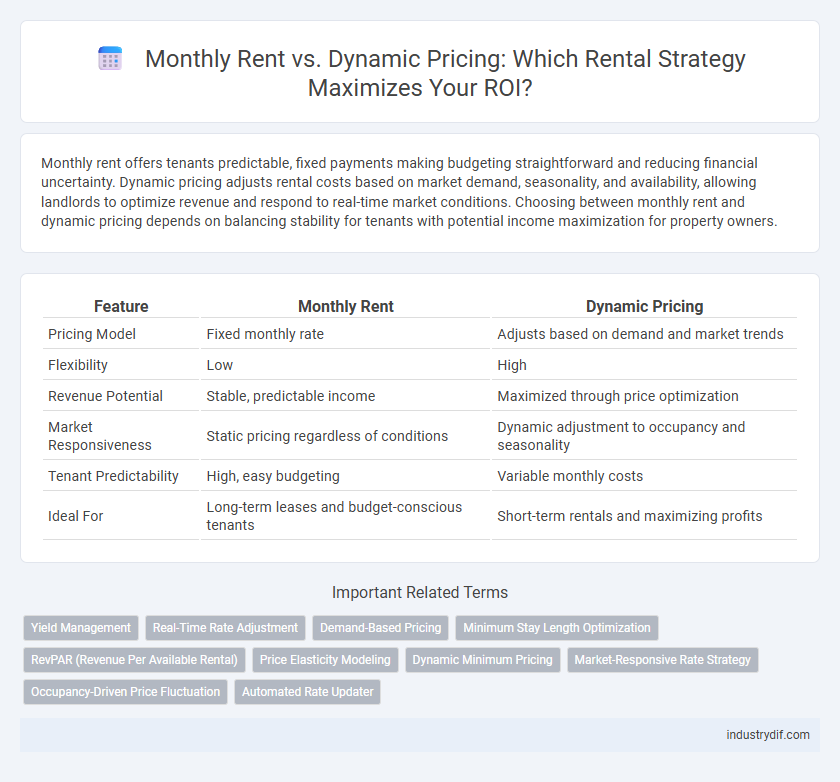

Monthly rent offers tenants predictable, fixed payments making budgeting straightforward and reducing financial uncertainty. Dynamic pricing adjusts rental costs based on market demand, seasonality, and availability, allowing landlords to optimize revenue and respond to real-time market conditions. Choosing between monthly rent and dynamic pricing depends on balancing stability for tenants with potential income maximization for property owners.

Table of Comparison

| Feature | Monthly Rent | Dynamic Pricing |

|---|---|---|

| Pricing Model | Fixed monthly rate | Adjusts based on demand and market trends |

| Flexibility | Low | High |

| Revenue Potential | Stable, predictable income | Maximized through price optimization |

| Market Responsiveness | Static pricing regardless of conditions | Dynamic adjustment to occupancy and seasonality |

| Tenant Predictability | High, easy budgeting | Variable monthly costs |

| Ideal For | Long-term leases and budget-conscious tenants | Short-term rentals and maximizing profits |

Understanding Monthly Rent in the Rental Industry

Monthly rent represents a fixed cost agreed upon by landlords and tenants, providing predictable expenses for budgeting purposes in the rental industry. Unlike dynamic pricing, which fluctuates based on demand, seasonality, and market conditions, monthly rent offers stability and clarity in lease agreements. Understanding monthly rent is essential for both property owners and renters to ensure transparent financial planning and consistent cash flow management.

What is Dynamic Pricing?

Dynamic pricing is a strategy where rental rates fluctuate based on market demand, seasonality, and local events, allowing landlords to optimize income by adjusting prices in real time. Unlike fixed monthly rent, dynamic pricing uses algorithms and data analytics to determine the most competitive rental rates, enhancing occupancy and revenue. This approach is increasingly employed in the rental market to maximize returns while responding to changing supply and demand conditions.

Key Differences Between Monthly Rent and Dynamic Pricing

Monthly rent offers a fixed, predictable payment amount for tenants, ensuring stability over the lease term. Dynamic pricing adjusts rent based on real-time market demand, occupancy rates, and seasonal trends, enabling landlords to maximize revenue. The key difference lies in stability versus flexibility--monthly rent provides consistency, while dynamic pricing responds to market fluctuations.

Pros and Cons of Monthly Rent

Monthly rent provides predictable income stability for landlords, simplifying financial planning and budgeting. This fixed pricing model appeals to tenants seeking consistent housing costs, reducing the risk of sudden increases. However, it limits potential earnings during high demand periods compared to dynamic pricing, which adjusts rent based on market fluctuations.

Advantages of Dynamic Pricing for Rentals

Dynamic pricing for rentals maximizes revenue by adjusting rates based on real-time demand, seasonal trends, and local market fluctuations, ensuring competitive pricing. This approach improves occupancy rates by attracting price-sensitive renters during low demand periods while capturing higher returns during peak seasons. Landlords benefit from increased profitability and optimized asset utilization compared to fixed monthly rent models.

Impact on Occupancy Rates

Monthly rent pricing provides stable and predictable costs for tenants, often resulting in higher occupancy rates due to affordability and budget certainty. Dynamic pricing adjusts rental rates based on demand, seasonality, and market conditions, potentially increasing revenue but causing fluctuations in occupancy rates. Properties using dynamic pricing can optimize revenue during peak demand while risking lower occupancy during off-peak periods compared to fixed monthly rent models.

