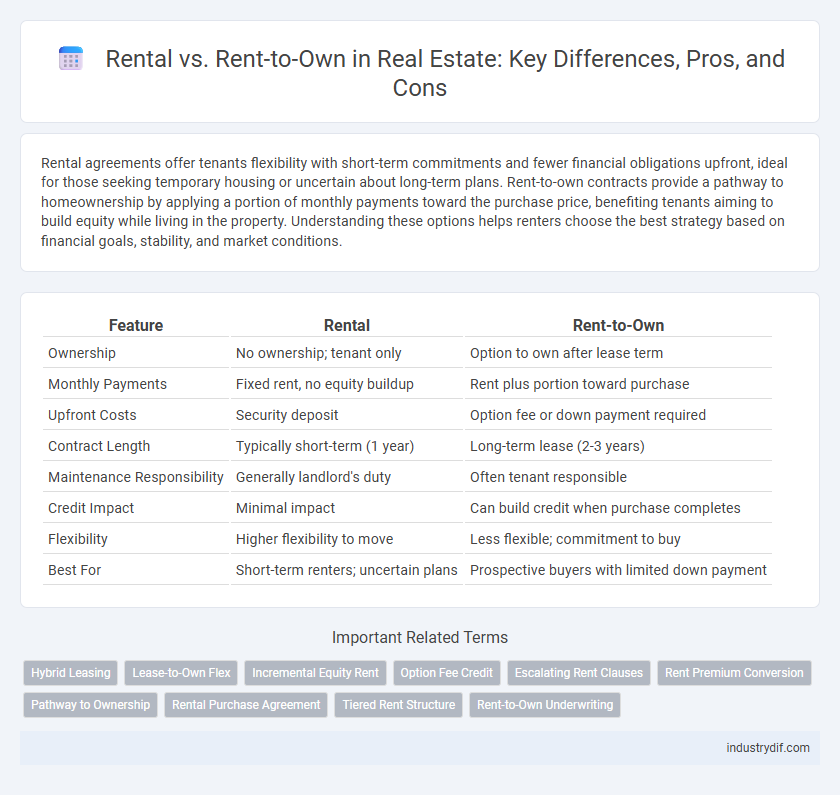

Rental agreements offer tenants flexibility with short-term commitments and fewer financial obligations upfront, ideal for those seeking temporary housing or uncertain about long-term plans. Rent-to-own contracts provide a pathway to homeownership by applying a portion of monthly payments toward the purchase price, benefiting tenants aiming to build equity while living in the property. Understanding these options helps renters choose the best strategy based on financial goals, stability, and market conditions.

Table of Comparison

| Feature | Rental | Rent-to-Own |

|---|---|---|

| Ownership | No ownership; tenant only | Option to own after lease term |

| Monthly Payments | Fixed rent, no equity buildup | Rent plus portion toward purchase |

| Upfront Costs | Security deposit | Option fee or down payment required |

| Contract Length | Typically short-term (1 year) | Long-term lease (2-3 years) |

| Maintenance Responsibility | Generally landlord's duty | Often tenant responsible |

| Credit Impact | Minimal impact | Can build credit when purchase completes |

| Flexibility | Higher flexibility to move | Less flexible; commitment to buy |

| Best For | Short-term renters; uncertain plans | Prospective buyers with limited down payment |

Introduction to Rental and Rent-to-Own in Real Estate

Rental agreements in real estate involve tenants paying a fixed monthly amount to lease a property without ownership rights, providing flexibility and lower upfront costs. Rent-to-own contracts enable tenants to accumulate equity over time with a portion of rent applied toward purchasing the property, combining aspects of renting and homeownership. Understanding key differences in payment structure, contractual obligations, and long-term financial benefits is essential for choosing between rental and rent-to-own options.

Key Differences Between Renting and Rent-to-Own Agreements

Renting typically involves monthly payments to occupy a property without ownership rights, while rent-to-own agreements combine rental payments with the option to purchase the home later, often applying a portion of rent toward the purchase price. Rent-to-own contracts usually require upfront option fees and specify purchase terms, offering tenants a path to homeownership after an agreed period. Key differences include financial commitment, contract duration, and the potential to build equity through rent credits in rent-to-own arrangements.

Financial Implications: Rental vs Rent-to-Own

Rental agreements typically require a monthly payment with minimal upfront costs, providing flexibility but no equity accumulation, which can limit long-term financial benefits. Rent-to-own contracts involve higher initial fees and monthly payments that partially contribute toward property ownership, offering a pathway to build equity while locking in purchase terms. Choosing between rental and rent-to-own depends on financial goals, cash flow capacity, and the desire to invest in property ownership versus short-term housing flexibility.

Lease Terms and Conditions: What to Expect

Rental agreements typically offer shorter lease terms ranging from six months to a year with fixed monthly payments and limited flexibility, suitable for tenants seeking temporary housing without long-term commitments. Rent-to-own contracts extend over multiple years, combining lease payments with an option to purchase the property, often requiring higher monthly payments and including clauses for credit qualification and maintenance responsibilities. Understanding specific terms such as lease duration, payment structure, maintenance obligations, and purchase options is critical when comparing rental leases to rent-to-own agreements in real estate transactions.

Pros and Cons of Renting Property

Renting property offers flexibility and lower upfront costs, allowing tenants to avoid maintenance expenses and property taxes typically borne by landlords. However, renting lacks equity building, subjects tenants to potential rent increases, and provides limited control over property modifications. Tenants benefit from mobility but face the downside of no asset accumulation compared to ownership options like rent-to-own agreements.

