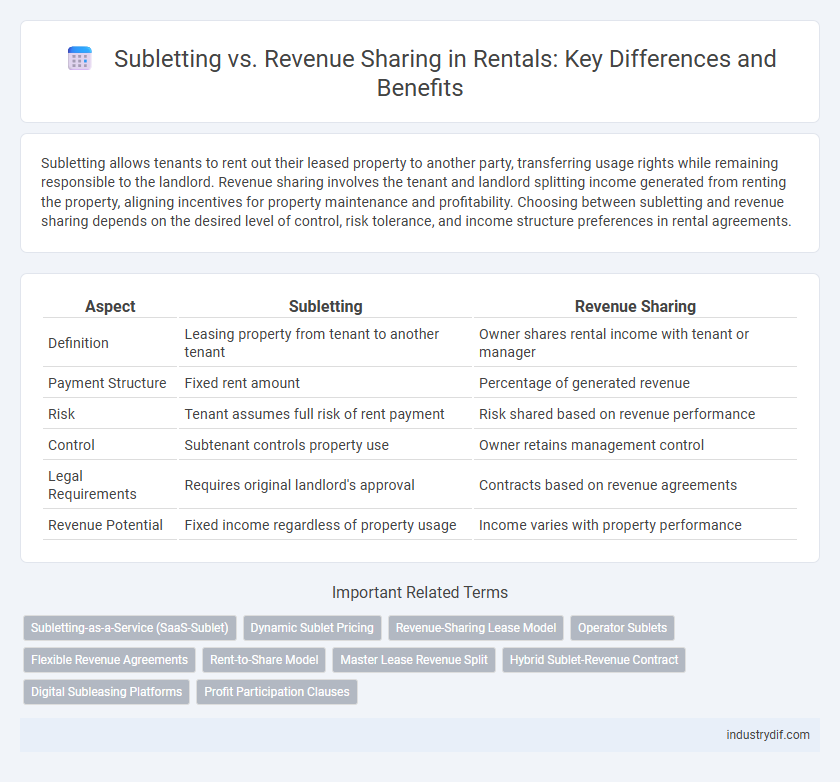

Subletting allows tenants to rent out their leased property to another party, transferring usage rights while remaining responsible to the landlord. Revenue sharing involves the tenant and landlord splitting income generated from renting the property, aligning incentives for property maintenance and profitability. Choosing between subletting and revenue sharing depends on the desired level of control, risk tolerance, and income structure preferences in rental agreements.

Table of Comparison

| Aspect | Subletting | Revenue Sharing |

|---|---|---|

| Definition | Leasing property from tenant to another tenant | Owner shares rental income with tenant or manager |

| Payment Structure | Fixed rent amount | Percentage of generated revenue |

| Risk | Tenant assumes full risk of rent payment | Risk shared based on revenue performance |

| Control | Subtenant controls property use | Owner retains management control |

| Legal Requirements | Requires original landlord's approval | Contracts based on revenue agreements |

| Revenue Potential | Fixed income regardless of property usage | Income varies with property performance |

Understanding Subletting in the Rental Industry

Subletting in the rental industry involves a tenant leasing the rented property to a third party while retaining the original lease agreement with the landlord. This practice requires explicit landlord approval to ensure legal compliance and avoid lease violations. Understanding the terms of subletting is crucial for both tenants and landlords to manage responsibilities and protect their financial interests effectively.

What Is Revenue Sharing in Rental Agreements?

Revenue sharing in rental agreements involves landlords and tenants agreeing to split rental income or business profits generated from the leased property, often used in commercial leases. This arrangement aligns incentives, allowing landlords to benefit from tenant success while tenants pay a portion of their earnings instead of a fixed rent. Unlike subletting, where tenants rent out the property to third parties, revenue sharing directly ties rent payments to actual business performance.

Key Differences Between Subletting and Revenue Sharing

Subletting involves a tenant leasing the rented property to a third party, maintaining full responsibility for the original lease agreement, whereas revenue sharing is a business arrangement where rental income is distributed between the property owner and a tenant or partner based on agreed percentages. In subletting, the subtenant pays rent directly to the original tenant, while in revenue sharing, income is split based on revenue generated, often linked to commercial or business activities on the property. Legal obligations and control over the property differ significantly, with subletting requiring landlord approval and maintaining tenant liability, while revenue sharing focuses on financial agreements without transferring leasehold rights.

Pros and Cons of Subletting for Property Owners

Subletting offers property owners steady rental income and reduced vacancy risks but may lead to less control over tenant selection and property use. Owners face potential complications with lease enforcement and increased wear and tear from subtenants not directly vetted by them. However, properly managed subletting can maintain cash flow and attract tenants during market downturns, although it requires clear agreements to mitigate risks.

Pros and Cons of Revenue Sharing Models

Revenue sharing models in rentals offer landlords consistent income aligned with tenant business performance, reducing vacancy risk and fostering long-term partnerships. However, this approach can result in unpredictable revenue streams compared to fixed rent agreements, complicating financial planning for property owners. Tenants benefit from lower initial payments, but revenue sharing may lead to higher overall costs during profitable periods.

Legal Implications: Subletting vs Revenue Sharing

Subletting involves legally transferring the tenant's rights to another party, often requiring landlord approval to avoid lease violations and potential eviction. Revenue sharing agreements in rentals must clearly define profit distribution and responsibilities to prevent disputes and ensure compliance with local rental laws. Understanding and adhering to jurisdiction-specific regulations is essential to mitigate legal risks associated with both subletting and revenue sharing arrangements.

