Military contractors specialize in defense systems with established government contracts, ensuring reliability and compliance with strict military standards. Dual-use startups innovate by developing technologies that serve both civilian and military applications, offering flexibility and faster adaptation to emerging threats. Choosing between the two depends on prioritizing either proven security infrastructure or cutting-edge, versatile solutions for defense needs.

Table of Comparison

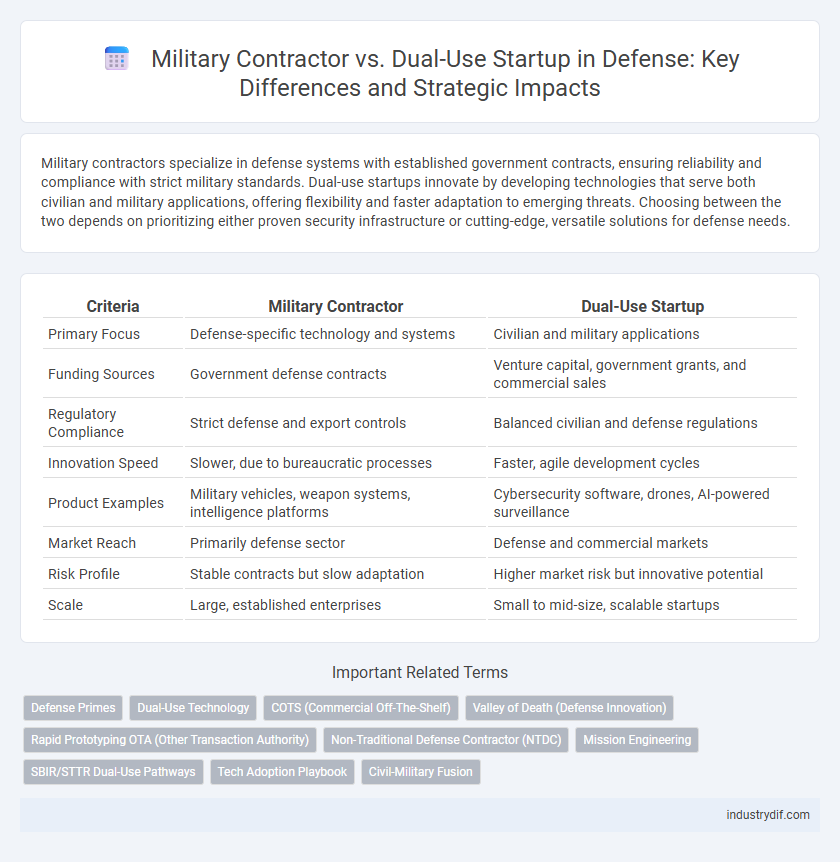

| Criteria | Military Contractor | Dual-Use Startup |

|---|---|---|

| Primary Focus | Defense-specific technology and systems | Civilian and military applications |

| Funding Sources | Government defense contracts | Venture capital, government grants, and commercial sales |

| Regulatory Compliance | Strict defense and export controls | Balanced civilian and defense regulations |

| Innovation Speed | Slower, due to bureaucratic processes | Faster, agile development cycles |

| Product Examples | Military vehicles, weapon systems, intelligence platforms | Cybersecurity software, drones, AI-powered surveillance |

| Market Reach | Primarily defense sector | Defense and commercial markets |

| Risk Profile | Stable contracts but slow adaptation | Higher market risk but innovative potential |

| Scale | Large, established enterprises | Small to mid-size, scalable startups |

Definition of Military Contractors vs Dual-Use Startups

Military contractors specialize in designing, manufacturing, and supplying defense-specific equipment and services primarily for government armed forces. Dual-use startups develop technologies and products that serve both civilian markets and military applications, enabling adaptable solutions with broader commercial viability. The distinction lies in military contractors' exclusive focus on defense contracts, whereas dual-use startups target versatility across defense and commercial sectors.

