REITs offer investors liquidity and diversification by pooling resources to invest in large-scale properties, while fractional ownership provides direct equity stakes in specific real estate assets, granting more control and potential tax benefits. REITs are typically traded on public exchanges, making them accessible and easy to buy or sell, whereas fractional ownership often involves longer holding periods and less market liquidity. Choosing between REITs and fractional ownership depends on investment goals, risk tolerance, and desired involvement in property management.

Table of Comparison

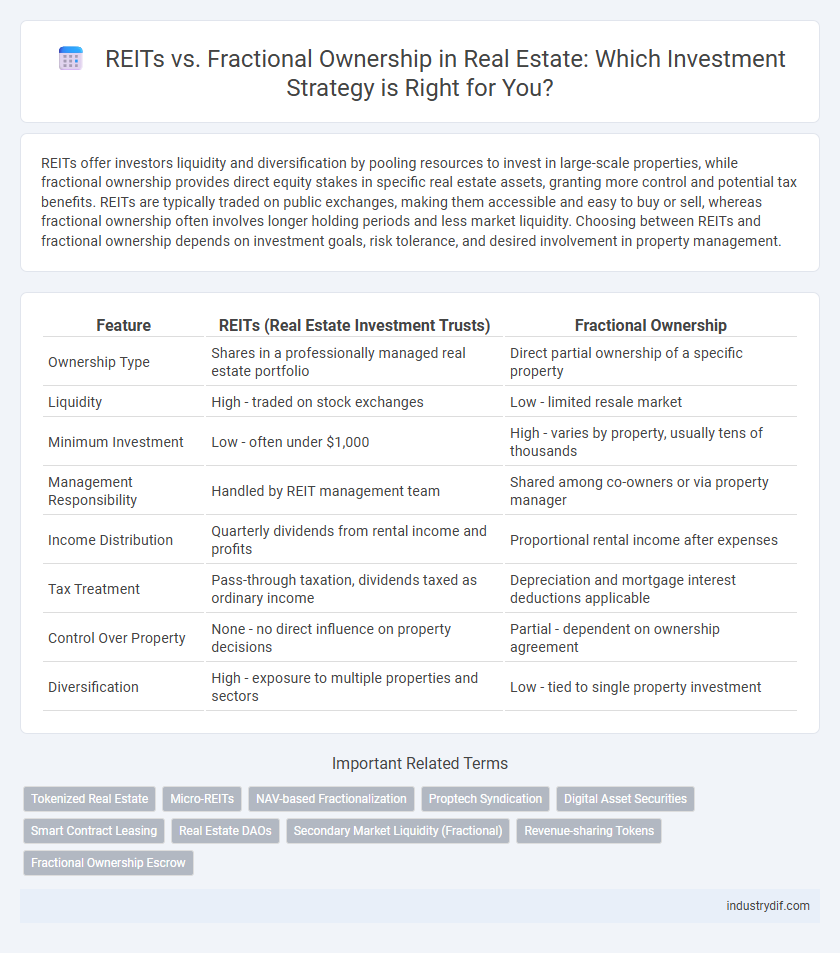

| Feature | REITs (Real Estate Investment Trusts) | Fractional Ownership |

|---|---|---|

| Ownership Type | Shares in a professionally managed real estate portfolio | Direct partial ownership of a specific property |

| Liquidity | High - traded on stock exchanges | Low - limited resale market |

| Minimum Investment | Low - often under $1,000 | High - varies by property, usually tens of thousands |

| Management Responsibility | Handled by REIT management team | Shared among co-owners or via property manager |

| Income Distribution | Quarterly dividends from rental income and profits | Proportional rental income after expenses |

| Tax Treatment | Pass-through taxation, dividends taxed as ordinary income | Depreciation and mortgage interest deductions applicable |

| Control Over Property | None - no direct influence on property decisions | Partial - dependent on ownership agreement |

| Diversification | High - exposure to multiple properties and sectors | Low - tied to single property investment |

Introduction to REITs and Fractional Ownership

Real Estate Investment Trusts (REITs) offer investors access to diversified property portfolios without the need for direct ownership, providing liquidity and professional management. Fractional ownership allows individuals to purchase a percentage of a specific property, granting them direct equity and potential rental income proportional to their share. Both investment models democratize real estate access but differ in structure, risk exposure, and control.

