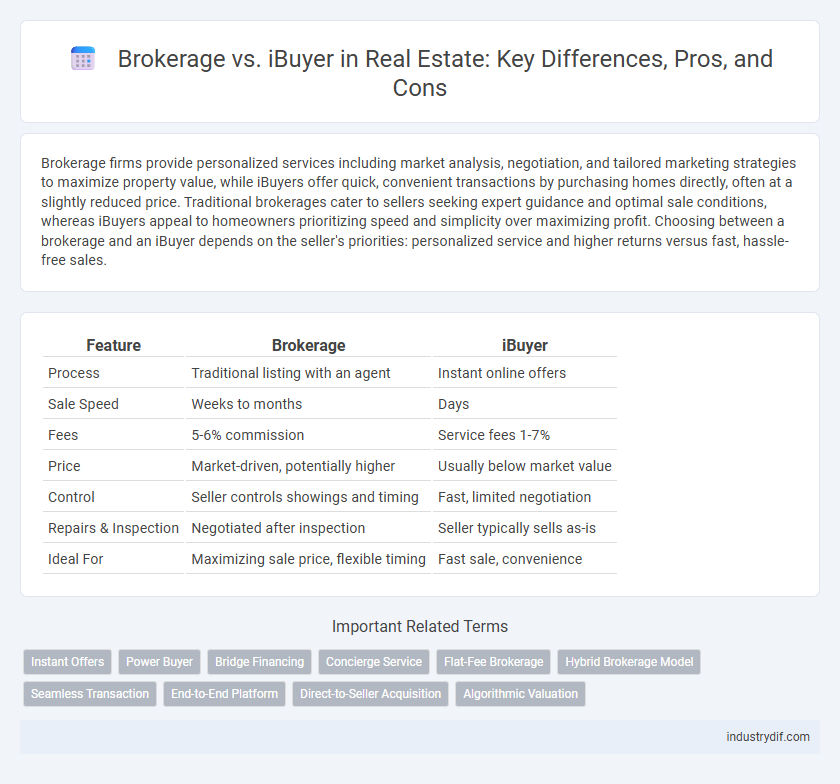

Brokerage firms provide personalized services including market analysis, negotiation, and tailored marketing strategies to maximize property value, while iBuyers offer quick, convenient transactions by purchasing homes directly, often at a slightly reduced price. Traditional brokerages cater to sellers seeking expert guidance and optimal sale conditions, whereas iBuyers appeal to homeowners prioritizing speed and simplicity over maximizing profit. Choosing between a brokerage and an iBuyer depends on the seller's priorities: personalized service and higher returns versus fast, hassle-free sales.

Table of Comparison

| Feature | Brokerage | iBuyer |

|---|---|---|

| Process | Traditional listing with an agent | Instant online offers |

| Sale Speed | Weeks to months | Days |

| Fees | 5-6% commission | Service fees 1-7% |

| Price | Market-driven, potentially higher | Usually below market value |

| Control | Seller controls showings and timing | Fast, limited negotiation |

| Repairs & Inspection | Negotiated after inspection | Seller typically sells as-is |

| Ideal For | Maximizing sale price, flexible timing | Fast sale, convenience |

Understanding Brokerage and iBuyer Models

Brokerage models in real estate involve agents representing buyers or sellers to negotiate deals and provide personalized market expertise, typically earning commissions based on the sale price. iBuyer models use technology and algorithms to offer instant cash offers on homes, aiming for a faster, more convenient transaction with streamlined processes and reduced time on market. Understanding these differences helps sellers choose between traditional agent support with potential for higher sale prices and quick, hassle-free transactions through iBuyers.

Key Differences Between Brokerages and iBuyers

Brokerages offer personalized service through licensed agents who facilitate negotiations and provide market expertise, while iBuyers use technology and algorithms to make instant cash offers for homes, streamlining the selling process. Brokerages typically involve commissions and longer transaction times, whereas iBuyers charge service fees and provide faster closings but may offer lower sale prices. The choice between brokerages and iBuyers depends on a seller's priorities regarding speed, convenience, and potential sale value.

How Traditional Brokerages Operate

Traditional brokerages operate by connecting buyers and sellers through licensed agents who provide personalized market expertise, negotiate offers, and manage the entire transaction process. These brokerages typically earn commissions based on a percentage of the final sale price, incentivizing agents to maximize value for their clients. Their business model relies on deep local market knowledge, client relationships, and tailored marketing strategies to facilitate successful property sales.

The iBuyer Process Explained

The iBuyer process simplifies home selling by providing instant cash offers based on algorithm-driven market analysis, eliminating the need for traditional listing and negotiations. Sellers submit property details online, receive a competitive offer within 24-48 hours, and can close quickly, often within a week. This streamlined approach contrasts with traditional brokerages by prioritizing speed and convenience over personalized agent services and market exposure.

Pros and Cons of Brokerage Services

Brokerage services offer personalized market expertise and tailored negotiation strategies, providing clients with comprehensive guidance throughout the buying or selling process. However, brokerages often charge higher commission fees and can have longer timeframes for closing deals compared to instant sale offers by iBuyers. Traditional brokerages maintain extensive networks and access to multiple listing services (MLS), which enhance market visibility but may involve more complex paperwork and contingencies.

