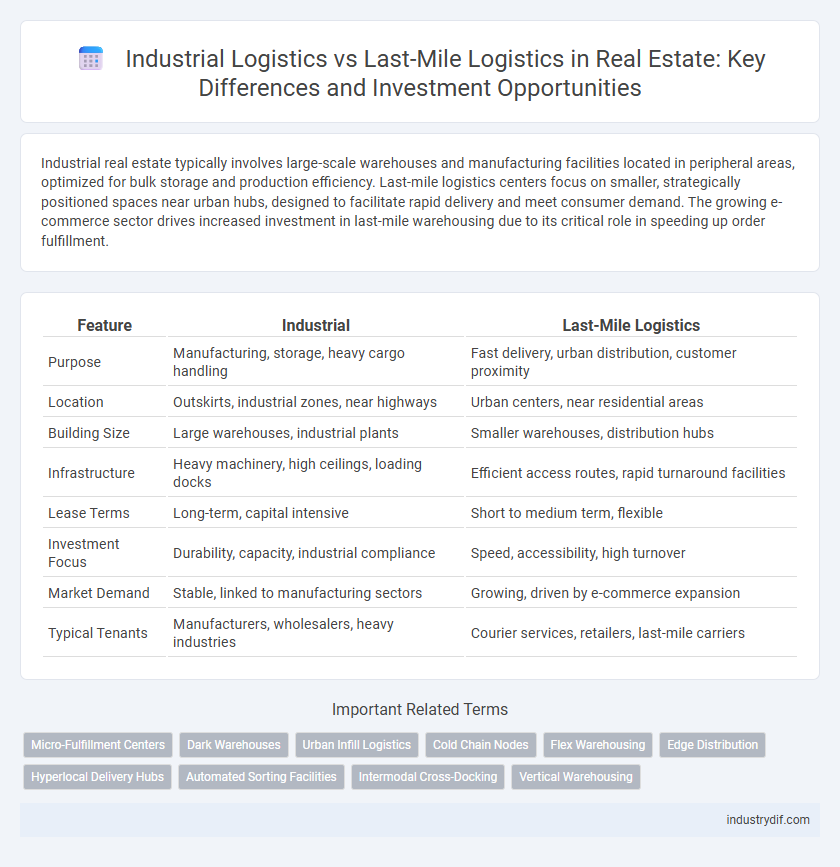

Industrial real estate typically involves large-scale warehouses and manufacturing facilities located in peripheral areas, optimized for bulk storage and production efficiency. Last-mile logistics centers focus on smaller, strategically positioned spaces near urban hubs, designed to facilitate rapid delivery and meet consumer demand. The growing e-commerce sector drives increased investment in last-mile warehousing due to its critical role in speeding up order fulfillment.

Table of Comparison

| Feature | Industrial | Last-Mile Logistics |

|---|---|---|

| Purpose | Manufacturing, storage, heavy cargo handling | Fast delivery, urban distribution, customer proximity |

| Location | Outskirts, industrial zones, near highways | Urban centers, near residential areas |

| Building Size | Large warehouses, industrial plants | Smaller warehouses, distribution hubs |

| Infrastructure | Heavy machinery, high ceilings, loading docks | Efficient access routes, rapid turnaround facilities |

| Lease Terms | Long-term, capital intensive | Short to medium term, flexible |

| Investment Focus | Durability, capacity, industrial compliance | Speed, accessibility, high turnover |

| Market Demand | Stable, linked to manufacturing sectors | Growing, driven by e-commerce expansion |

| Typical Tenants | Manufacturers, wholesalers, heavy industries | Courier services, retailers, last-mile carriers |

Defining Industrial Real Estate

Industrial real estate encompasses properties designed for manufacturing, warehousing, and distribution, including large-scale factories and regional distribution centers. These spaces support heavy machinery, bulk storage, and large vehicle access, distinguishing them from last-mile logistics facilities, which prioritize proximity to consumers and faster delivery times. Understanding the difference is crucial for investors and developers aiming to optimize supply chain efficiency and real estate portfolio performance.

