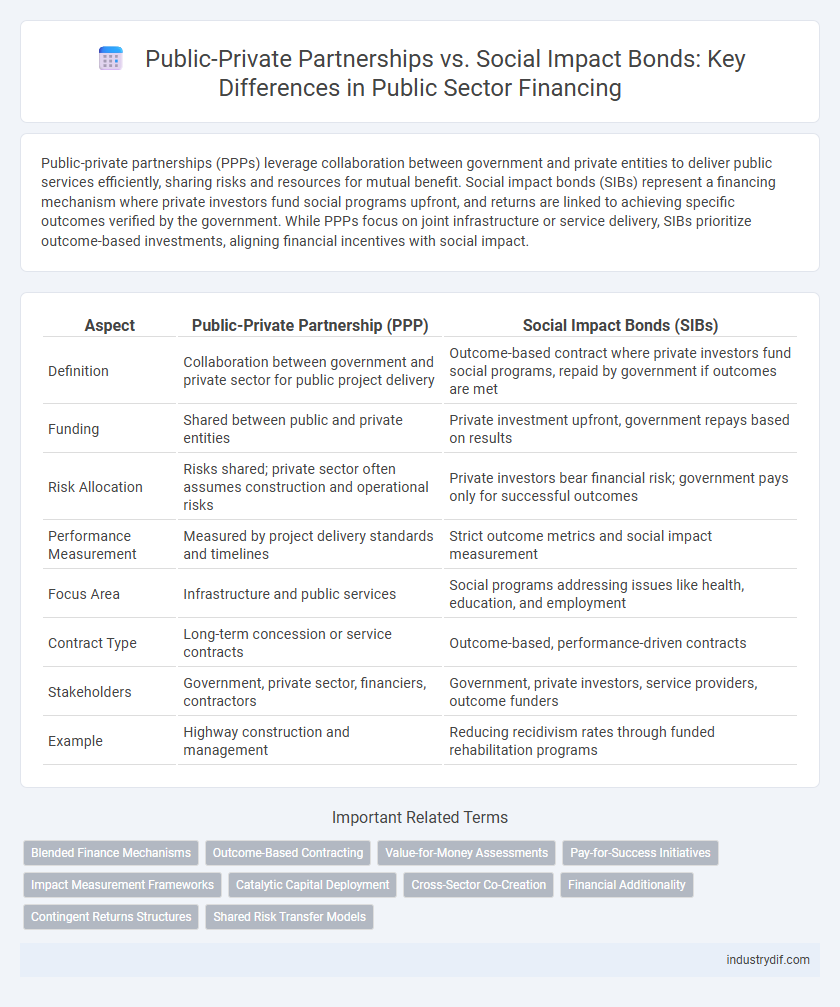

| Aspect | Public-Private Partnership (PPP) | Social Impact Bonds (SIBs) |

|---|---|---|

| Definition | Collaboration between government and private sector for public project delivery | Outcome-based contract where private investors fund social programs, repaid by government if outcomes are met |

| Funding | Shared between public and private entities | Private investment upfront, government repays based on results |

| Risk Allocation | Risks shared; private sector often assumes construction and operational risks | Private investors bear financial risk; government pays only for successful outcomes |

| Performance Measurement | Measured by project delivery standards and timelines | Strict outcome metrics and social impact measurement |

| Focus Area | Infrastructure and public services | Social programs addressing issues like health, education, and employment |

| Contract Type | Long-term concession or service contracts | Outcome-based, performance-driven contracts |

| Stakeholders | Government, private sector, financiers, contractors | Government, private investors, service providers, outcome funders |

| Example | Highway construction and management | Reducing recidivism rates through funded rehabilitation programs |

Overview of Public-Private Partnerships (PPPs)

Public-Private Partnerships (PPPs) are collaborative agreements between government entities and private sector companies to finance, build, and operate public infrastructure or services, leveraging private investment to reduce public sector risk. These partnerships typically involve long-term contracts that outline responsibilities, risk-sharing, and performance metrics, enabling efficient delivery of projects such as transportation, healthcare, and utilities. PPPs differ from Social Impact Bonds by focusing on infrastructure development and service provision rather than outcome-based financing linked to social outcomes.