Key Differences in Business Models

Military contractors primarily operate within government defense budgets, focusing on large-scale, long-term contracts for specialized, high-security military technologies and infrastructure. Dual-use startups target both civilian and military markets by developing adaptable technologies, emphasizing innovation and rapid scalability to meet diverse industry demands. The business model divergence hinges on procurement processes, funding sources, compliance requirements, and the balance between secrecy and market flexibility.

Regulatory Environment and Compliance

Military contractors face stringent regulatory requirements, including the International Traffic in Arms Regulations (ITAR) and Defense Federal Acquisition Regulation Supplement (DFARS), which govern the export and use of defense-related technologies. Dual-use startups operate within a complex compliance landscape that encompasses both defense-specific regulations and civilian technology standards, such as the Export Administration Regulations (EAR). Navigating these overlapping regulatory frameworks demands robust internal controls to ensure adherence and mitigate the risk of sanctions or contract termination.

Funding Sources and Investment Trends

Military contractors primarily secure funding through government defense contracts and classified budgets, often benefiting from stable, long-term agreements. In contrast, dual-use startups attract venture capital and private equity investments aiming to develop technologies with both civilian and military applications, reflecting a trend toward innovation-driven growth. Investment trends show an increasing preference for dual-use startups due to their potential for broader market impact and faster scalability within the defense sector.

Innovation and Technology Development

Military contractors drive innovation by leveraging extensive defense sector experience and specialized technologies tailored for combat readiness and national security applications. Dual-use startups accelerate technology development through versatile solutions that serve both civilian markets and military needs, fostering rapid prototyping and adaptive innovation cycles. The synergy between established defense contractors and agile dual-use startups enhances the defense ecosystem by integrating cutting-edge commercial advancements with mission-critical military requirements.

Government Partnerships and Procurement

Military contractors often secure large government contracts through established procurement channels, benefiting from extensive experience and compliance with strict defense regulations. Dual-use startups, leveraging innovative technologies applicable to both civilian and military markets, increasingly collaborate with government agencies to diversify procurement options and accelerate agile development cycles. Government partnerships with dual-use startups foster competitive acquisitions, driving cost efficiency and advanced capability integration in defense systems.

Market Access and Customer Segments

Military contractors primarily target government defense agencies and secure classified contracts, benefiting from established procurement channels and long-term agreements. Dual-use startups access broader commercial markets alongside defense customers, leveraging innovative technologies applicable to both civilian and military sectors. This dual market strategy enhances flexibility and growth opportunities, though it requires navigating diverse regulatory environments and customer requirements.

Ethical and Security Considerations

Military contractors often operate under strict governmental oversight, prioritizing national security but facing ethical scrutiny due to profit-driven motives and potential conflicts of interest. Dual-use startups innovate technologies applicable in both civilian and military contexts, raising complex ethical issues around technology proliferation and misuse while navigating less rigid regulatory frameworks. Ensuring robust security protocols and transparent ethical guidelines is critical to mitigate risks associated with dual-use technologies and maintain strategic defense integrity.

Challenges and Opportunities in Defense Sector

Military contractors face regulatory complexities and high compliance costs that can limit innovation speed, while dual-use startups benefit from greater flexibility but struggle with stringent defense procurement processes. Dual-use startups have opportunities to leverage commercial technology advancements for defense applications, driving cost efficiency and rapid development cycles. Both entities must navigate cybersecurity risks and intellectual property protections to maintain competitiveness in the evolving defense sector.

Future Outlook for Military Contractors and Dual-Use Startups

Military contractors are expected to maintain steady growth driven by increasing defense budgets, advanced weapons development, and government contracts prioritizing cybersecurity and autonomous systems. Dual-use startups benefit from flexible innovation cycles and crossover technologies applicable to both civilian markets and defense, positioning them for rapid scaling and diversified revenue streams. The convergence of defense needs with commercial technology trends fosters collaboration opportunities and intensifies competition, shaping a dynamic landscape for both military contractors and dual-use startups.

