Health insurance for pets typically offers comprehensive coverage for a range of medical expenses, providing peace of mind through predictable costs and broad protection. Usage-based health plans, on the other hand, tailor premiums and benefits according to the actual usage and health needs of the pet, potentially lowering costs for healthier animals with fewer vet visits. Choosing between these options depends on the pet's health status and the owner's preference for either steady payments or adaptable, need-based coverage.

Table of Comparison

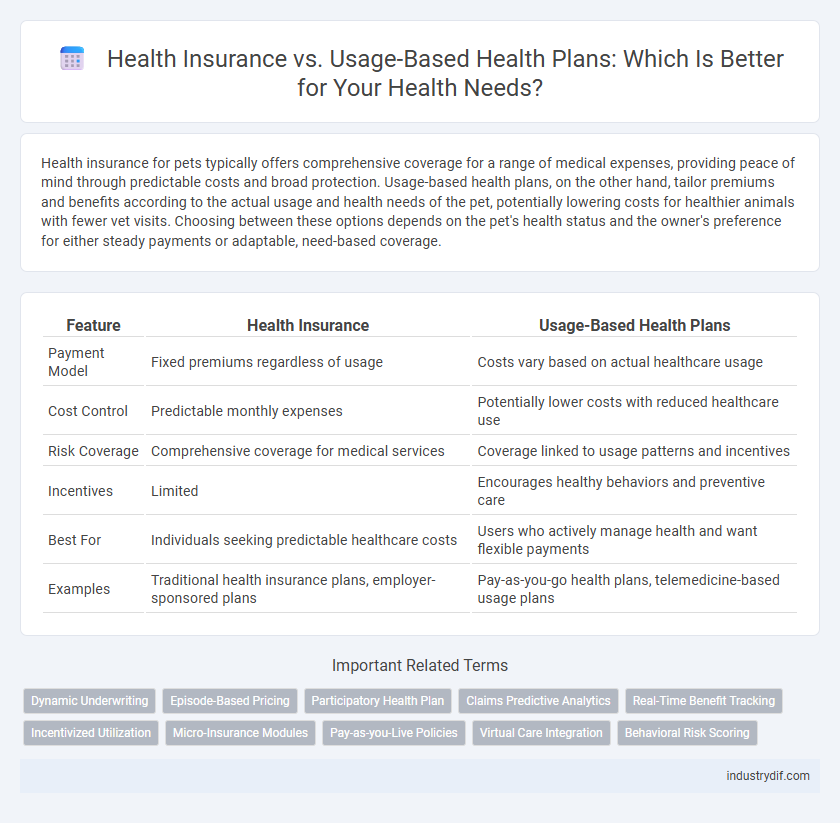

| Feature | Health Insurance | Usage-Based Health Plans |

|---|---|---|

| Payment Model | Fixed premiums regardless of usage | Costs vary based on actual healthcare usage |

| Cost Control | Predictable monthly expenses | Potentially lower costs with reduced healthcare use |

| Risk Coverage | Comprehensive coverage for medical services | Coverage linked to usage patterns and incentives |

| Incentives | Limited | Encourages healthy behaviors and preventive care |

| Best For | Individuals seeking predictable healthcare costs | Users who actively manage health and want flexible payments |

| Examples | Traditional health insurance plans, employer-sponsored plans | Pay-as-you-go health plans, telemedicine-based usage plans |

Understanding Traditional Health Insurance Plans

Traditional health insurance plans offer comprehensive coverage with fixed premiums, deductibles, and copayments, providing predictable financial protection against a broad range of medical expenses. These plans typically cover preventive services, hospital stays, physician visits, and prescription drugs under a network of providers, emphasizing long-term health management. Understanding the standard cost-sharing structure and benefits compared to usage-based health plans helps consumers make informed decisions based on their medical needs and financial preferences.

What Are Usage-Based Health Plans?

Usage-based health plans base premiums and coverage on real-time data about an individual's health behaviors, such as physical activity, diet, and biometric metrics tracked through wearable devices. These plans aim to promote healthier lifestyles by incentivizing positive habits and providing personalized risk assessments. By integrating continuous health monitoring, usage-based health plans offer a dynamic alternative to traditional health insurance models.

Key Differences Between Health Insurance and Usage-Based Plans

Health insurance typically involves fixed premiums and broad coverage, providing access to a wide range of medical services regardless of usage frequency. Usage-based health plans, also known as pay-as-you-go plans, charge premiums based on actual healthcare utilization, incentivizing lower consumption and potentially reducing costs for healthier individuals. The key difference lies in cost structure and risk distribution: traditional insurance spreads risk across a population, while usage-based plans align costs more closely with individual health behaviors and service usage.

Cost Comparison: Premiums and Out-of-Pocket Expenses

Health insurance typically involves higher fixed premiums but offers predictable out-of-pocket expenses, while usage-based health plans often feature lower premiums with variable costs tied to healthcare utilization. Usage-based plans can lead to significant savings for low-frequency healthcare users but may result in higher expenses for those requiring frequent medical care. Evaluating monthly premiums alongside potential co-pays, deductibles, and coinsurance is essential for accurate cost comparison between these health coverage options.

Flexibility and Customization in Coverage

Usage-based health plans offer enhanced flexibility by allowing policyholders to tailor coverage according to their actual health needs and lifestyle, often using real-time data from wearable devices. Traditional health insurance typically provides standardized packages with limited customization, resulting in less personalized coverage options. Emphasizing usage-based models enables consumers to optimize their benefits, reduce unnecessary expenses, and receive care that aligns more closely with their unique health profiles.

