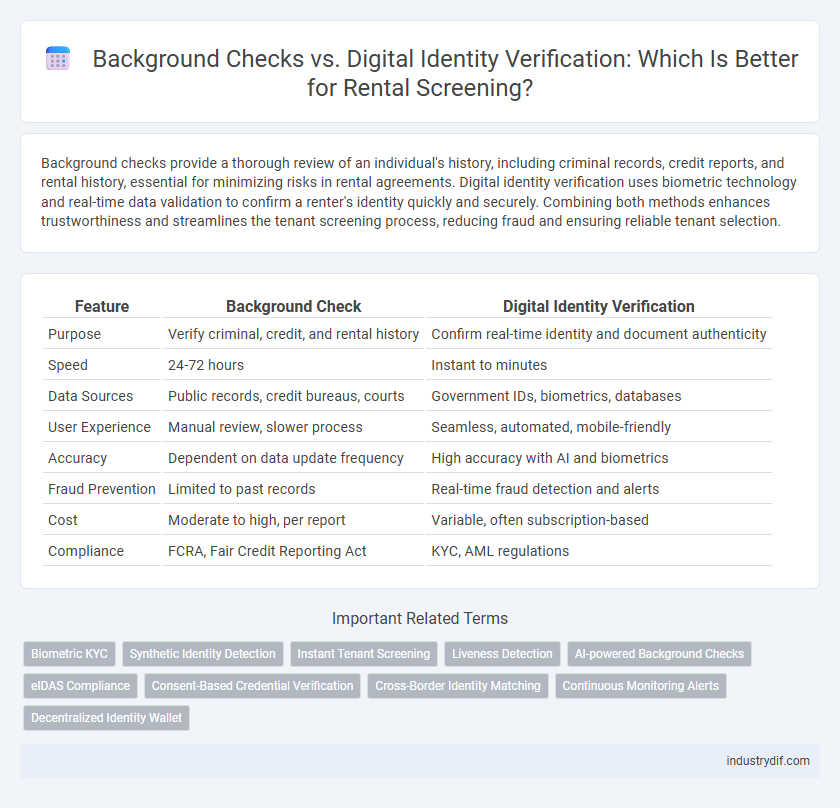

Background checks provide a thorough review of an individual's history, including criminal records, credit reports, and rental history, essential for minimizing risks in rental agreements. Digital identity verification uses biometric technology and real-time data validation to confirm a renter's identity quickly and securely. Combining both methods enhances trustworthiness and streamlines the tenant screening process, reducing fraud and ensuring reliable tenant selection.

Table of Comparison

| Feature | Background Check | Digital Identity Verification |

|---|---|---|

| Purpose | Verify criminal, credit, and rental history | Confirm real-time identity and document authenticity |

| Speed | 24-72 hours | Instant to minutes |

| Data Sources | Public records, credit bureaus, courts | Government IDs, biometrics, databases |

| User Experience | Manual review, slower process | Seamless, automated, mobile-friendly |

| Accuracy | Dependent on data update frequency | High accuracy with AI and biometrics |

| Fraud Prevention | Limited to past records | Real-time fraud detection and alerts |

| Cost | Moderate to high, per report | Variable, often subscription-based |

| Compliance | FCRA, Fair Credit Reporting Act | KYC, AML regulations |

Understanding Background Checks in the Rental Industry

Background checks in the rental industry primarily involve verifying tenants' criminal history, eviction records, credit scores, and employment status to assess their reliability and financial responsibility. Landlords rely on databases and public records to ensure prospective tenants meet lease requirements and reduce the risk of property damage or non-payment. These checks remain a critical tool for risk mitigation, even as digital identity verification gains popularity for streamlining application processes.

What Is Digital Identity Verification?

Digital identity verification is an advanced process that confirms a renter's identity using biometric data, government-issued ID scans, and real-time facial recognition technology. Unlike traditional background checks that rely on credit reports and criminal history, digital identity verification ensures immediate and accurate authentication to prevent identity fraud. This method enhances security and speeds up the rental approval process by validating the renter's authenticity in real time.

Key Differences: Background Checks vs Digital Identity Verification

Background checks in rentals involve comprehensive investigations into a tenant's criminal records, credit history, and previous rental behavior to assess risk, whereas digital identity verification uses biometric data, government-issued ID scans, and real-time authentication to confirm a tenant's identity instantly. Background checks often take days to process and rely on historical data, while digital identity verification provides faster, near-instant results by leveraging advanced technology and secure databases. Landlords use background checks to evaluate reliability and trustworthiness, while digital identity verification minimizes fraud and streamlines tenant onboarding processes.

Importance of Screening Tenants: Ensuring Security

Screening tenants through background checks and digital identity verification is crucial for ensuring rental property security by identifying potential risks such as criminal history, evictions, and fraud. Digital identity verification enhances the process by providing real-time validation of personal information, reducing the chances of identity theft and fraudulent applications. Effective tenant screening minimizes financial losses and protects landlords from property damage and legal liabilities.

Traditional Background Checks: Pros and Cons

Traditional background checks in rental screening often involve manual verification of credit history, criminal records, and employment, which can be time-consuming and prone to human error. While these checks provide comprehensive historical data, they may delay tenant approval and sometimes fail to capture real-time identity verification. Landlords benefit from detailed background insights but face challenges with outdated or incomplete information compared to faster, automated digital identity verification methods.

