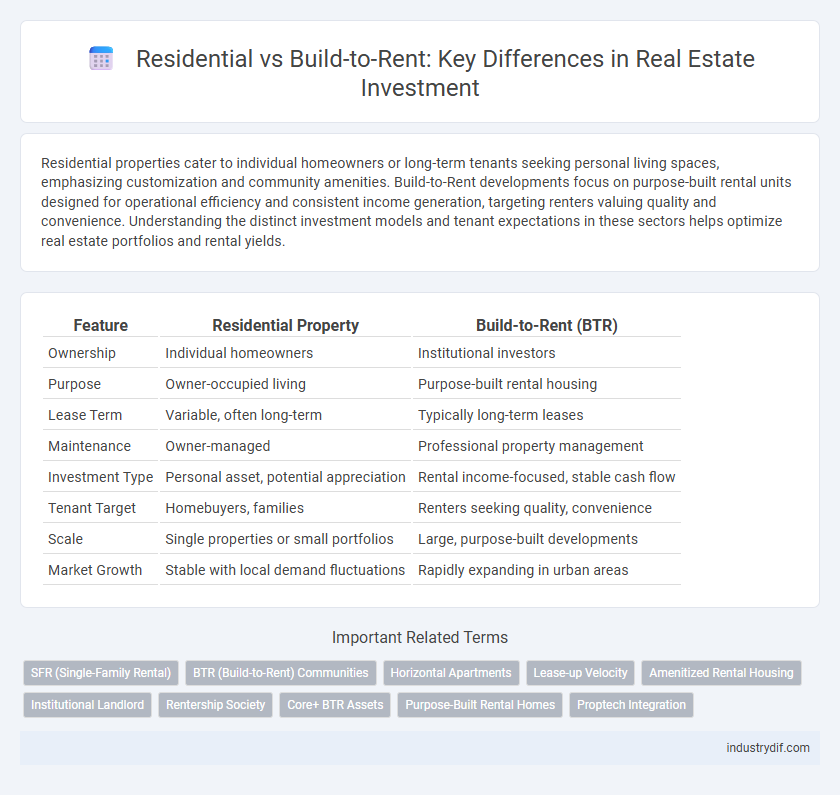

Residential properties cater to individual homeowners or long-term tenants seeking personal living spaces, emphasizing customization and community amenities. Build-to-Rent developments focus on purpose-built rental units designed for operational efficiency and consistent income generation, targeting renters valuing quality and convenience. Understanding the distinct investment models and tenant expectations in these sectors helps optimize real estate portfolios and rental yields.

Table of Comparison

| Feature | Residential Property | Build-to-Rent (BTR) |

|---|---|---|

| Ownership | Individual homeowners | Institutional investors |

| Purpose | Owner-occupied living | Purpose-built rental housing |

| Lease Term | Variable, often long-term | Typically long-term leases |

| Maintenance | Owner-managed | Professional property management |

| Investment Type | Personal asset, potential appreciation | Rental income-focused, stable cash flow |

| Tenant Target | Homebuyers, families | Renters seeking quality, convenience |

| Scale | Single properties or small portfolios | Large, purpose-built developments |

| Market Growth | Stable with local demand fluctuations | Rapidly expanding in urban areas |

Defining Residential Real Estate and Build-to-Rent

Residential real estate typically refers to properties designed for individual or family living, including single-family homes, townhouses, and condominiums. Build-to-Rent (BTR) developments are purpose-built rental communities, offering professionally managed apartments or homes designed specifically for long-term tenancy. Unlike traditional residential real estate, BTR focuses on providing renters with a comprehensive living experience featuring amenities, maintenance, and community management.

Key Features of Residential Properties

Residential properties typically include single-family homes, condominiums, and townhouses designed for long-term ownership or rental. Key features often encompass private living spaces, access to community amenities, and established neighborhood infrastructure supporting schools, parks, and retail. These properties emphasize personalization, stability, and investment appreciation within traditional real estate markets.

Characteristics of Build-to-Rent Developments

Build-to-rent developments are designed specifically for long-term rental occupancy, featuring professionally managed communities with amenities such as fitness centers, co-working spaces, and communal lounges. These properties typically prioritize tenant convenience and lifestyle, integrating modern design, high-quality finishes, and smart home technologies to attract and retain renters. Unlike traditional residential homes, build-to-rent developments emphasize scalability and operational efficiency, often located in urban or suburban areas with strong rental demand.

Investment Prospects: Residential vs Build-to-Rent

Residential real estate investments often offer long-term capital appreciation and potential tax benefits through property ownership, appealing to individual investors seeking wealth building. Build-to-Rent developments provide steady rental income streams and lower vacancy risks due to professional management and growing tenant demand, attracting institutional investors focused on consistent cash flow. Comparative analysis shows Build-to-Rent projects typically deliver higher yield stability and scalability, while traditional residential properties benefit from market value growth and personalized equity opportunities.

Tenant Demographics and Preferences

Residential properties primarily attract long-term tenants seeking stability, often families or individuals valuing community amenities and neighborhood schools. Build-to-Rent developments appeal to younger professionals and transient renters who prioritize modern design, flexible lease terms, and on-site services like gyms and co-working spaces. Understanding these tenant demographics and preferences helps investors tailor property features and marketing strategies to maximize occupancy and rental yields.

