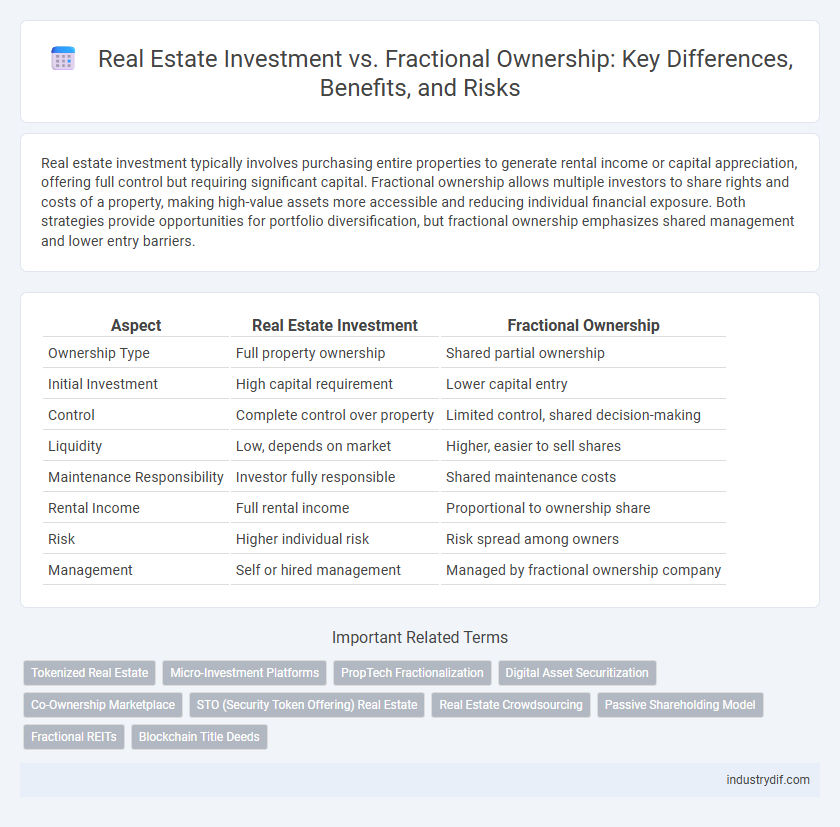

Real estate investment typically involves purchasing entire properties to generate rental income or capital appreciation, offering full control but requiring significant capital. Fractional ownership allows multiple investors to share rights and costs of a property, making high-value assets more accessible and reducing individual financial exposure. Both strategies provide opportunities for portfolio diversification, but fractional ownership emphasizes shared management and lower entry barriers.

Table of Comparison

| Aspect | Real Estate Investment | Fractional Ownership |

|---|---|---|

| Ownership Type | Full property ownership | Shared partial ownership |

| Initial Investment | High capital requirement | Lower capital entry |

| Control | Complete control over property | Limited control, shared decision-making |

| Liquidity | Low, depends on market | Higher, easier to sell shares |

| Maintenance Responsibility | Investor fully responsible | Shared maintenance costs |

| Rental Income | Full rental income | Proportional to ownership share |

| Risk | Higher individual risk | Risk spread among owners |

| Management | Self or hired management | Managed by fractional ownership company |

Introduction to Real Estate Investment

Real estate investment involves purchasing properties to generate rental income or capital appreciation, offering long-term growth and portfolio diversification. Fractional ownership allows multiple investors to share equity in a single property, reducing individual investment costs and risks. Understanding these models helps investors choose between full control with higher capital or shared access with lower financial commitment.

Understanding Fractional Ownership

Fractional ownership in real estate allows multiple investors to collectively purchase and share equity in a single property, offering access to high-value assets with reduced individual capital outlay and associated risks. This model provides investors with proportional usage rights and potential rental income, making it a flexible alternative to traditional real estate investment that often requires full ownership and management responsibilities. Understanding fractional ownership involves recognizing its benefits, including diversification, shared maintenance costs, and simplified entry into premium markets otherwise difficult for solo investors to access.

Key Differences Between Traditional Investment and Fractional Ownership

Traditional real estate investment involves full property ownership, requiring significant capital, management responsibilities, and risks associated with market fluctuations. Fractional ownership allows multiple investors to share property costs, reducing individual financial burden while offering access to high-value assets with limited management duties. Key differences include the scale of investment, degree of control, liquidity options, and risk exposure, making fractional ownership a flexible alternative to conventional real estate investment.

Benefits of Traditional Real Estate Investment

Traditional real estate investment offers full control over property management and decision-making, enabling investors to tailor improvements and maximize rental income. Investors benefit from potential property appreciation and various tax advantages, such as depreciation deductions and mortgage interest write-offs. This approach also allows for leveraging financing options to increase purchasing power and build equity over time.

Advantages of Fractional Ownership in Real Estate

Fractional ownership in real estate offers significant advantages such as reduced entry costs, allowing investors to access high-value properties with a smaller capital outlay compared to traditional real estate investment. Shared ownership lowers financial risk and diversifies investment portfolios by spreading costs and responsibilities among multiple owners. Efficient management and increased liquidity features make fractional ownership an attractive alternative to sole property ownership.

