A listing agreement is a traditional real estate contract granting an agent exclusive rights to sell a property, outlining commission and marketing terms. In contrast, a tokenized asset contract leverages blockchain technology to represent ownership through digital tokens, enabling fractional property investment and streamlined transactions. This innovative approach enhances liquidity and transparency in real estate markets compared to conventional listing agreements.

Table of Comparison

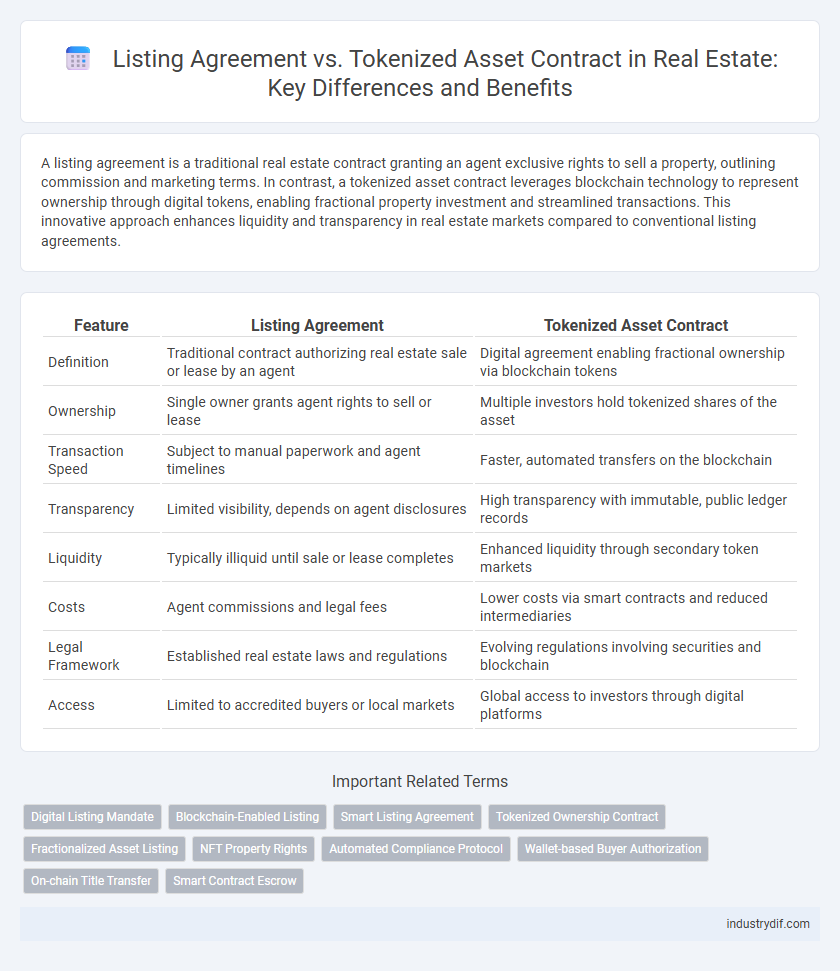

| Feature | Listing Agreement | Tokenized Asset Contract |

|---|---|---|

| Definition | Traditional contract authorizing real estate sale or lease by an agent | Digital agreement enabling fractional ownership via blockchain tokens |

| Ownership | Single owner grants agent rights to sell or lease | Multiple investors hold tokenized shares of the asset |

| Transaction Speed | Subject to manual paperwork and agent timelines | Faster, automated transfers on the blockchain |

| Transparency | Limited visibility, depends on agent disclosures | High transparency with immutable, public ledger records |

| Liquidity | Typically illiquid until sale or lease completes | Enhanced liquidity through secondary token markets |

| Costs | Agent commissions and legal fees | Lower costs via smart contracts and reduced intermediaries |

| Legal Framework | Established real estate laws and regulations | Evolving regulations involving securities and blockchain |

| Access | Limited to accredited buyers or local markets | Global access to investors through digital platforms |

Definition of Listing Agreement in Real Estate

A listing agreement in real estate is a legally binding contract between a property owner and a real estate broker that authorizes the broker to act as the owner's agent to sell or lease the property. This agreement specifies terms such as the listing price, duration, broker's commission, and responsibilities regarding marketing and negotiations. It differs from tokenized asset contracts by focusing on traditional property sales rather than digital ownership or blockchain-based transactions.

