Farm subsidies provide direct financial support to farmers to stabilize income and encourage food production, while carbon farming credits incentivize sustainable practices by rewarding reductions in greenhouse gas emissions. Carbon farming credits promote soil health and biodiversity through activities like cover cropping and reduced tillage, creating a market-driven approach to environmental stewardship. Balancing traditional subsidies with carbon credits can drive both economic stability and ecological benefits in modern agriculture.

Table of Comparison

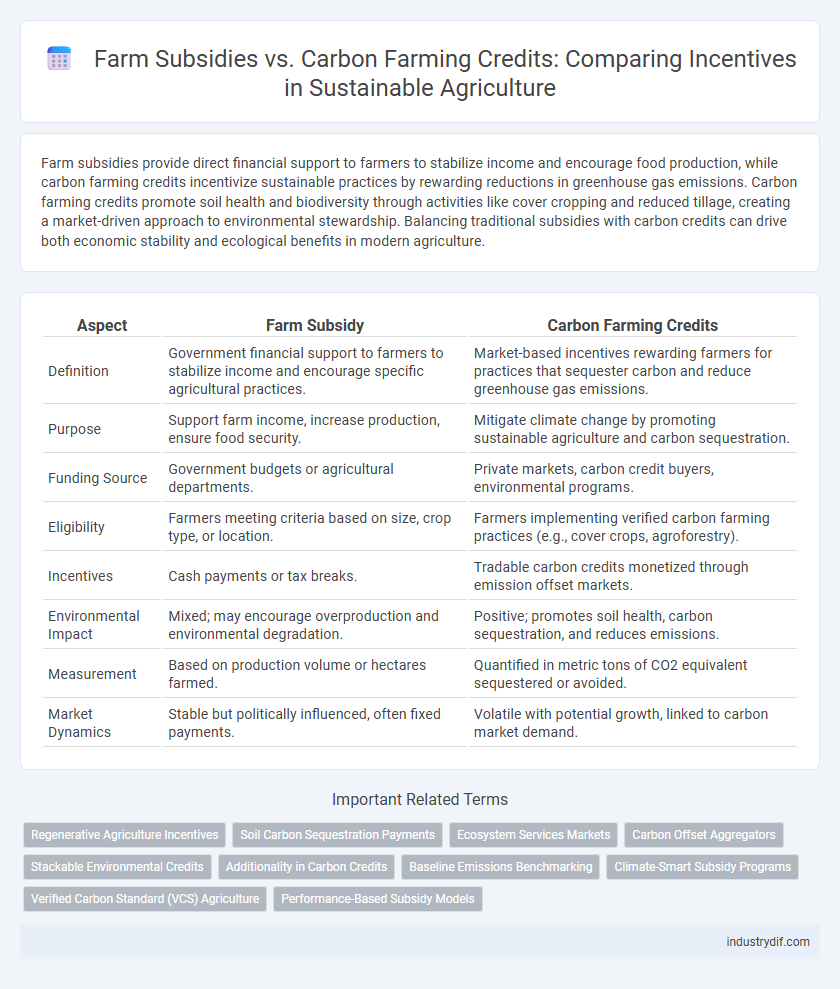

| Aspect | Farm Subsidy | Carbon Farming Credits |

|---|---|---|

| Definition | Government financial support to farmers to stabilize income and encourage specific agricultural practices. | Market-based incentives rewarding farmers for practices that sequester carbon and reduce greenhouse gas emissions. |

| Purpose | Support farm income, increase production, ensure food security. | Mitigate climate change by promoting sustainable agriculture and carbon sequestration. |

| Funding Source | Government budgets or agricultural departments. | Private markets, carbon credit buyers, environmental programs. |

| Eligibility | Farmers meeting criteria based on size, crop type, or location. | Farmers implementing verified carbon farming practices (e.g., cover crops, agroforestry). |

| Incentives | Cash payments or tax breaks. | Tradable carbon credits monetized through emission offset markets. |

| Environmental Impact | Mixed; may encourage overproduction and environmental degradation. | Positive; promotes soil health, carbon sequestration, and reduces emissions. |

| Measurement | Based on production volume or hectares farmed. | Quantified in metric tons of CO2 equivalent sequestered or avoided. |

| Market Dynamics | Stable but politically influenced, often fixed payments. | Volatile with potential growth, linked to carbon market demand. |

Overview of Farm Subsidies and Carbon Farming Credits

Farm subsidies are government financial supports designed to stabilize farm income, manage agricultural production, and ensure food security through direct payments or price supports. Carbon farming credits incentivize farmers to adopt sustainable practices that reduce greenhouse gas emissions or sequester carbon, generating tradable carbon credits in environmental markets. While subsidies focus on economic stability and production goals, carbon farming credits emphasize climate change mitigation and ecosystem services within agricultural landscapes.