Advantages of Digital Identity Verification for Rentals

Digital identity verification streamlines the rental process by providing instant and accurate tenant authentication, significantly reducing the risk of fraud compared to traditional background checks. It leverages biometric data and real-time document validation, enhancing security and compliance with rental regulations. This technology also improves tenant experience by speeding up application approvals and minimizing manual paperwork, making it a preferred choice for property managers.

Speed and Efficiency: Digital vs Manual Processes

Digital identity verification accelerates the rental screening process by instantly validating tenant information through automated systems, reducing approval times from days to minutes. Manual background checks rely on human intervention and data retrieval from multiple sources, often causing delays and inconsistent results. The efficiency of digital verification enhances rental operations by minimizing errors and enabling faster decision-making compared to traditional, manual methods.

Data Privacy and Compliance in Tenant Screening

Background checks in tenant screening often involve accessing extensive personal records, necessitating strict compliance with regulations like the Fair Credit Reporting Act (FCRA) to protect data privacy. Digital identity verification leverages biometric and multifactor authentication technologies, reducing the risk of identity fraud while ensuring compliance with data protection laws such as GDPR and CCPA. Landlords must balance thorough tenant vetting with safeguarding sensitive information, opting for solutions that provide transparent data handling and secure storage practices.

Cost Implications for Landlords and Property Managers

Background checks often involve higher costs due to third-party fees and longer processing times, impacting landlords' and property managers' budgets. Digital identity verification offers a more cost-effective solution with instant results, reducing administrative expenses and minimizing vacancy periods. Choosing digital identity verification can streamline tenant screening while maintaining security and compliance, ultimately optimizing operational costs.

Future Trends: Evolving Rental Screening Technologies

Future trends in rental screening highlight a shift from traditional background checks to advanced digital identity verification methods, incorporating biometric data and AI-driven analysis for enhanced accuracy and fraud prevention. Rental platforms increasingly adopt blockchain technology to ensure secure, transparent, and tamper-proof identity verification processes. These evolving technologies streamline tenant screening, reduce processing times, and improve overall rental transaction trustworthiness in an increasingly digital real estate market.

Related Important Terms

Biometric KYC

Biometric KYC in rental processes enhances tenant screening by combining background checks with digital identity verification methods such as facial recognition and fingerprint scanning, reducing fraud and ensuring accurate identity authentication. Integrating biometric data ensures faster, more secure tenant verification, minimizing risks associated with identity theft and rental fraud.

Synthetic Identity Detection

Background checks rely on historical data and public records to assess tenant credibility, often missing synthetic identities crafted from fabricated or stolen information. Digital identity verification leverages biometric authentication and AI-driven synthetic identity detection tools to identify inconsistencies in identity data, enhancing fraud prevention in rental applications.

Instant Tenant Screening

Instant tenant screening leverages digital identity verification to rapidly authenticate applicant information, reducing fraud and enhancing accuracy compared to traditional background checks. This method integrates real-time data analysis and biometric validation, streamlining approval processes and improving rental decision confidence.

Liveness Detection

Liveness detection plays a crucial role in digital identity verification by confirming a tenant's physical presence, reducing fraud in rental applications more effectively than traditional background checks relying solely on static data. Incorporating advanced biometric technologies, liveness detection ensures real-time validation, enhancing security and trust in tenant screening processes.

AI-powered Background Checks

AI-powered background checks streamline tenant screening by leveraging advanced algorithms to analyze criminal records, credit history, and employment verification in real time. This technology enhances accuracy and speed compared to traditional digital identity verification, reducing fraud and improving rental decision confidence.

eIDAS Compliance

Background checks rely on traditional databases and can be time-consuming, while digital identity verification leverages eIDAS-compliant electronic identification methods to ensure secure, efficient tenant authentication. Utilizing eIDAS standards enhances trust and regulatory compliance in rental processes by verifying identities through qualified digital certificates.

Consent-Based Credential Verification

Consent-based credential verification enhances rental background checks by securely validating tenant identities through digital means, reducing fraud and streamlining approval processes. This method leverages verifiable credentials issued with tenant consent, ensuring accurate data while maintaining privacy compliance in rental applications.

Cross-Border Identity Matching

Cross-border identity matching enhances rental security by integrating background checks with digital identity verification to accurately authenticate international tenants. Utilizing biometrics and global databases, this technology reduces fraud risk and streamlines tenant screening across different countries.

Continuous Monitoring Alerts

Continuous monitoring alerts in rental processes provide real-time updates on tenants' background changes, enhancing security beyond initial screening. Digital identity verification integrates continuous monitoring to instantly detect identity theft or fraudulent activity, reducing rental risks effectively.

Decentralized Identity Wallet

Background checks rely on centralized databases to verify tenant history, often causing delays and privacy concerns, whereas digital identity verification using decentralized identity wallets empowers renters with secure, user-controlled credentials that streamline verification and enhance data privacy in rental applications. Decentralized identity wallets leverage blockchain technology to provide tamper-proof, real-time verification of identity attributes, minimizing fraud risks while enabling tenants to share only necessary information with landlords.

Background Check vs Digital Identity Verification Infographic

industrydif.com

industrydif.com