Financial Impact: Subletting vs Revenue Sharing

Subletting generates consistent rental income by transferring lease rights to a third party, minimizing vacancy risk but potentially limiting profit upside. Revenue sharing aligns landlord earnings with tenant business performance, offering higher income potential during peak periods while exposing landlords to revenue fluctuations. Evaluating financial impact requires balancing guaranteed cash flow from subletting against variable but potentially greater returns from revenue sharing agreements.

How to Choose the Right Model for Your Rental Business

Selecting the right model for your rental business depends on factors like control, profitability, and risk management. Subletting offers fixed income and less operational involvement, making it suitable for landlords seeking consistent revenue without daily management. Revenue sharing aligns incentives between property owners and operators, ideal for those willing to share profits in exchange for potential higher earnings and active participation.

Common Pitfalls in Subletting and Revenue Sharing Arrangements

Common pitfalls in subletting include unclear lease terms, unauthorized tenants, and potential violations of landlord agreements, which can lead to legal disputes and lost deposit funds. Revenue sharing arrangements often face challenges such as ambiguous profit distribution, lack of transparency, and difficulties in tracking income accurately, increasing the risk of conflicts between parties. Careful documentation, explicit contract language, and regular financial audits are essential to avoid misunderstandings and ensure compliance in both subletting and revenue sharing scenarios.

Future Trends: Subletting vs Revenue Sharing in the Rental Market

Future trends in the rental market indicate a shift towards revenue sharing models that offer greater flexibility and financial incentives for property owners compared to traditional subletting. Subletting often faces regulatory challenges and limits landlord control, whereas revenue sharing aligns tenant success with owner profits, encouraging longer-term partnerships. Technology platforms facilitating transparent tracking and automated payments are expected to drive the growth of revenue sharing arrangements in urban and commercial rental sectors.

Related Important Terms

Subletting-as-a-Service (SaaS-Sublet)

Subletting-as-a-Service (SaaS-Sublet) transforms traditional rental models by enabling tenants to legally and efficiently lease their rented spaces to subtenants through digital platforms, optimizing space utilization and generating additional income without compromising lease agreements. Unlike revenue sharing, which splits profits derived from the property, SaaS-Sublet provides a streamlined, tech-driven approach focused on managing subleases, compliance, and automated transactions, enhancing transparency and control for primary tenants.

Dynamic Sublet Pricing

Dynamic sublet pricing leverages real-time market data and demand fluctuations to optimize rental income, unlike fixed-rate revenue sharing models that distribute a predetermined percentage of earnings. This pricing strategy enables subletters to maximize profitability by adjusting rates according to occupancy trends and competitor pricing, enhancing revenue potential in competitive rental markets.

Revenue-Sharing Lease Model

The revenue-sharing lease model allows tenants to pay rent based on a percentage of their business income, aligning landlord and tenant interests by linking rent to actual performance. This flexible approach minimizes fixed costs for tenants while incentivizing landlords to support tenant success through shared financial outcomes.

Operator Sublets

Operator sublets involve the original tenant leasing the rental property to a third party, retaining primary responsibility for the lease terms while generating rental income through subletting agreements. This method differs from revenue sharing, where the rental income is divided between parties based on agreed percentages without transferring lease obligations.

Flexible Revenue Agreements

Flexible revenue agreements in rental arrangements offer tenants the option to sublet their space or engage in revenue sharing models, providing adaptability in income generation. Subletting allows tenants to lease the property to third parties, while revenue sharing ties rent payments to business performance, optimizing financial flexibility for both landlords and tenants.

Rent-to-Share Model

The rent-to-share model blends subletting and revenue sharing by allowing tenants to generate income from their rental unit while maintaining lease responsibilities, optimizing rental income streams. This approach offers landlords steady base rent combined with a percentage of additional revenue, enhancing profitability and tenant engagement.

Master Lease Revenue Split

Master lease revenue split defines how rental income is divided between the primary tenant (master lessee) and subtenants in subletting agreements, establishing clear financial responsibilities. In revenue sharing models, income distribution is based on a percentage of gross or net revenues generated, aligning incentives but requiring transparent reporting and financial tracking for effective management.

Hybrid Sublet-Revenue Contract

A hybrid sublet-revenue contract combines elements of traditional subletting and revenue sharing by allowing tenants to lease a property while sharing a percentage of generated income with landlords, optimizing profit alignment. This approach provides flexibility for tenants to monetize space usage while ensuring landlords receive ongoing financial returns tied to business performance.

Digital Subleasing Platforms

Digital subleasing platforms streamline the process of subletting by connecting tenants with potential subtenants, offering flexible rental terms and automated payment systems that enhance transparency and convenience. In contrast, revenue sharing models in rental arrangements allocate rental income between property owners and management companies, often requiring complex agreements and less direct involvement of tenants in rental transactions.

Profit Participation Clauses

Profit participation clauses in rental agreements define how subtenants share earnings with the primary tenant, distinguishing subletting from revenue sharing by specifying financial entitlements tied to rental income or business profits. These clauses ensure transparency and equitable distribution of revenue, aligning incentives between property owners, primary tenants, and subtenants.

Subletting vs Revenue Sharing Infographic

industrydif.com

industrydif.com