Related Important Terms

Defense Primes

Defense primes prioritize strategic partnerships with dual-use startups to integrate cutting-edge technologies that enhance military capabilities while maintaining compliance with stringent security standards. Military contractors leverage established government contracts and extensive defense experience, but increasingly collaborate with innovative dual-use companies to accelerate technology adoption and operational adaptability.

Dual-Use Technology

Dual-use technology startups innovate by developing products that serve both civilian and military applications, enhancing versatility and cost-efficiency compared to traditional military contractors focused solely on defense. These startups leverage cutting-edge technologies such as AI, robotics, and cybersecurity to create adaptable solutions that meet evolving defense requirements while also addressing commercial market demands.

COTS (Commercial Off-The-Shelf)

Military contractors often rely on customized defense solutions, whereas dual-use startups prioritize innovative Commercial Off-The-Shelf (COTS) technologies to accelerate deployment and reduce costs. Leveraging COTS components allows dual-use startups to provide scalable, adaptable systems that meet both military and civilian applications with enhanced flexibility and rapid integration.

Valley of Death (Defense Innovation)

Military contractors often secure stable government funding but face bureaucratic hurdles, whereas dual-use startups navigating the Defense Innovation Valley of Death struggle to transition advanced technologies from commercial viability to military adoption due to limited defense-specific resources and extended acquisition cycles. Overcoming this innovation gap requires targeted investment in prototyping, rigorous testing, and streamlined procurement processes to accelerate dual-use technology integration within defense systems.

Rapid Prototyping OTA (Other Transaction Authority)

Military contractors leverage deep government relationships and extensive compliance experience to efficiently execute rapid prototyping under Other Transaction Authority (OTA) agreements, ensuring accelerated defense technology development. Dual-use startups capitalize on innovative agility and commercial technology adaptation to rapidly iterate prototype solutions within OTA frameworks, driving cost-effective and flexible defense applications.

Non-Traditional Defense Contractor (NTDC)

Non-Traditional Defense Contractors (NTDCs) often emerge from dual-use startups that develop innovative technologies adaptable for both commercial markets and defense applications, contrasting with traditional military contractors specialized exclusively in defense systems. This shift enables rapid integration of cutting-edge commercial advancements such as AI, cybersecurity, and advanced materials into military capabilities, expanding the defense innovation ecosystem beyond conventional procurement channels.

Mission Engineering

Military contractors specialize in mission engineering by delivering tailored defense systems with rigorous compliance to military standards, ensuring operational readiness and security. Dual-use startups innovate rapidly by integrating commercial technologies with defense applications, offering flexible and cost-effective solutions that accelerate mission engineering processes.

SBIR/STTR Dual-Use Pathways

Military contractors traditionally dominate defense contracts with specialized products and extensive compliance experience, while dual-use startups leverage SBIR/STTR dual-use pathways to innovate rapidly by bridging commercial technology with military applications. These programs facilitate the transition of cutting-edge commercial innovations into defense capabilities, enabling startups to address both civilian markets and defense needs efficiently.

Tech Adoption Playbook

Military contractors prioritize large-scale, vetted technology integration aligned with strict compliance and defense protocols, ensuring reliability and security for national defense applications. Dual-use startups accelerate tech adoption by innovating flexible solutions that serve both commercial markets and military needs, fostering rapid prototyping and agile development within a less rigid regulatory framework.

Civil-Military Fusion

Military contractors specialize in defense-specific technologies and procurement, providing advanced systems tailored to government requirements; dual-use startups leverage civilian innovation to develop solutions adaptable for both commercial markets and military applications, enhancing Civil-Military Fusion by accelerating technological integration and operational versatility. Civil-Military Fusion promotes seamless collaboration and resource sharing, driving innovation ecosystems that benefit defense capabilities while fostering economic growth in dual-use technology sectors.

Military contractor vs Dual-use startup Infographic

industrydif.com

industrydif.com