Financial Considerations and ROI Analysis

Residential real estate investments often require higher upfront costs and offer variable rental income, impacting cash flow stability and ROI. Build-to-Rent projects benefit from economies of scale, standardized construction costs, and consistent tenant demand, leading to potentially higher and more predictable returns. Analyzing net operating income, cap rates, and long-term appreciation is crucial in comparing financial performance between traditional residential properties and purpose-built rental communities.

Property Management Approaches

Residential property management typically involves individual homeowners or small-scale landlords focusing on tenant relations, maintenance schedules, and lease agreements to ensure long-term tenant satisfaction and property upkeep. Build-to-rent communities emphasize professional, large-scale property management teams that leverage technology, streamlined maintenance protocols, and centralized services to optimize operational efficiency and tenant experience across multiple units. These distinct approaches highlight the scalability and resource allocation differences in managing single-family homes versus multifamily rental complexes.

Market Trends Impacting Both Sectors

Rising demand for flexible living options and urbanization is driving growth in both residential and build-to-rent sectors, with Millennials and Gen Z favoring rental models over homeownership. Increased investor interest in build-to-rent developments is reshaping housing supply by targeting long-term rental stability, while residential markets face challenges from fluctuating mortgage rates and housing affordability. Technological advancements and sustainability trends are influencing property management and design in both sectors, enhancing appeal to environmentally conscious tenants and homeowners.

Regulatory Factors and Legal Implications

Residential real estate development faces complex zoning laws and stringent permitting processes that vary by locality, impacting project timelines and costs. Build-to-Rent communities must navigate additional regulatory frameworks related to tenant rights, landlord obligations, and long-term leasing structures, often requiring comprehensive compliance with housing and rental laws. Legal implications for both sectors include potential litigation risks related to property disclosures, fair housing regulations, and environmental compliance that critically influence investment viability.

Future Outlook for Residential and Build-to-Rent

The future outlook for residential real estate shows steady demand driven by population growth and urbanization, ensuring consistent appreciation in property values. Build-to-rent developments are projected to expand rapidly as changing lifestyles and affordability challenges increase demand for flexible, professionally managed rental communities. Investors are increasingly favoring build-to-rent due to reliable income streams and scalable portfolio opportunities in major urban markets.

Related Important Terms

SFR (Single-Family Rental)

Single-Family Rentals (SFR) in the build-to-rent sector offer institutional investors scalable, purpose-built homes designed for long-term tenancy, contrasting with traditional residential SFR properties often sold to individual homeowners. This strategic shift enhances portfolio diversification and meets the growing demand for quality rental housing in suburban markets.

BTR (Build-to-Rent) Communities

Build-to-Rent (BTR) communities offer purpose-built rental housing designed to meet long-term tenant needs with amenities such as shared workspaces, fitness centers, and community events, enhancing resident experience and retention. Unlike traditional residential properties, BTR developments focus on scalable rental income, professional management, and tailored living environments that foster social interaction and convenience.

Horizontal Apartments

Horizontal apartments in build-to-rent developments offer greater community-focused amenities and consistent property management compared to traditional residential apartments, enhancing tenant satisfaction and long-term investment stability. These horizontally structured units typically provide more outdoor spaces and privacy, appealing to renters seeking suburban living with urban conveniences.

Lease-up Velocity

Lease-up velocity in residential real estate typically experiences variability due to diverse buyer profiles and market conditions, often requiring extended marketing periods to achieve full occupancy. In contrast, build-to-rent properties demonstrate accelerated lease-up rates driven by targeted tenant demand and streamlined leasing processes, resulting in faster revenue generation for investors.

Amenitized Rental Housing

Amenitized rental housing in build-to-rent communities offers curated amenities such as fitness centers, coworking spaces, and communal lounges, enhancing tenant lifestyle and retention compared to traditional residential rentals which often lack integrated facilities. This strategic incorporation of on-site amenities drives higher occupancy rates and justifies premium rents within the growing build-to-rent sector.

Institutional Landlord

Institutional landlords are increasingly favoring build-to-rent developments due to their ability to generate stable, long-term rental income and mitigate market volatility compared to traditional residential sales. This shift supports scalable property management and aligns with growing tenant demand for quality rental housing in urban areas.

Rentership Society

The rise of the Rentership Society is reshaping housing preferences, with Build-to-Rent (BTR) developments offering tailored community amenities and long-term leasing options that appeal to modern renters seeking flexibility and convenience. Residential ownership remains a significant market segment, but BTR projects address growing demand for rental stability and professional property management, driving a shift toward purpose-built rental communities.

Core+ BTR Assets

Core+ Build-to-Rent (BTR) assets in real estate offer stable cash flows and moderate risk profiles compared to traditional residential properties, attracting institutional investors seeking steady income with growth potential. These BTR developments typically feature professionally managed, amenity-rich communities that enhance tenant retention and provide scalable investment opportunities in high-demand urban and suburban markets.

Purpose-Built Rental Homes

Purpose-built rental homes, designed specifically for long-term tenants, offer enhanced amenities, professional management, and community-focused layouts compared to traditional residential properties often sold for ownership. These build-to-rent developments address growing rental demand by providing consistent rental income and minimizing maintenance challenges typically associated with individual rental units.

Proptech Integration

Residential real estate increasingly incorporates Proptech solutions to enhance property management, tenant experiences, and energy efficiency through smart home devices and digital platforms. Build-to-Rent developments leverage advanced Proptech tools such as AI-driven leasing platforms, predictive maintenance systems, and IoT-enabled community amenities to optimize operational efficiency and attract long-term tenants.

Residential vs Build-to-Rent Infographic

industrydif.com

industrydif.com