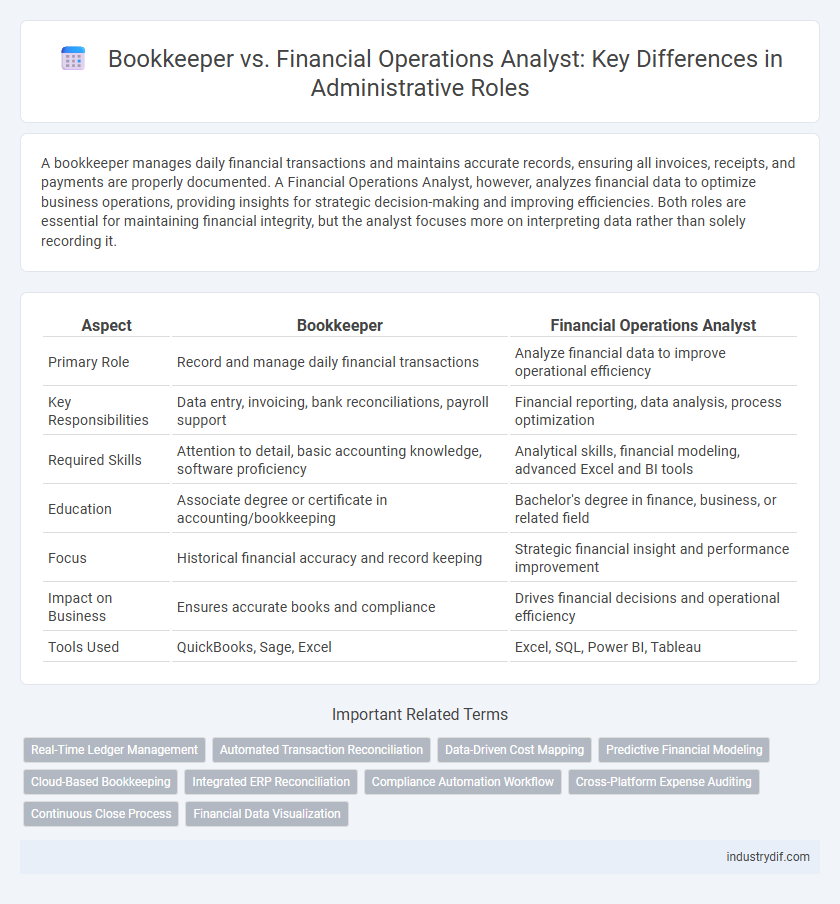

A bookkeeper manages daily financial transactions and maintains accurate records, ensuring all invoices, receipts, and payments are properly documented. A Financial Operations Analyst, however, analyzes financial data to optimize business operations, providing insights for strategic decision-making and improving efficiencies. Both roles are essential for maintaining financial integrity, but the analyst focuses more on interpreting data rather than solely recording it.

Table of Comparison

| Aspect | Bookkeeper | Financial Operations Analyst |

|---|---|---|

| Primary Role | Record and manage daily financial transactions | Analyze financial data to improve operational efficiency |

| Key Responsibilities | Data entry, invoicing, bank reconciliations, payroll support | Financial reporting, data analysis, process optimization |

| Required Skills | Attention to detail, basic accounting knowledge, software proficiency | Analytical skills, financial modeling, advanced Excel and BI tools |

| Education | Associate degree or certificate in accounting/bookkeeping | Bachelor's degree in finance, business, or related field |

| Focus | Historical financial accuracy and record keeping | Strategic financial insight and performance improvement |

| Impact on Business | Ensures accurate books and compliance | Drives financial decisions and operational efficiency |

| Tools Used | QuickBooks, Sage, Excel | Excel, SQL, Power BI, Tableau |

Role Definition: Bookkeeper vs Financial Operations Analyst

A Bookkeeper primarily manages day-to-day financial transactions, maintaining accurate records of invoices, payments, and payroll to ensure compliance and financial accuracy. A Financial Operations Analyst analyzes financial data to optimize operational efficiency, identifying trends, forecasting budgets, and providing actionable insights for strategic decision-making. The Bookkeeper focuses on transactional data entry and reconciliation, while the Financial Operations Analyst emphasizes data interpretation and financial process improvements.