Revenue Management Strategies: Fixed vs. Flexible Pricing

Monthly rent offers predictable income, simplifying financial planning for landlords while attracting tenants seeking stability. Dynamic pricing adjusts rental rates based on market demand, seasonal trends, and occupancy rates, maximizing revenue potential during high-demand periods. Combining fixed and flexible pricing strategies enables property managers to balance consistent cash flow with opportunities for increased returns.

Tenant Preferences: Stability vs. Flexibility

Tenants often prefer monthly rent for its stability, providing predictable housing costs and ease in budgeting. Dynamic pricing, however, appeals to those seeking flexibility, as rent can adjust based on market demand, potentially lowering costs during off-peak periods. Understanding tenant preferences is crucial for landlords balancing steady income with adaptive pricing strategies.

Technology’s Role in Dynamic Pricing Models

Dynamic pricing models leverage advanced algorithms and real-time data analytics to adjust monthly rent based on market demand, property attributes, and seasonal trends. Technology enables rental platforms to optimize pricing, increasing landlord revenue while maintaining competitive rates for tenants. Machine learning and AI tools continuously refine these models by analyzing historical occupancy and competitor pricing, ensuring rental prices reflect current market conditions accurately.

Choosing the Right Pricing Strategy for Your Rental Business

Selecting the right pricing strategy for your rental business involves evaluating monthly rent's stability against the flexibility of dynamic pricing, which adjusts rates based on demand and market trends. Monthly rent offers predictable cash flow and tenant retention, while dynamic pricing maximizes revenue through real-time rate optimization. Analyzing local market conditions, occupancy rates, and competitor pricing helps determine whether a steady monthly rate or a responsive dynamic approach best suits your business goals.

Related Important Terms

Yield Management

Dynamic pricing in rental yield management adjusts monthly rent based on real-time market demand, seasonal trends, and occupancy rates, maximizing revenue and minimizing vacancy periods. Unlike fixed monthly rent models, dynamic pricing leverages data analytics and predictive algorithms to optimize pricing strategies for increased profitability in competitive rental markets.

Real-Time Rate Adjustment

Monthly rent offers a fixed cost commitment, while dynamic pricing enables real-time rate adjustments based on fluctuating market demand and occupancy levels. Leveraging algorithms for dynamic pricing helps landlords maximize revenue by optimizing rental rates according to seasonality and local market trends.

Demand-Based Pricing

Monthly rent typically involves fixed payments regardless of market fluctuations, while dynamic pricing adjusts rental rates based on real-time demand, occupancy rates, and seasonal trends. Demand-based pricing leverages data analytics and algorithms to optimize rental income by increasing prices during peak demand periods and offering discounts when occupancy is low.

Minimum Stay Length Optimization

Monthly rent pricing stabilizes cash flow for property owners, but dynamic pricing models optimize income by adjusting rates based on demand, seasonality, and market trends. Minimum stay length optimization enhances revenue by balancing occupancy rates and reducing turnover costs, ensuring rentals maximize profitability without sacrificing guest flexibility.

RevPAR (Revenue Per Available Rental)

Monthly rent provides stable income but may underutilize potential revenue compared to dynamic pricing, which adjusts rates based on demand to maximize RevPAR (Revenue Per Available Rental). Implementing dynamic pricing strategies can increase occupancy rates and overall revenue, optimizing financial performance in competitive rental markets.

Price Elasticity Modeling

Monthly rent pricing often relies on fixed rates that lack responsiveness to fluctuating market demand, whereas dynamic pricing leverages price elasticity modeling to adjust rental rates based on variables such as seasonality, local events, and competitor pricing. Employing advanced elasticity models enables landlords and property managers to optimize revenue by predicting tenant sensitivity to price changes and setting rents that maximize occupancy and profitability.

Dynamic Minimum Pricing

Dynamic Minimum Pricing in rental markets adjusts the base monthly rent according to real-time demand, seasonal trends, and competitor rates, ensuring landlords maximize revenue while maintaining occupancy. This strategy leverages predictive analytics to set flexible minimum rent thresholds, optimizing profitability beyond static monthly rent models.

Market-Responsive Rate Strategy

Monthly rent establishes a fixed, predictable payment schedule for tenants, while dynamic pricing leverages real-time market data, demand fluctuations, and local occupancy rates to optimize rental income. Implementing a market-responsive rate strategy enables landlords to maximize revenue by adjusting prices based on seasonal trends, competitor rates, and consumer demand elasticity.

Occupancy-Driven Price Fluctuation

Monthly rent provides a fixed cost that offers tenants budgeting stability, while dynamic pricing adjusts rental rates based on real-time occupancy levels to maximize revenue. Occupancy-driven price fluctuation enables landlords to optimize rental income by increasing prices during high demand periods and lowering them when vacancy rates rise.

Automated Rate Updater

Automated rate updaters leverage real-time market data and demand fluctuations to optimize monthly rent pricing, maximizing rental income while maintaining competitive occupancy rates. This dynamic pricing approach reduces manual intervention, ensures timely adjustments, and aligns rental rates with current market conditions for better revenue management.

Monthly Rent vs Dynamic Pricing Infographic

industrydif.com

industrydif.com