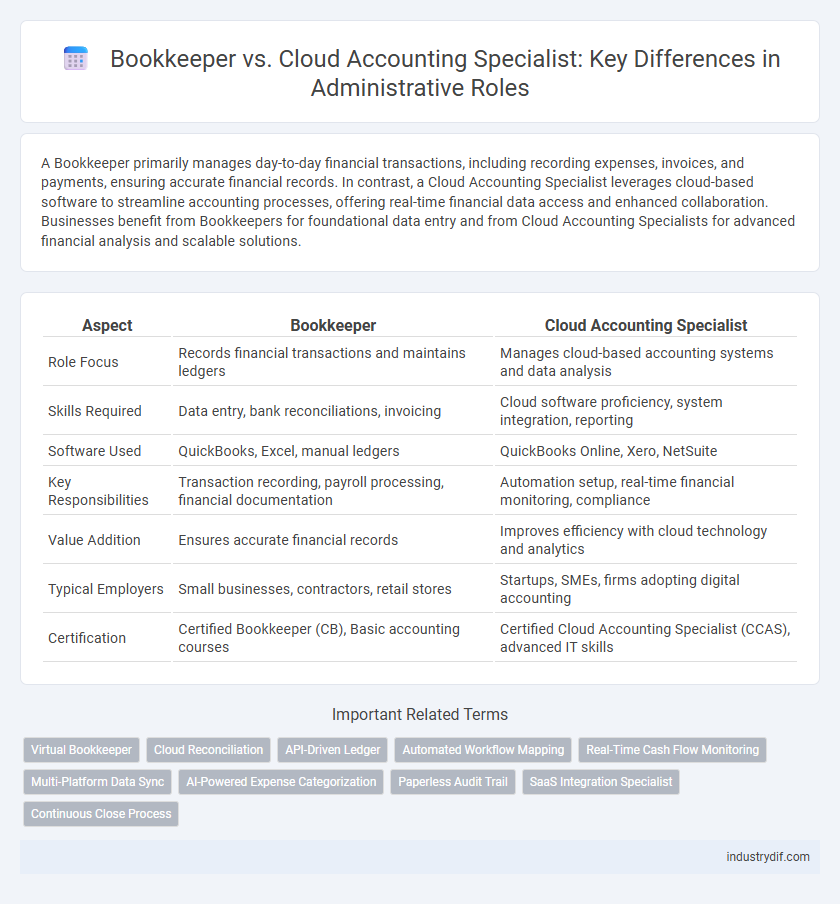

A Bookkeeper primarily manages day-to-day financial transactions, including recording expenses, invoices, and payments, ensuring accurate financial records. In contrast, a Cloud Accounting Specialist leverages cloud-based software to streamline accounting processes, offering real-time financial data access and enhanced collaboration. Businesses benefit from Bookkeepers for foundational data entry and from Cloud Accounting Specialists for advanced financial analysis and scalable solutions.

Table of Comparison

| Aspect | Bookkeeper | Cloud Accounting Specialist |

|---|---|---|

| Role Focus | Records financial transactions and maintains ledgers | Manages cloud-based accounting systems and data analysis |

| Skills Required | Data entry, bank reconciliations, invoicing | Cloud software proficiency, system integration, reporting |

| Software Used | QuickBooks, Excel, manual ledgers | QuickBooks Online, Xero, NetSuite |

| Key Responsibilities | Transaction recording, payroll processing, financial documentation | Automation setup, real-time financial monitoring, compliance |

| Value Addition | Ensures accurate financial records | Improves efficiency with cloud technology and analytics |

| Typical Employers | Small businesses, contractors, retail stores | Startups, SMEs, firms adopting digital accounting |

| Certification | Certified Bookkeeper (CB), Basic accounting courses | Certified Cloud Accounting Specialist (CCAS), advanced IT skills |

Introduction to Bookkeeping and Cloud Accounting

Bookkeepers manage day-to-day financial transactions, maintaining accurate records of invoices, payments, and expenses to ensure precise financial data. Cloud Accounting Specialists leverage cloud-based software to streamline accounting processes, enabling real-time financial reporting and enhanced collaboration. Both roles are essential for effective financial administration, with bookkeepers handling traditional record-keeping and cloud specialists optimizing technology-driven accounting workflows.