Historical Evolution of Agricultural Subsidies

Agricultural subsidies originated in the early 20th century as governments sought to stabilize farm incomes and ensure food security, primarily through price supports and direct payments. Over time, these subsidies evolved to address environmental concerns, leading to the introduction of carbon farming credits that incentivize sustainable practices such as soil carbon sequestration and reduced methane emissions. The shift reflects a broader historical transformation from productivity-based support to climate-smart agriculture policies integrating economic and ecological objectives.

Defining Carbon Farming Credits in Modern Agriculture

Carbon farming credits represent tradable certificates earned by farmers who implement agricultural practices that sequester carbon dioxide or reduce greenhouse gas emissions, such as cover cropping, agroforestry, or reduced tillage. These credits monetize sustainable farming methods by providing financial incentives aligned with environmental goals, contrasting traditional farm subsidies that primarily support production levels and commodity prices. The rise of carbon farming credits integrates climate action into agricultural economics, encouraging innovation and adoption of regenerative practices.

Eligibility Criteria for Farm Subsidies vs Carbon Credits

Farm subsidies typically require applicants to demonstrate active farming operations, adherence to specific crop or livestock production standards, and compliance with federal or state agricultural regulations. Carbon farming credits eligibility hinges on verified implementation of sustainable practices such as cover cropping, reduced tillage, or agroforestry, which sequester measurable amounts of carbon dioxide. Both programs demand thorough documentation, but carbon credits often require third-party verification to quantify carbon sequestration benefits accurately.

Environmental Impact: Subsidies vs Carbon Sequestration

Farm subsidies often incentivize high-input farming practices that can lead to soil degradation, water pollution, and increased greenhouse gas emissions. In contrast, carbon farming credits actively promote carbon sequestration through regenerative agriculture techniques such as cover cropping, reduced tillage, and agroforestry, enhancing soil health and biodiversity. This shift from subsidies to carbon credits supports sustainable agriculture by directly mitigating climate change and improving ecosystem resilience.

Economic Incentives for Farmers: Comparing Both Approaches

Farm subsidies provide direct financial support to farmers, stabilizing income and encouraging production of staple crops. Carbon farming credits offer market-based incentives by rewarding practices that sequester carbon, promoting sustainable agriculture while generating additional revenue streams. Comparing both approaches reveals that subsidies ensure economic security, whereas carbon credits drive environmental benefits alongside economic gains.

Government Policies Shaping Funding and Credits

Government policies increasingly prioritize carbon farming credits as a strategy to reduce agricultural emissions, shifting subsidies from traditional farm support to environmental incentives. Funding frameworks now integrate carbon sequestration metrics, rewarding farmers for adopting sustainable practices that enhance soil health and biodiversity. This policy evolution aligns financial incentives with climate goals, fostering a transition toward regenerative agriculture.

Market Trends and Future Outlook in Sustainable Agriculture

Farm subsidies traditionally support crop production stability but face increasing scrutiny as carbon farming credits gain traction by incentivizing carbon sequestration through regenerative practices. Market trends indicate a growing shift toward carbon credits driven by rising corporate demand for verifiable sustainability metrics and government policy reforms promoting net-zero agriculture. Future outlooks forecast integrated subsidy models combining financial support with carbon credit rewards to accelerate decarbonization and resilience in global food systems.

Challenges in Implementing Subsidies and Carbon Credits

Implementing farm subsidies faces challenges such as administrative complexity, potential market distortions, and difficulties in targeting support to small-scale farmers effectively. Carbon farming credits confront issues including measuring and verifying carbon sequestration accurately, ensuring additionality, and preventing leakage or double counting of emissions reductions. Both systems require robust monitoring frameworks and stakeholder collaboration to overcome these operational hurdles and achieve sustainable agricultural impacts.

