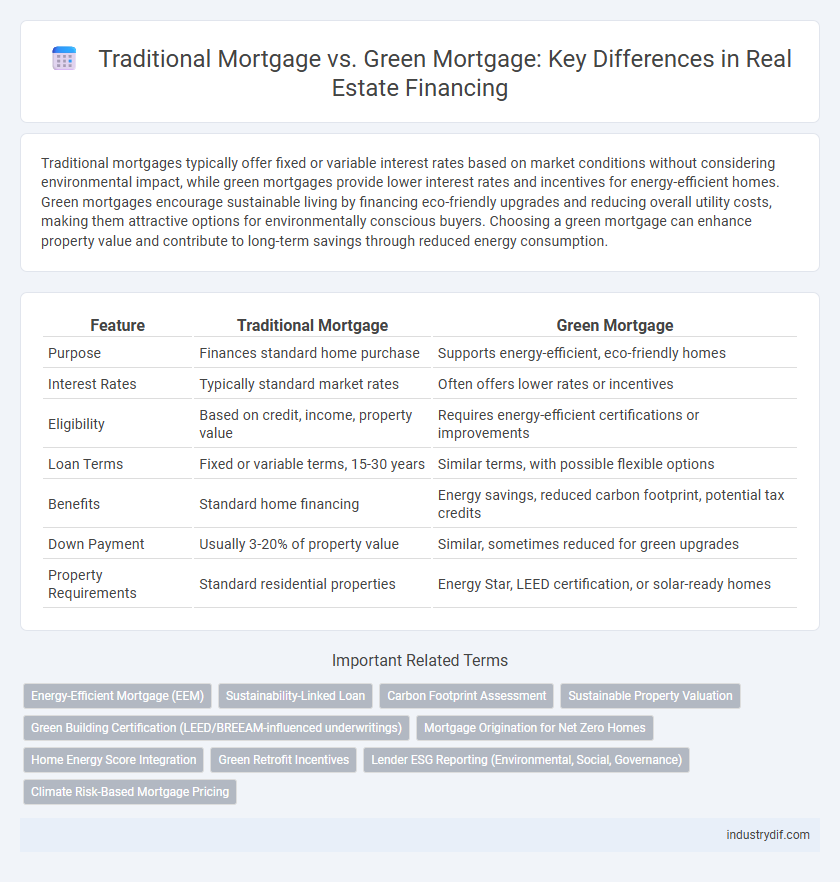

Traditional mortgages typically offer fixed or variable interest rates based on market conditions without considering environmental impact, while green mortgages provide lower interest rates and incentives for energy-efficient homes. Green mortgages encourage sustainable living by financing eco-friendly upgrades and reducing overall utility costs, making them attractive options for environmentally conscious buyers. Choosing a green mortgage can enhance property value and contribute to long-term savings through reduced energy consumption.

Table of Comparison

| Feature | Traditional Mortgage | Green Mortgage |

|---|---|---|

| Purpose | Finances standard home purchase | Supports energy-efficient, eco-friendly homes |

| Interest Rates | Typically standard market rates | Often offers lower rates or incentives |

| Eligibility | Based on credit, income, property value | Requires energy-efficient certifications or improvements |

| Loan Terms | Fixed or variable terms, 15-30 years | Similar terms, with possible flexible options |

| Benefits | Standard home financing | Energy savings, reduced carbon footprint, potential tax credits |

| Down Payment | Usually 3-20% of property value | Similar, sometimes reduced for green upgrades |

| Property Requirements | Standard residential properties | Energy Star, LEED certification, or solar-ready homes |

Understanding Traditional Mortgages

Traditional mortgages typically involve fixed or variable interest rates with loans secured by residential property and require a down payment usually between 5% to 20%. These loans are governed by standard underwriting criteria, including credit scores, income verification, and debt-to-income ratios, without special consideration for a property's environmental impact. Borrowers benefit from predictable repayment schedules and widespread lender availability, making traditional mortgages a common choice for financing home purchases.

What Is a Green Mortgage?

A green mortgage is a home loan specifically designed to finance energy-efficient properties or improvements that reduce environmental impact and lower utility costs. Unlike traditional mortgages, green mortgages often provide borrowers with lower interest rates or additional funding based on the property's energy efficiency ratings, such as ENERGY STAR certification or Home Energy Score. These loans encourage sustainable building practices and can increase a home's market value while promoting long-term savings on energy expenses.

Key Differences Between Traditional and Green Mortgages

Traditional mortgages typically involve standard loan terms based on credit score, income, and property value without considering environmental factors. Green mortgages offer lower interest rates or incentives for properties with energy-efficient certifications or sustainable features, promoting eco-friendly investments. Borrowers choosing green mortgages often benefit from reduced utility costs and enhanced property value due to energy-saving upgrades.

Eligibility Criteria for Each Mortgage Type

Traditional mortgage eligibility typically requires a strong credit score, stable income verification, and a down payment of at least 20%, with lenders focusing on debt-to-income ratios and property appraisal values. Green mortgage eligibility emphasizes energy-efficient home features, such as ENERGY STAR certification or solar panels, alongside similar credit and income requirements, often rewarding buyers with lower interest rates or higher loan-to-value ratios for sustainable properties. Borrowers seeking green mortgages must provide documentation of the home's eco-friendly attributes or planned improvements to qualify for these specialized loans.

Interest Rates: Traditional vs Green Mortgages

Traditional mortgages typically offer fixed or variable interest rates ranging from 3% to 5%, depending on credit score and market conditions. Green mortgages often provide lower interest rates or additional incentives, reflecting the reduced environmental impact and energy savings of certified sustainable properties. These preferential rates encourage buyers to invest in energy-efficient homes, ultimately lowering long-term financing costs.

