Credit checks remain the standard method for assessing rental applicants, providing landlords with a clear snapshot of financial reliability through credit scores and history. Alternative renter scoring evaluates factors beyond traditional credit data, such as rental payment history, employment stability, and utility payments, offering a more inclusive view of a tenant's trustworthiness. This approach can expand access to housing for applicants with limited credit history while still mitigating risk for landlords.

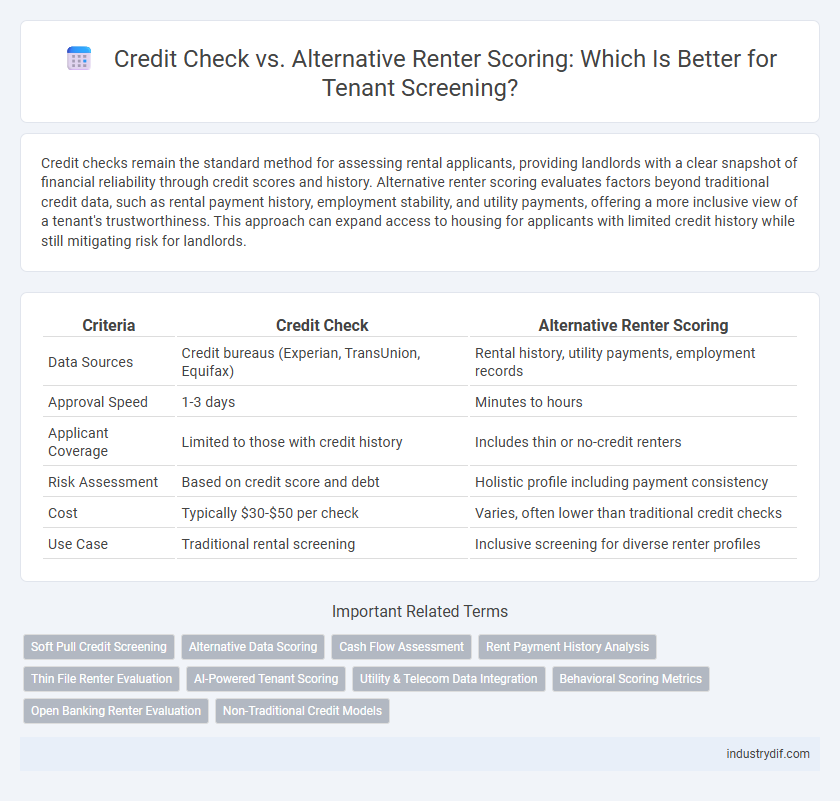

Table of Comparison

| Criteria | Credit Check | Alternative Renter Scoring |

|---|---|---|

| Data Sources | Credit bureaus (Experian, TransUnion, Equifax) | Rental history, utility payments, employment records |

| Approval Speed | 1-3 days | Minutes to hours |

| Applicant Coverage | Limited to those with credit history | Includes thin or no-credit renters |

| Risk Assessment | Based on credit score and debt | Holistic profile including payment consistency |

| Cost | Typically $30-$50 per check | Varies, often lower than traditional credit checks |

| Use Case | Traditional rental screening | Inclusive screening for diverse renter profiles |

Introduction to Renter Screening Methods

Renter screening methods include traditional credit checks and alternative renter scoring, each providing unique insights into tenant reliability. Credit checks analyze financial history through credit bureaus, highlighting payment behavior and debt management. Alternative renter scoring incorporates factors like rental payment history, employment stability, and utility payments to offer a broader assessment of tenant risk.

What Is a Traditional Credit Check?

A traditional credit check involves reviewing a renter's credit history through major credit bureaus like Experian, Equifax, and TransUnion to assess their financial reliability. It evaluates payment history, credit utilization, outstanding debts, and length of credit accounts to predict the likelihood of timely rent payments. Landlords use these scores to minimize risk by verifying that applicants have a proven track record of managing credit responsibly.

Common Limitations of Credit Checks

Traditional credit checks often overlook reliable tenants due to limited data on non-traditional credit activities such as rent payments or utility bills. Many renters, especially younger or low-income individuals, may have thin credit files that inadequately represent their payment reliability. Alternative renter scoring models incorporate diverse financial behaviors, providing landlords with a more inclusive and accurate assessment of tenant risk.

Understanding Alternative Renter Scoring Systems

Alternative renter scoring systems evaluate tenants beyond traditional credit checks by analyzing payment histories, employment stability, and rental history. These models use data points such as utility payments, bank transaction consistency, and social behavior to predict rental reliability. Implementing alternative scoring helps landlords identify trustworthy renters without credit histories or with limited credit data.

Key Differences: Credit Check vs Alternative Renter Scoring

Credit checks rely on traditional credit bureaus to evaluate a renter's financial history, focusing on credit scores and past loan repayments. Alternative renter scoring assesses a broader range of data, including rental payment history, utility bills, and employment stability, to provide a more comprehensive risk profile. This modern approach offers landlords a nuanced view of tenant reliability beyond conventional credit metrics.

Pros and Cons of Credit Checks for Landlords

Credit checks provide landlords with a comprehensive overview of a tenant's financial history, helping predict rental payment reliability and reducing default risks. However, they may exclude qualified renters with limited credit history and can delay the application process due to verification times. Alternative renter scoring methods offer inclusivity and faster results but might lack the detailed financial insights provided by traditional credit checks.

