Multiple listing services (MLS) provide a centralized database where real estate agents share property listings, enhancing market visibility and facilitating transactions through traditional methods. Real estate tokenization platforms transform property ownership into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and easier access to global investors. While MLS excels in conventional brokerage efficiency, tokenization platforms offer innovative, decentralized investment opportunities that redefine property trading and ownership.

Table of Comparison

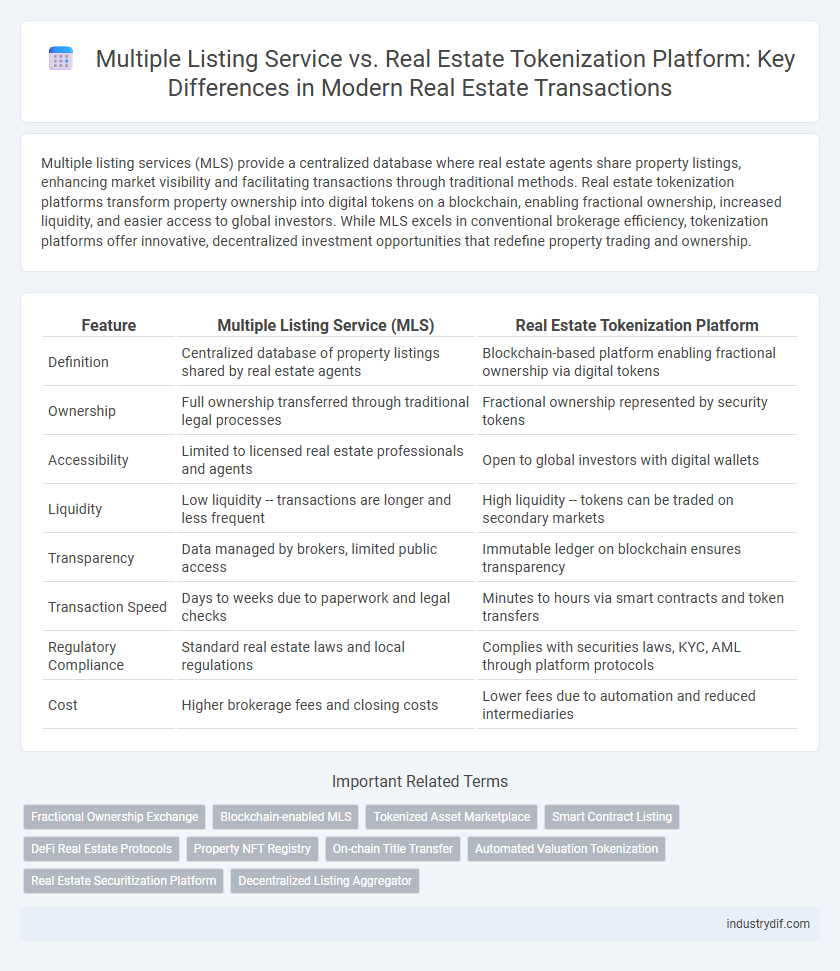

| Feature | Multiple Listing Service (MLS) | Real Estate Tokenization Platform |

|---|---|---|

| Definition | Centralized database of property listings shared by real estate agents | Blockchain-based platform enabling fractional ownership via digital tokens |

| Ownership | Full ownership transferred through traditional legal processes | Fractional ownership represented by security tokens |

| Accessibility | Limited to licensed real estate professionals and agents | Open to global investors with digital wallets |

| Liquidity | Low liquidity -- transactions are longer and less frequent | High liquidity -- tokens can be traded on secondary markets |

| Transparency | Data managed by brokers, limited public access | Immutable ledger on blockchain ensures transparency |

| Transaction Speed | Days to weeks due to paperwork and legal checks | Minutes to hours via smart contracts and token transfers |

| Regulatory Compliance | Standard real estate laws and local regulations | Complies with securities laws, KYC, AML through platform protocols |

| Cost | Higher brokerage fees and closing costs | Lower fees due to automation and reduced intermediaries |

Introduction to Multiple Listing Services and Real Estate Tokenization

Multiple Listing Services (MLS) centralize property listings, enabling real estate agents to share comprehensive data and facilitate transactions efficiently within local markets. Real estate tokenization platforms leverage blockchain technology to convert property ownership into digital tokens, enhancing liquidity and accessibility for investors globally. While MLS focuses on traditional brokerage collaboration, tokenization introduces decentralized investment opportunities and fractional ownership models.

