Security deposits typically require tenants to pay a significant upfront amount to cover potential damages or unpaid rent, providing landlords with financial protection. Deposit-free renting offers an alternative by allowing tenants to move in without a large upfront cost, often using insurance or third-party guarantees to protect landlords instead. This approach increases accessibility for renters while maintaining security for property owners.

Table of Comparison

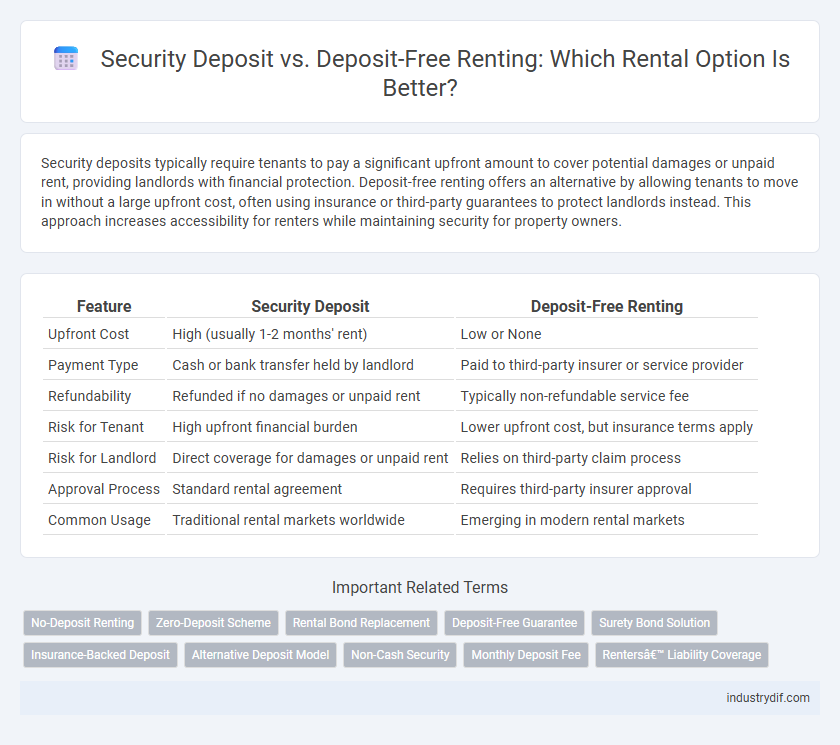

| Feature | Security Deposit | Deposit-Free Renting |

|---|---|---|

| Upfront Cost | High (usually 1-2 months' rent) | Low or None |

| Payment Type | Cash or bank transfer held by landlord | Paid to third-party insurer or service provider |

| Refundability | Refunded if no damages or unpaid rent | Typically non-refundable service fee |

| Risk for Tenant | High upfront financial burden | Lower upfront cost, but insurance terms apply |

| Risk for Landlord | Direct coverage for damages or unpaid rent | Relies on third-party claim process |

| Approval Process | Standard rental agreement | Requires third-party insurer approval |

| Common Usage | Traditional rental markets worldwide | Emerging in modern rental markets |

Understanding Security Deposits in Rental Agreements

Security deposits are a common requirement in rental agreements, typically amounting to one or two months' rent, held to cover potential damages or unpaid rent. Understanding the terms surrounding security deposits, including conditions for their return and any legal limits, is essential for tenants to avoid disputes. Deposit-free renting alternatives, such as insurance or guarantee programs, offer flexibility while eliminating upfront cash requirements, but may include different risk assessments or fees.

What is Deposit-Free Renting?

Deposit-free renting allows tenants to move in without paying a traditional security deposit upfront, using alternative methods such as insurance or third-party guarantees to protect landlords. This approach reduces the initial financial burden on renters while still providing landlords with security against potential damages or unpaid rent. It streamlines the rental process by offering more flexibility and accessibility compared to conventional deposit requirements.

Key Differences Between Security Deposits and Deposit-Free Renting

Security deposits require tenants to pay a refundable sum upfront, serving as financial protection against damages or unpaid rent, whereas deposit-free renting eliminates this initial cost, often utilizing alternative methods such as insurance or third-party guarantees. Security deposits typically range from one to two months' rent and are held by landlords until lease termination, while deposit-free options use risk-assessment technology to minimize upfront expenses and improve rental accessibility. The key difference lies in financial risk management for landlords and initial tenant cost burden, influencing rental market dynamics and tenant-landlord trust.

Pros and Cons of Security Deposits

Security deposits provide landlords with financial security against potential damages or unpaid rent, typically amounting to one or two months' rent, ensuring tenant accountability. However, security deposits can create entry barriers for tenants due to upfront costs, and disputes over deductions may lead to legal challenges. While offering protection for property owners, security deposits can delay tenants' access to funds and complicate moving processes.

Pros and Cons of Deposit-Free Renting

Deposit-free renting eliminates the upfront cost of a traditional security deposit, increasing affordability and accessibility for tenants who may struggle to gather large sums of money. It often involves a small fee or insurance premium, reducing financial risk for landlords while offering tenants greater flexibility. However, deposit-free options may come with restrictions or higher monthly costs, and tenants might not receive any refundable amount at the end of the lease, unlike traditional security deposits.