Understanding Social Impact Bonds (SIBs)

Social Impact Bonds (SIBs) are innovative financial instruments that enable public-private partnerships by attracting private investment to fund social programs with measurable outcomes. These bonds link investor returns directly to the achievement of specific social goals, such as reducing recidivism or improving educational attainment, ensuring accountability and effectiveness. Unlike traditional public-private partnerships, SIBs shift financial risk to investors, motivating performance-driven interventions that benefit communities.

Key Differences: PPPs vs. SIBs

Public-private partnerships (PPPs) involve long-term contracts where private entities finance, build, and operate public infrastructure or services, sharing risks and returns with the government. Social impact bonds (SIBs) are outcome-based contracts where private investors fund social programs and receive returns only if specific social outcomes are achieved, aligning financial incentives with measurable impact. While PPPs emphasize infrastructure and operational efficiency, SIBs prioritize social innovation and measurable impact tied to predefined social objectives.

Legal and Regulatory Frameworks

Public-private partnerships (PPPs) operate within established legal frameworks that define contractual obligations, risk allocation, and regulatory compliance between government entities and private sector partners. Social impact bonds (SIBs) are governed by regulatory structures emphasizing performance measurement, outcome-based payments, and accountability mechanisms tied to social outcomes. Differences in legal frameworks influence risk management, funding sources, and the enforcement of social objectives in these collaborative financial models.

Funding Structures and Financial Models

Public-private partnerships (PPPs) involve long-term contractual agreements where private sector investment funds infrastructure or public services with periodic government payments, ensuring risk sharing and financial sustainability. Social Impact Bonds (SIBs) use outcome-based contracts where private investors provide upfront capital for social programs and returns depend on achieving specific performance metrics, aligning financial incentives with social outcomes. Both models diversify funding sources but differ in risk allocation, with PPPs relying on asset-based revenues and SIBs contingent on measurable impact results.

Risk Allocation and Management

Public-private partnerships (PPPs) allocate risks between government entities and private sector partners by clearly defining responsibilities such as construction, operation, and financial risks to enhance project efficiency and accountability. Social impact bonds (SIBs) transfer outcomes-related risks primarily to investors, who receive returns only if predefined social objectives are met, incentivizing performance but requiring robust measurement frameworks. Effective risk management in PPPs centers on contractual agreements and regulatory oversight, while in SIBs, dynamic monitoring and stakeholder collaboration are critical to address social impact uncertainties.

Stakeholder Engagement in PPPs and SIBs

Stakeholder engagement in public-private partnerships (PPPs) involves direct collaboration between government agencies and private sector partners to align project goals and ensure efficient delivery of infrastructure or services. In social impact bonds (SIBs), stakeholders include investors, service providers, and governments, with a strong emphasis on outcome-based accountability and continuous communication to measure social impact effectively. Effective stakeholder engagement in both PPPs and SIBs is crucial for transparency, risk-sharing, and achieving shared social or economic objectives.

Measuring and Reporting Outcomes

Public-private partnerships often rely on contractually defined performance metrics that measure project delivery and financial returns, facilitating accountability through standardized reporting frameworks. Social impact bonds prioritize outcome-based evaluations by linking investor returns directly to social performance indicators, using rigorous, real-time data collection and independent verification methods. Both models emphasize transparent, quantifiable outcomes but differ in financial risk allocation and flexibility in outcome measurement approaches.

Global Case Studies: PPPs and SIBs in Practice

Public-private partnerships (PPPs) demonstrate significant success in infrastructure projects across countries like the United Kingdom, Canada, and Australia by leveraging private sector investment to improve public services. Social impact bonds (SIBs) in the United States and the Netherlands show promising outcomes in social sectors such as homelessness and recidivism reduction through performance-based funding models. Comparative analysis reveals PPPs excel in long-term asset management, while SIBs drive innovation in social program delivery through outcome-focused investments.