Core Functions of Multiple Listing Services

Multiple Listing Services (MLS) primarily function as centralized databases that enable real estate agents to share property listings, facilitating widespread market exposure and accurate property comparisons. MLS platforms provide comprehensive property details, including pricing history, photos, and agent contact information, enhancing transparency and market efficiency. Unlike real estate tokenization platforms that leverage blockchain to fractionalize ownership, MLS focuses on streamlining property discovery and traditional transaction processes within the real estate industry.

How Real Estate Tokenization Platforms Operate

Real estate tokenization platforms operate by converting property ownership into digital tokens on a blockchain, enabling fractional ownership and increased liquidity for investors. Unlike traditional Multiple Listing Services (MLS) that aggregate property listings for brokers and buyers, tokenization platforms facilitate seamless peer-to-peer transactions and transparent asset management through smart contracts. This technology also reduces barriers to entry, broadens access to global investors, and streamlines the transfer of real estate assets.

Accessibility and Market Reach Comparison

Multiple Listing Services (MLS) offer traditional real estate agents and buyers centralized databases with localized market access and comprehensive property listings, enhancing visibility within established networks. Real estate tokenization platforms extend accessibility globally by converting property ownership into digital tokens, enabling fractional investment and attracting a diverse, tech-savvy investor base. Tokenization significantly broadens market reach beyond geographic and financial constraints compared to MLS limitations confined to licensed professionals and regional markets.

Transparency and Data Integrity in Both Systems

Multiple Listing Service (MLS) ensures transparency by providing centralized, verified property data accessible to licensed agents, fostering trust through standardized listing updates. Real estate tokenization platforms leverage blockchain technology to enhance data integrity by recording immutable transaction histories and ownership details, reducing fraud and enabling real-time transparency for investors. Both systems prioritize accurate information dissemination but differ in their approach to data security and accessibility, with MLS focusing on centralized control and tokenization emphasizing decentralized verification.

Transaction Speed and Efficiency Differences

Multiple Listing Service (MLS) offers traditional real estate transaction processes that can take days to weeks due to manual paperwork and agent coordination. Real estate tokenization platforms utilize blockchain technology to enable near-instantaneous property transfers with automated smart contracts, significantly reducing transaction time. Enhanced efficiency in tokenization platforms lowers costs, mitigates fraud, and streamlines ownership transfer compared to the conventional MLS approach.

Cost Structures: MLS vs Tokenization Platforms

Multiple Listing Services (MLS) typically operate on subscription fees or commission splits shared among real estate agents, resulting in predictable but ongoing costs. Real estate tokenization platforms often involve initial setup fees, transaction costs, and platform usage fees that can vary based on the number of tokens issued and traded. Tokenization can reduce intermediary costs and enable fractional ownership, potentially lowering overall expenses compared to traditional MLS models.

Regulatory Compliance in MLS and Tokenized Real Estate

Multiple Listing Services (MLS) operate under strict regulatory frameworks established by real estate commissions and local laws, ensuring compliance with fair housing rules and licensing requirements. Real estate tokenization platforms face evolving regulatory environments involving securities laws, requiring adherence to the SEC, FINRA, and international regulations for blockchain asset offerings. Both systems emphasize transparency and investor protection, but tokenized real estate demands additional compliance with digital asset custody, anti-money laundering (AML), and know-your-customer (KYC) protocols.

Investment Opportunities and Fractional Ownership

Multiple Listing Services (MLS) provide centralized databases of real estate properties, enabling investors to access traditional investment opportunities with whole ownership. Real estate tokenization platforms offer fractional ownership, allowing investors to buy and trade digital tokens representing shares of property assets, reducing entry barriers and increasing liquidity. Tokenization enhances diversification and accessibility in real estate investment by converting assets into tradable digital units on blockchain technology.

