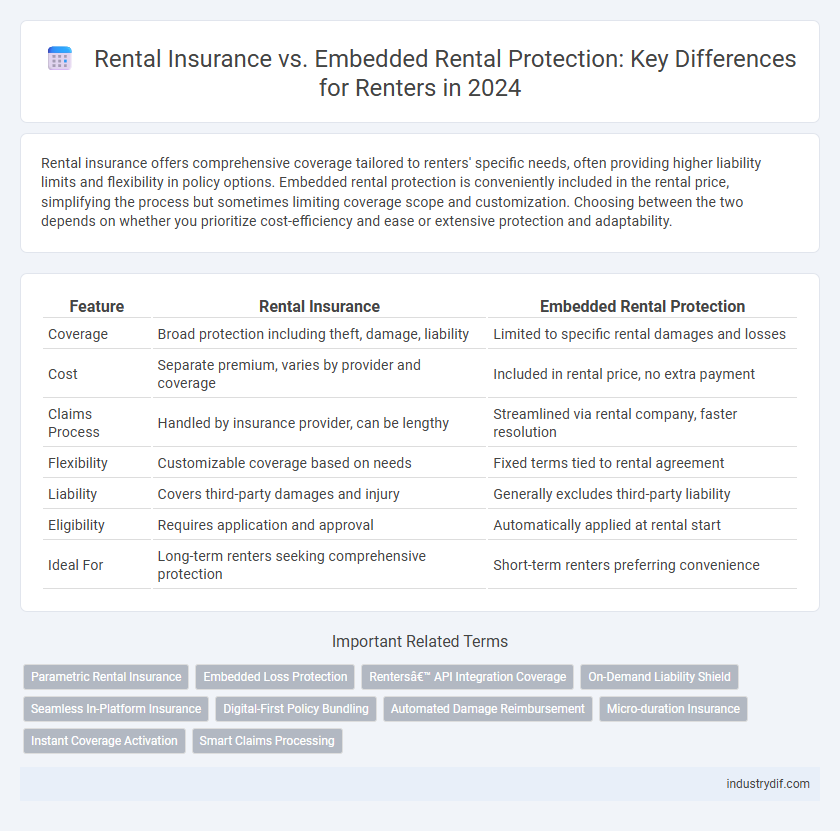

Rental insurance offers comprehensive coverage tailored to renters' specific needs, often providing higher liability limits and flexibility in policy options. Embedded rental protection is conveniently included in the rental price, simplifying the process but sometimes limiting coverage scope and customization. Choosing between the two depends on whether you prioritize cost-efficiency and ease or extensive protection and adaptability.

Table of Comparison

| Feature | Rental Insurance | Embedded Rental Protection |

|---|---|---|

| Coverage | Broad protection including theft, damage, liability | Limited to specific rental damages and losses |

| Cost | Separate premium, varies by provider and coverage | Included in rental price, no extra payment |

| Claims Process | Handled by insurance provider, can be lengthy | Streamlined via rental company, faster resolution |

| Flexibility | Customizable coverage based on needs | Fixed terms tied to rental agreement |

| Liability | Covers third-party damages and injury | Generally excludes third-party liability |

| Eligibility | Requires application and approval | Automatically applied at rental start |

| Ideal For | Long-term renters seeking comprehensive protection | Short-term renters preferring convenience |

Overview of Rental Insurance and Embedded Rental Protection

Rental insurance provides renters with coverage for personal property damage, liability, and loss during the rental period, typically offered through third-party insurance companies. Embedded rental protection is integrated directly into the rental transaction, offering streamlined coverage options such as damage waiver or theft protection included with the rental agreement. Both options aim to mitigate financial risk, but rental insurance offers broader protection, while embedded rental protection emphasizes convenience and immediate coverage at the point of rental.

Key Differences Between Rental Insurance and Embedded Protection

Rental insurance provides standalone coverage that renters purchase separately to protect against damages, theft, or liability during a rental period. Embedded rental protection is integrated into the rental contract or vehicle, offering automatic coverage but often with limited benefits and higher deductibles. Key differences include ownership of the policy, scope of coverage, cost structure, and claims process efficiency.

Coverage Scope: What’s Included and Excluded

Rental insurance typically offers comprehensive coverage including liability, collision, theft, and personal injury protection, but often excludes certain high-value items and pre-existing damages. Embedded rental protection provided by rental companies generally includes basic collision damage waiver and theft protection, yet excludes liability coverage and personal belongings. Understanding the specific inclusions and exclusions in each policy is crucial for renters seeking adequate protection.

Cost Comparison: Rental Insurance vs Embedded Rental Protection

Rental insurance often involves upfront premiums and potential deductibles that vary based on coverage limits and rental duration, typically resulting in higher out-of-pocket costs. Embedded rental protection is usually integrated into the rental price, offering a fixed, transparent fee that eliminates separate insurance purchases and can reduce overall expenses. Comparing both, embedded protection often provides cost certainty and convenience, while standalone rental insurance might offer broader coverage but at increased cost complexity.

Claims Process: How Each Option Handles Incidents

Rental insurance typically involves a formal claims process where the renter files a report, provides evidence of damage or loss, and waits for approval and reimbursement from the insurance company. Embedded rental protection often simplifies the claims procedure by integrating coverage directly with the rental agreement, allowing for faster resolution and direct billing without the need for additional documentation. Claims under embedded protection are generally processed through the rental company, streamlining incident handling and minimizing renter involvement.