Legal and Regulatory Considerations

Security deposit requirements are regulated by state and local laws that often cap the maximum amount landlords can charge and dictate conditions for timely returns, providing tenants with legal protections. Deposit-free renting alternatives, such as insurance-backed or third-party guarantee programs, must comply with consumer protection regulations and vary in acceptance across jurisdictions. Tenants and landlords should carefully review relevant statutes and agreements to ensure compliance and avoid disputes related to security or alternative deposits.

Impact on Tenant Affordability and Cash Flow

Security deposits typically require tenants to pay an upfront sum equal to one or more months' rent, which can strain initial cash flow and reduce immediate affordability. Deposit-free renting options, such as insurance-backed guarantees, eliminate large upfront payments, improving tenant liquidity and making moving more financially accessible. This shift enhances affordability by allowing tenants to allocate funds towards other essential expenses rather than tying them up in a security deposit.

Landlord Perspectives: Security vs Deposit-Free Solutions

Landlords often view security deposits as essential for mitigating financial risks related to property damage and tenant default, providing a direct financial safeguard. Deposit-free renting solutions, such as insurance-backed guarantees, offer a streamlined alternative that reduces upfront costs for tenants while still ensuring landlords receive compensation for potential losses. This shift toward deposit-free options appeals to landlords seeking lower administrative burdens without compromising security.

Common Myths About Deposit-Free Renting

Common myths about deposit-free renting include beliefs that it compromises tenant responsibility or increases landlord risk; however, many deposit-free schemes use insurance or third-party guarantees to mitigate these concerns. Another misconception is that deposit-free options are more expensive, but they often reduce upfront costs while providing similar protections as traditional security deposits. Tenants should evaluate the terms carefully, as some deposit-free programs may involve monthly fees or credit checks, which differ from standard deposit requirements.

Choosing the Right Option: Factors for Tenants and Landlords

Security deposits provide landlords financial protection against damages or unpaid rent, making them a preferred choice for high-risk tenants or properties requiring significant upkeep. Deposit-free renting options, such as third-party insurance or guarantee schemes, appeal to tenants seeking reduced upfront costs and quicker move-ins but may involve monthly fees or eligibility requirements. Tenants should consider financial flexibility and credit impact, while landlords assess risk tolerance and administrative complexity when choosing the appropriate deposit structure.

Related Important Terms

No-Deposit Renting

No-deposit renting eliminates upfront security deposits, making move-in more affordable and accessible for tenants while reducing financial barriers. This approach often leverages alternative risk assessments like creditworthiness or rental history, streamlining the leasing process and enhancing tenant flexibility.

Zero-Deposit Scheme

Zero-deposit schemes offer tenants an alternative to traditional security deposits by providing insurance-backed guarantees that protect landlords against damages or unpaid rent without requiring upfront cash. This innovative approach enhances rental affordability and accessibility while maintaining landlords' financial security.

Rental Bond Replacement

Rental bond replacement offers a deposit-free renting solution that eliminates the need for traditional security deposits, providing tenants with improved cash flow and landlords with guaranteed payment protection. This innovative approach reduces upfront costs while maintaining financial security through third-party guarantees, streamlining the rental process for both parties.

Deposit-Free Guarantee

Deposit-free renting with a Deposit-Free Guarantee eliminates upfront security deposits, offering tenants financial flexibility and landlords assured protection against damages or unpaid rent through third-party guarantees. This innovative solution reduces move-in costs and streamlines the rental process while maintaining security for property owners.

Surety Bond Solution

Surety bond solutions provide tenants an alternative to traditional security deposits by guaranteeing landlord protection without upfront cash payment, enhancing affordability and accessibility in rental agreements. This method reduces financial barriers for renters while ensuring landlords receive compensation for potential damages or unpaid rent through a third-party insurer.

Insurance-Backed Deposit

Insurance-backed deposit schemes offer renters an alternative to traditional security deposits by providing landlords with a guaranteed financial protection while requiring tenants to pay a smaller, non-refundable insurance premium instead of a large upfront cash deposit. This approach increases tenant affordability and accessibility, reduces move-in costs, and ensures landlords receive coverage against damages or unpaid rent without holding substantial funds.

Alternative Deposit Model

Alternative deposit models in rental agreements, such as deposit-free renting, provide tenants with options like insurance-backed guarantees or small non-refundable fees instead of traditional security deposits, reducing upfront financial burdens. These alternatives foster broader tenant accessibility and improve landlord cash flow management while maintaining protection against damages or defaults.

Non-Cash Security

Non-cash security deposit alternatives, such as surety bonds or security deposit insurance, offer tenants flexible options by eliminating the need for upfront cash payments while still protecting landlords from potential damages. These deposit-free renting solutions reduce the financial burden on renters and streamline the leasing process without compromising the landlord's security.

Monthly Deposit Fee

Monthly deposit fees in traditional rental agreements often require tenants to pay a significant upfront security deposit, usually ranging from one to three months' rent, impacting initial moving costs. Deposit-free renting eliminates this upfront cost by substituting it with a small monthly fee, which spreads the expense over the lease term, enhancing affordability and cash flow for renters.

Renters’ Liability Coverage

Security deposit requires renters to pay upfront, often amounting to one or two months' rent, to cover potential damages or unpaid rent, while deposit-free renting eliminates this upfront cost but may include renters' liability coverage to protect landlords against tenant-caused damages. Renters' liability coverage in deposit-free agreements shifts financial risk away from tenants by providing insurance for property damage, ensuring landlords receive compensation without holding a traditional security deposit.

Security Deposit vs Deposit-Free Renting Infographic

industrydif.com

industrydif.com