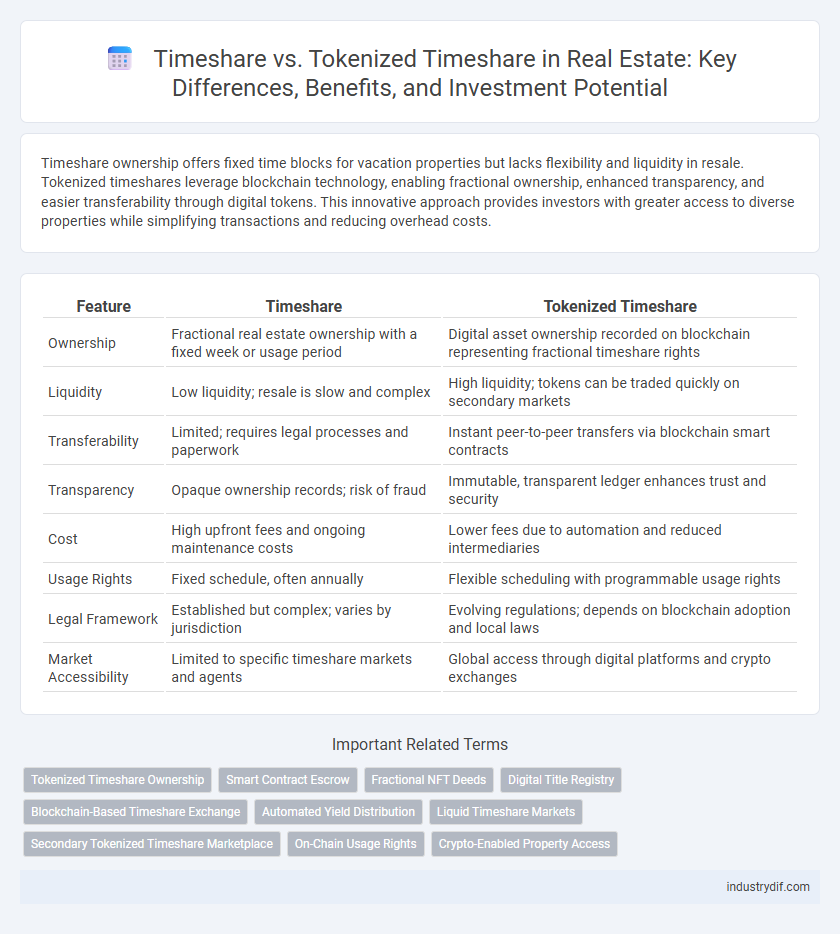

Timeshare ownership offers fixed time blocks for vacation properties but lacks flexibility and liquidity in resale. Tokenized timeshares leverage blockchain technology, enabling fractional ownership, enhanced transparency, and easier transferability through digital tokens. This innovative approach provides investors with greater access to diverse properties while simplifying transactions and reducing overhead costs.

Table of Comparison

| Feature | Timeshare | Tokenized Timeshare |

|---|---|---|

| Ownership | Fractional real estate ownership with a fixed week or usage period | Digital asset ownership recorded on blockchain representing fractional timeshare rights |

| Liquidity | Low liquidity; resale is slow and complex | High liquidity; tokens can be traded quickly on secondary markets |

| Transferability | Limited; requires legal processes and paperwork | Instant peer-to-peer transfers via blockchain smart contracts |

| Transparency | Opaque ownership records; risk of fraud | Immutable, transparent ledger enhances trust and security |

| Cost | High upfront fees and ongoing maintenance costs | Lower fees due to automation and reduced intermediaries |

| Usage Rights | Fixed schedule, often annually | Flexible scheduling with programmable usage rights |

| Legal Framework | Established but complex; varies by jurisdiction | Evolving regulations; depends on blockchain adoption and local laws |

| Market Accessibility | Limited to specific timeshare markets and agents | Global access through digital platforms and crypto exchanges |

Understanding Traditional Timeshares

Traditional timeshares involve purchasing the right to use a property for a specific period each year, often resulting in long-term commitments and limited flexibility. Owners typically share maintenance fees and have less control over resale or rental options compared to full ownership. Understanding these constraints is essential when comparing traditional timeshares to emerging tokenized timeshare models that promise increased liquidity and transparency.