Flexibility and Customization for Renters and Landlords

Rental insurance offers renters and landlords personalized coverage options tailored to specific property needs and risk levels, enhancing protection flexibility. Embedded rental protection, often included in lease agreements, provides standardized coverage with limited customization but simplifies the insurance process. Renters and landlords seeking adaptable policies typically prefer standalone rental insurance for its ability to customize premiums, coverage limits, and additional protections based on individual requirements.

Integration with Rental Platforms: Embedded Protection Advantages

Embedded rental protection offers seamless integration with rental platforms, allowing users to purchase coverage directly during the booking process without navigating to third-party insurers. This integration enhances user experience by providing instant quotes, streamlined claims processing, and tailored protection options based on the specific rental asset and duration. Rental platforms benefit from increased customer trust and higher conversion rates due to the convenience and transparency offered by embedded insurance solutions.

Regulatory Considerations and Compliance

Rental insurance and embedded rental protection differ significantly in regulatory considerations and compliance requirements. Rental insurance traditionally involves third-party providers regulated under state insurance laws, requiring clear disclosures, licensing, and consumer protection protocols. Embedded rental protection, often integrated into the rental transaction, faces increased scrutiny from regulatory bodies to ensure transparency, avoid anti-competitive practices, and comply with consumer finance regulations.

Who Should Choose Rental Insurance vs Embedded Protection?

Renters who prioritize comprehensive coverage and flexibility should choose rental insurance, as it often includes protection for personal belongings, liability, and temporary housing costs. Embedded rental protection is best suited for customers seeking convenient, low-cost coverage automatically included in their rental agreement, typically covering basic damages to the rental property. Homeowners or long-term renters requiring extensive liability limits and personalized protection benefit more from standalone rental insurance policies than embedded protection plans.

Future Trends in Rental Risk Management Solutions

Rental insurance is evolving with digital platforms integrating embedded rental protection directly into booking processes, reducing friction for customers while enhancing risk mitigation for providers. Future trends indicate increased use of AI-driven analytics and real-time risk assessment to tailor coverage dynamically based on renter behavior and property characteristics. This shift toward seamless, data-powered solutions promises more efficient claims handling and personalized protection options in the rental market.

Related Important Terms

Parametric Rental Insurance

Parametric rental insurance offers precise, data-driven protection by triggering payouts based on predefined rental-related events such as cancellations or property damage, ensuring swift claims without lengthy assessments. Unlike embedded rental protection, which is bundled and often limited within rental agreements, parametric insurance provides customizable coverage tailored to renters' specific risks, enhancing financial security in the rental market.

Embedded Loss Protection

Embedded loss protection in rental agreements offers seamless coverage integrated within the rental price, eliminating the need for separate rental insurance purchases. This embedded option simplifies the claims process and ensures consistent protection against damage or loss, enhancing renter convenience and reducing overall risks.

Renters’ API Integration Coverage

Rental insurance provides renters with comprehensive coverage through standalone policies that protect against property damage, theft, and liability, often requiring separate claims processes. Embedded rental protection via renters' API integration streamlines coverage by automating risk assessment and claims within the rental platform, enhancing user experience and real-time protection management.

On-Demand Liability Shield

On-demand Liability Shield enhances rental insurance by providing immediate, flexible coverage tailored to each rental period, reducing the risk of gaps associated with traditional policies. Embedded rental protection integrates seamlessly with the rental transaction, offering streamlined, automatic coverage that simplifies claims and lowers administrative costs for both renters and providers.

Seamless In-Platform Insurance

Seamless in-platform insurance integrates rental protection directly into the booking process, offering users immediate coverage without the need for separate policies, enhancing convenience and reducing friction. Embedded rental protection leverages data-driven risk assessments to provide tailored insurance options instantly, improving customer experience and streamlining claims management within the rental platform.

Digital-First Policy Bundling

Digital-first policy bundling integrates rental insurance with embedded rental protection, streamlining the user experience by offering comprehensive coverage through a single digital platform. This approach enhances convenience and reduces friction, enabling renters to secure tailored protection efficiently while leveraging real-time data analytics for personalized risk assessment.

Automated Damage Reimbursement

Rental insurance offers comprehensive coverage with potential claim delays, whereas embedded rental protection features automated damage reimbursement that accelerates payouts through integrated digital processes. Automated damage reimbursement reduces processing time and improves customer satisfaction by instantly verifying and settling claims within the rental platform.

Micro-duration Insurance

Micro-duration rental insurance provides targeted coverage for specific short periods, minimizing costs and offering flexibility compared to traditional rental insurance policies. Embedded rental protection integrated within booking platforms ensures seamless claims processing but often lacks the customizable duration and coverage options that micro-duration insurance delivers for brief rental periods.

Instant Coverage Activation

Rental insurance offers instant coverage activation at the moment of policy purchase, providing renters with immediate financial protection against damages or losses. Embedded rental protection is often integrated directly into the rental transaction, enabling seamless and automatic coverage without requiring separate insurance signup.

Smart Claims Processing

Rental insurance offers policyholders personalized coverage with direct claims handling, enabling faster approvals and tailored settlements, while embedded rental protection integrates coverage seamlessly into the rental fee, streamlining claims via automated, tech-driven processing for immediate resolution. Smart claims processing leverages AI and data analytics to reduce fraud, accelerate damage assessments, and enhance customer experience, whether through standalone insurance policies or embedded plans.

Rental Insurance vs Embedded Rental Protection Infographic

industrydif.com

industrydif.com