Risk Analysis: Real Estate Investment vs Fractional Ownership

Real estate investment involves full ownership with higher capital at risk but offers complete control over the property and potential for substantial long-term appreciation. Fractional ownership reduces individual financial exposure by dividing property costs among multiple investors, thereby mitigating risk through shared liability and diversified portfolios. Evaluating market volatility, liquidity constraints, and management responsibilities is crucial to balance risk and returns in both investment models.

Return on Investment Comparison

Real estate investment typically offers higher return on investment (ROI) through full asset control, potential rental income, and property appreciation, though it requires significant capital and management. Fractional ownership lowers initial costs and diversifies risk by sharing property equity among multiple investors, but ROI can be limited by shared expenses and less operational control. Careful analysis of property appreciation rates, rental yields, and fee structures is essential to compare the net returns of both models effectively.

Liquidity and Exit Strategies

Real estate investment typically offers moderate liquidity with exit strategies like property resale or rental income, but these processes can be time-consuming and involve significant transaction costs. Fractional ownership enhances liquidity by allowing investors to buy and sell shares on secondary markets or through structured buyback programs, providing more flexible exit options. Investors should evaluate market demand and platform policies to optimize liquidity and achieve efficient exit strategies in either approach.

Legal and Regulatory Considerations

Real estate investment often involves navigating complex legal frameworks, including property laws, zoning regulations, and tax implications specific to full ownership, while fractional ownership requires compliance with securities regulations and partnership agreements that govern shared equity structures. Due diligence is critical to ensure title clarity, adherence to local real estate codes, and understanding investor rights under both models. Regulatory bodies like the SEC may oversee fractional ownership to prevent fraud and protect investors, making legal consultation essential before committing funds.

Choosing the Right Investment Approach

Real estate investment offers full property control and potential for higher returns through rental income and property appreciation, appealing to investors seeking long-term wealth growth. Fractional ownership provides a lower-cost entry point with shared responsibilities, ideal for those looking to diversify portfolios without the burdens of full ownership management. Evaluating financial goals, risk tolerance, and involvement preferences is crucial when choosing between these investment approaches.

Related Important Terms

Tokenized Real Estate

Tokenized real estate transforms traditional investment by enabling fractional ownership through blockchain technology, allowing investors to purchase and trade digital shares of properties with increased liquidity and transparency. This innovation reduces barriers to entry and diversifies portfolios by combining the stability of real estate with the efficiency of digital assets.

Micro-Investment Platforms

Micro-investment platforms in real estate enable investors to participate in property markets with lower capital through fractional ownership, offering diversified portfolios and reduced entry barriers. Unlike traditional real estate investments requiring substantial funds and management, these platforms streamline access to high-value assets and generate passive income with minimal risk exposure.

PropTech Fractionalization

Real estate investment through PropTech fractionalization enables investors to buy smaller, digital shares of high-value properties, enhancing liquidity and accessibility compared to traditional whole-property ownership. This innovative approach leverages blockchain technology and digital platforms to streamline transactions, reduce entry barriers, and diversify portfolios with lower capital requirements.

Digital Asset Securitization

Real estate investment through digital asset securitization enables fractional ownership by tokenizing property assets, enhancing liquidity and accessibility for investors. This approach streamlines transactions on blockchain platforms, reduces entry barriers, and provides transparent, tradable digital shares of real estate holdings.

Co-Ownership Marketplace

Real estate investment through traditional channels often requires significant capital and carries higher risk, whereas fractional ownership via co-ownership marketplaces allows multiple investors to share property costs and benefits, enhancing diversification and liquidity. These platforms streamline access to premium properties by enabling fractional shares, making real estate investment more accessible and flexible without full property acquisition.

STO (Security Token Offering) Real Estate

Security Token Offering (STO) real estate investment enables fractional ownership by tokenizing property assets, providing liquidity, transparency, and regulatory compliance compared to traditional real estate investments. Token holders gain proportional rights to income and capital appreciation, democratizing access to high-value properties through blockchain-based digital securities.

Real Estate Crowdsourcing

Real estate crowdsourcing allows investors to pool funds for large-scale property projects, offering portfolio diversification and lower capital requirements compared to traditional real estate investment. Fractional ownership divides a single property into shares, providing direct equity and decision-making power, but typically requires higher individual investment and involves more complex management than crowdsourced platforms.

Passive Shareholding Model

Real estate investment through a passive shareholding model allows investors to gain exposure to property assets without the complexities of direct management, offering liquidity and diversification benefits. Fractional ownership, by contrast, involves shared legal title and often requires more active participation, limiting flexibility compared to passive real estate investment trusts (REITs) or real estate syndications.

Fractional REITs

Fractional REITs offer a diversified, low-entry-cost alternative to traditional real estate investment by allowing investors to purchase shares in pooled property portfolios managed by professionals. This approach provides liquidity and reduced risk exposure compared to direct real estate acquisitions, making it accessible to smaller investors seeking consistent income and capital appreciation.

Blockchain Title Deeds

Blockchain title deeds enhance transparency and security in real estate investment by providing immutable proof of ownership, reducing fraud risks compared to traditional methods. Fractional ownership leverages blockchain technology to enable investors to hold verified, divisible shares of high-value properties, increasing liquidity and access to diversified portfolios.

Real estate investment vs Fractional ownership Infographic

industrydif.com

industrydif.com