Traditional landlords purchase properties to live in or rent out, managing tenants and maintaining the property directly. Rentvesting allows individuals to rent where they want to live while investing in property elsewhere, combining lifestyle flexibility with potential long-term capital growth. This approach minimizes personal living costs and diversifies investment portfolios without the responsibilities of being a full-time landlord.

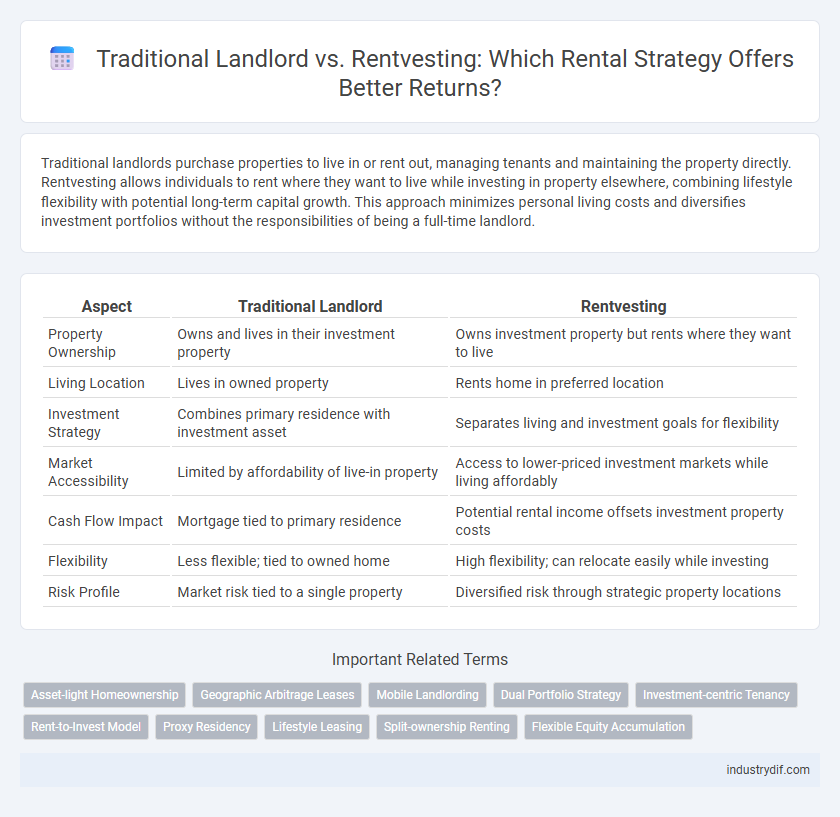

Table of Comparison

| Aspect | Traditional Landlord | Rentvesting |

|---|---|---|

| Property Ownership | Owns and lives in their investment property | Owns investment property but rents where they want to live |

| Living Location | Lives in owned property | Rents home in preferred location |

| Investment Strategy | Combines primary residence with investment asset | Separates living and investment goals for flexibility |

| Market Accessibility | Limited by affordability of live-in property | Access to lower-priced investment markets while living affordably |

| Cash Flow Impact | Mortgage tied to primary residence | Potential rental income offsets investment property costs |

| Flexibility | Less flexible; tied to owned home | High flexibility; can relocate easily while investing |

| Risk Profile | Market risk tied to a single property | Diversified risk through strategic property locations |

Understanding Traditional Landlord and Rentvesting Strategies

Traditional landlords typically purchase properties with the intention of living in or renting them out directly, generating steady rental income and building equity over time. Rentvesting involves buying investment properties in more affordable locations while renting in preferred areas, allowing investors to enter the property market without compromising lifestyle choices. Understanding these strategies helps investors balance financial goals with personal preferences, optimizing portfolio growth and cash flow management.

Key Differences Between Traditional Landlord and Rentvestor Profiles

Traditional landlords typically own and manage rental properties directly, bearing full responsibility for maintenance, tenant relations, and property management. Rentvestors purchase properties to rent out while choosing to rent their own residence elsewhere, leveraging their investments to build wealth without relocating. The key differences lie in property ownership strategies, lifestyle flexibility, and financial risk exposure, with rentvestors often prioritizing portfolio growth over immediate occupation.

Financial Implications: Rental Yields and Capital Growth

Traditional landlords often benefit from higher rental yields due to purchasing properties in established locations with strong tenant demand, providing steady cash flow. Rentvesting allows investors to enter high-growth markets by living in affordable areas while renting out properties in more expensive regions, aiming for greater capital growth despite potentially lower initial rental yields. Both strategies require balancing short-term income through rental yields and long-term wealth accumulation via capital appreciation to optimize financial returns.

Entry Requirements and Initial Investment Costs

Traditional landlords typically face higher entry requirements, including substantial deposits and stringent credit checks, leading to increased initial investment costs such as property purchase, renovation, and maintenance expenses. Rentvesting allows investors to enter the property market with lower upfront capital by renting where they want to live while purchasing investment properties in more affordable areas. This strategy reduces initial financial barriers and enables potential owners to build equity without the immediate burden of high entry costs.

Tax Benefits and Deductions for Each Strategy

Traditional landlords can claim tax deductions on mortgage interest, property management fees, repairs, and depreciation, reducing their taxable rental income significantly. Rentvestors benefit from tax deductions related to their investment property expenses while maintaining residence elsewhere, allowing them to leverage capital growth and rental income simultaneously. Both strategies offer distinct tax advantages that can optimize cash flow and build wealth depending on individual financial goals.