What Is Last-Mile Logistics?

Last-mile logistics refers to the final step in the supply chain where goods are delivered from a transportation hub to the end customer, often in urban or suburban areas. This segment requires strategically located distribution centers near dense populations to ensure faster delivery times and reduce transportation costs. In real estate, last-mile logistics facilities demand proximity to major highways, retail centers, and residential zones to support the growing e-commerce market and consumer expectations for rapid delivery.

Key Differences Between Industrial and Last-Mile Logistics

Industrial logistics typically involves large-scale distribution centers located near major transportation hubs, optimizing long-haul freight movement and storage capacity. Last-mile logistics prioritizes proximity to urban centers and residential areas, focusing on rapid delivery, smaller facilities, and increased accessibility for final consumer distribution. The key differences lie in facility size, location strategy, and delivery speed requirements, with industrial logistics emphasizing bulk storage and transit efficiency, while last-mile logistics targets speed, flexibility, and convenience.

Market Demand and Growth Trends

Market demand for industrial real estate remains robust, driven by manufacturing, warehousing, and distribution needs that support large-scale supply chains. Last-mile logistics spaces are experiencing exponential growth due to the surge in e-commerce, requiring smaller, strategically located facilities near urban centers to enable faster delivery times. These contrasting trends reflect a shift in logistics strategies, with industrial properties supporting bulk distribution while last-mile logistics fulfill the growing consumer expectation for quick and flexible order fulfillment.

Location Strategies: Suburban vs Urban

Suburban locations for industrial real estate offer expansive land and lower costs, suitable for large-scale warehousing and manufacturing operations. Urban last-mile logistics prioritize proximity to dense consumer populations, enabling faster delivery times and enhanced customer service. Strategic location selection balances operational efficiency with cost, leveraging suburban space or urban accessibility based on supply chain demands.

Facility Design and Features

Industrial facilities prioritize large-scale storage with high ceilings, expansive floor plans, and robust loading docks to accommodate bulk shipments and heavy machinery. Last-mile logistics centers emphasize proximity to urban areas, featuring smaller footprints, enhanced security systems, and advanced automation for rapid sorting and delivery. Key design elements for last-mile facilities include optimized parking for delivery vehicles and technology integration to streamline parcel handling and reduce turnaround times.

Impact of E-commerce on Logistics Real Estate

E-commerce growth has significantly increased demand for last-mile logistics facilities, driving a shift from traditional large-scale industrial warehouses to smaller, strategically located urban distribution centers. Industrial real estate portfolios now prioritize proximity to consumers, with last-mile logistics hubs enhancing delivery speed and reducing transportation costs. This trend accelerates urban industrial property redevelopment, optimizing real estate value and improving supply chain efficiency.

Leasing Structures and Tenant Requirements

Industrial real estate leasing structures often favor long-term triple net leases with large tenants requiring extensive warehouse space and heavy-duty infrastructure to support manufacturing and distribution. In contrast, last-mile logistics leases tend to be shorter-term, flexible agreements tailored to e-commerce companies demanding proximity to urban centers and rapid delivery capabilities. Tenant requirements for last-mile facilities emphasize advanced technology integration, high dock door counts, and efficient traffic flow to accommodate fast turnaround times and high shipment volumes.

Investment Opportunities and Risks

Industrial real estate investments in large distribution centers offer stable long-term returns due to high tenant demand and scalability, while last-mile logistics properties provide higher rental yields driven by e-commerce growth and proximity to urban consumers. Risks in industrial assets include market saturation and changing trade policies, whereas last-mile logistics faces risks from rising urban real estate costs and regulatory constraints. Investors seeking diversification benefit by balancing the consistent cash flow of large-scale industrial warehouses with the high-margin potential of strategically located last-mile facilities.

