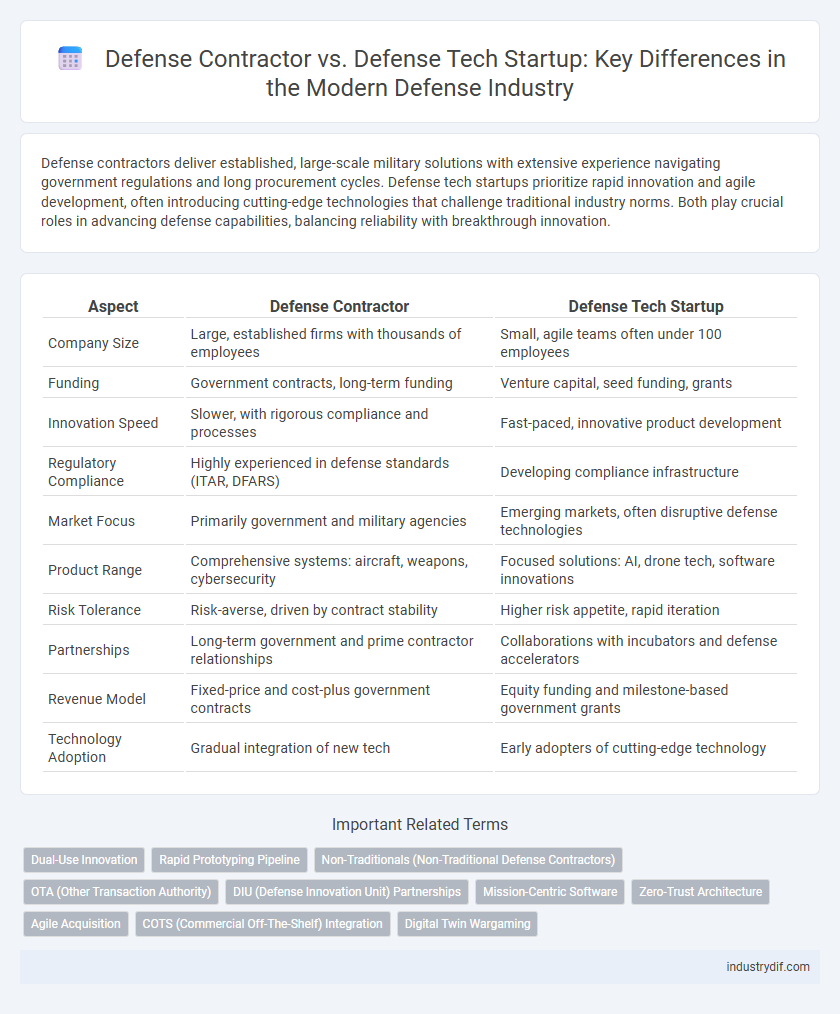

Defense contractors deliver established, large-scale military solutions with extensive experience navigating government regulations and long procurement cycles. Defense tech startups prioritize rapid innovation and agile development, often introducing cutting-edge technologies that challenge traditional industry norms. Both play crucial roles in advancing defense capabilities, balancing reliability with breakthrough innovation.

Table of Comparison

| Aspect | Defense Contractor | Defense Tech Startup |

|---|---|---|

| Company Size | Large, established firms with thousands of employees | Small, agile teams often under 100 employees |

| Funding | Government contracts, long-term funding | Venture capital, seed funding, grants |

| Innovation Speed | Slower, with rigorous compliance and processes | Fast-paced, innovative product development |

| Regulatory Compliance | Highly experienced in defense standards (ITAR, DFARS) | Developing compliance infrastructure |

| Market Focus | Primarily government and military agencies | Emerging markets, often disruptive defense technologies |

| Product Range | Comprehensive systems: aircraft, weapons, cybersecurity | Focused solutions: AI, drone tech, software innovations |

| Risk Tolerance | Risk-averse, driven by contract stability | Higher risk appetite, rapid iteration |

| Partnerships | Long-term government and prime contractor relationships | Collaborations with incubators and defense accelerators |

| Revenue Model | Fixed-price and cost-plus government contracts | Equity funding and milestone-based government grants |

| Technology Adoption | Gradual integration of new tech | Early adopters of cutting-edge technology |

Definition of Defense Contractor

A defense contractor is a company or individual that provides products or services directly to military organizations, typically through government procurement contracts. These contractors specialize in manufacturing weapons, vehicles, or related equipment and often operate on large-scale, long-term projects with substantial regulatory oversight. Unlike defense tech startups, which emphasize innovative technologies and rapid development, defense contractors focus on established defense systems and compliance with stringent contractual requirements.