Advantages and Disadvantages of Rent-to-Own

Rent-to-own agreements offer the advantage of building equity while providing an opportunity to test a property before full purchase, appealing to renters with limited credit history. However, they often involve higher monthly payments and the risk of forfeiting accumulated equity if the purchase option is not exercised. This method benefits those aiming for ownership flexibility but requires careful contract review to avoid potential financial drawbacks.

Ideal Candidates for Rent-to-Own Options

Ideal candidates for rent-to-own options typically include individuals with limited credit history or those currently unable to secure traditional mortgage financing. Rent-to-own arrangements appeal to renters seeking to build equity while improving credit scores before purchasing a home. This strategy benefits people anticipating future financial stability who want to lock in homeownership at today's prices.

Impact on Credit and Homeownership Goals

Renting typically has little to no direct impact on credit scores, making it a neutral option for those building or maintaining credit, but it does not contribute to homeownership goals. Rent-to-own agreements often include monthly payments partially credited toward the eventual purchase price, potentially helping individuals with imperfect credit transition into ownership while improving their creditworthiness through timely payments. Choosing rent-to-own can accelerate homeownership but requires careful financial planning to manage credit impact and long-term commitment.

Legal Considerations in Rental and Rent-to-Own Contracts

Rental contracts typically involve straightforward lease agreements with clear terms for duration, rent payments, and tenant responsibilities, strictly governed by local landlord-tenant laws. Rent-to-own agreements combine rental and purchase elements, requiring careful legal review to address option fees, purchase price terms, and the allocation of maintenance responsibilities. Understanding specific state regulations and legal protections for buyers and renters is crucial to avoid disputes and ensure enforceability in both contract types.

Choosing the Best Option: Rental or Rent-to-Own

Evaluating rental versus rent-to-own options involves considering financial flexibility, long-term investment goals, and market conditions. Rental agreements provide lower upfront costs and mobility, ideal for short-term or uncertain housing needs. Rent-to-own offers a pathway to homeownership by applying rental payments toward the purchase price, benefiting those seeking equity accumulation and stability in competitive real estate markets.

Related Important Terms

Hybrid Leasing

Hybrid leasing combines elements of rental agreements and rent-to-own contracts, allowing tenants to apply a portion of their monthly rent toward the future purchase of the property. This innovative approach offers flexibility, reduces upfront costs, and provides an alternative path to homeownership compared to traditional rental or rent-to-own models.

Lease-to-Own Flex

Lease-to-Own Flex combines the benefits of traditional rental agreements with a pathway to homeownership, allowing tenants to apply a portion of their monthly rent towards the purchase price. This flexible approach appeals to renters seeking to build equity while maintaining the option to buy, offering greater financial adaptability compared to standard rent-to-own contracts.

Incremental Equity Rent

Incremental equity rent in rent-to-own agreements allows tenants to build homeownership equity gradually while paying monthly rent, contrasting with traditional rental where payments contribute solely to occupancy without asset accumulation. This structure benefits tenants seeking to transition into ownership by applying a portion of each payment towards the home's purchase price, enhancing long-term investment potential in real estate markets.

Option Fee Credit

The option fee credit in rent-to-own agreements allows a portion of the initial fee to be applied toward the property's purchase price, differentiating it from standard rental arrangements where no such credit exists. This credit incentivizes tenants by building equity while renting, offering a pathway to ownership that traditional leases do not provide.

Escalating Rent Clauses

Escalating rent clauses in rental agreements often impose predictable annual increases, impacting long-term affordability for tenants, whereas rent-to-own contracts may integrate these escalations into the purchase price, offering a pathway to ownership while locking in rising costs. Understanding the financial implications of escalating rents is crucial for tenants comparing traditional rentals with rent-to-own options in real estate markets.

Rent Premium Conversion

Rent-to-own options typically involve a rent premium conversion where a portion of the monthly rent is credited toward the eventual down payment, providing tenants with a pathway to homeownership while building equity. This rent premium conversion contrasts with standard rental agreements, where monthly payments solely cover occupancy without accumulating ownership benefits.

Pathway to Ownership

Rent-to-own offers a structured pathway to homeownership by allowing tenants to apply a portion of their rent payments toward the eventual purchase price, providing time to build credit and save for a down payment. Traditional rental agreements lack this equity-building component, making them a less direct route to owning a property.

Rental Purchase Agreement

A Rental Purchase Agreement allows tenants to rent a property with the option to buy it later, combining the advantages of both rental and ownership. This agreement typically includes terms on rent credits, purchase price, and contract duration, providing flexibility for renters aiming to transition into homeowners.

Tiered Rent Structure

A tiered rent structure in rent-to-own agreements allows tenants to pay increasing rental rates over time, building equity toward homeownership, unlike traditional rentals where the rent is fixed or subject to periodic increases without ownership benefits. This model provides a strategic path to ownership by applying a portion of each payment as credit, making it a financially advantageous option for tenants seeking to transition from renting to buying.

Rent-to-Own Underwriting

Rent-to-own underwriting involves assessing tenant buyers' creditworthiness, income stability, and property value projections to mitigate risks and structure fair lease-option agreements. This process often includes evaluating market trends and potential appreciation, ensuring both parties benefit from eventual ownership transfer.

Rental vs Rent-to-own Infographic

industrydif.com

industrydif.com