Integrating Subsidy Programs with Carbon Farming Initiatives

Integrating farm subsidy programs with carbon farming initiatives enhances sustainable agricultural practices by providing financial incentives for carbon sequestration methods such as cover cropping, agroforestry, and reduced tillage. Aligning subsidies with carbon credits encourages farmers to adopt environmentally friendly techniques that improve soil health, reduce greenhouse gas emissions, and increase biodiversity. Coordinated policy frameworks enable efficient resource allocation, promote long-term climate resilience, and support economic viability in rural communities.

Related Important Terms

Regenerative Agriculture Incentives

Farm subsidies often provide direct financial support to traditional crop and livestock production, while carbon farming credits reward practices that sequester carbon and reduce greenhouse gas emissions. Regenerative agriculture incentives prioritize soil health improvement, biodiversity, and carbon capture, promoting sustainable farming methods aligned with climate change mitigation goals.

Soil Carbon Sequestration Payments

Farm subsidy programs primarily support agricultural production costs, whereas carbon farming credits provide financial incentives for practices that enhance soil carbon sequestration, directly contributing to climate change mitigation. Payments for soil carbon sequestration under carbon credits reward farmers for adopting sustainable land management techniques that increase organic carbon storage in soils, improving soil health and reducing greenhouse gas emissions.

Ecosystem Services Markets

Farm subsidies often prioritize crop yields and commodity prices, whereas carbon farming credits incentivize regenerative practices that sequester carbon and enhance soil health, directly supporting ecosystem services markets. Ecosystem services markets value biodiversity, water filtration, and carbon storage, creating financial rewards for farmers adopting sustainable land management beyond traditional subsidy models.

Carbon Offset Aggregators

Carbon offset aggregators streamline the sale of carbon farming credits by bundling multiple small-scale farm initiatives into larger, market-ready portfolios, enhancing accessibility for farmers and buyers. These platforms maximize revenue potential while promoting sustainable agricultural practices through verified carbon sequestration projects.

Stackable Environmental Credits

Farm subsidy programs provide financial support to farmers for crop production, while carbon farming credits offer compensation for carbon sequestration practices that reduce greenhouse gas emissions. Stackable environmental credits enable farmers to maximize revenue by combining multiple incentive programs, such as carbon credits with biodiversity or water quality credits, enhancing sustainable agriculture profitability.

Additionality in Carbon Credits

Farm subsidies primarily support traditional agricultural productivity, whereas carbon farming credits incentivize additional carbon sequestration beyond baseline practices, emphasizing the principle of additionality to ensure genuine environmental benefits. Ensuring additionality in carbon credits prevents double-counting and guarantees that carbon farming results in measurable, verifiable greenhouse gas reductions not achieved through conventional farming subsidies.

Baseline Emissions Benchmarking

Baseline emissions benchmarking is essential for accurately measuring farm subsidy impacts and validating carbon farming credits in sustainable agriculture. Establishing precise baseline emissions enables farmers to quantify carbon sequestration gains, optimizing subsidy allocations and enhancing the credibility of carbon credit markets.

Climate-Smart Subsidy Programs

Climate-smart subsidy programs integrate farm subsidies with carbon farming credits to incentivize sustainable agricultural practices that reduce greenhouse gas emissions and enhance soil carbon sequestration. These initiatives support farmers financially while promoting climate resilience and long-term environmental sustainability in the agricultural sector.

Verified Carbon Standard (VCS) Agriculture

Farm subsidies provide financial support to farmers, while Verified Carbon Standard (VCS) agriculture credits enable them to earn revenue by sequestering carbon through sustainable practices such as cover cropping and no-till farming. VCS-certified carbon farming credits offer a market-driven incentive aligned with climate goals, enhancing the economic viability of environmentally beneficial agricultural methods.

Performance-Based Subsidy Models

Performance-based subsidy models in agriculture prioritize rewarding farmers for measurable environmental outcomes rather than fixed payments, improving resource efficiency and sustainability. Carbon farming credits incentivize practices like cover cropping and reduced tillage, enabling farmers to generate revenue from verified carbon sequestration, aligning economic support with climate goals.

Farm Subsidy vs Carbon Farming Credits Infographic

industrydif.com

industrydif.com