Advantages and Drawbacks of Alternative Renter Scoring

Alternative renter scoring uses non-traditional data like rental payment history, utility bills, and employment records to assess tenant reliability, providing a more inclusive approach for those with limited or no credit history. Its advantages include improved access to housing for credit-invisible applicants and potentially faster approval processes, but drawbacks involve inconsistent data quality, lack of standardization across scoring models, and potential privacy concerns from evaluating sensitive personal information. While alternative scoring can expand rental opportunities, landlords may face challenges in validating data accuracy and ensuring compliance with fair housing regulations.

Impact on Tenant Diversity and Fair Housing

Credit checks often disproportionately exclude tenants with limited credit history, reducing diversity and potentially violating fair housing principles. Alternative renter scoring methods incorporate factors like rental payment history and utility bills, promoting inclusion of underrepresented groups. These innovative approaches foster equitable access to housing by broadening criteria beyond traditional credit metrics.

Which Renter Scoring Approach Fits Your Rental Business?

Traditional credit checks provide a standardized evaluation of a renter's financial history, primarily relying on credit scores and past loan repayments. Alternative renter scoring incorporates non-traditional data sources such as rental payment history, utility bills, and employment verification to create a more comprehensive risk assessment. Choosing the right renter scoring approach depends on your rental business's risk tolerance, tenant demographic, and the need for inclusivity versus strict financial criteria.

Future Trends in Tenant Screening Technologies

Future trends in tenant screening technologies emphasize a shift from traditional credit checks to alternative renter scoring methods, utilizing data such as rental payment history, utility bills, and social media behavior. Advanced algorithms and machine learning models analyze diverse datasets to provide a more comprehensive risk assessment and predict tenant reliability more accurately. These innovations aim to increase rental market inclusivity by accommodating applicants with limited or no credit history while reducing default rates for landlords.

Related Important Terms

Soft Pull Credit Screening

Soft pull credit screening allows landlords to assess potential renters' creditworthiness without impacting their credit score, making it a preferred approach over hard pull credit checks. Alternative renter scoring incorporates non-traditional data such as rental payment history and utility bills, providing a comprehensive view for rental approvals.

Alternative Data Scoring

Alternative renter scoring utilizes non-traditional data sources such as utility payments, rental history, and social behavior to assess creditworthiness, offering a more comprehensive evaluation than standard credit checks. This method improves access to housing for individuals with limited or no credit history by capturing financial reliability through diverse behavioral indicators.

Cash Flow Assessment

Credit checks primarily evaluate a renter's credit history and debt obligations, while alternative renter scoring focuses on cash flow assessment by analyzing income patterns, bank transaction data, and rent payment consistency. Utilizing cash flow assessment provides landlords with a comprehensive view of a tenant's financial stability beyond traditional credit scores, improving rental approval accuracy.

Rent Payment History Analysis

Rent payment history analysis serves as a critical component in credit checks by providing verified data on timely payments, missed rent, and eviction records, which traditional credit scores may not capture. Alternative renter scoring systems leverage this detailed rental payment data alongside utilities and phone bills to offer a more inclusive assessment of tenant reliability, especially for those with limited or no credit history.

Thin File Renter Evaluation

Traditional credit checks often fail to evaluate thin file renters who have limited credit history, leaving many qualified applicants overlooked. Alternative renter scoring leverages data such as rental payment history, utility bills, and employment records to create a more comprehensive and accurate assessment of these applicants' creditworthiness.

AI-Powered Tenant Scoring

AI-powered tenant scoring leverages machine learning algorithms to analyze diverse data points beyond traditional credit checks, including rental history, employment stability, and social behavior patterns. This advanced approach enhances accuracy in predicting tenant reliability, reduces bias, and accelerates the rental approval process.

Utility & Telecom Data Integration

Integrating utility and telecom data into renter scoring models enhances predictive accuracy by capturing consistent payment behavior beyond traditional credit checks. This alternative scoring method improves risk assessment for landlords, especially for applicants with limited or no credit history, enabling a more inclusive and data-driven rental approval process.

Behavioral Scoring Metrics

Behavioral scoring metrics in rental credit checks analyze payment history, rental consistency, and utility bill payments to assess tenant reliability beyond traditional credit scores. Alternative renter scoring incorporates data such as on-time rent payments, employment stability, and social behavior patterns to provide landlords with a comprehensive risk evaluation.

Open Banking Renter Evaluation

Open Banking renter evaluation leverages real-time financial data to provide a more comprehensive and accurate credit assessment compared to traditional credit checks, capturing income stability, spending behavior, and transaction history. This alternative renter scoring method reduces reliance on credit bureau reports, enabling lenders and landlords to better assess risk for applicants with limited or no credit history.

Non-Traditional Credit Models

Non-traditional credit models utilize alternative data such as utility payments, rental history, and subscription services to assess renter reliability, offering a more inclusive evaluation than conventional credit checks. These alternative scoring methods enhance rental approval rates by providing landlords with a broader understanding of a tenant's financial behavior beyond traditional credit reports.

Credit Check vs Alternative Renter Scoring Infographic

industrydif.com

industrydif.com