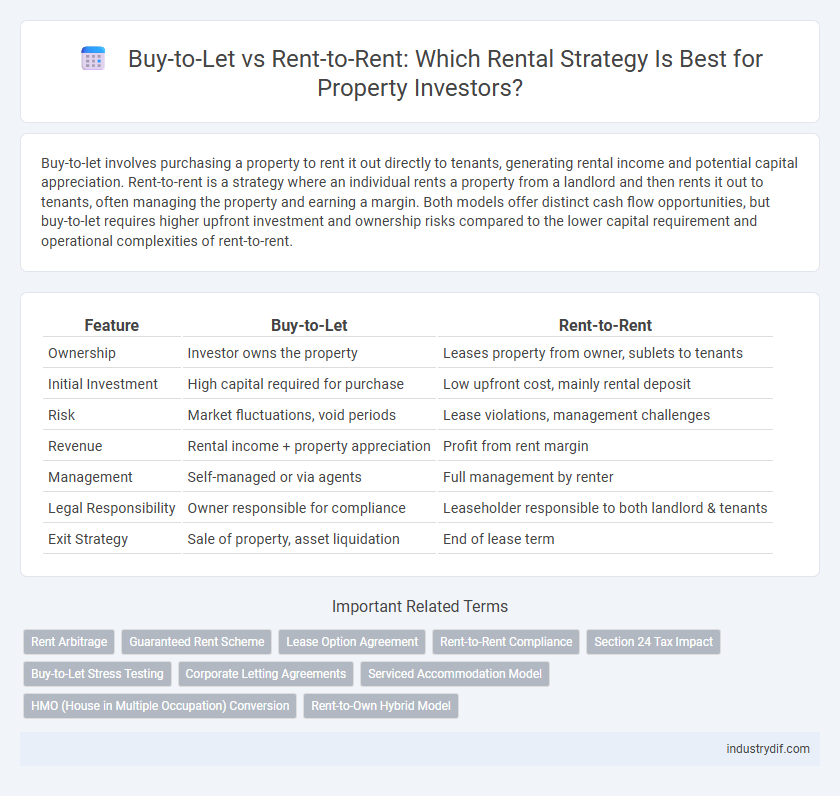

Buy-to-let involves purchasing a property to rent it out directly to tenants, generating rental income and potential capital appreciation. Rent-to-rent is a strategy where an individual rents a property from a landlord and then rents it out to tenants, often managing the property and earning a margin. Both models offer distinct cash flow opportunities, but buy-to-let requires higher upfront investment and ownership risks compared to the lower capital requirement and operational complexities of rent-to-rent.

Table of Comparison

| Feature | Buy-to-Let | Rent-to-Rent |

|---|---|---|

| Ownership | Investor owns the property | Leases property from owner, sublets to tenants |

| Initial Investment | High capital required for purchase | Low upfront cost, mainly rental deposit |

| Risk | Market fluctuations, void periods | Lease violations, management challenges |

| Revenue | Rental income + property appreciation | Profit from rent margin |

| Management | Self-managed or via agents | Full management by renter |

| Legal Responsibility | Owner responsible for compliance | Leaseholder responsible to both landlord & tenants |

| Exit Strategy | Sale of property, asset liquidation | End of lease term |

Introduction to Buy-to-Let and Rent-to-Rent

Buy-to-let involves purchasing a property to rent out directly to tenants, generating long-term rental income and potential property appreciation. Rent-to-rent is a strategy where an individual rents a property from a landlord and then sublets it to tenants, creating profit through the rental margin. Both methods offer distinct entry points into property investment with varying levels of capital commitment and management responsibilities.

Defining Buy-to-Let: Key Features

Buy-to-let involves purchasing a property specifically to lease it out to tenants, generating rental income and potential capital appreciation. Key features include long-term ownership, responsibility for property maintenance, and the ability to leverage mortgage financing tailored for investment purposes. Investors typically benefit from tax relief on mortgage interest and can build equity over time while managing tenant relationships directly.

What is Rent-to-Rent? Core Principles

Rent-to-rent is a property rental strategy where an individual or company leases a property from a landlord and then rents it out to tenants, often at a higher rate, without owning the property itself. The core principles include securing long-term lease agreements, managing tenant occupancy, and ensuring property maintenance while generating positive cash flow. This model minimizes upfront capital investment compared to buy-to-let, focusing on rental arbitrage and operational efficiency.

Entry Requirements: Buy-to-Let vs Rent-to-Rent

Buy-to-let requires significant upfront capital, including a large mortgage deposit typically around 25%, alongside strong credit history and proof of income. Rent-to-rent demands lower initial investment but often involves securing suitable property agreements and managing tenant relationships effectively. Understanding these entry requirements is essential to choose the right rental strategy aligned with financial capacity and risk tolerance.

Investment Costs and Financing Options

Buy-to-Let investments require substantial upfront capital, including mortgage deposits typically ranging from 20% to 30%, and ongoing costs such as maintenance and property management fees. Rent-to-Rent strategies demand lower initial investment since the investor leases a property from a landlord and sublets it, avoiding mortgage commitments but often incurring higher operational and agreement-based costs. Financing options for Buy-to-Let usually involve specialized mortgages with stricter lending criteria, while Rent-to-Rent relies primarily on rental income without the need for traditional mortgage financing.

Rental Income Potential and Profit Margins

Buy-to-Let properties typically offer higher rental income potential due to direct ownership, enabling landlords to capitalize on property appreciation and tax benefits. Rent-to-Rent schemes often generate lower profit margins since operators lease properties from owners and then sublet, adding management fees that reduce overall returns. Investors seeking stable, long-term income may prefer Buy-to-Let for its scalable rental yields and asset growth prospects.

