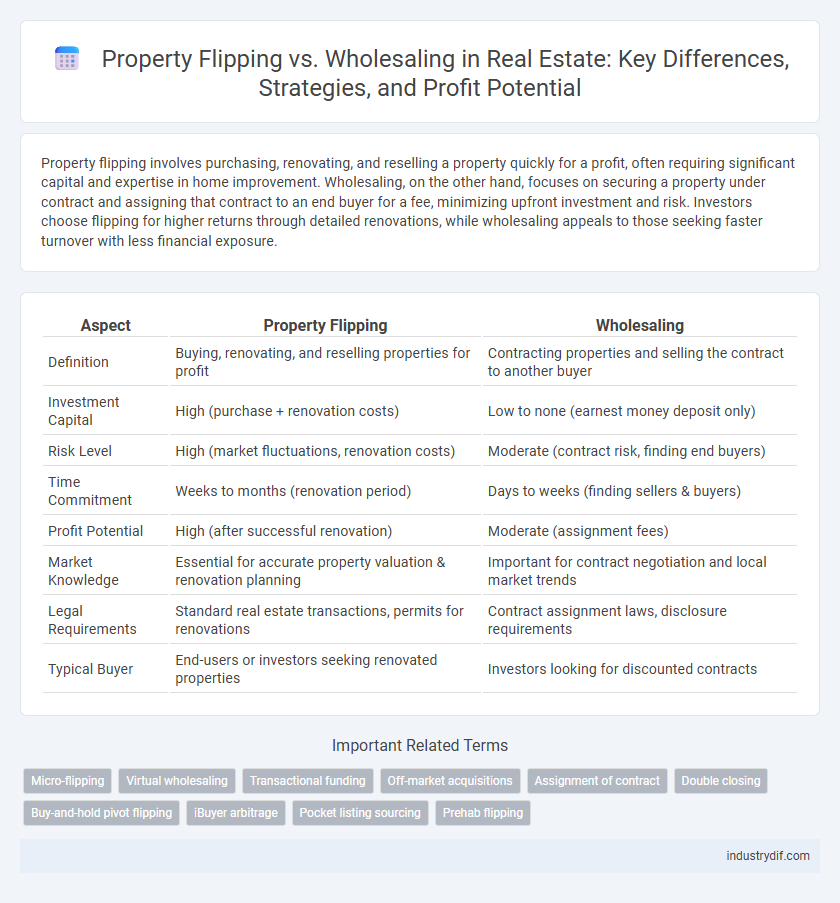

Property flipping involves purchasing, renovating, and reselling a property quickly for a profit, often requiring significant capital and expertise in home improvement. Wholesaling, on the other hand, focuses on securing a property under contract and assigning that contract to an end buyer for a fee, minimizing upfront investment and risk. Investors choose flipping for higher returns through detailed renovations, while wholesaling appeals to those seeking faster turnover with less financial exposure.

Table of Comparison

| Aspect | Property Flipping | Wholesaling |

|---|---|---|

| Definition | Buying, renovating, and reselling properties for profit | Contracting properties and selling the contract to another buyer |

| Investment Capital | High (purchase + renovation costs) | Low to none (earnest money deposit only) |

| Risk Level | High (market fluctuations, renovation costs) | Moderate (contract risk, finding end buyers) |

| Time Commitment | Weeks to months (renovation period) | Days to weeks (finding sellers & buyers) |

| Profit Potential | High (after successful renovation) | Moderate (assignment fees) |

| Market Knowledge | Essential for accurate property valuation & renovation planning | Important for contract negotiation and local market trends |

| Legal Requirements | Standard real estate transactions, permits for renovations | Contract assignment laws, disclosure requirements |

| Typical Buyer | End-users or investors seeking renovated properties | Investors looking for discounted contracts |

Understanding Property Flipping

Property flipping involves purchasing a property, renovating it to increase its market value, and selling it quickly for a profit, focusing on maximizing return on investment through strategic improvements. Investors need a thorough understanding of market trends, renovation costs, and resale potential to effectively execute property flipping. Skilled flippers analyze comparable properties and buyer demand to ensure the renovated property attracts competitive offers and timely sales.

What is Real Estate Wholesaling?

Real estate wholesaling involves securing a property under contract and then assigning that contract to an end buyer for a profit, without taking ownership of the property. This method requires minimal upfront capital and limited risk compared to property flipping, which involves purchasing, renovating, and reselling a property. Wholesalers focus on building a network of motivated sellers and cash buyers to facilitate quick property transactions.

Key Differences Between Flipping and Wholesaling

Property flipping involves purchasing, renovating, and reselling a property for a profit, requiring upfront capital and hands-on management. Wholesaling focuses on securing a property under contract and assigning that contract to an end buyer without taking ownership, which minimizes financial risk and capital requirements. Flipping demands market knowledge, renovation skills, and timing, while wholesaling relies heavily on networking and negotiation expertise.

Startup Costs: Flipping vs Wholesaling

Property flipping requires significant startup costs including purchasing the property, renovation expenses, and carrying costs such as taxes and insurance, often totaling tens of thousands of dollars or more. Wholesaling demands minimal upfront investment, usually limited to marketing, earnest money deposits, and possibly inspection fees, making it accessible with relatively low capital. Flipping involves higher financial risk and capital commitment, whereas wholesaling prioritizes speed and lower entry barriers in real estate transactions.

Required Skills and Experience

Property flipping demands strong skills in market analysis, renovation management, and financing, with experience in construction and real estate trends being crucial for quick, profitable resales. Wholesaling requires expertise in negotiation, contract assignment, and lead generation, with a deep understanding of local real estate markets and legal processes to secure deals without property ownership. Both strategies benefit significantly from networking and knowledge of buyer preferences to maximize returns.

