A security deposit is a traditional requirement where tenants provide upfront funds to cover potential damages or unpaid rent, offering landlords financial protection. Zero-deposit schemes eliminate this upfront cost by replacing the deposit with an insurance model, making renting more accessible and affordable for tenants. These schemes benefit landlords by ensuring compensation without the administrative burden of managing deposits.

Table of Comparison

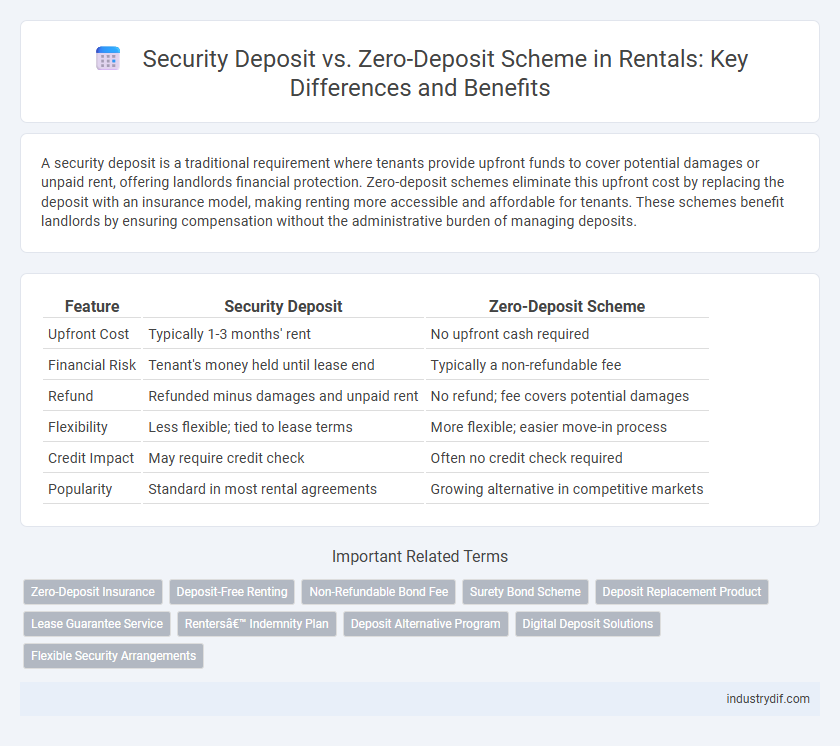

| Feature | Security Deposit | Zero-Deposit Scheme |

|---|---|---|

| Upfront Cost | Typically 1-3 months' rent | No upfront cash required |

| Financial Risk | Tenant's money held until lease end | Typically a non-refundable fee |

| Refund | Refunded minus damages and unpaid rent | No refund; fee covers potential damages |

| Flexibility | Less flexible; tied to lease terms | More flexible; easier move-in process |

| Credit Impact | May require credit check | Often no credit check required |

| Popularity | Standard in most rental agreements | Growing alternative in competitive markets |

Understanding Security Deposits in Rentals

Security deposits in rentals serve as a financial safeguard for landlords, typically amounting to one to two months' rent, ensuring compensation for potential damages or unpaid rent. These deposits are held in escrow or trust accounts and are refundable at the end of the lease term, minus any deductions for repairs beyond normal wear and tear. Understanding the legal regulations and conditions governing security deposits is crucial for both tenants and landlords to prevent disputes and ensure compliance with local rental laws.

What Is a Zero-Deposit Scheme?

A zero-deposit scheme allows tenants to rent a property without paying a traditional cash security deposit, often by purchasing a non-refundable insurance or bond product instead. This alternative reduces upfront costs and provides landlords with financial protection against damages or unpaid rent. Zero-deposit schemes are gaining popularity as a flexible and financially accessible option in the rental market.

Key Differences: Security Deposit vs Zero-Deposit Scheme

The security deposit is a traditional upfront payment, usually equivalent to one or two months' rent, held by the landlord to cover potential damages or unpaid rent. In contrast, the zero-deposit scheme allows tenants to move in without a large initial payment by using a third-party insurance or guarantee service, reducing financial burden. While the security deposit is refundable after tenancy, the zero-deposit scheme typically involves a non-refundable or partially refundable fee for the service provided.

Pros and Cons of Traditional Security Deposits

Traditional security deposits provide landlords with financial protection against tenant damages, unpaid rent, and lease violations, typically equating to one to two months' rent. However, they require tenants to pay a significant upfront sum, which can create a financial barrier to renting and reduce affordability. While security deposits offer a clear recovery mechanism for landlords, the funds are often held in escrow, potentially limiting their immediate liquidity for tenants.

Advantages and Disadvantages of Zero-Deposit Schemes

Zero-deposit schemes offer tenants the advantage of lower upfront costs, eliminating the need for a traditional security deposit and enabling quicker access to rental properties. However, these schemes may come with higher monthly rent or non-refundable fees, which can increase the overall cost of tenancy compared to standard deposits. Landlords might face greater financial risk with zero-deposit options, potentially leading to stricter tenant screening or additional insurance requirements.

Impact on Tenant Affordability and Accessibility

Security deposits typically require tenants to pay a substantial upfront sum, increasing initial move-in costs and potentially limiting accessibility for low-income renters. Zero-deposit schemes replace traditional deposits with smaller, non-refundable fees or insurance premiums, reducing immediate financial barriers and enhancing tenant affordability. These alternatives improve housing access by lowering entry costs while shifting some risk management from landlords to third-party providers.