Future Trends: MLS Evolution vs Tokenization Growth

Multiple Listing Service (MLS) platforms are evolving by integrating AI-driven analytics and virtual tours to enhance property visibility and streamline transactions for agents and buyers. Real estate tokenization platforms leverage blockchain technology to fractionalize property ownership, enabling increased liquidity and access to global investors through digital tokens. Future trends indicate a convergence where MLS systems incorporate tokenization features, facilitating seamless investment and trading of real estate assets on decentralized platforms.

Related Important Terms

Fractional Ownership Exchange

Multiple Listing Service (MLS) offers centralized property listings for traditional real estate transactions, while Real Estate Tokenization Platforms enable fractional ownership exchange through blockchain technology, allowing investors to buy and trade digital shares of properties. Fractional ownership exchange enhances liquidity, lowers entry barriers, and democratizes access to high-value real estate assets compared to conventional MLS systems.

Blockchain-enabled MLS

Blockchain-enabled Multiple Listing Services (MLS) enhance transparency and immutability in real estate transactions by securely recording property data and ownership history on a decentralized ledger, reducing fraud and increasing trust among buyers and sellers. Real estate tokenization platforms further democratize access to property investment by converting ownership into tradable digital tokens, enabling fractional ownership and liquidity that traditional MLS cannot provide.

Tokenized Asset Marketplace

Tokenized asset marketplaces leverage blockchain technology to offer fractional ownership, increased liquidity, and transparent transactions compared to traditional Multiple Listing Services (MLS). These platforms enable seamless trading of real estate tokens representing property shares, reducing barriers and broadening investor access in the real estate market.

Smart Contract Listing

Smart Contract Listings on real estate tokenization platforms enhance transaction security and automate escrow functions, eliminating traditional MLS intermediaries. These blockchain-powered contracts provide transparency, reduce fraud, and enable fractional ownership, transforming how properties are listed and traded compared to conventional Multiple Listing Service systems.

DeFi Real Estate Protocols

Multiple listing services (MLS) aggregate traditional property listings with centralized controls, while real estate tokenization platforms leverage DeFi real estate protocols to fractionalize property ownership on blockchain networks, enabling increased liquidity and 24/7 trading. DeFi protocols integrate smart contracts for transparent, secure transactions, reducing intermediaries and enhancing investment accessibility in real estate markets.

Property NFT Registry

Multiple Listing Service (MLS) aggregates property listings in a centralized database accessible to licensed agents, streamlining traditional real estate transactions through standardized data formats and regional market coverage. In contrast, Real Estate Tokenization Platforms utilize blockchain technology to create a Property NFT Registry, enabling fractional ownership, transparent transaction histories, and decentralized verification, fundamentally transforming asset liquidity and investor accessibility.

On-chain Title Transfer

Multiple Listing Service (MLS) centralizes property data for agents, but lacks direct on-chain title transfer capabilities, relying on traditional escrow and legal processes. Real estate tokenization platforms enable seamless on-chain title transfers through blockchain smart contracts, increasing transparency, reducing fraud, and expediting property ownership settlement.

Automated Valuation Tokenization

Multiple Listing Service (MLS) provides centralized property data with automated valuation models based on historical sales and market trends, facilitating traditional real estate transactions. Real estate tokenization platforms leverage blockchain technology to enable Automated Valuation Tokenization, offering fractional ownership, enhanced liquidity, and transparent, real-time property valuations through smart contracts.

Real Estate Securitization Platform

Real Estate Securitization Platforms enable fractional ownership through blockchain technology, enhancing liquidity and accessibility compared to traditional Multiple Listing Services (MLS) that primarily list properties for sale without facilitating investment diversification. These platforms tokenize real estate assets, allowing investors to buy, sell, and trade secured digital shares, streamlining transactions and reducing entry barriers in the real estate market.

Decentralized Listing Aggregator

Decentralized listing aggregators leverage blockchain technology to provide transparent, tamper-proof property data across multiple real estate markets, contrasting with traditional Multiple Listing Services (MLS) that centralize control and limit data accessibility. Real estate tokenization platforms enable fractional property ownership and faster transactions, while decentralized aggregators enhance data interoperability and democratize access to comprehensive listings without intermediaries.

Multiple listing service vs Real estate tokenization platform Infographic

industrydif.com

industrydif.com