How Tokenized Timeshares Work

Tokenized timeshares operate by converting traditional timeshare ownership into blockchain-based digital tokens, enabling fractional ownership and seamless transferability. Each token represents a specific time period or share in a property, secured through smart contracts that enforce ownership rights and usage terms transparently. This blockchain integration enhances liquidity, reduces transaction costs, and broadens market access compared to conventional timeshare agreements.

Key Differences Between Timeshare and Tokenized Timeshare

Traditional timeshares involve purchasing fixed time or usage rights in a property, often requiring significant upfront costs and complex resale processes. Tokenized timeshares leverage blockchain technology to represent ownership as digital tokens, enabling fractional ownership, increased liquidity, and seamless transfers on decentralized platforms. The key differences lie in accessibility, transparency, and flexibility, with tokenized timeshares offering more efficient market participation and reduced administrative overhead.

Legal Framework and Compliance

Timeshare ownership is governed by established legal frameworks that require strict compliance with consumer protection laws, contract regulations, and property rights management, ensuring clear title transfer and resale procedures. Tokenized timeshares operate within emerging regulatory landscapes involving securities law, blockchain regulations, and smart contract compliance, creating new challenges for legal clarity and investor protection. Navigating these distinctions demands a thorough understanding of traditional property statutes versus evolving digital asset regulations to mitigate risks and ensure transparent ownership rights.

Ownership Structure and Transferability

Timeshare ownership typically involves shared legal rights to a specific property for a fixed period each year, often with complex deed structures and limited transferability due to restrictive resale markets. Tokenized timeshares leverage blockchain technology to represent ownership as digital tokens, enabling fractional ownership with transparent, immutable records and seamless peer-to-peer transferability on secure platforms. This decentralized structure enhances liquidity, simplifies the transfer process, and reduces reliance on traditional administrative procedures.

Pros and Cons of Traditional Timeshares

Traditional timeshares offer guaranteed annual access to vacation properties but often come with high upfront costs and ongoing maintenance fees that can increase over time. Resale value tends to be low, limiting financial flexibility, and owners face strict usage schedules, reducing spontaneity in vacation planning. Limited market transparency and potential for complex legal agreements make traditional timeshares less attractive compared to emerging tokenized alternatives.

Pros and Cons of Tokenized Timeshares

Tokenized timeshares offer increased liquidity by enabling fractional ownership and easier transferability through blockchain technology, reducing traditional timeshare resale challenges. However, they face regulatory uncertainties and require digital literacy, potentially limiting adoption among older investors accustomed to conventional real estate transactions. Security and transparency benefits from decentralized ledgers enhance trust but depend heavily on platform reliability and smart contract integrity.

Impact of Blockchain Technology on Timeshare Industry

Blockchain technology revolutionizes the timeshare industry by enhancing transparency and security through decentralized ledgers, ensuring immutable ownership records and reducing fraud. Tokenized timeshares allow fractional ownership with increased liquidity, enabling seamless transferability and access to a global market via smart contracts. This innovative approach lowers transaction costs and facilitates automated compliance, significantly improving user trust and operational efficiency compared to traditional timeshare models.

Cost Considerations and Investment Potential

Timeshare ownership typically involves upfront purchase fees, annual maintenance costs, and limited liquidity, which can restrict long-term investment growth. Tokenized timeshares use blockchain technology to reduce transaction fees, increase transparency, and allow fractional ownership, enhancing cost efficiency and market accessibility. The investment potential of tokenized timeshares benefits from easier resale options and global market reach, making them more adaptable compared to traditional timeshares.