What is a Tokenized Asset Contract?

A Tokenized Asset Contract in real estate represents ownership through blockchain-based digital tokens, enabling fractional investment and streamlined transactions. Unlike traditional listing agreements that establish terms for property sale between sellers and agents, tokenized asset contracts digitize asset rights, enhancing liquidity and transparency. This approach leverages smart contracts to enforce conditions automatically, reducing intermediaries and increasing accessibility for investors.

Key Differences Between Listing Agreements and Tokenized Asset Contracts

Listing agreements establish a traditional contract between property owners and real estate agents, detailing the sale terms, commission, and marketing responsibilities. Tokenized asset contracts leverage blockchain technology to fractionalize property ownership, enabling secure, transparent transactions and trading of property tokens. Key differences include the mode of ownership transfer, regulatory frameworks, and liquidity options, with tokenized contracts offering increased accessibility and efficiency compared to conventional listing agreements.

Legal Framework for Listing Agreements

Listing agreements are governed by state-specific real estate laws and regulations that define the duties, rights, and obligations of agents and sellers, ensuring compliance with fiduciary responsibilities and disclosure requirements. Tokenized asset contracts, emerging under blockchain frameworks, introduce smart contracts that automate transactions but face evolving legal recognition and regulatory scrutiny regarding property rights and securities laws. The legal framework for listing agreements remains well-established and enforceable, whereas tokenized asset contracts require ongoing legal adaptation to align with existing real estate statutes and financial regulations.

Regulatory Considerations for Tokenized Asset Contracts

Tokenized asset contracts in real estate introduce complex regulatory considerations due to their classification as digital securities, requiring compliance with SEC regulations and anti-money laundering (AML) laws. Unlike traditional listing agreements, these contracts must adhere to securities laws under the Securities Act of 1933 and the Securities Exchange Act of 1934, ensuring proper investor protection and disclosure. Regulatory frameworks vary by jurisdiction, emphasizing the need for blockchain transparency, smart contract auditability, and adherence to Know Your Customer (KYC) protocols to mitigate legal risks.

Advantages of Traditional Listing Agreements

Traditional listing agreements provide clear legal frameworks with well-established protections for both sellers and brokers, ensuring trust and regulatory compliance. These agreements facilitate direct, personalized negotiations and expert broker support, which can enhance property marketing effectiveness and sale terms. Moreover, the widely recognized nature of listing agreements simplifies transaction processes and reduces investor uncertainty compared to emerging tokenized asset contracts.

Benefits of Tokenized Asset Contracts in Property Transactions

Tokenized asset contracts enhance property transactions by enabling fractional ownership, increasing liquidity, and reducing entry barriers for investors. These contracts leverage blockchain technology to ensure transparency, immutability, and faster settlement compared to traditional listing agreements. Smart contract automation minimizes administrative costs and mitigates fraud risks, streamlining the entire process for buyers and sellers.

Risk Factors: Listing Agreements vs Tokenized Asset Contracts

Risk factors in listing agreements primarily involve market volatility, agent performance, and contract termination clauses that affect property sale outcomes. Tokenized asset contracts carry risks related to blockchain security, regulatory compliance, and smart contract vulnerabilities that may impact asset transfer and investor protection. Understanding these differences is crucial for stakeholders when choosing between traditional real estate contracts and emerging tokenized investment models.

Process Workflow: Traditional vs Tokenized Real Estate Transactions

Traditional real estate transactions rely on listing agreements that involve multiple intermediaries, lengthy paperwork, and manual approvals, often leading to delays and increased costs. Tokenized asset contracts streamline the workflow by leveraging blockchain technology to enable secure, transparent, and automated execution of agreements, significantly reducing transaction time and enhancing liquidity. This decentralized process eliminates intermediaries, facilitating faster settlement and real-time ownership transfer through smart contracts.