Flexibility and Lifestyle Choices

Traditional landlords often face limited flexibility due to the responsibility of managing a single rental property, which can restrict their ability to relocate or pursue diverse investment opportunities. Rentvesting enables tenants to own property in affordable locations while renting in preferred areas, offering greater lifestyle freedom and geographic mobility. This strategy supports balancing wealth building with personal lifestyle preferences without sacrificing housing quality or location.

Risk Factors and Asset Diversification

Traditional landlords face concentrated market risks due to ownership of a single property or location, exposing them to fluctuations in local vacancy rates and property values. Rentvesting offers greater asset diversification by allowing investors to rent where they live while purchasing multiple properties in varied regions, spreading risk across different markets. This strategy reduces vulnerability to localized downturns and enhances long-term portfolio stability.

Common Challenges for Landlords vs Rentvestors

Traditional landlords often face challenges such as property maintenance, tenant management, and fluctuating market rents, leading to inconsistent cash flow and increased stress. Rentvestors encounter difficulties balancing rental property investments with their own rental living arrangements, including managing mortgage commitments and navigating potential conflicts between personal and investment priorities. Both groups must navigate regulatory compliance, tax implications, and the complexities of property market trends to optimize their rental income and asset growth.

Suitability for First-Time Property Investors

Traditional landlords benefit from direct control and long-term capital growth by purchasing properties in preferred locations, but bear the burden of substantial upfront costs and ongoing maintenance. Rentvesting allows first-time investors to rent in desired areas while investing in more affordable rental properties elsewhere, minimizing financial strain and increasing portfolio diversification. This strategy suits investors seeking entry into property markets without compromising lifestyle choices or immediate cash flow.

Long-Term Wealth Creation: Which Strategy Wins?

Rentvesting offers a strategic advantage in long-term wealth creation by allowing investors to live in affordable areas while owning rental properties in high-growth markets, maximizing capital gains and rental income simultaneously. Traditional landlords often face liquidity constraints and limited property diversification, which can slow equity accumulation and wealth growth over time. By leveraging rentvesting, investors can build a diverse property portfolio, enhance cash flow, and capitalize on market appreciation more effectively than traditional buy-to-live approaches.

Related Important Terms

Asset-light Homeownership

Traditional landlords typically invest heavily in property ownership and management, requiring significant upfront capital and ongoing maintenance responsibilities. Rentvesting offers an asset-light homeownership model by allowing investors to rent where they want to live while purchasing property in more affordable locations, optimizing cash flow and building equity without the full burden of direct landlord duties.

Geographic Arbitrage Leases

Traditional landlords typically invest in rental properties within their local area, limiting potential returns due to higher market prices and demand, whereas rentvestors leverage geographic arbitrage leases by purchasing properties in lower-cost regions to maximize rental income and minimize personal living expenses. This strategy exploits regional price disparities, allowing rentvestors to build wealth through rental income from undervalued markets while residing in more expensive urban centers.

Mobile Landlording

Mobile landlording revolutionizes traditional landlord practices by enabling property owners to manage rentals remotely through digital platforms and local agents, significantly reducing the need for on-site presence. This approach aligns with rentvesting strategies where investors purchase property in affordable markets while living elsewhere, optimizing cash flow and expanding real estate portfolios efficiently.

Dual Portfolio Strategy

Traditional landlords typically hold a single rental property as their primary investment, focusing on property management and local market dynamics, whereas rentvestors adopt a dual portfolio strategy by living in an affordable home while investing in higher-yield rental properties elsewhere, optimizing cash flow and capital growth. This dual approach allows rentvestors to leverage rental income from investment properties to offset living expenses and accelerate wealth accumulation through diversified geographic exposure.

Investment-centric Tenancy

Investment-centric tenancy in rentvesting allows property owners to strategically rent out their primary residences while living in more affordable or desirable locations, maximizing rental income and capital growth potential. Traditional landlords typically focus on acquiring properties solely for rental income, often limiting personal housing flexibility and investment diversification.

Rent-to-Invest Model

The rent-to-invest model allows tenants to build equity by allocating a portion of their rent towards purchasing the property, providing a flexible pathway to homeownership compared to traditional landlords who typically collect rent without investment options. This approach benefits renters seeking long-term financial growth while maintaining the flexibility of renting, blending investment and living arrangements seamlessly.

Proxy Residency

Traditional landlords manage properties by owning and renting them out directly, while rentvesting allows investors to live in their preferred location by renting a home while owning investment properties elsewhere. Proxy residency in rentvesting enables tenants to maintain a lifestyle in high-demand areas without the financial burden of property ownership, leveraging rental income from distant assets to afford prime living spaces.

Lifestyle Leasing

Traditional landlords manage properties for long-term rental income, often requiring significant capital and involvement in maintenance, while rentvesting allows individuals to live in desirable locations by renting their primary residence and investing in rental properties elsewhere, maximizing lifestyle flexibility and financial growth. Lifestyle leasing through rentvesting provides tenants the opportunity to enjoy premium neighborhoods without property ownership burdens, blending rental convenience with strategic investment benefits.

Split-ownership Renting

Traditional landlords fully own investment properties and manage tenant rentals, while rentvesting involves owners living in their primary residence and renting out separate investment properties, enabling split-ownership renting that maximizes financial flexibility and Portfolio diversification. Split-ownership renting allows investors to benefit from rental income streams without occupying the property, optimizing tax advantages and wealth growth strategies.

Flexible Equity Accumulation

Traditional landlords accumulate equity primarily through property appreciation and mortgage repayments tied to a single rental investment, which can limit financial flexibility. Rentvesting enables investors to build equity across multiple properties by living in affordable areas while investing in higher-growth markets, enhancing portfolio diversification and cash flow potential.

Traditional Landlord vs Rentvesting Infographic

industrydif.com

industrydif.com