Key Differences Between REITs and Fractional Ownership

Real Estate Investment Trusts (REITs) offer liquidity through publicly traded shares and professional management of diversified property portfolios, while fractional ownership involves direct equity in specific properties, providing hands-on control and potential tax benefits. REITs typically require lower minimum investments and provide passive income distributions, contrasting with the higher capital commitment and active involvement often needed in fractional ownership. The risk exposure differs as REITs spread risk across multiple assets, whereas fractional ownership ties returns closely to the performance of individual properties.

Investment Structures Explained

REITs (Real Estate Investment Trusts) offer investors a way to pool capital into professionally managed real estate portfolios, providing liquidity and diversification through publicly traded shares. Fractional ownership allows individuals to directly purchase a specific percentage of a property, gaining proportional ownership and control without full property management responsibilities. While REITs emphasize passive income and easy market entry, fractional ownership delivers tangible asset stakes and potential tax benefits tied to individual property investments.

Accessibility and Minimum Investment Requirements

REITs offer greater accessibility with low minimum investments, often allowing participation through public stock exchanges with amounts as low as $500. Fractional ownership typically requires higher minimum investments, starting at several thousand dollars, limiting access to wealthier buyers. The liquidity of REITs also provides easier entry and exit compared to the longer-term commitment usually associated with fractional property ownership.

Liquidity and Exit Strategies

REITs offer higher liquidity through publicly traded shares, enabling investors to buy or sell ownership stakes quickly on stock exchanges. Fractional ownership typically involves private agreements with limited secondary market options, making exit strategies more complex and time-consuming. Investors seeking flexible exit opportunities often prefer REITs due to transparent pricing and ease of transaction.

Income Generation and Dividend Potential

REITs (Real Estate Investment Trusts) offer consistent income generation through regular dividends derived from a diversified portfolio of commercial and residential properties. Fractional ownership provides direct equity stakes in specific properties, potentially allowing for higher dividend yields based on property performance and rental income. While REITs emphasize liquidity and steady payouts, fractional ownership emphasizes personalized asset control with variable income tied to individual property profitability.

Risk Profiles and Diversification Benefits

REITs offer diversified exposure to real estate markets by pooling assets across various property types and geographic locations, reducing individual investment risk. Fractional ownership provides direct equity in specific properties, increasing potential returns but concentrating risk in a single asset. Investors seeking broad market diversification and lower volatility often prefer REITs, while those aiming for targeted control accept higher risk through fractional ownership.

Regulatory Framework and Compliance

REITs operate under strict regulatory frameworks governed by the Securities and Exchange Commission (SEC), mandating transparency, periodic disclosures, and adherence to income distribution requirements, which provide investors with legal protections and standardized compliance measures. Fractional ownership involves decentralized property rights where regulatory oversight varies significantly by jurisdiction, often requiring customized compliance with local real estate and taxation laws, resulting in less uniform investor protections. Understanding the regulatory distinctions between REITs and fractional ownership is crucial for evaluating legal risks, reporting obligations, and the overall security of real estate investments.

Tax Implications for Investors

Real Estate Investment Trusts (REITs) typically offer tax advantages such as pass-through income that is taxed at the investor's ordinary income rate, while allowing investors to avoid corporate-level taxation. Fractional ownership investors face direct property taxes and potential capital gains taxes on their share of the property income and appreciation, often requiring more complex personal tax filings. Understanding these distinctions helps investors optimize tax efficiency based on their investment goals and income brackets.