Key Roles and Responsibilities

Bookkeepers are responsible for recording daily financial transactions, maintaining accurate ledgers, and reconciling accounts to ensure data integrity. Cloud Accounting Specialists manage and optimize cloud-based financial software, automate processes, and provide real-time financial analysis for strategic decision-making. Both roles require a strong understanding of accounting principles, but Cloud Accounting Specialists emphasize technological integration and data accessibility.

Core Skills and Qualifications

Bookkeepers must have strong attention to detail, proficiency in data entry, and experience with basic accounting software to maintain accurate financial records. Cloud Accounting Specialists require advanced knowledge of cloud-based platforms like QuickBooks Online and Xero, along with expertise in integrating software tools and automating financial workflows. Both roles demand a solid understanding of accounting principles, but Cloud Accounting Specialists must possess technical skills for real-time data management and cybersecurity awareness.

Technology Used in Each Role

Bookkeepers primarily use traditional accounting software such as QuickBooks, Xero, and Sage, emphasizing data entry and transaction record accuracy. Cloud Accounting Specialists leverage advanced cloud-based platforms like Oracle NetSuite, FreshBooks, and Zoho Books, enabling real-time financial data access, automation, and integration with other business systems. Both roles require proficiency in technology, but Cloud Accounting Specialists focus more on scalable, collaborative tools designed for dynamic financial management.

Data Security and Compliance

Bookkeepers handle financial record-keeping with manual processes that may increase risks of human error and data breaches, whereas Cloud Accounting Specialists leverage secure, encrypted cloud platforms to enhance data protection and ensure real-time compliance with regulations such as GDPR and SOX. Cloud-based solutions offer automatic updates for regulatory changes, reducing the risk of non-compliance faced by traditional bookkeeping methods. Employing a Cloud Accounting Specialist significantly improves audit trails, access controls, and data backup strategies essential for maintaining financial data confidentiality and integrity.

Workflow and Process Differences

Bookkeepers primarily manage manual data entry, transaction recording, and reconciliation tasks using traditional accounting software, ensuring accuracy in financial documentation. Cloud Accounting Specialists leverage cloud-based platforms to automate workflows, facilitate real-time collaboration, and integrate advanced analytics for streamlined financial processes. The shift from manual to automated cloud solutions enhances efficiency, reduces errors, and supports scalable financial management within administrative functions.

Collaboration with Management and Staff

A Bookkeeper primarily handles accurate record-keeping and transactional data entry, ensuring financial records are up-to-date for management review. A Cloud Accounting Specialist leverages advanced software to streamline financial reporting and offer real-time insights, facilitating more dynamic collaboration with management and staff. Their expertise in cloud platforms enhances communication and data accessibility, driving informed decision-making across departments.

Cost Implications for Businesses

Bookkeepers typically offer a more affordable solution for basic financial record-keeping, with costs varying between $30 and $60 per hour, making them ideal for small businesses with straightforward accounting needs. Cloud Accounting Specialists command higher fees, often ranging from $75 to $150 per hour, due to their expertise in integrating advanced software like QuickBooks Online or Xero, which can streamline financial processes and reduce long-term operational costs. Investing in a Cloud Accounting Specialist may lead to greater cost efficiency over time through improved accuracy, real-time reporting, and automated reconciliation, offsetting their initial higher expense.

Scalability and Future-Proofing

A Bookkeeper manages daily financial transactions and record-keeping, offering foundational support for small businesses, while a Cloud Accounting Specialist leverages scalable cloud-based platforms to automate processes and provide real-time financial insights. Cloud Accounting Specialists enable seamless integration with other business systems, enhancing adaptability and future-proofing through continuous software updates and remote access. Scalability is significantly improved with cloud solutions, allowing businesses to expand operations without the constraints of traditional bookkeeping limitations.

