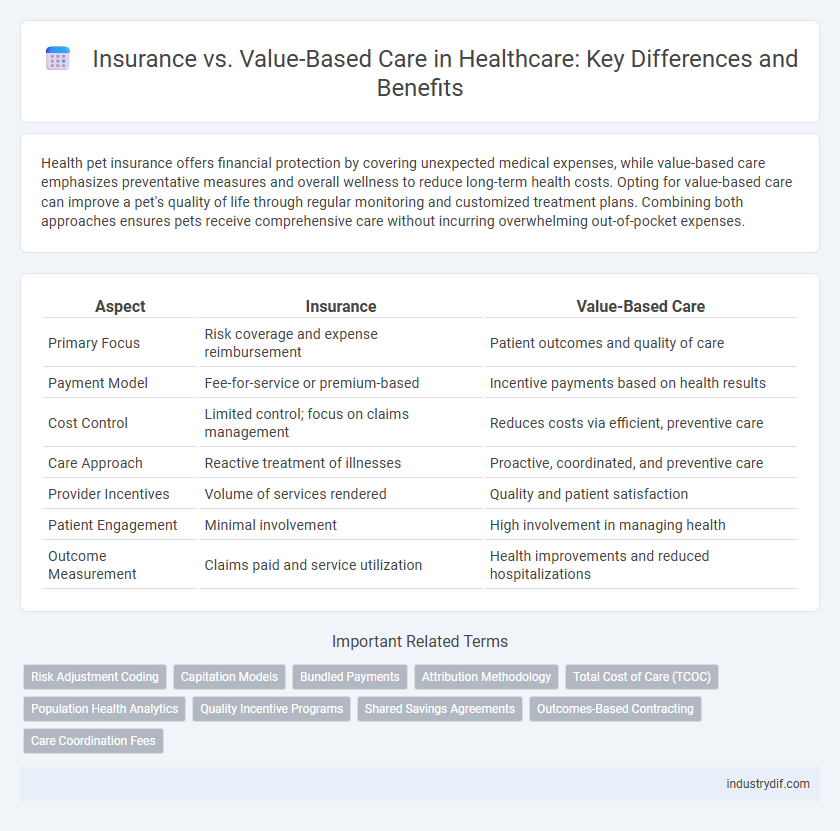

Health pet insurance offers financial protection by covering unexpected medical expenses, while value-based care emphasizes preventative measures and overall wellness to reduce long-term health costs. Opting for value-based care can improve a pet's quality of life through regular monitoring and customized treatment plans. Combining both approaches ensures pets receive comprehensive care without incurring overwhelming out-of-pocket expenses.

Table of Comparison

| Aspect | Insurance | Value-Based Care |

|---|---|---|

| Primary Focus | Risk coverage and expense reimbursement | Patient outcomes and quality of care |

| Payment Model | Fee-for-service or premium-based | Incentive payments based on health results |

| Cost Control | Limited control; focus on claims management | Reduces costs via efficient, preventive care |

| Care Approach | Reactive treatment of illnesses | Proactive, coordinated, and preventive care |

| Provider Incentives | Volume of services rendered | Quality and patient satisfaction |

| Patient Engagement | Minimal involvement | High involvement in managing health |

| Outcome Measurement | Claims paid and service utilization | Health improvements and reduced hospitalizations |

Understanding Insurance in Healthcare

Health insurance acts as a financial safety net by covering medical expenses and reducing out-of-pocket costs for patients, enabling access to necessary treatments and preventive services. It typically involves monthly premiums, copayments, deductibles, and network restrictions that influence utilization and affordability. Understanding these insurance components is essential for navigating healthcare options and aligning coverage with personal health needs in a value-based care environment.

Defining Value-Based Care

Value-Based Care (VBC) centers on improving patient health outcomes while controlling costs, shifting away from traditional fee-for-service insurance models that reward volume over quality. VBC prioritizes coordinated care, preventive measures, and patient engagement to enhance treatment effectiveness and reduce hospital readmissions. This approach aligns provider incentives with patient well-being, optimizing resource utilization across healthcare systems.

Key Differences: Insurance vs Value-Based Care

Insurance primarily focuses on risk management by providing financial coverage for medical expenses, whereas value-based care emphasizes improving patient outcomes through coordinated, efficient healthcare services. Key differences include payment models, with insurance relying on fee-for-service or premium-based structures, while value-based care uses performance-based reimbursements linked to quality metrics. This shift encourages providers to prioritize preventative care, reduce hospital readmissions, and enhance overall health system efficiency.

Payment Models Compared

Insurance typically operates on a fee-for-service payment model, reimbursing providers based on the volume of care delivered, which may incentivize higher utilization without necessarily improving patient outcomes. Value-Based Care shifts payment structures to reward healthcare providers for quality and efficiency, emphasizing patient health outcomes and cost reduction through coordinated care and preventive measures. Compared to traditional insurance, value-based payment models align financial incentives with improved health results, promoting accountability and long-term cost savings in healthcare systems.

Patient Outcomes: Value-Based Care vs Traditional Insurance

Value-Based Care prioritizes patient outcomes by linking payments to the effectiveness of treatments, encouraging providers to deliver higher quality care and reduce hospital readmissions. Traditional insurance often reimburses based on services rendered, which may lead to unnecessary procedures without guaranteeing improved patient health. Studies show Value-Based Care models result in better chronic disease management and overall patient satisfaction compared to standard insurance frameworks.

