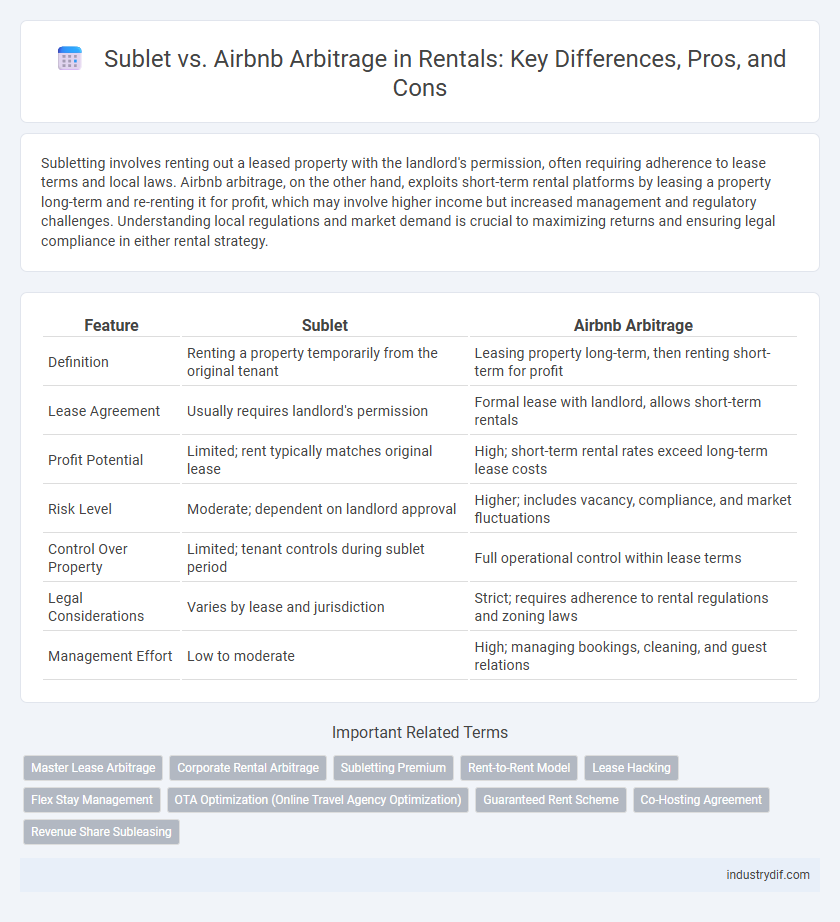

Subletting involves renting out a leased property with the landlord's permission, often requiring adherence to lease terms and local laws. Airbnb arbitrage, on the other hand, exploits short-term rental platforms by leasing a property long-term and re-renting it for profit, which may involve higher income but increased management and regulatory challenges. Understanding local regulations and market demand is crucial to maximizing returns and ensuring legal compliance in either rental strategy.

Table of Comparison

| Feature | Sublet | Airbnb Arbitrage |

|---|---|---|

| Definition | Renting a property temporarily from the original tenant | Leasing property long-term, then renting short-term for profit |

| Lease Agreement | Usually requires landlord's permission | Formal lease with landlord, allows short-term rentals |

| Profit Potential | Limited; rent typically matches original lease | High; short-term rental rates exceed long-term lease costs |

| Risk Level | Moderate; dependent on landlord approval | Higher; includes vacancy, compliance, and market fluctuations |

| Control Over Property | Limited; tenant controls during sublet period | Full operational control within lease terms |

| Legal Considerations | Varies by lease and jurisdiction | Strict; requires adherence to rental regulations and zoning laws |

| Management Effort | Low to moderate | High; managing bookings, cleaning, and guest relations |

Understanding Subletting in the Rental Industry

Subletting in the rental industry involves a tenant leasing their rented property or a portion of it to another party, while remaining responsible to the original landlord under the primary lease agreement. This practice requires explicit permission from landlords to avoid breaches of contract and potential legal issues. Understanding subletting enables tenants to maximize rental income and navigate landlord-tenant regulations effectively within the rental market.