Choosing the Right Option: REITs vs Fractional Ownership

Choosing between REITs and fractional ownership depends on investment goals and risk tolerance; REITs offer liquidity and diversification through publicly traded real estate portfolios, while fractional ownership provides direct property equity and potential tax benefits. Investors seeking hands-off management and lower entry costs may prefer REITs, whereas those desiring control and tangible asset exposure often opt for fractional ownership. Understanding factors like market volatility, minimum investment, and income distribution is crucial for aligning with personal financial strategies.

Related Important Terms

Tokenized Real Estate

Tokenized real estate offers enhanced liquidity and accessibility compared to traditional REITs and fractional ownership by enabling digital asset trading on blockchain platforms. This innovative model reduces entry barriers, allowing investors to buy, sell, and manage property shares securely and transparently with smart contracts.

Micro-REITs

Micro-REITs offer investors fractional ownership in diversified real estate portfolios with lower capital requirements compared to traditional REITs, enhancing accessibility and liquidity. Unlike fractional ownership in individual properties, Micro-REITs provide professional asset management and broader market exposure, optimizing risk-adjusted returns.

NAV-based Fractionalization

NAV-based fractional ownership in real estate allows investors to buy shares proportional to the net asset value of properties, offering precise valuation transparency compared to REITs, which pool investments but may trade based on market sentiment rather than underlying asset values. This method enhances direct asset exposure and aligns investor returns more closely with actual property performance, minimizing the volatility seen in REIT shares.

Proptech Syndication

Proptech syndication enhances access to real estate investments by leveraging technology to streamline REITs and fractional ownership, enabling diversified portfolios with lower capital requirements. REITs offer liquidity and professional management, while fractional ownership provides direct asset control, both benefiting from digital platforms that simplify syndication and investor participation.

Digital Asset Securities

Digital asset securities enable fractional ownership in real estate through tokenization, allowing investors to buy and trade shares of properties with increased liquidity and transparency compared to traditional REITs. Unlike REITs, which pool investor funds into managed portfolios, digital asset securities offer direct property exposure, reduced entry barriers, and regulatory compliance via blockchain technology.

Smart Contract Leasing

Smart contract leasing in REITs automates rental agreements and payments, enhancing transparency and reducing administrative overhead, whereas fractional ownership uses blockchain to enable direct asset tokenization, giving investors greater control and flexibility over property shares. Both methods leverage decentralized technology, but smart contract leasing within REITs optimizes passive income streams, while fractional ownership emphasizes personalized investment and liquidity.

Real Estate DAOs

Real Estate DAOs revolutionize property investment by combining the liquidity and diversification of REITs with the transparency and direct ownership benefits of fractional property ownership, offering decentralized governance and automated smart contracts on blockchain platforms. This innovative model enhances investor control, reduces intermediaries, and democratizes access to high-value real estate assets globally.

Secondary Market Liquidity (Fractional)

Fractional ownership offers enhanced secondary market liquidity by allowing investors to buy and sell shares more easily compared to the often limited liquidity of Real Estate Investment Trusts (REITs), which are subject to stock exchange trading hours and regulatory constraints. This increased liquidity in fractional ownership enables quicker capital access and more flexible portfolio management for real estate investors.

Revenue-sharing Tokens

Revenue-sharing tokens in real estate offer a blockchain-based alternative to traditional REITs and fractional ownership by enabling direct income distribution from property earnings to token holders. This decentralized model enhances liquidity, transparency, and accessibility for investors seeking passive income through digital asset ownership.

Fractional Ownership Escrow

Fractional ownership escrow secures investors' funds by holding payments in a trusted third-party account until all contractual conditions for shared property acquisition and management are met, providing transparency and reducing risk. This mechanism contrasts with REITs by offering direct equity stakes in specific properties rather than pooled shares, enhancing control and tailored investment strategies in real estate portfolios.

REITs vs Fractional Ownership Infographic

industrydif.com

industrydif.com