Impact on Patient Behavior and Wellness Incentives

Health insurance plans that incorporate wellness incentives through usage-based models significantly influence patient behavior by encouraging healthier lifestyle choices and adherence to preventive care. Tracking metrics such as physical activity, biometric data, and medication compliance creates personalized incentives, resulting in improved health outcomes and reduced healthcare costs. These plans foster proactive patient engagement and motivate consistent wellness efforts, contrasting with traditional insurance structures that often lack direct behavior-based rewards.

Accessibility and Eligibility Criteria

Health insurance typically offers broad accessibility with standardized eligibility criteria based on factors like age, employment status, and pre-existing conditions, ensuring wide population coverage. Usage-based health plans require active monitoring of health metrics and often impose stricter eligibility, prioritizing individuals with quantifiable health data or preferred risk profiles. These plans enhance personalized care but may limit accessibility due to technological and privacy prerequisites.

Claims Process and Reimbursement

Health insurance typically involves a predefined claims process where policyholders submit medical bills for reimbursement based on fixed coverage terms, often requiring detailed documentation and approval periods. Usage-based health plans leverage real-time data from wearable devices or health apps to streamline claims, enabling quicker, more personalized reimbursements directly tied to individual health behaviors and service utilization. This technology-driven approach reduces administrative delays and incentivizes healthier lifestyles through dynamic premium adjustments and faster claim settlements.

Data Privacy in Usage-Based Health Plans

Usage-based health plans collect real-time health data through wearable devices and mobile apps to tailor coverage and premiums, raising significant concerns about data privacy and security. Unlike traditional health insurance, these plans require continuous monitoring, which increases risks of unauthorized access, data breaches, and potential misuse of sensitive personal health information. Ensuring robust encryption, transparent data policies, and strict compliance with regulations like HIPAA is essential to protect user privacy in usage-based health plans.

Choosing the Right Health Plan for Your Needs

Health insurance plans offer predictable monthly premiums and comprehensive coverage, ideal for individuals seeking financial stability and broad healthcare access. Usage-based health plans tailor costs to actual healthcare utilization, benefiting those with generally low medical needs and promoting cost-saving through healthy lifestyle incentives. Selecting the right health plan depends on evaluating your typical medical expenses, risk tolerance, and preference for predictable costs versus potential savings linked to personalized usage patterns.

Related Important Terms

Dynamic Underwriting

Dynamic underwriting in usage-based health plans leverages real-time data from wearable devices and health apps to continuously assess individual risk profiles, enabling more personalized premium adjustments compared to traditional health insurance models. This approach enhances accuracy in coverage cost predictions, incentivizes healthier behaviors, and reduces overall claims by aligning insurance terms with actual lifestyle metrics.

Episode-Based Pricing

Episode-based pricing in health insurance offers a fixed cost for an entire treatment episode, promoting cost transparency and efficiency compared to traditional fee-for-service models. Usage-based health plans leverage real-time patient data and behavior monitoring to customize premiums and care management, enhancing personalized healthcare while controlling expenses.

Participatory Health Plan

Participatory Health Plans involve health insurance models that reward insured individuals for engaging in healthy behaviors such as regular exercise, preventive screenings, and wellness activities, utilizing data from wearable devices and health apps to adjust premiums and incentives. These usage-based health plans promote proactive health management, reduce overall healthcare costs, and enhance patient outcomes by aligning insurance benefits with personal health data and lifestyle choices.

Claims Predictive Analytics

Claims predictive analytics in health insurance leverages historical claim data and machine learning algorithms to forecast future medical expenses, enabling insurers to optimize risk assessment and pricing models. Usage-based health plans integrate real-time health monitoring data to enhance claim prediction accuracy, personalize premiums, and improve preventive care strategies.

Real-Time Benefit Tracking

Usage-based health plans utilize real-time benefit tracking to provide immediate insights into coverage, enabling users to monitor expenses and benefits dynamically. Traditional health insurance often lacks this instant feedback, making usage-based plans more transparent and cost-efficient for personalized healthcare management.

Incentivized Utilization

Usage-based health plans promote incentivized utilization by rewarding policyholders with lower premiums or cash back for healthy behaviors and reduced medical claims, encouraging proactive health management. Traditional health insurance typically involves fixed premiums regardless of individual health choices, lacking direct incentives to minimize claims or engage in preventive care.

Micro-Insurance Modules

Micro-insurance modules in health insurance offer affordable coverage tailored to low-income populations, while usage-based health plans leverage real-time health data to customize premiums and benefits. Integrating micro-insurance with usage-based models enhances accessibility and personalized risk assessment in underserved communities.

Pay-as-you-Live Policies

Pay-as-you-Live policies in usage-based health plans tailor insurance premiums according to real-time health behaviors, such as physical activity, sleep patterns, and biometric data, promoting preventive care and cost savings. Unlike traditional health insurance with fixed premiums, these dynamic plans incentivize healthier lifestyles through wearable technology integration and data-driven risk assessment.

Virtual Care Integration

Health insurance plans traditionally offer broad coverage, while usage-based health plans leverage real-time data to tailor benefits and costs; integration of virtual care platforms enhances both models by providing convenient access to remote consultations, continuous health monitoring, and personalized treatment plans. Virtual care integration reduces healthcare costs, improves patient outcomes, and supports preventive care, making it a critical feature in modern health insurance and usage-based health plans.

Behavioral Risk Scoring

Behavioral Risk Scoring in health insurance uses data on lifestyle and behavior patterns to predict individual health risks, enabling more personalized premiums and coverage options. Usage-based health plans leverage real-time monitoring of patient behaviors and medical service usage to adjust insurance costs and incentivize healthier habits effectively.

Health insurance vs Usage-based health plans Infographic

industrydif.com

industrydif.com