Future Trends and Innovations in Public Finance

Emerging trends in public finance emphasize the integration of digital technologies and data analytics to enhance the effectiveness of public-private partnerships (PPPs) and social impact bonds (SIBs). Innovations such as blockchain for transparency and AI-driven impact measurement are transforming these financing models, enabling more precise outcomes and real-time performance tracking. Future developments also include hybrid financing structures that combine elements of PPPs and SIBs to maximize resource mobilization and social returns.

Related Important Terms

Blended Finance Mechanisms

Blended finance mechanisms leverage public-private partnerships and social impact bonds to mobilize diverse funding sources, combining government resources with private capital to address social challenges efficiently. Public-private partnerships typically involve direct collaboration for infrastructure projects, while social impact bonds focus on outcome-based investments where returns depend on achieving specific social goals.

Outcome-Based Contracting

Outcome-Based Contracting in public-private partnerships emphasizes measurable results through shared risk and rewards, aligning government objectives with private sector innovation. Social impact bonds specifically structure private investment to fund social programs, where repayment depends on achieving predefined social outcomes, driving efficiency and accountability.

Value-for-Money Assessments

Value-for-money assessments in public-private partnerships emphasize long-term efficiency by evaluating cost savings and risk transfer between public entities and private partners. Social impact bonds focus value-for-money evaluations on outcome-based payments linked to measurable social improvements, aligning investor returns with public sector goal attainment.

Pay-for-Success Initiatives

Public-private partnerships engage multiple stakeholders to share risks and resources in delivering public services, while social impact bonds specifically align financial returns with measurable social outcomes through Pay-for-Success initiatives. Pay-for-Success models leverage private capital to fund interventions upfront, with government repayments contingent on verified social performance, enhancing accountability and incentivizing effective service delivery.

Impact Measurement Frameworks

Impact measurement frameworks in public-private partnerships (PPPs) primarily employ traditional cost-benefit analyses and performance metrics to evaluate infrastructure and service delivery outcomes. Social impact bonds (SIBs) utilize more dynamic, outcome-based measurement approaches with real-time data tracking and rigorous social performance indicators to directly link financial returns to measurable social improvements.

Catalytic Capital Deployment

Public-private partnerships leverage joint investment to finance infrastructure and services, while social impact bonds deploy catalytic capital by attracting private investors who receive returns based on achieved social outcomes; catalytic capital in social impact bonds mitigates risk, incentivizes innovation, and unlocks additional funding streams for scalable impact. This strategic deployment accelerates resource mobilization and enhances accountability in delivering public value compared to traditional partnership models.

Cross-Sector Co-Creation

Public-private partnerships facilitate cross-sector co-creation by aligning government resources with private sector innovation to address community needs, fostering collaborative investment and shared risk. Social impact bonds further enhance this model by measuring social outcomes and incentivizing performance, enabling dynamic partnerships between public entities, investors, and service providers for scalable social impact.

Financial Additionality

Public-private partnerships (PPPs) often leverage private capital to enhance infrastructure projects but may not always generate significant financial additionality beyond government funding. Social impact bonds (SIBs) create financial additionality by attracting private investment specifically tied to social outcomes, ensuring funds are deployed only when measurable impact is achieved.

Contingent Returns Structures

Public-private partnerships (PPPs) often feature fixed or risk-adjusted payment structures linked to project milestones, contrasting with Social Impact Bonds (SIBs) that employ contingent returns based on achieving specific social outcomes tied to independent evaluations. The contingent return structures in SIBs align investors' financial incentives directly with measurable social impact, distributing risk and potential rewards according to performance metrics, unlike the more predetermined financial flows in PPPs.

Shared Risk Transfer Models

Public-private partnerships (PPPs) and social impact bonds (SIBs) both utilize shared risk transfer models, where financial and operational risks are distributed among government entities, private investors, and service providers to enhance project sustainability and accountability. In PPPs, risk is often transferred through long-term contracts emphasizing infrastructure delivery, while SIBs allocate risk based on achieving predefined social outcomes, linking investor returns to performance metrics.

public-private partnership vs social impact bonds Infographic

industrydif.com

industrydif.com