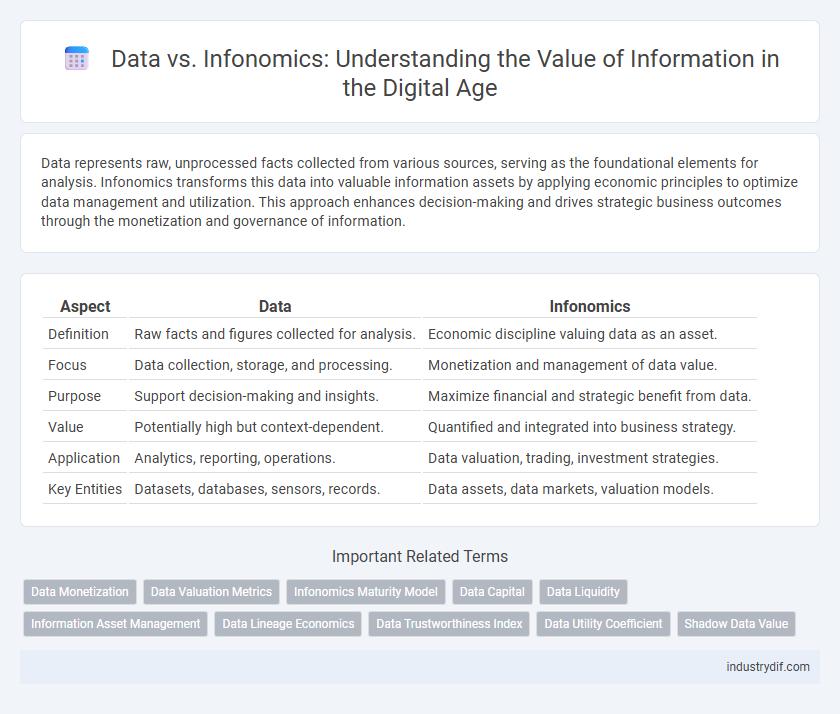

Data represents raw, unprocessed facts collected from various sources, serving as the foundational elements for analysis. Infonomics transforms this data into valuable information assets by applying economic principles to optimize data management and utilization. This approach enhances decision-making and drives strategic business outcomes through the monetization and governance of information.

Table of Comparison

| Aspect | Data | Infonomics |

|---|---|---|

| Definition | Raw facts and figures collected for analysis. | Economic discipline valuing data as an asset. |

| Focus | Data collection, storage, and processing. | Monetization and management of data value. |

| Purpose | Support decision-making and insights. | Maximize financial and strategic benefit from data. |

| Value | Potentially high but context-dependent. | Quantified and integrated into business strategy. |

| Application | Analytics, reporting, operations. | Data valuation, trading, investment strategies. |

| Key Entities | Datasets, databases, sensors, records. | Data assets, data markets, valuation models. |

Defining Data and Infonomics

Data refers to raw, unprocessed facts and figures collected from various sources, serving as the foundational input for analysis and decision-making. Infonomics, a discipline blending information economics and business strategy, treats data as a valuable asset that can be measured, managed, and monetized to enhance organizational value. By defining data as tangible digital assets and applying infonomics principles, businesses can unlock strategic insights and drive competitive advantage.

Key Differences Between Data and Infonomics

Data refers to raw, unprocessed facts and figures, while infonomics treats data as a strategic asset with economic value that can be measured and managed. Infonomics emphasizes data governance, monetization, and the impact of data on business performance, contrasting with data's traditional role in basic recording and analysis. The key difference lies in infonomics' focus on maximizing the financial and operational benefits derived from data utilization.

The Evolution of Data in Business

The evolution of data in business has shifted from basic data collection to strategic asset management through infonomics, emphasizing data as a key economic resource. Infonomics integrates data governance, valuation, and monetization to transform raw data into valuable insights that drive competitive advantage and operational efficiency. Advanced analytics, AI, and machine learning now enable businesses to leverage data beyond traditional roles, enhancing decision-making and creating new revenue streams.

Principles of Infonomics: Treating Data as an Asset

Principles of Infonomics emphasize treating data as a strategic asset with measurable economic value, similar to physical assets. This approach involves rigorous data governance, valuation techniques, and accountability frameworks to optimize data's utility and drive organizational decision-making. By monetizing and managing data assets effectively, enterprises can enhance innovation, compliance, and competitive advantage.

Measuring Data Value: Metrics and Methods

Measuring data value involves quantifying the economic impact, usability, and quality of data through metrics such as accuracy, completeness, timeliness, and relevancy. Infonomics emphasizes financial valuation methods including cost savings, revenue generation, and risk reduction to assess data as a business asset. Techniques like data quality scores, return on data investment (RODI), and data monetization analytics are critical for translating raw data into actionable economic insights.

