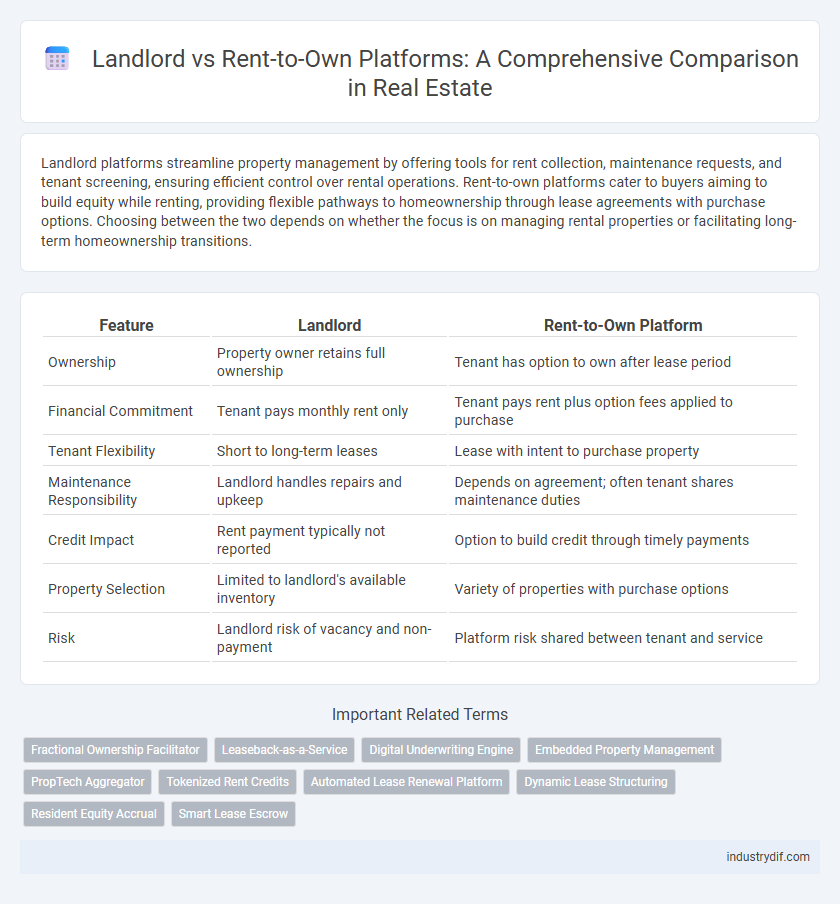

Landlord platforms streamline property management by offering tools for rent collection, maintenance requests, and tenant screening, ensuring efficient control over rental operations. Rent-to-own platforms cater to buyers aiming to build equity while renting, providing flexible pathways to homeownership through lease agreements with purchase options. Choosing between the two depends on whether the focus is on managing rental properties or facilitating long-term homeownership transitions.

Table of Comparison

| Feature | Landlord | Rent-to-Own Platform |

|---|---|---|

| Ownership | Property owner retains full ownership | Tenant has option to own after lease period |

| Financial Commitment | Tenant pays monthly rent only | Tenant pays rent plus option fees applied to purchase |

| Tenant Flexibility | Short to long-term leases | Lease with intent to purchase property |

| Maintenance Responsibility | Landlord handles repairs and upkeep | Depends on agreement; often tenant shares maintenance duties |

| Credit Impact | Rent payment typically not reported | Option to build credit through timely payments |

| Property Selection | Limited to landlord's available inventory | Variety of properties with purchase options |

| Risk | Landlord risk of vacancy and non-payment | Platform risk shared between tenant and service |

Understanding Traditional Landlords

Traditional landlords maintain direct ownership and management of rental properties, collecting monthly rent while handling maintenance and tenant relations personally. Their revenue depends largely on consistent occupancy and timely rent payments, exposing them to risks like tenant turnover and property damage. Unlike rent-to-own platforms that facilitate gradual ownership transfers, landlords retain full control and responsibility throughout the lease term.

What is a Rent-to-Own Platform?

A rent-to-own platform is an innovative real estate solution that allows tenants to rent a property with the option to purchase it later, often applying a portion of monthly rent toward the down payment. This model bridges the gap between traditional renting and homeownership by providing flexibility and financial planning advantages for renters who may not qualify for immediate mortgage financing. These platforms typically offer transparent contracts, property listings tailored for rent-to-own, and tools to track equity accumulation during the rental period.

Key Differences: Landlord vs Rent-to-Own Model

The landlord model involves property owners leasing homes directly to tenants in exchange for monthly rent, maintaining full ownership and control of the property. The rent-to-own platform allows tenants to rent a home with the option to purchase it later, often applying a portion of rent towards the down payment, bridging rental and ownership phases. Key differences include ownership status, payment structure, and long-term commitment, where landlords focus on rental income while rent-to-own platforms facilitate gradual equity building for tenants.

Pros and Cons for Tenants

Rent-to-own platforms provide tenants with a pathway to homeownership by applying rental payments towards a future purchase, offering flexibility and a chance to build credit. However, tenants may face higher monthly costs and risk losing invested fees if unable to complete the purchase. Traditional landlords typically offer lower upfront costs and shorter commitments but do not contribute rental payments toward equity or ownership.

Pros and Cons for Property Owners

Landlords maintain direct control over rental terms and tenant selection, ensuring steady cash flow with fewer complexities. Rent-to-own platforms offer property owners potential for higher sale prices and reduced vacancy rates but involve longer-term commitments and increased risk of tenant default. Evaluating factors like market demand, property condition, and risk tolerance is crucial for maximizing returns while minimizing financial exposure.

