A real estate broker offers personalized service by guiding clients through negotiations, pricing, and market analysis to maximize property value, while iBuyers provide quick, cash offers with streamlined transactions that minimize time on market. Brokers typically achieve higher sale prices through targeted marketing and expert negotiation, whereas iBuyers prioritize convenience and speed, often at the expense of potential profit. Choosing between a broker and an iBuyer depends on sellers' priorities: maximizing sale price versus a fast, hassle-free closing process.

Table of Comparison

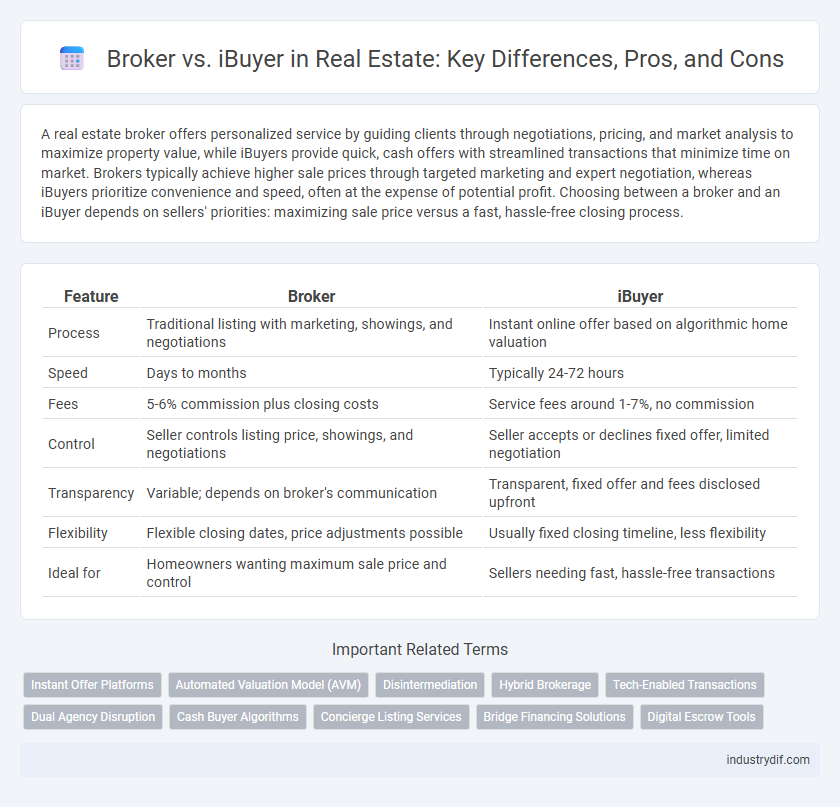

| Feature | Broker | iBuyer |

|---|---|---|

| Process | Traditional listing with marketing, showings, and negotiations | Instant online offer based on algorithmic home valuation |

| Speed | Days to months | Typically 24-72 hours |

| Fees | 5-6% commission plus closing costs | Service fees around 1-7%, no commission |

| Control | Seller controls listing price, showings, and negotiations | Seller accepts or declines fixed offer, limited negotiation |

| Transparency | Variable; depends on broker's communication | Transparent, fixed offer and fees disclosed upfront |

| Flexibility | Flexible closing dates, price adjustments possible | Usually fixed closing timeline, less flexibility |

| Ideal for | Homeowners wanting maximum sale price and control | Sellers needing fast, hassle-free transactions |

Understanding Brokers and iBuyers: Key Definitions

Brokers are licensed real estate professionals who represent buyers or sellers, providing personalized market analysis, negotiation expertise, and tailored marketing strategies. iBuyers use algorithm-driven technology to offer quick, cash-based home purchases, streamlining transactions but often at the cost of market-specific insights. Understanding these key differences helps sellers choose between traditional, relationship-centered service and fast, technology-based convenience.

How Traditional Brokers Operate in Real Estate

Traditional real estate brokers operate by providing personalized services that include property listing, market analysis, negotiation, and coordination of inspections and closings. They leverage local market expertise and established networks to connect buyers and sellers, often earning a commission based on the final sale price. This approach emphasizes human interaction and customized guidance throughout the buying or selling process.

The iBuyer Model: How It Works

The iBuyer model streamlines home selling by leveraging technology to provide instant, algorithm-driven offers based on real-time market data and property condition. Unlike traditional brokers, iBuyers reduce the timeline for transactions, often closing sales within days and minimizing the need for showings or negotiations. This approach appeals to sellers seeking convenience and speed, though it may involve fees or offers below market value compared to broker-assisted sales.

Comparing Costs: Broker Fees vs iBuyer Charges

Broker fees typically range from 5% to 6% of the home's sale price, covering marketing, negotiations, and closing assistance, whereas iBuyer charges a service fee that averages around 7% to 14%, including instant offers and convenience services. Traditional brokers may require upfront costs for staging and inspections, whereas iBuyers incorporate these expenses into their service fee, resulting in fewer out-of-pocket costs but often a lower net sale price. Sellers should compare the higher upfront broker commissions against the potentially reduced sale price and faster transaction speed offered by iBuyer services to determine the most cost-effective option.

Speed of Sale: Broker vs iBuyer Timeline

iBuyers typically complete property transactions within 7 to 14 days by leveraging automated valuation models and streamlined processes, offering sellers rapid liquidity without traditional market exposure. In contrast, brokers may take 30 to 60 days or more, dependent on market conditions and negotiation phases, providing potentially higher sale prices through targeted marketing and competitive bidding. The speed of sale with iBuyers appeals to sellers prioritizing immediacy, while brokers cater to clients seeking maximum return through broader market engagement.