What Is Airbnb Rental Arbitrage?

Airbnb rental arbitrage is a strategy where individuals lease properties long-term and then rent them out short-term on platforms like Airbnb to generate higher income. This approach allows renters to profit from the difference between the fixed monthly rent and the variable short-term rental income without owning the property. Unlike traditional subletting, Airbnb arbitrage often involves professional management, dynamic pricing, and marketing to maximize occupancy and revenue.

Key Differences Between Sublet and Airbnb Arbitrage

Sublet involves renting out a leased property to another tenant for the remaining lease term, often requiring landlord approval and is typically governed by traditional lease agreements. Airbnb arbitrage entails leasing a property long-term and then renting it out short-term on platforms like Airbnb, leveraging dynamic pricing strategies to maximize rental income. Key differences include lease permission requirements, rental duration flexibility, and potential profit margins influenced by the short-term rental market.

Legal Considerations for Subletting vs Airbnb Arbitrage

Legal considerations for subletting typically require explicit permission from the primary landlord and compliance with local lease agreements, while Airbnb arbitrage involves navigating stricter municipal regulations and short-term rental laws that vary significantly by city. Subletting often falls under traditional tenancy laws, whereas Airbnb arbitrage must adhere to complex licensing requirements, tax obligations, and zoning restrictions specific to short-term rentals. Failure to comply with these legal frameworks in either scenario can result in fines, lease termination, or legal disputes.

Profitability Comparison: Sublet vs Airbnb Arbitrage

Subletting typically offers stable, predictable monthly income by leasing a property long-term and renting it out, often with lower management costs and reduced turnover expenses. Airbnb arbitrage can generate significantly higher profits through short-term rentals due to dynamic pricing and higher nightly rates, though it entails increased operational efforts, cleaning fees, and variable occupancy rates. Profitability depends on market demand, location, and regulatory constraints, with Airbnb arbitrage providing greater revenue potential but higher risk and workload compared to subletting.

Risk Factors in Sublet and Airbnb Arbitrage Strategies

Subletting often carries higher risk factors such as lease violations, tenant disputes, and potential eviction due to unauthorized subleases. Airbnb arbitrage strategies mitigate some risks by securing landlord permissions and leveraging short-term rental platforms for flexible guest turnover and revenue maximization. However, Airbnb arbitrage faces regulatory challenges, seasonal demand fluctuations, and platform dependency that must be managed to sustain profitability.

Landlord Approval: Sublet and Airbnb Arbitrage Explained

Landlord approval is crucial in both subletting and Airbnb arbitrage, as unauthorized rentals can lead to lease violations and eviction. Subletting typically requires explicit consent from the landlord since tenants directly transfer lease rights to another occupant for a fixed term. Airbnb arbitrage involves leasing a property long-term and renting it short-term, demanding clear landlord permission to avoid breaching lease agreements and facing legal consequences.

Tenant Rights and Responsibilities

Tenants engaging in sublet or Airbnb arbitrage must understand their rights, including obtaining explicit landlord consent to avoid lease violations. Responsibilities entail maintaining the property, adhering to occupancy limits, and addressing potential liability for damages caused by short-term guests. Awareness of local regulations governing short-term rentals is crucial to ensure compliance and protect tenant interests.

Impact on Long-Term Rental Markets

Sublet arrangements often lead to increased housing instability by shortening lease terms and causing fluctuations in tenant occupancy, which can reduce the availability of long-term rental units. Airbnb arbitrage, where renters lease properties to list on short-term rental platforms, frequently drives up rental prices and diminishes affordable housing stock in urban neighborhoods. Both practices contribute to tighter long-term rental markets by diverting properties from traditional renters to transient guests, exacerbating housing shortages and affordability issues.

Which Strategy Suits Different Rental Investment Goals?

