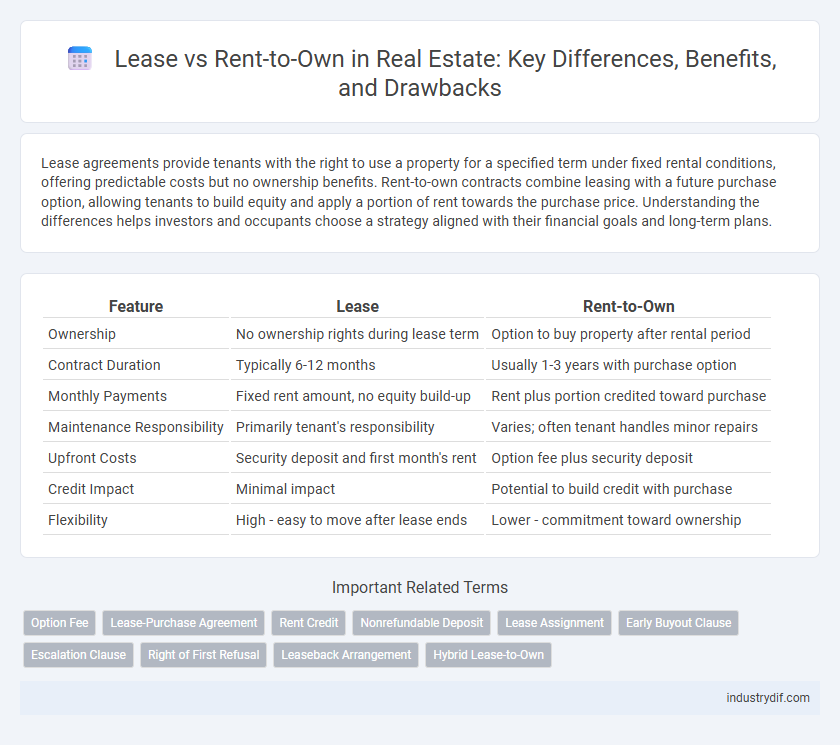

Lease agreements provide tenants with the right to use a property for a specified term under fixed rental conditions, offering predictable costs but no ownership benefits. Rent-to-own contracts combine leasing with a future purchase option, allowing tenants to build equity and apply a portion of rent towards the purchase price. Understanding the differences helps investors and occupants choose a strategy aligned with their financial goals and long-term plans.

Table of Comparison

| Feature | Lease | Rent-to-Own |

|---|---|---|

| Ownership | No ownership rights during lease term | Option to buy property after rental period |

| Contract Duration | Typically 6-12 months | Usually 1-3 years with purchase option |

| Monthly Payments | Fixed rent amount, no equity build-up | Rent plus portion credited toward purchase |

| Maintenance Responsibility | Primarily tenant's responsibility | Varies; often tenant handles minor repairs |

| Upfront Costs | Security deposit and first month's rent | Option fee plus security deposit |

| Credit Impact | Minimal impact | Potential to build credit with purchase |

| Flexibility | High - easy to move after lease ends | Lower - commitment toward ownership |

Key Definitions: Lease vs Rent-to-Own

A lease is a contractual agreement where a tenant pays a fixed amount for the right to occupy a property over a specified term without ownership rights. Rent-to-own combines renting with an option to purchase, allowing tenants to apply part of their rent toward buying the property at a later date. This hybrid model offers a pathway to homeownership while providing flexibility compared to traditional leasing.

Structural Differences in Agreements

Lease agreements establish a fixed-term contract where tenants pay rent to occupy a property without acquiring ownership rights, typically lasting six months to a year. Rent-to-own contracts combine renting with a future purchase option, allowing a portion of monthly payments to be credited toward the down payment or purchase price. Structural differences include lease agreements focusing on tenant rights and responsibilities, while rent-to-own agreements detail purchase terms, option fees, and conditions for exercising ownership rights.

Financial Commitment and Payment Terms

Lease agreements require a fixed monthly payment for a specified term, often with a security deposit, providing predictable financial commitment and no ownership equity accumulation. Rent-to-own contracts blend rental payments with a portion credited towards future property purchase, allowing gradual equity build-up but typically involving higher monthly costs and option fees. Understanding these payment structures is crucial for budgeting and long-term financial planning in property acquisition.

Legal Implications and Tenant Rights

Lease agreements legally bind tenants to fixed-term commitments with clearly defined rights and responsibilities, often providing stronger tenant protections under landlord-tenant laws. Rent-to-own contracts combine rental and purchase options, which may complicate tenant rights due to the hybrid nature of the agreement and varying state regulations. Understanding local real estate laws and consulting legal professionals are crucial to navigating potential disputes and ensuring compliance in both lease and rent-to-own arrangements.

Flexibility and Exit Strategies

Lease agreements offer fixed terms with limited flexibility, typically requiring tenants to fulfill the contract duration or face penalties. Rent-to-own arrangements provide more adaptable exit strategies, allowing renters to apply rental payments toward ownership while retaining the option to walk away before purchase. This hybrid model balances commitment with the opportunity to evaluate the property before fully investing.

