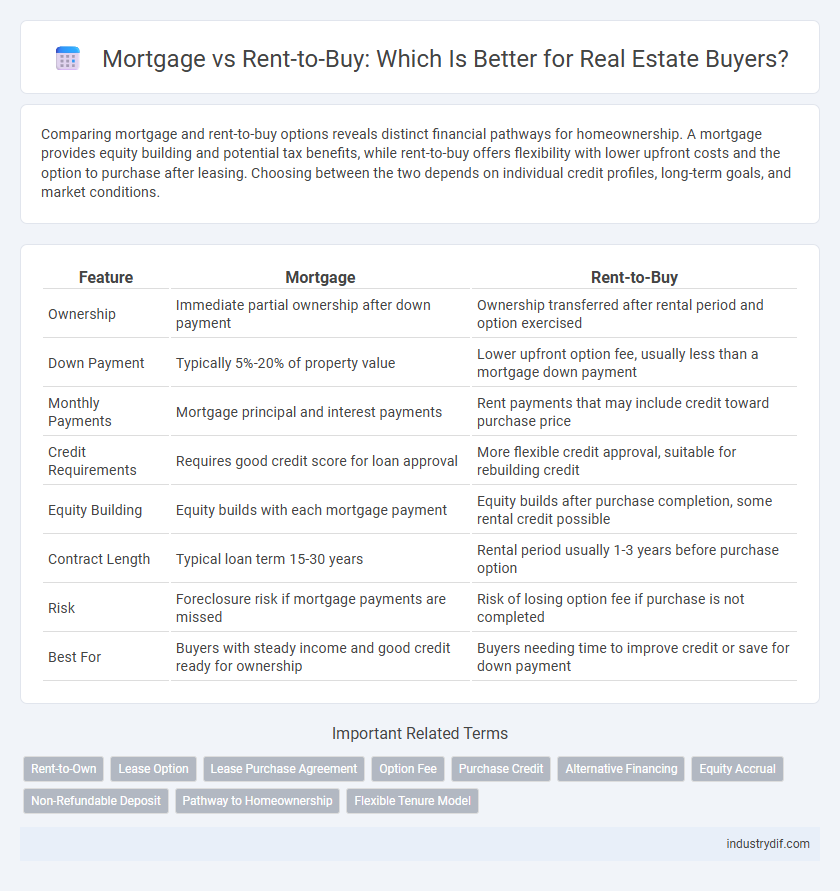

Comparing mortgage and rent-to-buy options reveals distinct financial pathways for homeownership. A mortgage provides equity building and potential tax benefits, while rent-to-buy offers flexibility with lower upfront costs and the option to purchase after leasing. Choosing between the two depends on individual credit profiles, long-term goals, and market conditions.

Table of Comparison

| Feature | Mortgage | Rent-to-Buy |

|---|---|---|

| Ownership | Immediate partial ownership after down payment | Ownership transferred after rental period and option exercised |

| Down Payment | Typically 5%-20% of property value | Lower upfront option fee, usually less than a mortgage down payment |

| Monthly Payments | Mortgage principal and interest payments | Rent payments that may include credit toward purchase price |

| Credit Requirements | Requires good credit score for loan approval | More flexible credit approval, suitable for rebuilding credit |

| Equity Building | Equity builds with each mortgage payment | Equity builds after purchase completion, some rental credit possible |

| Contract Length | Typical loan term 15-30 years | Rental period usually 1-3 years before purchase option |

| Risk | Foreclosure risk if mortgage payments are missed | Risk of losing option fee if purchase is not completed |

| Best For | Buyers with steady income and good credit ready for ownership | Buyers needing time to improve credit or save for down payment |

Understanding Mortgage and Rent-to-Buy: Key Definitions

A mortgage is a loan specifically used to purchase real estate, where the buyer makes monthly payments to repay the principal and interest over time. Rent-to-buy, also known as lease-to-own, allows tenants to rent a property with an option to purchase it later, often applying a portion of rent payments toward the down payment. Understanding these key definitions helps potential homeowners weigh long-term financial commitments against short-term flexibility in real estate investments.

How the Mortgage Process Works in Real Estate

The mortgage process in real estate involves a thorough application review, including credit checks, income verification, and property appraisal to determine loan eligibility and terms. Lenders assess risk by analyzing financial documents and set interest rates based on market conditions and borrower profiles. Once approved, the mortgage agreement details payment schedules, principal amounts, and interest rates, providing a structured path to homeownership.

Exploring the Rent-to-Buy Model: An Overview

The rent-to-buy model offers a hybrid approach where tenants pay rent with a portion applied toward the future purchase of the property, providing a pathway to homeownership without immediate full financing. This arrangement benefits buyers by allowing accumulation of equity while living in the home, often appealing to those with limited credit or saving capability for down payments. Sellers gain steady rental income and a committed buyer, reducing market exposure and potential vacancies during the contract period.

Major Differences Between Mortgage and Rent-to-Buy

Mortgage involves securing a loan to purchase property outright, with monthly payments toward ownership and accruing equity over time. Rent-to-buy allows tenants to lease a home with an option to purchase later, where a portion of rent may contribute to the eventual down payment. Mortgages require qualifying for credit and typically involve long-term financial commitment, whereas rent-to-buy offers flexibility with lower initial costs but may include higher overall payments or forfeited rent if the purchase option is declined.

Financial Implications: Mortgage vs Rent-to-Buy

Mortgage payments typically build home equity over time, offering long-term financial benefits, whereas rent-to-buy agreements involve higher monthly rent that may partly contribute to a future down payment but often lack immediate equity growth. Mortgage loans require upfront costs like down payments, closing fees, and interest, resulting in potentially lower overall expenses compared to rent-to-buy's premium rents and option fees. Rent-to-buy can provide flexibility for buyers with limited credit or savings but usually entails higher total payments compared to traditional mortgage financing.