Subletting suits rental investors aiming for stable, long-term cash flow by leasing existing rental properties and renting them out under the original lease terms. Airbnb arbitrage targets investors seeking higher short-term profits through short-term rentals, capitalizing on premium nightly rates in high-demand locations. Selecting the right strategy depends on goals like steady income versus maximizing immediate returns from transient tenants.

Related Important Terms

Master Lease Arbitrage

Master lease arbitrage involves securing a long-term lease on a property and then subletting it, often on short-term rental platforms like Airbnb to maximize rental income. This strategy differs from traditional subletting by leveraging a master lease agreement to legally control multiple units or entire buildings, optimizing revenue through Airbnb arbitrage without property ownership.

Corporate Rental Arbitrage

Corporate rental arbitrage leverages long-term leases to sublet properties to business clients, ensuring stable occupancy and consistent revenue streams. Unlike Airbnb arbitrage, which targets short-term tourists, corporate rental arbitrage focuses on extended stays with professionals, maximizing profitability through reliable, higher-paying tenants.

Subletting Premium

Subletting premium refers to the additional profit landlords or tenants can earn by leasing a property at a higher rate than the original rent, often seen in sublet agreements where tenants rent out their leased space. This strategy differs from Airbnb arbitrage, which leverages short-term rentals on platforms to maximize income, but subletting premium typically offers more stable, long-term revenue by capitalizing on fixed-term leases.

Rent-to-Rent Model

The rent-to-rent model in rental arbitrage involves leasing a property long-term and subletting it either through platforms like Airbnb or traditional subletting agreements, maximizing profit margins by leveraging short-term rental demand. This strategy requires careful contract negotiation and compliance with local regulations to optimize occupancy rates and revenue streams while mitigating legal risks.

Lease Hacking

Lease hacking through sublet or Airbnb arbitrage involves maximizing rental income by legally leasing a property and then renting it out to short-term tenants or on Airbnb platforms. This strategy requires understanding lease terms, local regulations, and market demand to optimize profitability while minimizing risks and legal issues.

Flex Stay Management

Flex Stay Management offers a streamlined approach to rental income by blending sublet agreements with Airbnb arbitrage strategies, maximizing occupancy rates and revenue. This hybrid model leverages short-term rental platforms' high demand while maintaining stable lease terms, optimizing property utilization and cash flow.

OTA Optimization (Online Travel Agency Optimization)

Sublet vs Airbnb arbitrage strategies differ significantly in OTA optimization, as Airbnb arbitrage leverages dynamic pricing algorithms and targeted listing enhancements on platforms like Airbnb or Vrbo to maximize occupancy and revenue. Subletting often lacks such advanced OTA tools, relying more on fixed rental terms and less frequent update of listing data, resulting in lower potential for optimized online visibility and booking rates.

Guaranteed Rent Scheme

The Guaranteed Rent Scheme offers landlords a fixed income by leasing properties to intermediaries who manage sublets or Airbnb arbitrage, minimizing vacancy risks and ensuring consistent cash flow. This model contrasts with typical Airbnb arbitrage, where income fluctuates based on occupancy rates, providing more stability for property owners through guaranteed monthly payments.

Co-Hosting Agreement

A Co-Hosting Agreement in Airbnb arbitrage formalizes the partnership between property owners and co-hosts, detailing responsibilities, revenue sharing, and operational duties to optimize rental income while maintaining compliance with platform policies. Unlike typical sublet arrangements, this agreement leverages Airbnb's guest management tools and dynamic pricing strategies to maximize profitability and minimize vacancy rates.

Revenue Share Subleasing

Sublet vs Airbnb arbitrage revenue share subleasing often involves dividing earnings between the property owner and subtenant or host, with Airbnb arbitrage typically generating higher profit margins due to short-term rental premiums. Revenue share agreements in subletting usually consist of fixed percentages ranging from 20% to 50%, optimizing income streams while maintaining lease compliance and property management responsibilities.

Sublet vs Airbnb Arbitrage Infographic

industrydif.com

industrydif.com