Future Trends in Shared Vacation Ownership

Tokenized timeshares leverage blockchain technology to enhance transparency, liquidity, and fractional ownership in shared vacation properties, surpassing traditional timeshares' limitations. Future trends indicate a growing adoption of digital assets for seamless transferability, smart contract automation, and reduced transaction costs. This shift aims to democratize access to vacation ownership and create a more flexible, secure marketplace for stakeholders.

Related Important Terms

Tokenized Timeshare Ownership

Tokenized timeshare ownership leverages blockchain technology to provide transparent, secure, and easily transferable real estate interests, enabling fractional ownership with reduced fraud risk and increased liquidity compared to traditional timeshares. This digital approach allows investors to trade timeshare tokens on secondary markets, enhancing accessibility and flexibility in vacation property investment.

Smart Contract Escrow

Tokenized timeshares utilize blockchain-based smart contract escrow systems to automate secure transactions and eliminate intermediaries, ensuring transparent ownership transfers and reduced fraud. Traditional timeshare agreements rely on manual escrow processes that often involve delays, higher costs, and increased risk of mismanagement or disputes.

Fractional NFT Deeds

Fractional NFT deeds transform traditional timeshares by allowing multiple owners to securely hold and trade digital shares of real estate on blockchain platforms, enhancing transparency and liquidity. This decentralized model eliminates intermediaries, reduces transaction costs, and offers immutable proof of ownership, revolutionizing the timeshare market with increased flexibility and global accessibility.

Digital Title Registry

Tokenized timeshares leverage blockchain technology to create a secure, transparent digital title registry, enhancing ownership verification and transfer efficiency compared to traditional timeshares, which rely on centralized, paper-based records prone to delays and disputes. This decentralized approach reduces administrative costs and enables fractional ownership, increasing liquidity and market accessibility in the timeshare real estate market.

Blockchain-Based Timeshare Exchange

Blockchain-based timeshare exchange revolutionizes traditional timeshare ownership by enabling secure, transparent transactions and fractional ownership through tokenization, reducing entry barriers and enhancing liquidity. Tokenized timeshares leverage blockchain technology to facilitate real-time trading on decentralized platforms, minimizing fraud and increasing global market accessibility compared to conventional timeshare agreements.

Automated Yield Distribution

Tokenized timeshares leverage blockchain technology to enable automated yield distribution through smart contracts, ensuring transparent and real-time profit sharing among multiple investors. Traditional timeshares lack this automation, often requiring manual processes that delay revenue allocation and limit liquidity potential.

Liquid Timeshare Markets

Tokenized timeshares leverage blockchain technology to create liquid timeshare markets, enabling fractional ownership, real-time trading, and enhanced transparency compared to traditional timeshares. This liquidity facilitates easier asset transfer, increased market access, and potential for higher returns on investment in the real estate sector.

Secondary Tokenized Timeshare Marketplace

Secondary tokenized timeshare marketplaces enable fractional ownership transfers with enhanced liquidity, transparency, and security through blockchain technology, differentiating them from traditional timeshare resales that face limited buyers and complex paperwork. These platforms facilitate real-time trades of digital tokens representing timeshare interests, reducing transaction costs and expanding access to a global pool of investors.

On-Chain Usage Rights

Tokenized timeshares utilize blockchain technology to securely record on-chain usage rights, enabling transparent, immutable proof of ownership and simplifying transferability compared to traditional timeshares. This digital ledger ensures fractional ownership is verified in real-time, enhancing liquidity and reducing fraud risk in the timeshare market.

Crypto-Enabled Property Access

Tokenized timeshares leverage blockchain technology to enable secure, transparent ownership and fractional property access through cryptocurrency transactions, reducing traditional timeshare limitations like complex resale and high fees. Crypto-enabled property access facilitates seamless liquidity and global market participation, enhancing flexibility and investment opportunities compared to conventional timeshare models.

Timeshare vs Tokenized timeshare Infographic

industrydif.com

industrydif.com