Advantages and Disadvantages of iBuyers

iBuyers offer homeowners a fast and convenient selling process by providing instant cash offers and eliminating the need for traditional showings, reducing the time on market significantly. However, iBuyer services often come with higher service fees compared to traditional brokerages, and their offers may be lower than market value due to the expedited nature of the sale. This model suits sellers prioritizing speed and convenience but may not maximize profit for those seeking the highest sale price.

Costs and Fees: Brokerage vs iBuyer

Brokerage services typically charge a commission fee ranging from 5% to 6% of the home's sale price, which covers marketing, negotiations, and closing support. iBuyers usually charge a service fee between 6% and 12%, plus potential repair costs, offering faster closings but higher upfront costs. Comparing total expenses, traditional brokerages often prove more cost-effective for sellers seeking maximum sale price, while iBuyers appeal to those valuing convenience and speed despite increased fees.

Impact on Home Sellers and Buyers

Traditional brokerage offers personalized guidance, negotiating expertise, and a broader market reach, often resulting in higher sale prices and tailored buyer matches. iBuyers provide quick, hassle-free transactions with instant offers and fast closings, appealing to sellers prioritizing convenience over maximum profit. Buyers and sellers must weigh speed and certainty against potentially higher returns and personalized service when choosing between brokerage and iBuyer options.

Market Trends Shaping Brokerages and iBuyers

Market trends show a growing preference for iBuyers due to their speed and convenience, driven by advancements in AI and data analytics that streamline home selling processes. Traditional brokerages adapt by integrating digital tools and offering personalized services to enhance client trust and market expertise. The competitive landscape increasingly favors hybrid models combining technology with human insight to meet evolving consumer expectations.

Choosing the Right Option: Brokerage or iBuyer

Choosing between a traditional real estate brokerage and an iBuyer depends on your priorities such as speed, convenience, and cost efficiency. Brokerages typically offer personalized services, expert negotiation, and potentially higher sale prices, while iBuyers provide quick, hassle-free transactions with instant offers but may charge service fees and offer slightly lower prices. Understanding market conditions, property type, and your timeline will help determine if a full-service agent or an iBuyer aligns best with your real estate goals.

Related Important Terms

Instant Offers

Instant Offers provided by iBuyers enable homeowners to sell their properties quickly with minimal hassle, leveraging data-driven algorithms to deliver competitive, near-market bids without traditional listing processes. Traditional brokerages typically offer personalized market expertise and negotiation strategies but often require longer time frames and higher transaction costs compared to the streamlined, cash-based instant offer models of iBuyers.

Power Buyer

Power buyers leverage traditional real estate brokerages for personalized market insights and negotiation expertise, ensuring tailored property acquisition strategies. In contrast, iBuyers offer speed and convenience through automated cash offers, but may lack the customized guidance critical for securing optimal investment opportunities.

Bridge Financing

Bridge financing offers a critical advantage in real estate transactions for traditional brokerages by providing short-term funding that helps clients secure new properties before selling existing ones. In contrast, iBuyers typically use automated cash offers and instant transactions, which may limit the need for bridge loans but reduce personalized financial flexibility for sellers navigating market timing.

Concierge Service

Concierge services in real estate brokerage offer personalized support, handling everything from home staging to coordinating inspections, ensuring a tailored and hands-on experience. iBuyers provide streamlined, technology-driven transactions with limited concierge assistance, focusing primarily on speed and convenience over customized service.

Flat-Fee Brokerage

Flat-fee brokerages offer fixed, transparent pricing for real estate transactions, contrasting with iBuyers who provide instant cash offers but may charge higher fees or lower sale prices. Sellers prioritizing cost savings and control often prefer flat-fee services over iBuyers' convenience-driven models that may compromise net proceeds.

Hybrid Brokerage Model

The hybrid brokerage model combines traditional real estate brokerage services with iBuyer technology, offering sellers instant offers alongside expert agent guidance. This approach maximizes convenience and market exposure, balancing speed and personalized service for optimal property transactions.

Seamless Transaction

Brokerage services provide personalized guidance and negotiation expertise, ensuring a seamless transaction through tailored support and market insight. iBuyer platforms offer speed and convenience with instant offers and quick closings, streamlining the selling process by eliminating traditional listing steps.

End-to-End Platform

An end-to-end platform in real estate brokerage offers personalized service, local market expertise, and comprehensive transaction management from listing to closing, ensuring tailored support for buyers and sellers. iBuyer platforms streamline home sales with instant offers and quick closings using automated valuation models, but often lack the nuanced negotiation and customer service provided by traditional brokerages.

Direct-to-Seller Acquisition

Direct-to-seller acquisition through iBuyers leverages technology to provide instant offers and faster closings, bypassing traditional brokerage intermediaries. Brokerages, while offering personalized market expertise and negotiation skills, often involve longer timelines and commissions, making iBuyers a competitive choice for sellers seeking speed and convenience.

Algorithmic Valuation

Algorithmic valuation leverages machine learning models and extensive property datasets to provide instant and data-driven home price estimates, offering greater speed compared to traditional brokerage appraisals. iBuyers utilize these automated valuations to make quick cash offers, while brokerages rely on expert analysis and local market insights for more nuanced pricing strategies.

Brokerage vs iBuyer Infographic

industrydif.com

industrydif.com