Financial Implications for Buyers and Renters

Rent-to-own platforms offer buyers the advantage of building equity over time while renting, which can be beneficial for those with limited savings for a down payment, contrasting with traditional landlords who typically require full upfront deposits without equity benefits. Buyers using rent-to-own arrangements may face higher monthly payments as a portion is credited toward purchase price, impacting cash flow differently than standard renting. Understanding these financial implications helps renters evaluate the trade-offs between immediate affordability with landlords and potential homeownership through rent-to-own contracts.

Legal Considerations and Responsibilities

Landlords must comply with local tenant laws, including lease agreements, eviction regulations, and property maintenance obligations, while ensuring clear communication of rights and responsibilities. Rent-to-own platforms require strict adherence to contract transparency, disclosure of purchase options, and compliance with consumer protection statutes to prevent potential litigation. Understanding the nuanced legal frameworks governing lease terms, payment structures, and ownership transfer is crucial to mitigate risks for both parties in real estate transactions.

Flexibility and Control: A Comparative Analysis

Landlord arrangements typically offer less flexibility but greater control over rental terms and property decisions, ensuring consistent income and property management authority. Rent-to-own platforms provide tenants with increased flexibility through gradual equity building and eventual ownership options, though landlords experience reduced control due to extended timelines and contractual complexities. The choice between these models hinges on balancing immediate control with long-term investment flexibility in real estate portfolios.

Market Trends in Rental and Rent-to-Own

The real estate market shows a rising trend in rent-to-own platforms as they offer flexible homeownership solutions, appealing to renters who face credit challenges or seek long-term investment stability. Traditional landlords continue to dominate the rental sector, but competition increases as rent-to-own options attract millennials and Gen Z buyers looking for alternative paths to homeownership. Market data indicates a growing shift, with rent-to-own transactions projected to increase annually by over 15%, reshaping rental dynamics and investment strategies.

Choosing the Right Option for Your Needs

Evaluating a landlord rental versus a rent-to-own platform requires analyzing financial flexibility, long-term goals, and market conditions. Landlord rentals provide standard lease agreements with predictable monthly payments, while rent-to-own offers an opportunity to build equity and potentially purchase the property. Selecting the right option depends on your readiness for homeownership, credit situation, and desire for investment stability.

Related Important Terms

Fractional Ownership Facilitator

Fractional ownership facilitators streamline the rent-to-own process by enabling multiple investors to collectively purchase and manage real estate, reducing individual financial risk while maximizing property access. This model contrasts with traditional landlords who typically hold sole ownership and directly lease property, limiting tenant equity-building opportunities.

Leaseback-as-a-Service

Leaseback-as-a-Service transforms traditional landlord roles by enabling property owners to sell their assets while leasing them back, providing immediate liquidity without losing occupancy. Rent-to-own platforms complement this model by offering tenants a pathway to homeownership through structured lease payments that contribute to future equity, aligning long-term investment incentives.

Digital Underwriting Engine

Digital underwriting engines in rent-to-own platforms leverage advanced algorithms and comprehensive data analytics to assess tenant creditworthiness more accurately than traditional landlord evaluations, reducing risk and enabling tailored payment plans. These engines automate income verification, rental history analysis, and property valuation, streamlining the approval process and enhancing financial inclusivity for prospective homeowners.

Embedded Property Management

Embedded property management within rent-to-own platforms streamlines tenant screening, payment processing, and maintenance tracking, enhancing operational efficiency compared to traditional landlord management. This automated integration reduces administrative burdens and improves cash flow consistency while enabling scalable tenant relations and property oversight.

PropTech Aggregator

A PropTech aggregator streamlines the decision-making process by comparing landlord offerings with rent-to-own platforms, highlighting factors such as lease terms, payment flexibility, and property maintenance services. Utilizing data analytics and user reviews, these platforms enhance transparency and empower tenants and investors to find optimal real estate solutions tailored to their financial and long-term ownership goals.

Tokenized Rent Credits

Tokenized rent credits in rent-to-own platforms offer tenants a transparent and secure way to accumulate equity toward homeownership by converting monthly rent payments into digital assets. Unlike traditional landlords, these platforms leverage blockchain technology to enable seamless transfer and tracking of rent credits, enhancing trust and liquidity in the property rental market.

Automated Lease Renewal Platform

An automated lease renewal platform streamlines the process for landlords by reducing manual tasks and minimizing tenant turnover through timely notifications and seamless contract updates. Rent-to-own platforms benefit from these automated systems by ensuring consistent lease agreements while integrating purchase options that enhance tenant retention and long-term property investment potential.

Dynamic Lease Structuring

Dynamic lease structuring in rent-to-own platforms offers flexible payment schedules and customizable terms that adapt to tenants' financial situations, enhancing affordability and long-term commitment. Traditional landlords typically provide fixed lease agreements with less adaptability, limiting opportunities for tenants to gradually transition into ownership.

Resident Equity Accrual

Rent-to-own platforms enable residents to build equity over time by applying a portion of their monthly payments toward property ownership, contrasting with traditional landlords where rent payments do not contribute to equity. This model incentivizes long-term residency and financial investment, providing a pathway to homeownership that enhances resident equity accrual compared to standard rental agreements.

Smart Lease Escrow

Smart Lease Escrow platforms offer landlords secure, automated management of rent-to-own agreements by holding payments in escrow until contract conditions are met, reducing risks and ensuring transparency. This technology streamlines property transactions, enhances tenant trust, and provides landlords with a reliable mechanism to track lease-to-own milestones and payment histories.

Landlord vs Rent-to-Own Platform Infographic

industrydif.com

industrydif.com