Risk Factors in Each Strategy

Property flipping involves higher financial risk due to upfront investment in renovation, market fluctuations, and holding costs, which can lead to significant losses if the property doesn't sell quickly. Wholesaling carries comparatively lower financial exposure since wholesalers assign contracts without purchasing properties, but it demands strong networking and market knowledge to avoid legal pitfalls and contract disputes. Both strategies require careful risk management, but flipping's capital commitment and market dependency pose greater potential hazards compared to wholesaling's transactional risks.

Profit Potential Comparison

Property flipping generally offers higher profit potential due to value-adding renovations that can significantly increase resale prices, often yielding returns of 20% to 50% per project. Wholesaling typically involves lower risk and quicker turnover, with profits primarily derived from assignment fees averaging 5% to 10% of the property's purchase price. Investors seeking substantial long-term gains may prefer flipping, while those prioritizing cash flow and minimal investment often lean toward wholesaling.

Time Investment Analysis

Property flipping requires a significant time investment for property acquisition, renovation, and resale, often spanning several months to maximize profit margins. Wholesaling demands less time, focusing primarily on finding motivated sellers and buyers to quickly assign contracts, typically closing deals within weeks. Investors prioritizing faster returns and lower time commitments often prefer wholesaling over the extended timelines involved in property flipping.

Legal Considerations and Compliance

Property flipping requires thorough adherence to state disclosure laws, including timely reporting of renovations and accurately disclosing property conditions to avoid legal liabilities. Wholesaling hinges on compliance with real estate licensing requirements and contract assignments, with failure to secure proper licenses potentially resulting in fines or lawsuits. Both strategies demand strict adherence to local zoning regulations and truth-in-advertising laws to maintain legal integrity and avoid penalties.

Choosing the Right Strategy for Your Goals

Property flipping involves purchasing, renovating, and quickly reselling homes for profit, appealing to investors with capital and renovation expertise. Wholesaling focuses on securing property contracts and assigning them to buyers, requiring less upfront investment and ideal for those seeking fast turnover without extensive repairs. Selecting between property flipping and wholesaling depends on financial resources, risk tolerance, market knowledge, and desired time commitment to maximize returns.

Related Important Terms

Micro-flipping

Micro-flipping involves quickly buying and reselling properties with minimal holding time and renovation, targeting small profit margins through fast transactions, unlike traditional property flipping which requires extensive rehab and longer market exposure. This strategy shares similarities with wholesaling by capitalizing on rapid turnover, but micro-flippers take ownership of the property briefly, benefiting from quick asset appreciation in competitive real estate markets.

Virtual wholesaling

Virtual wholesaling in real estate offers a low-risk method to flip properties by securing contracts remotely and assigning them to buyers without owning the property. This strategy eliminates the need for physical property inspections, reducing overhead costs and expanding market reach beyond local limitations.

Transactional funding

Transactional funding plays a crucial role in both property flipping and wholesaling by providing short-term capital to complete deals quickly without long-term financial risk. Unlike traditional loans, this funding enables investors to secure properties and resell them within a 24- to 72-hour window, maximizing profit margins in competitive real estate markets.

Off-market acquisitions

Property flipping involves purchasing off-market properties, renovating them, and quickly reselling for profit, capitalizing on market inefficiencies and undervalued assets. Wholesaling off-market deals requires securing purchase contracts at below-market prices and assigning them to investors, enabling low capital investment with rapid turnover in real estate transactions.

Assignment of contract

Assignment of contract in property flipping involves a buyer securing a property under contract and transferring their purchase rights to another investor for a profit, enabling quick turnaround without property ownership. Wholesaling leverages contract assignments as the primary strategy, requiring minimal capital and focusing on connecting motivated sellers with end buyers through binding agreements instead of traditional transactions.

Double closing

Double closing in real estate involves simultaneous transactions where an investor purchases a property and immediately resells it, requiring two separate closings on the same day to maintain ownership transfer privacy. This technique is commonly used in property flipping to secure a quick profit without assigning contracts, unlike wholesaling which generally relies on contract assignments and lower upfront capital.

Buy-and-hold pivot flipping

Property flipping targets quick resale after renovations for fast profits, whereas wholesaling involves assigning a contract without property ownership; the buy-and-hold pivot flipping strategy combines holding assets to build equity before flipping to capitalize on market appreciation and rental income potential. This hybrid approach leverages long-term value growth and cash flow benefits, optimizing investment returns in dynamic real estate markets.

iBuyer arbitrage

iBuyer arbitrage leverages instant cash offers to buy properties below market value, enabling quick resale profits similar to property flipping without extensive renovations. Unlike traditional wholesaling, iBuyer arbitrage capitalizes on algorithm-driven pricing and fast transactions, reducing holding time and increasing deal turnover in competitive real estate markets.

Pocket listing sourcing

Pocket listing sourcing in property flipping involves acquiring exclusive, off-market properties to renovate and resell for profit, maximizing control over purchase price and market timing. In wholesaling, pocket listings enable investors to quickly assign contracts to end buyers without public exposure, streamlining deal flow and reducing competition.

Prehab flipping

Prehab flipping involves purchasing undervalued properties and making essential repairs to increase market value quickly, optimizing return on investment compared to traditional flipping that requires extensive renovations. Unlike wholesaling, which centers on assigning contracts without property improvements, prehab flipping demands strategic repairs to attract buyers while minimizing holding costs and time on market.

Property Flipping vs Wholesaling Infographic

industrydif.com

industrydif.com