Cost Implications for Providers and Patients

Value-based care shifts healthcare reimbursement from volume to quality, impacting cost structures by incentivizing providers to focus on patient outcomes rather than the number of services rendered. Insurance models rooted in fee-for-service often lead to higher costs due to unnecessary procedures, whereas value-based care can reduce overall expenses by preventing hospital readmissions and promoting preventive care. Both providers and patients potentially benefit financially as value-based care emphasizes efficient resource use and improved health outcomes, reducing out-of-pocket costs and long-term expenditures.

Impact on Healthcare Quality

Value-based care improves healthcare quality by prioritizing patient outcomes and reducing unnecessary treatments, unlike traditional insurance models that focus on service volume. Insurance systems based on fee-for-service often lead to overtreatment and higher costs without corresponding improvements in patient health. Shifting to value-based care aligns reimbursement with effective, evidence-based practices, enhancing overall healthcare quality and patient satisfaction.

Challenges in Implementing Value-Based Care

Implementing value-based care presents significant challenges, including the need for robust data analytics systems to accurately measure patient outcomes and costs. Providers often face difficulties in aligning financial incentives with quality care, as fee-for-service models remain deeply entrenched in the healthcare system. Furthermore, transitioning to value-based care requires substantial investments in care coordination and patient engagement, which can strain limited resources and infrastructure.

The Future of Health Insurance Models

The future of health insurance models is shifting toward value-based care, emphasizing patient outcomes over service volume. This approach incentivizes providers to deliver efficient, high-quality care, reducing unnecessary treatments and lowering overall costs. Health insurance companies adopting value-based strategies are positioned to improve population health while maintaining financial sustainability in a rapidly evolving healthcare landscape.

Integrating Insurance with Value-Based Strategies

Integrating insurance with value-based care strategies enhances patient outcomes by aligning reimbursement structures with quality metrics and cost efficiency. Insurance models that incorporate value-based frameworks prioritize preventive care and chronic disease management, reducing hospital readmissions and healthcare disparities. Collaborative efforts between insurers and providers foster data-driven decision-making, optimizing resource allocation and improving overall healthcare value.

Related Important Terms

Risk Adjustment Coding

Risk adjustment coding plays a critical role in value-based care by accurately capturing patient severity to ensure fair reimbursement and resource allocation, contrasting with traditional insurance models that often rely on fixed payments regardless of patient complexity. Effective risk adjustment minimizes financial risk for providers and supports improved health outcomes through targeted care management.

Capitation Models

Capitation models in value-based care represent a fixed payment approach where providers receive a set amount per patient regardless of services rendered, incentivizing efficient, preventive care to improve health outcomes while controlling costs. Insurance under traditional fee-for-service often drives higher utilization and fragmented care, whereas capitation aligns financial risk with quality, promoting coordinated management of chronic diseases and reducing unnecessary interventions.

Bundled Payments

Bundled payments in value-based care consolidate multiple services into a single, fixed payment that incentivizes providers to deliver efficient, high-quality treatment while controlling costs. Unlike traditional insurance models that reimburse fees per service, bundled payments promote coordinated care and reduce unnecessary expenses by aligning financial rewards with patient outcomes.

Attribution Methodology

Attribution methodology in health insurance versus value-based care determines how patient outcomes and costs are assigned to providers, impacting reimbursement models and care quality assessments. Accurate attribution enables value-based care programs to reward providers for efficient, outcome-driven services rather than volume-based interventions.

Total Cost of Care (TCOC)

Value-Based Care models target reducing the Total Cost of Care (TCOC) by emphasizing patient outcomes and preventive services, contrasting traditional insurance approaches that often focus on fee-for-service reimbursements. Integrating value-based strategies can lower hospital readmissions and chronic disease management costs, driving efficiency in healthcare spending.

Population Health Analytics

Population health analytics plays a crucial role in value-based care by identifying high-risk patient groups and enabling targeted interventions that improve outcomes while reducing costs. Unlike traditional insurance models focused on fee-for-service payments, value-based care leverages data-driven insights to optimize resource allocation and enhance preventive measures across diverse populations.

Quality Incentive Programs

Quality incentive programs in value-based care prioritize patient outcomes and cost efficiency, directly linking provider reimbursements to performance metrics such as reduced readmissions and preventive care adherence. Traditional insurance models often emphasize service volume over quality, whereas value-based care frameworks empower providers through quality-driven incentives to improve health care delivery and patient satisfaction.

Shared Savings Agreements

Shared Savings Agreements in value-based care promote collaboration between insurers and providers to reduce healthcare costs while maintaining quality, incentivizing providers to deliver efficient, patient-centered care. These agreements align financial rewards with improved health outcomes, contrasting traditional insurance models that emphasize fee-for-service payments.

Outcomes-Based Contracting

Outcomes-based contracting in value-based care aligns insurance reimbursements with patient health results, incentivizing providers to deliver higher-quality care that reduces hospital readmissions and improves chronic disease management. This model shifts financial risk from insurers to providers, promoting cost-efficiency while enhancing patient satisfaction and long-term health outcomes.

Care Coordination Fees

Care coordination fees in value-based care models incentivize providers to manage patient care efficiently across multiple services, reducing hospital readmissions and improving health outcomes. Unlike traditional insurance fee-for-service models that reimburse per procedure, these fees support integrated care teams and comprehensive management, aligning costs with quality rather than volume.

Insurance vs Value-Based Care Infographic

industrydif.com

industrydif.com