Tenant screening traditionally relies on credit checks, background verifications, and rental history to assess applicant reliability, but AI-based applicant evaluation enhances this process by analyzing vast data sets for predictive insights on tenant behavior. AI tools can identify patterns, flag potential risks, and streamline decision-making, reducing human bias and improving accuracy. Combining traditional screening with AI technology offers a more comprehensive and efficient approach to evaluating rental applicants.

Table of Comparison

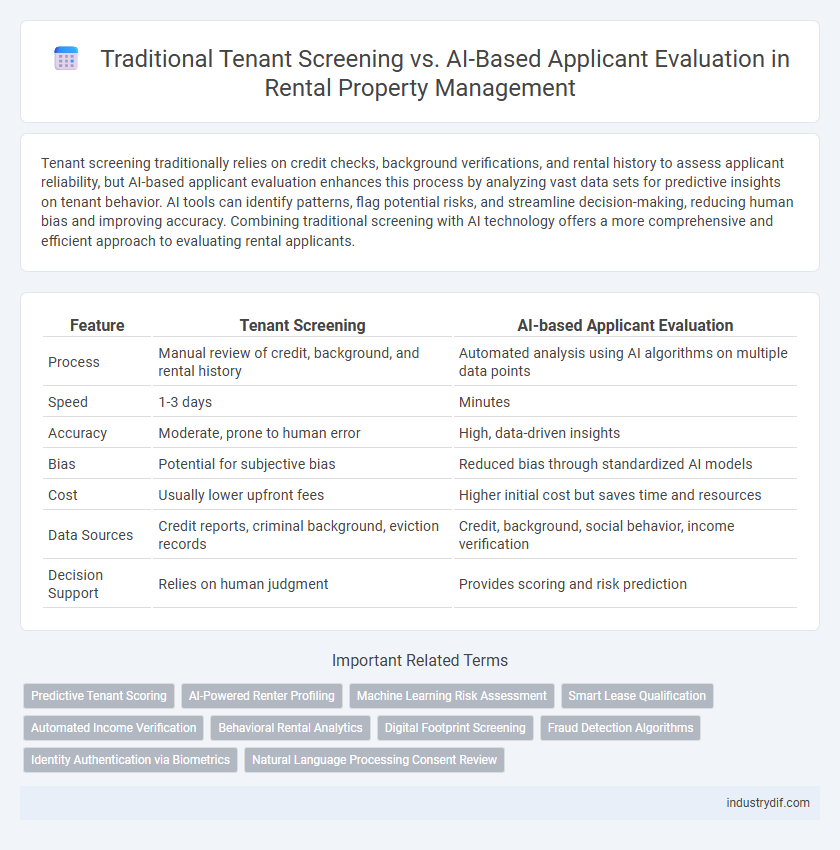

| Feature | Tenant Screening | AI-based Applicant Evaluation |

|---|---|---|

| Process | Manual review of credit, background, and rental history | Automated analysis using AI algorithms on multiple data points |

| Speed | 1-3 days | Minutes |

| Accuracy | Moderate, prone to human error | High, data-driven insights |

| Bias | Potential for subjective bias | Reduced bias through standardized AI models |

| Cost | Usually lower upfront fees | Higher initial cost but saves time and resources |

| Data Sources | Credit reports, criminal background, eviction records | Credit, background, social behavior, income verification |

| Decision Support | Relies on human judgment | Provides scoring and risk prediction |

Introduction to Tenant Screening in the Rental Industry

Tenant screening is a critical process in the rental industry, involving background checks, credit reports, and rental history verification to ensure reliable tenants. Traditional methods emphasize manual reviews and standardized criteria to assess applicant suitability and reduce the risk of defaults or property damage. Emerging AI-based applicant evaluation enhances this process by utilizing machine learning algorithms to analyze patterns and predict tenant behavior more accurately.

Traditional Tenant Screening: Methods and Limitations

Traditional tenant screening relies on credit checks, background verification, and rental history reviews to evaluate applicants, often resulting in lengthy processing times and inconsistent outcomes. These methods can overlook nuanced tenant behavior patterns and may inadvertently introduce human biases, affecting the accuracy of risk assessment. Limited access to comprehensive data and slow manual processes further restrict the effectiveness of conventional screening in identifying reliable tenants.

Rise of AI-Based Applicant Evaluation

AI-based applicant evaluation revolutionizes tenant screening by utilizing advanced algorithms and machine learning to analyze applicant data more comprehensively and objectively. This technology enhances accuracy in predicting tenant behavior, reducing bias and streamlining the decision-making process for landlords. The rise of AI-driven tools in rental markets improves efficiency, compliance, and tenant quality, outperforming traditional screening methods reliant on manual reviews and limited data sets.

Key Differences: Manual vs AI-Driven Screening

Tenant screening traditionally relies on manual processes such as background checks, credit reports, and personal references, which can be time-consuming and prone to human bias. AI-based applicant evaluation leverages machine learning algorithms to analyze large datasets quickly, identifying patterns and predicting tenant reliability with greater accuracy. This AI-driven approach enhances efficiency and consistency while reducing the risk of subjective decision-making in rental applicant assessments.

Accuracy and Efficiency in Application Assessment

Tenant screening traditionally relies on credit reports, background checks, and rental history to evaluate applicants, ensuring accuracy through verified data but often requiring substantial manual effort. AI-based applicant evaluation leverages machine learning algorithms to analyze diverse data points rapidly, enhancing efficiency and consistency while reducing human bias. Combining AI with tenant screening processes improves application assessment by delivering faster, more precise insights into applicant risk and suitability.

