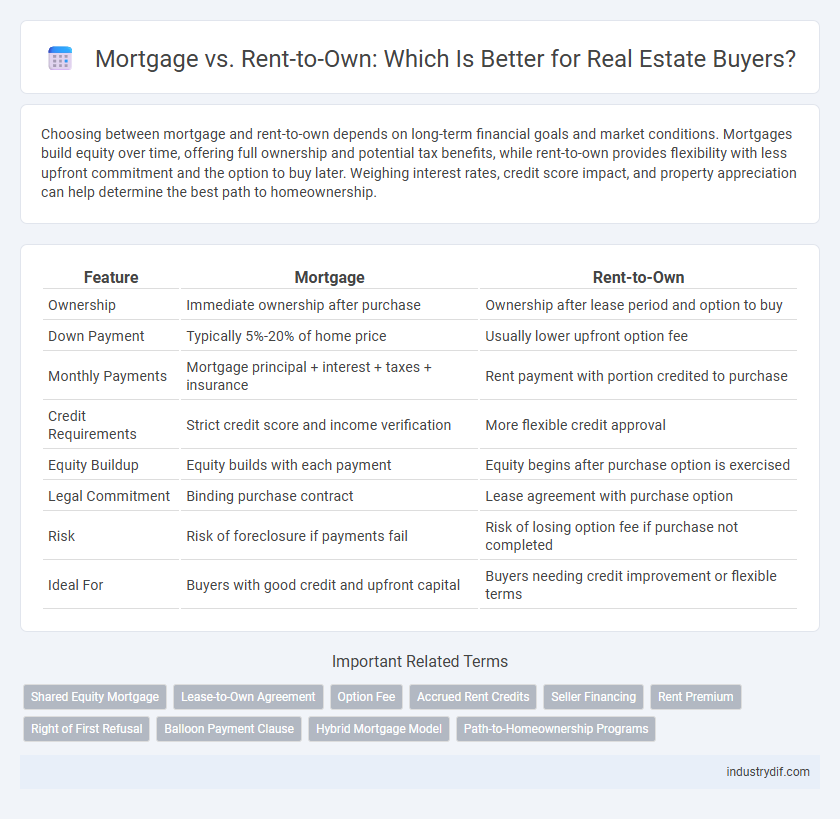

Choosing between mortgage and rent-to-own depends on long-term financial goals and market conditions. Mortgages build equity over time, offering full ownership and potential tax benefits, while rent-to-own provides flexibility with less upfront commitment and the option to buy later. Weighing interest rates, credit score impact, and property appreciation can help determine the best path to homeownership.

Table of Comparison

| Feature | Mortgage | Rent-to-Own |

|---|---|---|

| Ownership | Immediate ownership after purchase | Ownership after lease period and option to buy |

| Down Payment | Typically 5%-20% of home price | Usually lower upfront option fee |

| Monthly Payments | Mortgage principal + interest + taxes + insurance | Rent payment with portion credited to purchase |

| Credit Requirements | Strict credit score and income verification | More flexible credit approval |

| Equity Buildup | Equity builds with each payment | Equity begins after purchase option is exercised |

| Legal Commitment | Binding purchase contract | Lease agreement with purchase option |

| Risk | Risk of foreclosure if payments fail | Risk of losing option fee if purchase not completed |

| Ideal For | Buyers with good credit and upfront capital | Buyers needing credit improvement or flexible terms |

Understanding Mortgage Agreements

Mortgage agreements outline the terms of a loan secured by real estate, including interest rates, repayment schedules, and potential penalties for default. These contracts legally bind homeowners to monthly payments over a set period, often 15 to 30 years, impacting long-term financial planning. Understanding mortgage clauses such as escrow accounts, adjustable rates, and prepayment options is crucial for informed decision-making in homeownership.

What Is Rent-to-Own in Real Estate?

Rent-to-own in real estate is a financing arrangement where tenants lease a property with the option to purchase it after a specified period, allowing part of the rent to be credited toward the down payment. This approach benefits buyers who need time to improve credit scores or save for a down payment, while providing sellers with steady income and potential sale security. Rent-to-own contracts typically outline the purchase price, rental terms, and option fee, creating a flexible path to homeownership.

Key Differences Between Mortgage and Rent-to-Own

Mortgage agreements involve borrowers obtaining a loan to purchase property outright with fixed or variable interest rates, resulting in full ownership after loan repayment. Rent-to-own contracts allow tenants to rent a property with an option to buy later, where a portion of monthly rent contributes to the future purchase price, offering flexibility without immediate mortgage qualification. Key differences include immediate equity accumulation in mortgages versus deferred ownership in rent-to-own, along with varying financial commitments and credit requirements.

Financial Implications: Mortgage vs Rent-to-Own

Mortgage payments typically build equity over time, offering potential tax benefits such as interest deductions, whereas rent-to-own agreements often include higher monthly payments with a portion applied to the future purchase price but lack traditional mortgage tax advantages. Rent-to-own arrangements may require upfront option fees that are non-refundable, impacting overall financial planning, while mortgages usually involve down payments and closing costs that are part of the loan principal. Long-term financial implications favor mortgages for building homeownership wealth, but rent-to-own can provide a pathway for buyers with challenged credit to transition into ownership.

Eligibility Requirements for Mortgage vs Rent-to-Own

Mortgage eligibility requirements typically include a strong credit score, stable income verification, and a down payment of 3% to 20%, making it accessible mainly to financially prepared buyers. Rent-to-own agreements often have more flexible qualifications, allowing individuals with lower credit scores or limited savings to gradually build equity while living in the property. Understanding these eligibility differences helps buyers choose the best path toward homeownership based on their financial situation and credit history.