Future Trends: Tokenization and the Evolution of Real Estate Contracts

Tokenized asset contracts are revolutionizing real estate by enabling fractional ownership and enhancing liquidity beyond traditional listing agreements. Blockchain technology ensures transparent, immutable records, reducing intermediaries and transaction costs in property deals. Emerging trends indicate a shift towards smart contracts that automate compliance and payments, signaling a future where real estate transactions become more efficient, accessible, and secure.

Related Important Terms

Digital Listing Mandate

Digital Listing Mandate enhances traditional listing agreements by leveraging blockchain technology to create tokenized asset contracts, enabling secure, transparent, and immutable records of property listings. This innovation streamlines real estate transactions, facilitates fractional ownership, and increases liquidity in the property market through digital asset tokenization.

Blockchain-Enabled Listing

Blockchain-enabled listing agreements transform traditional real estate contracts by leveraging decentralized ledger technology to ensure transparency, immutability, and real-time verification of property details. Tokenized asset contracts further enhance this ecosystem by enabling fractional ownership through digital tokens, improving liquidity and simplifying transactions in real estate markets.

Smart Listing Agreement

Smart Listing Agreements leverage blockchain technology to enhance transparency, security, and automation in real estate transactions compared to traditional listing agreements. Tokenized asset contracts enable fractional ownership and liquidity by representing properties as digital tokens, transforming how buyers and sellers interact within the market.

Tokenized Ownership Contract

A Tokenized Ownership Contract in real estate transforms traditional listing agreements by enabling fractional ownership through blockchain technology, enhancing liquidity and transparency for investors. This contract digitizes property rights into tokens, facilitating easier transfers and secure, verifiable proof of ownership while reducing reliance on conventional intermediary processes.

Fractionalized Asset Listing

A listing agreement traditionally governs the sale or lease of whole real estate properties, establishing terms between sellers and agents. In contrast, a tokenized asset contract enables fractionalized asset listing by digitizing real estate into blockchain-based tokens, allowing investors to buy and trade partial ownership while enhancing liquidity and transparency in property transactions.

NFT Property Rights

Listing agreements traditionally establish the terms between sellers and brokers for marketing real estate, while tokenized asset contracts leverage blockchain technology to represent property ownership through NFT property rights. NFT property rights enable fractional ownership, transparent transfer records, and increased liquidity in real estate markets compared to conventional listing agreements.

Automated Compliance Protocol

Listing agreements rely on traditional manual verification processes that often delay compliance checks, whereas tokenized asset contracts integrate automated compliance protocols using smart contracts to ensure real-time adherence to regulatory requirements. This automation reduces errors, accelerates transactions, and enhances transparency in real estate asset management.

Wallet-based Buyer Authorization

Listing agreements in traditional real estate secure exclusive rights for agents to sell properties, requiring buyer authorization through notarized documents or signed contracts. Tokenized asset contracts leverage blockchain technology to enable wallet-based buyer authorization, allowing seamless, secure, and real-time validation of purchase rights without intermediaries or paper documentation.

On-chain Title Transfer

A listing agreement traditionally governs the sale of real estate through intermediaries, while a tokenized asset contract enables direct on-chain title transfer using blockchain technology, ensuring transparent, immutable ownership records. On-chain title transfer eliminates delays and reduces fraud risks by automating property ownership verification and transaction settlement through smart contracts.

Smart Contract Escrow

Listing agreements in real estate establish traditional terms between buyers and sellers, while tokenized asset contracts utilize blockchain-based smart contract escrow to automate and secure transactions. Smart contract escrow ensures transparent, immutable, and real-time execution of payment and asset transfer conditions, reducing fraud and enhancing trust in property deals.

Listing agreement vs Tokenized asset contract Infographic

industrydif.com

industrydif.com