Data Governance and Infonomics

Data governance establishes frameworks and policies ensuring data quality, security, and compliance across organizational systems. Infonomics applies economic principles to treat data as a valuable asset, emphasizing its monetization, valuation, and strategic management. Integrating data governance with infonomics enhances decision-making by combining regulatory control with economic insights on data utilization.

The Impact of Infonomics on Decision-Making

Infonomics revolutionizes decision-making by quantifying the economic value of data assets, enabling organizations to treat data as a strategic business resource rather than just an operational byproduct. This approach enhances data-driven decisions by integrating data valuation methods, leading to improved risk management, investment prioritization, and innovation strategies. As a result, businesses gain competitive advantages through optimized resource allocation and more accurate forecasting models based on high-quality, economically valued data.

Monetizing Data: Strategies and Examples

Monetizing data involves transforming raw data into valuable assets through strategies like data licensing, subscription services, and targeted advertising. Infonomics emphasizes treating data as a strategic enterprise asset, implementing governance and valuation frameworks to optimize its economic value. Companies like Amazon and Google successfully monetize data by leveraging consumer insights and predictive analytics to drive revenue growth and enhance customer experiences.

Risk Management in Data and Infonomics

Risk management in data involves identifying, assessing, and mitigating threats related to data breaches, loss, and quality issues, ensuring data integrity and security. Infonomics extends this by treating information as a valuable corporate asset, emphasizing strategic governance and economic valuation to optimize risk-adjusted returns. Integrating infonomics principles enhances risk management frameworks by quantifying data-driven risks and aligning them with enterprise value creation.

Future Trends in Data and Infonomics

Future trends in data emphasize the exponential growth of data volume and the increasing adoption of artificial intelligence for advanced analytics. Infonomics is evolving towards monetizing data as a strategic asset, integrating data valuation frameworks to drive business decision-making and improve competitive advantage. Emerging technologies such as blockchain and edge computing are set to enhance data security, governance, and real-time processing in both data management and infonomics practices.

Related Important Terms

Data Monetization

Data monetization transforms raw data into valuable revenue streams by leveraging advanced analytics, AI, and market insights, distinguishing itself from traditional data management which primarily emphasizes storage and accessibility. Infonomics enhances this process by treating data as a strategic asset, optimizing its economic value through policies, governance, and valuation models to maximize business impact and competitive advantage.

Data Valuation Metrics

Data valuation metrics quantify the economic value and utility of data by assessing factors such as accuracy, relevance, timeliness, and completeness. Infonomics emphasizes these metrics to transform raw data into strategic assets that drive informed decision-making and competitive advantage.

Infonomics Maturity Model

The Infonomics Maturity Model evaluates an organization's capability to manage data as a strategic asset by assessing dimensions such as data quality, governance, monetization, and cultural adoption. Higher maturity levels indicate advanced integration of data value realization, driving informed decision-making and competitive advantage beyond traditional data management approaches.

Data Capital

Data capital refers to the strategic value derived from organizing, managing, and leveraging data assets to drive business growth and innovation. Infonomics highlights how treating data as a formal business asset, rather than a byproduct, transforms raw data into measurable capital that enhances decision-making and competitive advantage.

Data Liquidity

Data liquidity measures how easily data flows and is accessed across systems, enhancing value extraction and operational efficiency. Infonomics emphasizes data as a strategic asset, advocating for governance and policies that maximize data liquidity to drive informed decision-making and business innovation.

Information Asset Management

Data represents raw facts and figures, while Infonomics treats data as a strategic business asset, emphasizing Information Asset Management to maximize its value. Effective Information Asset Management integrates data governance, quality, and analytics to drive informed decision-making and enhance organizational performance.

Data Lineage Economics

Data lineage economics examines the cost-benefit analysis of tracing data flow from origin to destination, optimizing data quality and compliance while reducing operational risks. Infonomics integrates these economic principles with data governance to quantify the value and impact of accurate data lineage in strategic business decisions.

Data Trustworthiness Index

The Data Trustworthiness Index measures the reliability, accuracy, and security of data assets, serving as a critical component in Infonomics to quantify data's economic value. This index enhances decision-making by ensuring data integrity and fostering trust in data-driven processes within organizations.

Data Utility Coefficient

Data utility coefficient quantifies the practical value derived from data sets by measuring relevance, accuracy, timeliness, and completeness, which directly impacts business decisions and operational efficiency. Infonomics emphasizes this coefficient as a key metric to assign economic value to data assets, transforming raw data into strategic corporate resources.

Shadow Data Value

Shadow data generates hidden value by capturing unstructured or unmanaged information outside formal data governance, often overlooked yet rich in insights. Infonomics emphasizes monetizing all data--including shadow data--by quantifying its business impact to optimize strategic decision-making and operational efficiency.

Data vs Infonomics Infographic

industrydif.com

industrydif.com