Landlord Perspectives: Security Deposit vs Zero-Deposit

Landlords benefit from traditional security deposits as they provide upfront financial protection against tenant damages or unpaid rent, ensuring immediate funds for repairs or losses. Zero-deposit schemes, while attractive to tenants, shift the financial risk to third-party insurers or require landlords to wait for claims processing, which can delay compensation. Choosing between these options depends on a landlord's risk tolerance and preference for liquidity versus tenant appeal.

Legal and Regulatory Considerations

Security deposits are typically regulated by state laws that define maximum amounts, allowable uses, and timelines for refunds to protect tenants from unfair practices. Zero-deposit schemes, often governed by specific rental regulations or insurance frameworks, shift financial risk from tenants to insurers while complying with landlord-tenant laws to ensure security and legal accountability. Understanding these legal frameworks is essential for landlords and tenants to navigate liabilities, dispute resolution, and compliance with local housing regulations.

Cost Comparison: Upfront vs Ongoing Expenses

Security deposits typically require a substantial upfront payment, often equivalent to one or two months' rent, creating an immediate financial burden for tenants. Zero-deposit schemes eliminate this upfront cost by replacing it with a smaller, ongoing fee, spreading expenses over the lease term and reducing initial cash outflow. While zero-deposit plans can increase total long-term payments due to recurring charges, security deposits offer the potential for full refund if no damages occur, influencing overall cost effectiveness.

Choosing the Right Option for Your Rental Needs

Choosing between a security deposit and a zero-deposit scheme depends on your financial flexibility and risk tolerance. Security deposits, typically amounting to one to two months' rent, offer landlords financial protection against damages, while zero-deposit schemes usually require a smaller upfront fee but rely on third-party insurers. Assessing your cash flow, lease duration, and landlord requirements will help determine the best rental option tailored to your needs.

Related Important Terms

Zero-Deposit Insurance

Zero-Deposit Insurance offers renters an alternative to traditional security deposits by providing landlords with a guarantee against damages and unpaid rent without requiring upfront cash from tenants. This innovative insurance scheme enhances rental affordability and simplifies move-in processes while maintaining financial protection for property owners.

Deposit-Free Renting

Zero-deposit schemes offer renters the advantage of moving in without upfront security deposits, reducing initial financial burdens and increasing accessibility to rental properties. These programs typically replace traditional deposits with insurance or guarantee services that protect landlords against potential damages or unpaid rent.

Non-Refundable Bond Fee

A security deposit is a refundable amount held by landlords to cover potential damages, while a zero-deposit scheme replaces this with a non-refundable bond fee, offering tenants a more affordable upfront cost but no direct reimbursement. Tenants opting for zero-deposit schemes must understand that the non-refundable bond fee secures the landlord's interests without the possibility of reclaiming the fee after tenancy ends.

Surety Bond Scheme

The Surety Bond Scheme offers tenants an alternative to traditional security deposits by providing a guarantee from a third-party insurer, reducing upfront costs while ensuring landlords receive compensation for potential damages or unpaid rent. This zero-deposit approach enhances rental accessibility and tenant affordability without compromising landlord protection or financial security.

Deposit Replacement Product

A Deposit Replacement Product allows tenants to move in without paying a traditional security deposit by providing landlords with guaranteed financial protection in case of damages or unpaid rent. This innovative rental solution reduces upfront costs for tenants while ensuring landlords receive compensation similar to a standard security deposit.

Lease Guarantee Service

Lease Guarantee Service offers tenants a flexible alternative to traditional security deposits by providing landlords with a financial assurance without upfront cash, enhancing rental accessibility and cash flow management. This service mitigates risk for landlords while enabling tenants to avoid large initial payments, streamlining the rental process and promoting more secure lease agreements.

Renters’ Indemnity Plan

The Renters' Indemnity Plan offers tenants a zero-deposit scheme by providing landlords with a financial guarantee, eliminating the need for upfront cash security deposits and enhancing renters' affordability. This plan protects landlords against potential damages or unpaid rent while allowing tenants to secure housing without the financial burden of a traditional security deposit.

Deposit Alternative Program

The Deposit Alternative Program offers renters a cost-effective option by replacing traditional security deposits with a small, non-refundable fee or monthly premium, reducing upfront moving expenses. This innovative scheme enhances tenant affordability and Landlord assurance while maintaining financial protection against potential damages or unpaid rent.

Digital Deposit Solutions

Digital deposit solutions offer tenants a convenient alternative to traditional security deposits by enabling zero-deposit schemes that reduce upfront costs and improve cash flow. These platforms leverage secure escrow accounts and insurance-backed guarantees to protect landlords while providing tenants with flexible, interest-free payment options.

Flexible Security Arrangements

Flexible security arrangements in rental agreements include traditional security deposits and zero-deposit schemes, which often use third-party insurance or bond options. Zero-deposit schemes provide tenants with reduced upfront costs while maintaining landlord protection against damages and unpaid rent, enhancing affordability and financial flexibility.

Security Deposit vs Zero-Deposit Scheme Infographic

industrydif.com

industrydif.com