Environmental Impact and Sustainability

Traditional mortgages typically lack incentives for energy-efficient home improvements, potentially resulting in higher carbon footprints and increased utility costs. Green mortgages promote sustainable building practices by offering lower interest rates and financial benefits for energy-efficient homes, reducing environmental impact through decreased greenhouse gas emissions. Adopting green mortgages supports long-term sustainability by encouraging eco-friendly construction and energy-saving upgrades in residential properties.

Financial Incentives and Savings

Green mortgages often provide borrowers with lower interest rates, reduced fees, and potential tax credits, incentivizing energy-efficient property investments. Traditional mortgages typically lack these financial benefits, focusing solely on standard loan terms without considering environmental impact. Energy savings from green homes can lead to significant long-term financial advantages, further enhancing the total cost-effectiveness of green mortgage options.

Property Requirements and Standards

Traditional mortgages typically require standard property appraisals focusing on market value and structural integrity, while green mortgages demand specific energy efficiency certifications such as ENERGY STAR or LEED. Properties must meet strict environmental standards, including sustainable materials, improved insulation, and renewable energy installations, to qualify for green mortgage programs. These enhanced property requirements incentivize environmentally responsible upgrades, resulting in long-term cost savings and increased market appeal.

Pros and Cons of Traditional Mortgages

Traditional mortgages offer a straightforward application process and generally wider acceptance among lenders, making them accessible to a broad range of borrowers. However, these loans typically do not provide incentives for energy-efficient home improvements, potentially leading to higher utility costs over time. Borrowers may also face stricter qualification criteria and less flexibility in financing eco-friendly upgrades compared to green mortgage options.

Pros and Cons of Green Mortgages

Green mortgages offer lower interest rates and incentivize energy-efficient home improvements, reducing long-term utility costs and environmental impact. However, they may require additional documentation and higher upfront appraisal costs to verify energy efficiency standards, potentially limiting borrower eligibility. Despite possible upfront challenges, green mortgages promote sustainable living and increase property value in eco-conscious markets.

Related Important Terms

Energy-Efficient Mortgage (EEM)

Energy-Efficient Mortgages (EEMs) provide homebuyers with the opportunity to finance energy-saving improvements within their loan, reducing utility costs and increasing property value compared to traditional mortgages. These specialized loans incentivize energy efficiency by incorporating the projected savings into the borrower's total mortgage qualification, promoting sustainable real estate investments.

Sustainability-Linked Loan

Traditional mortgages typically offer fixed or variable interest rates based on creditworthiness without integrating environmental criteria, whereas green mortgages or sustainability-linked loans provide favorable terms for borrowers investing in energy-efficient homes or renewable energy upgrades. These sustainability-linked loans incentivize reduced carbon footprints by tying interest rates or loan conditions to achieving specific environmental performance targets.

Carbon Footprint Assessment

Traditional mortgages typically do not require a carbon footprint assessment, focusing solely on the borrower's creditworthiness and property value, whereas green mortgages incorporate environmental evaluations to measure and reduce the carbon footprint of the property. This shift encourages energy-efficient home improvements and sustainable practices, aligning financing options with environmental impact reduction goals.

Sustainable Property Valuation

Traditional mortgage appraisals primarily focus on factors such as location, size, and market trends, often overlooking the impact of energy efficiency and sustainability features on property value. Green mortgages emphasize sustainable property valuation by incorporating energy savings, reduced environmental impact, and potential tax incentives, ultimately reflecting higher long-term value and lower risk for both lenders and buyers.

Green Building Certification (LEED/BREEAM-influenced underwritings)

Green mortgages often provide favorable terms for properties with LEED or BREEAM certifications, reflecting lower environmental impact and energy efficiency standards. These certifications influence underwriting by reducing risk factors associated with operational costs and property value depreciation compared to traditional mortgage assessments.

Mortgage Origination for Net Zero Homes

Mortgage origination for net zero homes increasingly favors green mortgages, which offer lower interest rates and incentives for energy-efficient properties compared to traditional mortgages. Lenders assess energy performance metrics and sustainability certifications during underwriting to align financing with long-term environmental goals and homeowner savings.

Home Energy Score Integration

Traditional mortgages typically rely on credit history and income verification, while green mortgages integrate the Home Energy Score to assess a property's energy efficiency, incentivizing eco-friendly improvements. Integrating the Home Energy Score allows lenders to offer lower interest rates or higher loan limits for energy-efficient homes, promoting sustainable real estate investments.

Green Retrofit Incentives

Green mortgages offer reduced interest rates and flexible terms to encourage energy-efficient home upgrades, leveraging government and utility green retrofit incentives that cover insulation, solar panels, and HVAC improvements. Traditional mortgages lack these targeted benefits, making green mortgages a cost-effective financing option for sustainable property investments.

Lender ESG Reporting (Environmental, Social, Governance)

Lenders reporting on ESG metrics increasingly favor green mortgages for their alignment with environmental sustainability goals, offering lower interest rates and incentives for energy-efficient homes. Traditional mortgages lack specific ESG benefits, making green mortgages a strategic choice for investors prioritizing responsible financing and reducing carbon footprints in real estate portfolios.

Climate Risk-Based Mortgage Pricing

Traditional mortgages typically base interest rates on credit scores and financial history, while green mortgages incorporate climate risk assessments, offering lower rates for energy-efficient homes. This climate risk-based mortgage pricing incentivizes sustainable property investments by factoring potential environmental hazards and energy savings into loan terms.

Traditional Mortgage vs Green Mortgage Infographic

industrydif.com

industrydif.com