Legal Responsibilities and Compliance Considerations

Buy-to-let landlords must adhere to strict legal responsibilities including property safety regulations, landlord licensing, and tenant rights under the Housing Act 2004, ensuring compliance with eviction procedures and deposit protection schemes. Rent-to-rent operators, while not property owners, assume substantial compliance obligations by managing tenancy agreements, maintaining property standards, and adhering to local authority regulations to avoid accusations of unauthorized subletting. Both models require rigorous record-keeping and adherence to evolving rental laws to mitigate legal risks and ensure tenant protection.

Risk Factors and Management Strategies

Buy-to-Let investments carry risks such as market volatility, tenant default, and property depreciation, requiring thorough tenant screening and regular maintenance to mitigate financial losses. Rent-to-Rent models face challenges including subletting legality, landlord consent, and short-term rental demand fluctuations, demanding clear contracts and proactive relationship management with property owners. Effective risk management involves rigorous due diligence, legal compliance, and contingency planning to safeguard rental income and property value in both strategies.

Exit Strategies and Long-Term Prospects

Buy-to-let investors benefit from asset appreciation and potential mortgage paydown, offering profitable exit strategies through property sales or refinancing. Rent-to-rent provides flexibility with lower upfront costs but relies heavily on contract renewals, making long-term prospects less stable. Evaluating market trends and financial goals is crucial for selecting the best exit plan and ensuring sustainable rental income.

Choosing the Right Model: Buy-to-Let or Rent-to-Rent?

Buy-to-Let involves purchasing property to generate rental income and build equity over time, requiring significant upfront capital and mortgage considerations. Rent-to-Rent allows control of rental properties without ownership by leasing from landlords and subletting, offering lower financial commitment but potentially less long-term asset growth. Evaluating factors like investment budget, risk tolerance, and income goals is crucial to selecting the most suitable rental business model.

Related Important Terms

Rent Arbitrage

Rent arbitrage in Rent-to-Rent involves leasing a property long-term and subletting it for short-term stays, maximizing rental income without property ownership, while Buy-to-Let requires purchasing property to rent out traditionally. Rent-to-Rent offers lower capital investment and faster scalability, but Buy-to-Let provides long-term asset appreciation and equity building.

Guaranteed Rent Scheme

The Guaranteed Rent Scheme offers landlords a steady, predictable income by leasing properties to managing agents who then sublet to tenants, contrasting with Buy-to-Let where landlords directly manage tenant agreements and face market fluctuations. This scheme minimizes void periods and maintenance costs, enhancing cash flow stability compared to traditional Buy-to-Let investments.

Lease Option Agreement

Buy-to-Let involves purchasing a property to rent out directly, generating rental income and potential capital appreciation, whereas Rent-to-Rent utilizes a Lease Option Agreement to control a property without ownership by leasing it and subletting to tenants for profit. Lease Option Agreements offer flexibility and lower upfront costs, allowing investors to secure rental income streams while mitigating risks associated with property ownership.

Rent-to-Rent Compliance

Rent-to-rent compliance requires strict adherence to landlord licensing, safety regulations, and tenancy deposit protection schemes to avoid legal penalties and ensure tenant safety. Unlike buy-to-let, rent-to-rent operators must maintain transparent agreements with both property owners and tenants, emphasizing regulatory standards and comprehensive property management.

Section 24 Tax Impact

Section 24 tax changes limit buy-to-let landlords from deducting full mortgage interest, increasing taxable rental income and potentially reducing net returns. Rent-to-rent operators, not owning the property, avoid these restrictions and may benefit from more favorable tax treatment on profits.

Buy-to-Let Stress Testing

Buy-to-Let stress testing involves evaluating potential rental income against mortgage repayments, interest rate fluctuations, void periods, and maintenance costs to ensure sustainable cash flow and investment viability. This financial assessment helps landlords mitigate risks by projecting worst-case scenarios and confirming they can cover expenses even if rental markets soften or unexpected costs arise.

Corporate Letting Agreements

Corporate letting agreements in buy-to-let typically involve direct landlord-to-tenant contracts offering longer-term stability and consistent rental income, ideal for investors seeking steady cash flow. Rent-to-rent arrangements, conversely, rely on third-party managers subletting properties under corporate letting agreements, maximizing occupancy rates while potentially increasing management complexity and operational control costs.

Serviced Accommodation Model

Buy-to-Let involves purchasing property to rent out long-term, generating steady rental income and capital growth, whereas Rent-to-Rent focuses on leasing properties to sublet them, often as serviced accommodation, maximizing short-term rental yields through higher occupancy rates and premium pricing. The serviced accommodation model under Rent-to-Rent leverages flexible stays, enhanced amenities, and detailed management services to attract business travelers and tourists, offering higher returns but requiring intensive operational oversight.

HMO (House in Multiple Occupation) Conversion

Buy-to-Let involves purchasing a property to convert into an HMO, allowing landlords to maximize rental income through multiple tenants, while Rent-to-Rent focuses on leasing a property long-term and legally subletting rooms after HMO conversion without owning it. HMO conversion requires compliance with local housing regulations, licenses, and safety standards to optimize rental yields and ensure tenant safety in both strategies.

Rent-to-Own Hybrid Model

The Rent-to-Own hybrid model combines the advantages of Buy-to-Let and Rent-to-Rent by allowing tenants to rent properties with an option to purchase after a set period, creating a pathway to homeownership while providing landlords with steady rental income and reduced vacancy risks. This model optimizes cash flow, enhances tenant commitment, and opens new investment opportunities in the residential rental market.

Buy-to-Let vs Rent-to-Rent Infographic

industrydif.com

industrydif.com