Property Valuation Differences: Human vs Algorithm

Human brokers leverage local market expertise, neighborhood trends, and property nuances to deliver customized property valuations, often considering qualitative factors that algorithms may overlook. iBuyers utilize algorithm-driven models analyzing vast datasets such as recent sales, market fluctuations, and property characteristics, providing quick, data-based valuations with less emphasis on subjective property details. The disparity stems from brokers' personalized approach versus iBuyers' reliance on standardized algorithms, impacting accuracy and flexibility in property pricing.

Flexibility and Control: Seller Experience Compared

A traditional broker offers sellers greater flexibility and control throughout the real estate transaction by facilitating personalized negotiations and tailored marketing strategies. In contrast, iBuyers provide a streamlined, quick-sale process with limited seller input, often resulting in less control over price and timing. Sellers prioritizing a customizable experience typically prefer brokers, while those seeking convenience may opt for iBuyer solutions.

Market Suitability: Where Brokers or iBuyers Excel

Brokers excel in complex real estate markets with unique properties requiring personalized negotiation and local expertise. iBuyers thrive in high-volume, homogenous markets where speed and convenience are prioritized, leveraging algorithms to offer quick cash sales. Market suitability depends on property type, regional demand, and seller urgency.

Potential Risks and Drawbacks of Each Approach

Traditional brokers may involve higher fees and longer selling times due to market listing and negotiation processes, potentially impacting net proceeds. iBuyers offer quick sales with convenience but often at reduced prices, risking lower returns compared to traditional market value. Both methods carry risks of less-than-optimal financial outcomes depending on market conditions, seller urgency, and property uniqueness.

Making the Right Choice: Broker or iBuyer for Your Needs

Choosing between a real estate broker and an iBuyer depends on your priorities such as speed, convenience, and maximizing sale price. Brokers offer personalized market expertise and negotiation skills to secure the best value, while iBuyers provide quick, hassle-free transactions often with instant offers but potentially lower net proceeds. Evaluating factors like market conditions, property type, and your timeline ensures you select the optimal selling method for your specific real estate goals.

Related Important Terms

Instant Offer Platforms

Instant offer platforms offered by iBuyers provide homeowners with quick property appraisals and cash offers within days, streamlining the selling process without traditional showings or negotiations. Real estate brokers, however, leverage market expertise, personalized marketing strategies, and negotiation skills to potentially secure higher sale prices despite longer timelines.

Automated Valuation Model (AVM)

Automated Valuation Models (AVMs) leverage advanced algorithms and extensive real estate data to provide instant property valuations, a key advantage favored by iBuyers for quick, data-driven offers without requiring traditional broker involvement. While brokers incorporate AVMs as one of many tools, they complement these models with expert market knowledge and personalized negotiation strategies to optimize sale outcomes in complex transactions.

Disintermediation

Disintermediation in real estate reduces reliance on traditional brokers by allowing iBuyers to streamline transactions, offering homeowners faster sales through direct, technology-driven offers. This shift leverages data analytics and AI to provide competitive pricing, minimizing commissions and accelerating closing times without the conventional broker involvement.

Hybrid Brokerage

Hybrid brokerages combine traditional real estate agents' personalized service with iBuyer technology's speed and convenience, offering sellers instant cash offers alongside expert negotiation. This model leverages data analytics and market insights to provide flexible transaction options, maximizing value and efficiency in home sales.

Tech-Enabled Transactions

Tech-enabled transactions through iBuyers leverage algorithms and data analytics to provide instant home offers and faster closings, streamlining the selling process compared to traditional brokers. While brokers offer personalized service and negotiation expertise, iBuyers emphasize speed and convenience using technology-driven platforms.

Dual Agency Disruption

Dual agency disruption occurs when an iBuyer bypasses traditional real estate brokers, limiting the broker's ability to represent both buyer and seller simultaneously. This shift challenges the conventional dual agency model by emphasizing technology-driven transactions that reduce agent involvement and potential conflicts of interest.

Cash Buyer Algorithms

Cash buyer algorithms leverage data-driven models to provide instant offers in the iBuyer market, streamlining transactions by minimizing traditional broker negotiations. These algorithms analyze market trends, property details, and buyer demand to deliver competitive cash offers quickly, contrasting with brokers who rely on personalized client interactions and market expertise.

Concierge Listing Services

Concierge listing services offered by brokers provide personalized home preparation, professional staging, and targeted marketing to maximize property value and attract qualified buyers. Unlike iBuyers, who offer quick, algorithm-driven sales with limited customization, brokers' concierge services deliver tailored strategies and human expertise for optimal real estate outcomes.

Bridge Financing Solutions

Bridge financing solutions offer critical capital for both brokers and iBuyers to facilitate property transactions during transitional phases. While brokers leverage bridge loans to secure traditional home sales, iBuyers utilize these short-term funds to quickly purchase, renovate, and resell homes, optimizing turnaround time and market agility.

Digital Escrow Tools

Digital escrow tools streamline transactions by providing secure, transparent fund handling between buyers, sellers, and brokers, reducing fraud risks and enhancing trust. iBuyers integrate these tools into automated platforms for faster closings, while traditional brokers use them to facilitate conventional deals with personalized client support.

Broker vs iBuyer Infographic

industrydif.com

industrydif.com