Core Responsibilities Compared

Bookkeepers primarily manage daily financial transactions, including recording sales, purchases, and payroll, ensuring accurate and up-to-date ledgers. Financial Operations Analysts focus on analyzing financial data, preparing reports, and improving financial processes to support strategic decision-making. Both roles are essential for maintaining financial integrity, with bookkeepers emphasizing data accuracy and analysts driving operational efficiency.

Required Qualifications and Skills

Bookkeepers require proficiency in accounting software, attention to detail, and knowledge of basic accounting principles such as ledger management and transaction recording. Financial Operations Analysts must possess strong analytical skills, experience in financial modeling, and expertise in data analysis tools like Excel and SQL to assess operational efficiency and budget forecasting. Advanced qualifications for analysts often include a degree in finance, economics, or business administration, complemented by certifications such as CFA or CPA.

Tools and Technologies Utilized

Bookkeepers primarily utilize accounting software such as QuickBooks, Xero, and Sage to manage daily transactions, maintain ledgers, and reconcile accounts with high accuracy. Financial Operations Analysts employ advanced analytical tools like Microsoft Excel with pivot tables, ERP systems like SAP and Oracle, and data visualization software such as Tableau or Power BI to analyze financial data, optimize processes, and support strategic decision-making. Both roles leverage cloud-based platforms for real-time data access and collaboration, but analysts typically require more sophisticated data modeling and forecasting technologies.

Reporting Structure and Collaboration

A Bookkeeper typically reports to the Finance Manager or Controller, focusing on daily transaction recording and maintaining accurate financial records. A Financial Operations Analyst collaborates closely with cross-functional teams, including finance, operations, and management, to analyze financial data and improve operational efficiency. The reporting structure for the analyst is often more integrated within strategic planning departments, enabling influence over decision-making processes.

Impact on Business Decision-Making

Bookkeepers provide accurate and timely financial records that form the foundation for business decision-making by ensuring data integrity and compliance. Financial Operations Analysts analyze financial data trends and operational metrics to deliver actionable insights that drive strategic planning and resource allocation. Together, these roles enhance organizational decision-making by combining precise data management with in-depth financial analysis.

Regulatory Compliance and Risk Management

A Bookkeeper primarily ensures accurate financial records and transaction documentation, supporting regulatory compliance by maintaining detailed audit trails. A Financial Operations Analyst evaluates financial data to identify risks and implement controls, enhancing risk management strategies aligned with regulatory requirements. Both roles contribute to compliance, but the analyst focuses more on analyzing financial operations for potential vulnerabilities and regulatory adherence.

Salary Expectations and Career Growth

Bookkeepers typically earn an average salary of $40,000 to $55,000 annually, with modest growth opportunities primarily within accounting firms or small businesses. Financial Operations Analysts command higher salaries ranging from $65,000 to $90,000, driven by their advanced analytical skills and strategic role in financial decision-making. Career growth for Financial Operations Analysts is robust, often leading to senior finance positions such as finance manager or director, while bookkeepers may advance to supervisory roles or specialize in areas like payroll or tax preparation.

Industry Demand and Job Outlook

The demand for Bookkeepers remains steady in industries such as retail, healthcare, and small businesses, with the U.S. Bureau of Labor Statistics projecting a 5% growth rate through 2031. Financial Operations Analysts are experiencing faster growth, approximately 10%, driven by increased reliance on data analytics in financial services, technology, and corporate sectors. Job outlook trends highlight a shift toward analytical roles requiring proficiency in financial software and data interpretation, making Financial Operations Analysts more sought after in evolving market conditions.