Definition of Defense Tech Startup

A defense tech startup is an early-stage company specializing in innovative technologies tailored to military and defense applications, often leveraging cutting-edge advancements like AI, cyber security, and robotics. Unlike traditional defense contractors, which are established firms with extensive government contracts and large-scale production capabilities, startups focus on agile development and disruptive solutions. These startups aim to rapidly prototype and deliver niche technologies that address emerging defense challenges.

Business Models Compared

Defense contractors operate on long-term government contracts, prioritizing stable revenue streams and compliance with extensive regulatory requirements, often involving large-scale production and lifecycle support. Defense tech startups emphasize agility and innovation, leveraging venture capital funding to rapidly develop cutting-edge technologies and pursue flexible partnerships or commercial applications beyond traditional defense sectors. The contrast lies in contractors' dependency on established procurement processes versus startups' focus on disruptive solutions and scalable business models.

Key Players in the Industry

Lockheed Martin, Boeing, and Raytheon Technologies dominate the defense contractor landscape with extensive government contracts and global influence. In contrast, defense tech startups such as Anduril Industries, Palantir Technologies, and Shield AI drive innovation by developing advanced AI, autonomous systems, and cybersecurity solutions tailored for modern warfare. These key players collectively shape the defense ecosystem by blending traditional manufacturing expertise with cutting-edge technological advancements.

Funding Sources and Investment Trends

Defense contractors primarily secure funding through government contracts and long-term military procurement budgets, ensuring steady revenue streams aligned with national security priorities. Defense tech startups attract venture capital and private equity investments focused on innovative technologies like AI, cybersecurity, and autonomous systems, reflecting a trend toward agile, cutting-edge solutions in defense modernization. Investment trends reveal a growing convergence, with defense contractors increasingly partnering with startups to leverage novel technologies and diversify funding avenues.

Innovation and Technology Development

Defense contractors leverage established expertise and extensive resources to deliver large-scale, reliable defense solutions, often focusing on incremental improvements and compliance with strict regulatory standards. Defense tech startups emphasize rapid innovation, agility, and disruptive technologies, pushing the boundaries of artificial intelligence, autonomous systems, and cybersecurity in defense applications. The dynamic interplay between traditional defense contractors and agile startups accelerates technology development and fuels advancements in defense capabilities.

Regulatory and Compliance Challenges

Defense contractors face stringent regulatory frameworks such as ITAR, DFARS, and NIST standards that demand extensive compliance protocols, often requiring dedicated legal and compliance teams. Defense tech startups encounter challenges navigating these complex regulations while maintaining agility and innovation, frequently struggling with funding constraints and less experience in regulatory adherence. Both entities must prioritize cybersecurity measures and export controls to safeguard sensitive data and align with government oversight requirements critical to national security projects.

Collaboration with Government Agencies

Defense contractors have established long-term contracts and deep relationships with government agencies, ensuring consistent compliance with regulatory requirements and security protocols. Defense tech startups bring innovative solutions and agile development processes, often partnering with agencies through pilot programs and grants to rapidly prototype advanced technologies. Collaborative efforts between defense contractors and startups enhance government capabilities by combining proven project management with cutting-edge innovation.

Market Entry Barriers

Defense contractors face high market entry barriers due to extensive government regulations, long procurement cycles, and established relationships with military agencies. Defense tech startups often struggle with limited access to classified information, stringent security clearances, and the need for significant capital investment to meet compliance standards. Both entities must navigate complex certification processes and evolving cybersecurity requirements to successfully enter and compete in the defense market.