Flexibility and Commitment Levels

Mortgage agreements typically require long-term commitment with fixed monthly payments, ensuring property ownership upon completion. Rent-to-own options offer greater flexibility by combining rental payments with the option to purchase later, often accommodating buyers who need time to improve credit or save for a down payment. This arrangement allows tenants to test the property and neighborhood before committing to full ownership, reducing financial risk compared to traditional mortgages.

Pros and Cons of Mortgage Financing

Mortgage financing offers the advantage of building equity over time and generally provides lower monthly payments compared to rent-to-own agreements, making it a cost-effective long-term investment for homebuyers. However, mortgages require strong credit scores, substantial down payments, and incur long-term debt obligations with potential risks of foreclosure. Homeowners gain tax benefits and predictable payments through fixed rates, but must also handle maintenance costs and market fluctuations that can affect property value.

Rent-to-Own: Advantages and Drawbacks

Rent-to-own offers the advantage of building equity while living in the home, providing a pathway to ownership without immediate mortgage qualification. It allows for flexible terms and the opportunity to lock in a purchase price, which can be beneficial in a rising market. However, drawbacks include potentially higher monthly payments, the risk of losing invested option fees if the purchase is not completed, and limited control over the property until ownership is finalized.

Common Misconceptions in Home Financing

Mortgage vs rent-to-own often brings confusion regarding ownership timing and financial commitment; a mortgage secures immediate equity accumulation through loan repayment, while rent-to-own delays ownership until purchase terms are met. Many believe rent-to-own is easier credit-wise, but it often requires a higher upfront option fee and can result in forfeiting equity if the purchase is not completed. Misunderstandings about long-term costs, contract obligations, and credit impact can lead to unexpected financial challenges in both financing routes.

Choosing the Best Option: Mortgage or Rent-to-Own

Evaluating mortgage versus rent-to-own options requires analyzing financial stability, long-term goals, and market conditions. Mortgages generally build equity over time with fixed payments and potential tax benefits, while rent-to-own contracts offer flexibility with smaller upfront costs but often higher overall expenses. Buyers should consider credit scores, down payment availability, and the likelihood of home appreciation to determine the most advantageous path.

Related Important Terms

Shared Equity Mortgage

Shared equity mortgages enable homebuyers to co-invest with a lender or investor, reducing upfront costs and monthly payments compared to traditional mortgages or rent-to-own arrangements. This model aligns interests by allowing both parties to share property appreciation or depreciation, offering a flexible alternative for buyers struggling with conventional financing.

Lease-to-Own Agreement

Lease-to-own agreements provide an alternative path to homeownership by allowing tenants to apply a portion of their rent toward the purchase price, combining renting and buying benefits. This arrangement benefits buyers with limited upfront capital or credit challenges, while sellers receive steady rental income and a committed tenant-buyer.

Option Fee

In rent-to-own agreements, the option fee is a non-refundable upfront payment that secures the right to purchase the property later, typically ranging from 1% to 5% of the home's purchase price. Unlike a mortgage down payment, this fee does not build equity but is often credited toward the final purchase price if the buyer exercises the option to buy.

Accrued Rent Credits

Accrued rent credits in rent-to-own agreements allow tenants to apply a portion of their monthly rent towards the future down payment, effectively building equity before homeownership. Unlike traditional mortgages, where equity accrues through principal payments and property appreciation, rent-to-own setups provide gradual credit accumulation that can reduce upfront financing needs.

Seller Financing

Seller financing in mortgage vs rent-to-own agreements offers buyers flexible payment terms directly with the seller, bypassing traditional lenders and credit checks. This arrangement often includes negotiated interest rates and down payments, benefiting both parties by simplifying transactions and expediting property transfer.

Rent Premium

Rent-to-own agreements often involve a rent premium, where tenants pay above-market rent to build equity toward a future home purchase, accelerating property ownership compared to traditional renting. This premium can be viewed as a forced savings plan, making it an attractive option for buyers with limited upfront capital or imperfect credit.

Right of First Refusal

The right of first refusal in rent-to-own agreements grants tenants the opportunity to purchase the property before the owner accepts another offer, creating a strategic advantage absent in traditional mortgages. This clause provides a flexible pathway to homeownership while allowing prospective buyers to build equity and test the property before fully committing.

Balloon Payment Clause

A balloon payment clause in a rent-to-own agreement requires a large lump sum payment at the end of the lease term, contrasting with mortgage loans where payments are amortized over time. Buyers should carefully evaluate the balloon payment amount to avoid financial strain, as mortgage mortgages typically offer more predictable monthly installments without unexpected large payments.

Hybrid Mortgage Model

The hybrid mortgage model combines features of traditional mortgages and rent-to-own agreements, allowing buyers to build equity while renting with an option to purchase later. This approach offers flexible payment structures and can be an effective solution for individuals transitioning from renting to homeownership in competitive real estate markets.

Path-to-Homeownership Programs

Mortgage financing offers immediate equity building and long-term stability by securing homeownership through traditional loans, while rent-to-own programs provide an alternative path by allowing renters to apply a portion of their rent toward a future purchase, ideal for those with limited credit or savings. Path-to-homeownership programs combine these options with financial counseling and flexible terms to support buyers in overcoming barriers and achieving sustainable homeownership.

Mortgage vs Rent-to-Own Infographic

industrydif.com

industrydif.com