Data Privacy and Compliance in AI Tenant Evaluation

Tenant screening traditionally relies on manual background checks and credit reports, which often involve standard data privacy protocols under the Fair Credit Reporting Act (FCRA). AI-based applicant evaluation leverages advanced algorithms to analyze broader data sets but raises significant concerns regarding data privacy, requiring strict compliance with regulations like GDPR and CCPA to protect sensitive tenant information. Ensuring transparent data handling, consent management, and non-discriminatory algorithmic decision-making is critical for landlords adopting AI tenant evaluation tools in compliance with privacy laws.

Reducing Bias: Human Judgment vs Algorithmic Fairness

Tenant screening traditionally relies on human judgment, which can inadvertently introduce biases based on race, gender, or socioeconomic status. AI-based applicant evaluation employs algorithmic fairness techniques designed to minimize these biases by analyzing data patterns objectively and consistently. Using AI in rental applications enhances equitable decision-making, improving the accuracy and fairness of tenant selection processes.

Cost Implications for Landlords and Property Managers

Tenant screening traditionally involves manual background and credit checks, which can be costly and time-consuming for landlords and property managers. AI-based applicant evaluation reduces expenses by automating data analysis, speeding up the process while maintaining accuracy in risk assessment. This technology lowers operational costs and minimizes the financial impact of tenant default by enabling faster, data-driven decision-making.

Enhancing Tenant Experience with AI

AI-based applicant evaluation transforms tenant screening by providing faster, more accurate assessments that reduce bias and improve fairness. Leveraging machine learning algorithms, landlords can quickly identify reliable tenants while streamlining application processes to enhance convenience and transparency. This technology fosters a superior tenant experience by minimizing wait times, ensuring consistent criteria, and promoting trust through data-driven decisions.

Future Trends in Rental Applicant Evaluation

AI-based applicant evaluation is transforming tenant screening by leveraging machine learning algorithms to analyze vast datasets, enhancing accuracy and reducing bias in rental decisions. Future trends point toward integrating predictive analytics with real-time data feeds, enabling landlords to assess financial stability, rental history, and behavioral patterns instantly. This shift promises faster, more objective tenant evaluations, minimizing risks and improving rental market efficiency.

Related Important Terms

Predictive Tenant Scoring

Predictive tenant scoring leverages AI-based applicant evaluation to analyze rental history, credit scores, and behavioral data for more accurate risk assessment compared to traditional tenant screening methods. This advanced technology enhances decision-making by identifying high-risk applicants and improving tenant selection efficiency.

AI-Powered Renter Profiling

AI-powered renter profiling leverages machine learning algorithms to analyze applicant data more accurately than traditional tenant screening methods, incorporating behavioral patterns, credit history, and rental background for comprehensive risk assessment. This technology enhances predictive accuracy, reduces screening time, and minimizes human bias, resulting in more reliable tenant selection in the rental industry.

Machine Learning Risk Assessment

Tenant screening traditionally evaluates credit history, rental records, and criminal background, while AI-based applicant evaluation leverages machine learning algorithms to analyze vast data points for more accurate risk assessment. Machine learning risk assessment enhances predictive accuracy by identifying patterns in applicant behavior, reducing human bias, and enabling landlords to make data-driven decisions quickly.

Smart Lease Qualification

Smart lease qualification leverages AI-based applicant evaluation to enhance tenant screening by analyzing credit scores, rental history, and behavioral patterns with greater accuracy and speed. This technology reduces human bias and improves risk assessment, ensuring landlords select reliable tenants efficiently.

Automated Income Verification

Automated income verification in AI-based applicant evaluation enhances tenant screening by quickly validating financial stability through real-time access to pay stubs, bank statements, and tax returns. This reduces human error, shortens approval times, and increases accuracy compared to traditional manual income verification processes.

Behavioral Rental Analytics

Tenant screening traditionally relies on credit scores and background checks, whereas AI-based applicant evaluation integrates behavioral rental analytics to predict lease adherence and payment reliability more accurately. By analyzing patterns such as rental history consistency, communication behavior, and lifestyle indicators, AI enhances the precision of tenant risk assessments, leading to more informed leasing decisions.

Digital Footprint Screening

Tenant screening traditionally relies on credit scores, rental history, and background checks, whereas AI-based applicant evaluation incorporates digital footprint screening to analyze online behavior, social media activity, and public records for a comprehensive risk assessment. Leveraging AI algorithms to process digital footprints enhances accuracy in predicting tenant reliability and reduces biases inherent in conventional screening methods.

Fraud Detection Algorithms

Tenant screening traditionally relies on credit checks and background verification, whereas AI-based applicant evaluation employs advanced fraud detection algorithms that analyze patterns in applicant data to identify inconsistencies and potential identity theft. These algorithms leverage machine learning models to detect anomalies in rental applications faster and more accurately, significantly reducing the risk of fraudulent tenants gaining approval.

Identity Authentication via Biometrics

Tenant screening traditionally relies on background checks and credit reports, but AI-based applicant evaluation enhances the process by incorporating identity authentication through biometric data such as facial recognition and fingerprint scanning. This biometric verification ensures higher accuracy in confirming applicant identity, reducing fraud and streamlining approval timelines in rental applications.

Natural Language Processing Consent Review

Tenant screening traditionally involves background checks and credit reports, while AI-based applicant evaluation leverages Natural Language Processing (NLP) to analyze consent forms and extract relevant information quickly and accurately. NLP-driven consent review enhances compliance and efficiency by automatically identifying key terms and verifying applicant authorization during the rental application process.

Tenant Screening vs AI-based Applicant Evaluation Infographic

industrydif.com

industrydif.com