Future Outlook and Industry Trends

Defense contractors continue to dominate the market with established government relationships and large-scale production capabilities, while defense tech startups drive innovation through agility and cutting-edge technologies such as AI, cybersecurity, and autonomous systems. Industry trends indicate a growing convergence where traditional contractors partner with startups to accelerate modernization and integrate advanced digital solutions. The future outlook highlights increased investment in dual-use technologies and a shift towards modular, software-driven defense platforms to address evolving security threats.

Related Important Terms

Dual-Use Innovation

Defense contractors leverage established government relationships and extensive regulatory experience to deliver proven dual-use technologies that serve both military and civilian markets, ensuring reliability and compliance. In contrast, defense tech startups drive rapid innovation with cutting-edge, adaptable solutions that often prioritize agility and disruptive potential in dual-use applications, though they may face challenges in scaling and navigating defense procurement processes.

Rapid Prototyping Pipeline

Defense contractors leverage established resources and extensive supply chains to maintain a streamlined rapid prototyping pipeline, ensuring scalability and compliance with military standards. Defense tech startups focus on agility and innovation within their rapid prototyping pipeline, enabling faster iteration cycles and the integration of cutting-edge technologies for disruptive defense solutions.

Non-Traditionals (Non-Traditional Defense Contractors)

Non-traditional defense contractors, often defense tech startups, leverage agile innovation and cutting-edge technologies such as AI, cybersecurity, and advanced materials to rapidly address modern military challenges. These non-traditional entities disrupt established defense supply chains by offering specialized solutions and fostering public-private partnerships that accelerate defense modernization.

OTA (Other Transaction Authority)

Defense contractors typically operate within established federal acquisition regulations, while defense tech startups leverage Other Transaction Authority (OTA) to accelerate innovation and streamline contract processes. OTA enables startups to bypass traditional procurement hurdles, facilitating faster delivery of cutting-edge technologies to the Department of Defense.

DIU (Defense Innovation Unit) Partnerships

Defense contractors offer established infrastructure and extensive government experience, while Defense Innovation Unit (DIU) partnerships enable agile defense tech startups to rapidly prototype cutting-edge technologies for military applications. DIU's streamlined collaboration accelerates innovation adoption by connecting startups' advanced solutions with Defense Department priorities, enhancing national security capabilities.

Mission-Centric Software

Defense contractors provide established, large-scale mission-centric software solutions often backed by extensive government experience and compliance with rigorous security standards. In contrast, defense tech startups deliver innovative, agile mission-centric software leveraging cutting-edge technologies such as AI and machine learning to rapidly address emerging defense challenges.

Zero-Trust Architecture

Defense contractors typically leverage established resources and extensive government contracts to implement Zero-Trust Architecture at scale, ensuring robust security compliance across military networks. Defense tech startups, by contrast, innovate rapidly with cutting-edge Zero-Trust solutions, offering agile, adaptive cybersecurity technologies tailored to evolving threat landscapes and niche operational needs.

Agile Acquisition

Defense contractors traditionally follow rigid procurement cycles, while defense tech startups leverage Agile Acquisition to accelerate innovation and rapidly deliver adaptive solutions to evolving military needs. Agile Acquisition emphasizes iterative development, continuous feedback, and flexible contracting, enabling startups to outpace conventional contractors in responding to dynamic defense requirements.

COTS (Commercial Off-The-Shelf) Integration

Defense contractors leverage established relationships and extensive expertise to seamlessly integrate Commercial Off-The-Shelf (COTS) components into large-scale military systems, ensuring compliance with rigorous defense standards. In contrast, defense tech startups prioritize agile innovation and rapid prototyping to customize COTS solutions, accelerating deployment while addressing niche operational requirements.

Digital Twin Wargaming

Defense contractors leverage extensive experience and established infrastructure to develop large-scale Digital Twin Wargaming systems, ensuring robust integration with existing military platforms and compliance with strict regulatory standards. Defense tech startups prioritize agility and innovation, rapidly deploying advanced Digital Twin Wargaming solutions that utilize cutting-edge AI and real-time data analytics to enhance strategic simulation and decision-making capabilities.

Defense contractor vs Defense tech startup Infographic

industrydif.com

industrydif.com