Choosing Between Bookkeeping and Financial Operations Analysis

Choosing between bookkeeping and financial operations analysis depends on your career goals and skill set. Bookkeepers focus on accurately recording daily financial transactions and maintaining ledgers, making it ideal for those detail-oriented with a strong grasp of accounting basics. Financial Operations Analysts analyze financial data to optimize budgeting, forecasting, and operational efficiency, requiring advanced analytical skills and expertise in financial software.

Related Important Terms

Real-Time Ledger Management

Bookkeepers specialize in precise, real-time ledger management by recording daily financial transactions, ensuring accuracy and compliance within accounting systems. Financial Operations Analysts leverage real-time ledger data to analyze trends, optimize cash flow, and support strategic financial decision-making for enhanced operational efficiency.

Automated Transaction Reconciliation

Automated transaction reconciliation in bookkeeping streamlines data entry and error reduction by matching transactions across multiple financial accounts using accounting software. Financial operations analysts leverage advanced analytics and automation tools to identify discrepancies, optimize cash flow processes, and enhance financial reporting accuracy.

Data-Driven Cost Mapping

Bookkeepers maintain accurate financial records, ensuring transactional data is correctly categorized for real-time expense tracking, while Financial Operations Analysts leverage advanced data analytics to map costs, identify trends, and optimize budget allocations for strategic decision-making. Data-driven cost mapping by analysts transforms raw bookkeeping entries into actionable insights, enhancing operational efficiency and financial forecasting.

Predictive Financial Modeling

Bookkeepers primarily handle accurate record-keeping and transaction documentation, while Financial Operations Analysts focus on predictive financial modeling to forecast trends and support strategic decision-making. Predictive financial modeling leverages historical data analysis and statistical techniques, enabling analysts to optimize cash flow management and enhance budgeting accuracy.

Cloud-Based Bookkeeping

Cloud-based bookkeeping streamlines financial record management with real-time data access and automated reconciliation, enabling bookkeepers to focus on accuracy and compliance. Financial operations analysts leverage this cloud data to perform in-depth financial analysis and strategic planning, driving better business decisions.

Integrated ERP Reconciliation

Bookkeepers stabilize financial data inputs by meticulously recording transactions and performing reconciliations within integrated ERP systems, ensuring accuracy and compliance. Financial Operations Analysts leverage ERP reconciliation data to analyze, optimize cash flow, and drive strategic decision-making across financial operations.

Compliance Automation Workflow

Bookkeepers manage transaction recording and ensure financial data accuracy, while Financial Operations Analysts optimize compliance automation workflows by integrating regulatory requirements with real-time financial reporting and data analytics. Implementing automated compliance systems reduces manual errors and enhances adherence to policies in financial operations.

Cross-Platform Expense Auditing

Bookkeepers specialize in recording daily transactions and maintaining accurate financial records, ensuring cross-platform expense data is meticulously tracked across accounting software and spreadsheets. Financial Operations Analysts analyze these integrated expense reports, detecting discrepancies and optimizing cost efficiency through advanced cross-platform auditing tools and data-driven insights.

Continuous Close Process

A Bookkeeper manages daily transaction records ensuring accurate and timely data entry, supporting the initial stages of the continuous close process. A Financial Operations Analyst leverages these records to perform variance analysis, streamline reconciliations, and accelerate financial reporting within the continuous close framework.

Financial Data Visualization

A Bookkeeper primarily manages and records daily financial transactions with basic reporting capabilities, while a Financial Operations Analyst specializes in analyzing complex financial data and creating advanced visualizations using tools like Tableau or Power BI to support strategic decision-making. Effective financial data visualization by Analysts enhances data interpretation, identifies trends, and drives operational efficiency across departments.

Bookkeeper vs Financial Operations Analyst Infographic

industrydif.com

industrydif.com