Property Ownership Pathways

Lease agreements provide tenants with temporary property usage rights, typically without equity accumulation, and involve fixed monthly payments for a specified term. Rent-to-own contracts combine rental payments with an option to purchase the property, allowing tenants to build equity while living in the home and apply a portion of rent toward the down payment. This pathway offers a flexible route to property ownership, accommodating buyers with limited initial capital or credit challenges.

Credit Impact and Financial Planning

Lease agreements typically have minimal direct impact on credit scores since payments are not always reported to credit bureaus, whereas rent-to-own contracts may influence credit if structured with timely payment reporting. Rent-to-own options can enhance financial planning by building equity over time, offering a path to homeownership while improving creditworthiness through consistent payments. Understanding the credit implications of each option is essential for effective budget management and long-term financial stability in real estate transactions.

Maintenance and Repair Responsibilities

Lease agreements typically assign maintenance and repair responsibilities to the landlord, ensuring tenants are not burdened with major repairs during the contract term. Rent-to-own contracts often require tenants to take on more maintenance duties, as they are prospective buyers investing in the property's upkeep. Understanding the specific clauses regarding property care in each agreement type is crucial for managing costs and responsibilities effectively.

Ideal Candidate Profiles

Lease agreements are ideal for tenants seeking short-term housing solutions with stable monthly payments and minimal long-term commitments. Rent-to-own arrangements suit individuals aiming to build home equity while improving credit scores, often favoring those who may not currently qualify for traditional mortgages. Investors and families planning eventual homeownership benefit most from rent-to-own contracts, whereas renters prioritizing flexibility and lower upfront costs typically prefer standard leases.

Pros and Cons Comparison Chart

Lease agreements provide tenants with fixed rental terms and predictable costs, making budgeting easier, but they often lack flexibility and do not build equity. Rent-to-own contracts allow tenants to apply a portion of rent towards purchasing the property, offering a pathway to homeownership and credit improvement, yet they usually involve higher monthly payments and potential forfeiture of premiums if the purchase is not completed. Comparing these options reveals that leases suit short-term housing needs with less financial risk, while rent-to-own suits buyers aiming for ownership despite upfront cost and commitment challenges.

Related Important Terms

Option Fee

The option fee in a lease versus rent-to-own agreement serves as a non-refundable payment securing the tenant's right to purchase the property, typically ranging from 1% to 5% of the property's purchase price. This fee is credited toward the down payment in rent-to-own contracts, whereas in standard leases, it usually does not contribute to future home equity.

Lease-Purchase Agreement

A Lease-Purchase Agreement combines elements of both leasing and buying, allowing tenants to live in the property with the option to purchase it after a specified lease term, often applying a portion of the rent toward the down payment. This agreement benefits buyers who need time to improve credit or save funds while locking in a purchase price and securing property control during the lease period.

Rent Credit

Rent-to-own agreements often include a rent credit, which is a portion of the monthly rent applied toward the future purchase price, enabling tenants to build equity while living in the property. Unlike traditional leases, rent credits provide a financial incentive that helps tenants accumulate funds for a down payment, making homeownership more accessible over time.

Nonrefundable Deposit

In real estate, lease agreements typically require a refundable security deposit, whereas rent-to-own contracts often involve a nonrefundable deposit that contributes toward the eventual purchase price. This nonrefundable deposit provides sellers with financial assurance and incentivizes buyers to commit to the home's purchase, differentiating it fundamentally from standard rental arrangements.

Lease Assignment

Lease assignment allows tenants to transfer their remaining lease term and responsibilities to a new party, providing flexibility in long-term rental agreements. This contrasts with rent-to-own arrangements, where payments contribute toward eventual property ownership rather than simply transferring lease obligations.

Early Buyout Clause

The early buyout clause in lease vs rent-to-own agreements allows tenants to purchase the property before the lease term ends, often applying a portion of paid rent toward the down payment. This clause provides flexibility and financial advantage, enabling buyers to secure ownership while potentially avoiding higher market prices.

Escalation Clause

An escalation clause in a lease or rent-to-own agreement automatically increases the payment amount based on predetermined factors like inflation or market value changes, protecting landlords from loss of income over time. This clause is more common in lease agreements but can be tailored in rent-to-own contracts to adjust monthly payments while providing tenants with a path to homeownership.

Right of First Refusal

The Right of First Refusal in lease agreements grants tenants the priority to purchase the property before the landlord accepts other offers, offering a strategic advantage over traditional lease terms. In rent-to-own contracts, this right is often embedded to ensure tenants can secure ownership, aligning rental payments towards equity accumulation and future purchase.

Leaseback Arrangement

A leaseback arrangement allows property owners to sell their real estate while simultaneously leasing it back from the buyer, providing immediate capital without relocating. This strategy differs from rent-to-own by enabling sellers to retain operational control, making it a preferred option for businesses needing liquidity alongside continued property use.

Hybrid Lease-to-Own

Hybrid Lease-to-Own agreements combine elements of traditional leasing and rent-to-own contracts, allowing tenants to lease a property with a portion of their rent applied toward the eventual purchase price. This arrangement offers flexibility for buyers who may need time to improve credit or save for a down payment while securing the option to buy at a predetermined price.

Lease vs Rent-to-Own Infographic

industrydif.com

industrydif.com