Future Outlook: Industrial vs Last-Mile Logistics

The future outlook for industrial real estate emphasizes expansion in last-mile logistics facilities due to the surge in e-commerce and demand for faster delivery times, driving developers to prioritize urban warehouses near consumer hubs. Industrial properties for traditional manufacturing may face slower growth compared to agile distribution centers equipped with advanced automation technologies and sustainability features. Investors are increasingly favoring last-mile logistics assets, recognizing their critical role in supply chain resilience and the evolving landscape of consumer expectations.

Related Important Terms

Micro-Fulfillment Centers

Micro-fulfillment centers, essential in last-mile logistics, optimize speedy delivery and reduce transportation costs by situating inventory close to urban consumers. Unlike traditional industrial warehouses, these compact facilities leverage automation to enhance efficiency and meet growing e-commerce demands in densely populated areas.

Dark Warehouses

Dark warehouses, a key component in last-mile logistics, operate with minimal human presence through advanced automation, optimizing space utilization and reducing operational costs compared to traditional industrial warehouses. These facilities enhance delivery speed and efficiency in urban areas, meeting the rising demand for e-commerce fulfillment while minimizing the need for large distribution centers.

Urban Infill Logistics

Urban infill logistics, a critical component of last-mile delivery, prioritizes strategically located warehouses within dense metropolitan areas to reduce delivery times and transportation costs. Industrial real estate is increasingly adapting to this trend by transforming older manufacturing sites into compact, multi-level distribution centers optimized for rapid order fulfillment and minimal urban footprint.

Cold Chain Nodes

Cold chain nodes in industrial real estate are critical for preserving perishable goods through temperature-controlled warehouses strategically located near manufacturing hubs. Last-mile logistics facilities emphasize proximity to urban centers to enable rapid distribution while maintaining strict cold chain requirements, meeting the growing demand for fresh and frozen products in e-commerce and retail sectors.

Flex Warehousing

Flex warehousing in industrial real estate offers adaptable spaces catering to both large-scale manufacturing operations and last-mile logistics distribution centers, optimizing inventory management and reducing delivery times. These flexible facilities support varying business models by enabling rapid adjustments in storage capacity and operational workflows, critical for meeting fluctuating demand in e-commerce and supply chain efficiency.

Edge Distribution

Industrial real estate properties are typically large-scale warehouses and manufacturing hubs designed for bulk storage and production, whereas last-mile logistics facilities focus on edge distribution centers located near urban areas to facilitate faster delivery and reduced transit times. Edge distribution centers optimize supply chain efficiency by enabling real-time inventory management and meeting consumer demand for rapid delivery in e-commerce and retail sectors.

Hyperlocal Delivery Hubs

Hyperlocal delivery hubs in last-mile logistics optimize speed and efficiency by situating warehouses closer to urban centers, significantly reducing transit times compared to traditional industrial real estate located in peripheral areas. The strategic placement of these hubs caters to the rising demand for same-day delivery services, making them essential assets in e-commerce supply chains.

Automated Sorting Facilities

Automated sorting facilities in industrial real estate significantly enhance efficiency by streamlining the handling and distribution of goods, reducing labor costs, and accelerating processing times in large-scale logistics hubs. In contrast, last-mile logistics prioritize proximity to urban centers for rapid delivery, where space constraints limit the integration of extensive automated systems despite increasing demand for speed and flexibility.

Intermodal Cross-Docking

Intermodal cross-docking optimizes last-mile logistics by streamlining the transfer of goods between transportation modes, reducing handling time and accelerating delivery speeds critical for urban distribution centers. Industrial real estate facilities designed for intermodal cross-docking offer strategic advantages, including proximity to rail yards and highways, enabling efficient inventory turnover and minimizing storage costs in last-mile supply chains.

Vertical Warehousing

Vertical warehousing in industrial real estate maximizes space efficiency by building multi-story storage facilities, crucial for last-mile logistics that demand rapid delivery in dense urban areas. This approach reduces land footprint while enhancing inventory accessibility and operational scalability, addressing urban congestion challenges inherent in last-mile distribution.

Industrial vs Last-Mile Logistics Infographic

industrydif.com

industrydif.com