Pros and Cons of Taking a Mortgage

Taking a mortgage provides long-term homeownership stability and potential property appreciation, making it an investment in real estate equity. However, mortgages involve significant upfront costs such as down payments and closing fees, along with ongoing financial obligations like interest payments and property taxes. Borrowers face risks of foreclosure if unable to meet payment schedules, contrasting with the lower initial commitment and flexibility offered by rent-to-buy options.

Advantages and Drawbacks of Rent-to-Buy Agreements

Rent-to-buy agreements offer the advantage of allowing tenants to lock in a purchase price while building equity through rental payments, making homeownership accessible for those with insufficient upfront funds or credit challenges. However, these agreements often require higher monthly payments and may include non-refundable option fees, posing financial risks if the tenant decides not to purchase. The lack of standardized regulations in rent-to-buy contracts can result in ambiguous terms, potentially leading to disputes over maintenance responsibilities and purchase conditions.

Eligibility Requirements for Mortgage and Rent-to-Buy

Mortgage eligibility requirements typically include a strong credit score, steady income verification, a low debt-to-income ratio, and a down payment ranging from 3% to 20%. Rent-to-buy programs often require a rental history with timely payments, an option fee as a percentage of the purchase price, and sometimes proof of intent to purchase within a specified period. Lenders and sellers assess financial stability differently, with mortgages demanding stricter credit checks while rent-to-buy focuses more on rental reliability and future purchase commitment.

Long-Term Ownership: Comparing Mortgage and Rent-to-Buy

Mortgage offers a clear path to long-term ownership by allowing buyers to build equity with each payment, ultimately resulting in full property ownership once the loan is paid off. Rent-to-buy, however, combines rental payments with an option to purchase, providing flexibility but often involving higher total costs and less immediate equity accumulation. Evaluating property value trends, interest rates, and individual financial stability is crucial when choosing between mortgage and rent-to-buy for sustained homeownership.

Which Option Fits Your Real Estate Goals?

Choosing between a mortgage and rent-to-buy depends on your financial stability and long-term property goals; a mortgage offers equity buildup and potential tax benefits, ideal for those ready to commit to homeownership. Rent-to-buy allows flexibility with lower upfront costs and an option to purchase later, suited for buyers needing time to improve credit or save for a down payment. Assess market conditions, your credit score, and future plans to determine which option aligns best with your real estate investment strategy.

Related Important Terms

Rent-to-Own

Rent-to-own offers a flexible pathway to homeownership by allowing tenants to apply a portion of their rent towards the eventual purchase price, making it ideal for buyers with limited credit or savings. This arrangement provides the opportunity to lock in a purchase price while building equity, reducing barriers compared to traditional mortgages.

Lease Option

Lease option agreements provide homebuyers the flexibility to rent a property with the exclusive option to purchase it later, often applying a portion of the rent toward the down payment. This alternative to traditional mortgages can benefit those needing time to improve credit or save funds while securing a future purchase price.

Lease Purchase Agreement

A Lease Purchase Agreement combines renting and buying, allowing tenants to lease a property with an option to purchase it later, often applying a portion of rent toward the down payment. This strategy benefits buyers with limited credit or savings by securing homeownership while living in the property, differing from traditional mortgages that require immediate financing approval.

Option Fee

The option fee in rent-to-buy agreements typically ranges from 1% to 5% of the property's purchase price, granting tenants the exclusive right to buy later while applying this fee toward the down payment. In contrast, mortgages require a substantial upfront down payment--often 10% to 20%--without an option fee, directly affecting initial buyer investment and loan terms.

Purchase Credit

Mortgage offers long-term purchase credit through structured loan repayments that build home equity over time, while Rent-to-Buy provides a portion of rent payments credited towards the property's purchase price, allowing gradual accumulation of purchase credit without immediate full financing. Rent-to-Buy agreements typically require lower upfront costs compared to traditional mortgages, making homeownership more accessible for buyers with limited credit history or savings.

Alternative Financing

Mortgage financing typically offers lower long-term costs and builds equity, making it a preferred choice for homebuyers with strong credit and stable income. Rent-to-buy serves as an alternative financing method for those facing credit challenges or short-term financial constraints, allowing gradual equity accumulation while living in the property.

Equity Accrual

Mortgage payments build home equity by gradually converting monthly installments into ownership stakes, allowing homeowners to accumulate wealth over time. Rent-to-buy agreements offer limited equity accrual, often only after completing the lease term and exercise of the purchase option, making mortgage plans more effective for long-term investment growth.

Non-Refundable Deposit

A non-refundable deposit in a rent-to-buy agreement secures the option to purchase a property and is often credited toward the final purchase price, providing a low-risk commitment compared to a mortgage down payment. Unlike mortgage payments, which contribute to home equity, rent-to-buy deposits may be forfeited if the buyer decides not to proceed, making it essential to evaluate financial readiness before committing.

Pathway to Homeownership

Mortgage provides a direct pathway to homeownership through long-term financing that builds equity and ownership rights from the start. Rent-to-buy offers a flexible alternative allowing renters to apply part of their payments toward a future purchase, easing the transition into homeownership while mitigating upfront costs.

Flexible Tenure Model

The flexible tenure model in rent-to-buy agreements offers tenants the option to transition from renting to ownership while adjusting terms based on financial readiness, contrasting with traditional mortgages that require fixed loan durations and immediate qualification criteria. This model provides adaptability in payment schedules and commitment length, catering to buyers needing gradual equity accumulation without the stringent upfront requirements of conventional mortgage lending.

Mortgage vs Rent-to-Buy Infographic

industrydif.com

industrydif.com