Choosing the Right Professional for Your Business

Selecting the right financial professional depends on your business needs, with bookkeepers managing daily transaction records and cloud accounting specialists leveraging software to analyze and streamline financial data in real time. Bookkeepers provide accurate data entry and reconciliations, while cloud accounting specialists integrate cloud-based platforms like QuickBooks Online or Xero to enhance financial reporting and decision-making. Evaluating your business's complexity, volume of transactions, and desire for automation ensures the right balance between traditional bookkeeping accuracy and advanced cloud accounting insights.

Related Important Terms

Virtual Bookkeeper

A Virtual Bookkeeper manages financial records remotely, ensuring accurate transaction tracking and bank reconciliations without on-site presence, unlike traditional Bookkeepers who operate physically. Cloud Accounting Specialists leverage advanced software like QuickBooks Online and Xero to provide real-time financial insights and automate processes, enhancing efficiency and decision-making for businesses.

Cloud Reconciliation

A Cloud Accounting Specialist utilizes automated cloud reconciliation tools to ensure real-time transaction matching and accurate financial reporting, which significantly reduces manual errors compared to traditional bookkeepers who often perform reconciliations manually. This cloud-based approach enhances data accuracy, streamlines audit processes, and improves overall financial transparency for businesses.

API-Driven Ledger

Cloud Accounting Specialists leverage API-driven ledgers to automate data synchronization between multiple financial platforms, enhancing real-time accuracy and efficiency. Bookkeepers, while skilled in manual data entry and reconciliation, often lack the technical expertise to fully integrate and optimize API-driven systems for seamless ledger management.

Automated Workflow Mapping

Bookkeepers manage financial records with manual data entry, while Cloud Accounting Specialists leverage automated workflow mapping to streamline transactions, improve accuracy, and integrate real-time data across cloud platforms. Automated workflow mapping enables specialists to design efficient processes that reduce errors and enhance financial reporting speed compared to traditional bookkeeping methods.

Real-Time Cash Flow Monitoring

A Cloud Accounting Specialist leverages advanced software platforms to provide real-time cash flow monitoring, enabling immediate financial insights and decision-making for businesses. In contrast, a traditional Bookkeeper often records transactions manually or with basic tools, resulting in delayed visibility of cash flow status.

Multi-Platform Data Sync

Bookkeepers primarily handle manual data entry and reconciliation across traditional accounting software, while Cloud Accounting Specialists leverage advanced multi-platform data sync technologies to integrate real-time financial data from various applications. This seamless synchronization enhances accuracy, reduces errors, and ensures up-to-date financial reporting across cloud-based ecosystems.

AI-Powered Expense Categorization

AI-powered expense categorization enhances accuracy by automatically sorting transactions based on learned patterns, significantly reducing manual entry errors typically handled by bookkeepers. Cloud accounting specialists leverage this technology within integrated platforms to streamline financial workflows, improve real-time reporting, and enable more strategic decision-making.

Paperless Audit Trail

A Bookkeeper typically manages financial records manually, which can lead to fragmented paper trails, whereas a Cloud Accounting Specialist utilizes digital platforms that ensure a seamless, paperless audit trail with real-time data synchronization and enhanced transparency. This paperless system improves accuracy, accelerates audit processes, and facilitates regulatory compliance by maintaining secure, easily accessible financial documentation.

SaaS Integration Specialist

A SaaS Integration Specialist bridges the gap between traditional bookkeeping and cloud accounting by ensuring seamless integration of multiple software platforms, enhancing data accuracy and real-time financial reporting. This role requires deep expertise in cloud-based accounting tools such as QuickBooks Online, Xero, and specialized SaaS platforms to streamline workflows and automate financial processes.

Continuous Close Process

A Bookkeeper typically manages daily transaction records and reconciliations, while a Cloud Accounting Specialist leverages real-time software tools to facilitate the Continuous Close Process, enabling faster financial closing cycles and improved accuracy. Cloud-based systems automate data integration and reporting, significantly reducing manual errors and accelerating month-end close timelines.

Bookkeeper vs Cloud Accounting Specialist Infographic

industrydif.com

industrydif.com